Title: Understanding Hillsboro Oregon Plaintiff's Complaint for Breach of Credit Card Agreement Keywords: Hillsboro Oregon, Plaintiff's Complaint, Breach of Credit Card Agreement, types Description: In Hillsboro, Oregon, a Plaintiff's Complaint for Breach of Credit Card Agreement is a legal document filed by an individual or organization (the plaintiff) against a party (the defendant) who has failed to honor the terms outlined in a credit card agreement. This complaint seeks resolution and potential compensation for the damages incurred due to the defendant's breach of contract. Types of Hillsboro Oregon Plaintiff's Complaint for Breach of Credit Card Agreement: 1. Hillsboro Oregon Plaintiff's Complaint for Failure to Make Minimum Payments: This type of complaint is filed when the defendant fails to make the required minimum payments specified in the credit card agreement. The plaintiff alleges that this breach has caused financial loss and seeks remedies such as repayment of outstanding balances, interest, and potentially punitive damages. 2. Hillsboro Oregon Plaintiff's Complaint for Unauthorized Charges: In this scenario, the plaintiff accuses the defendant of making unauthorized charges on the credit card account, violating the terms of the credit card agreement. The complaint may demand an investigation into the alleged fraud, removal of unauthorized charges, and compensation for any financial losses suffered by the plaintiff. 3. Hillsboro Oregon Plaintiff's Complaint for Defaulting on Credit Card Account: When the defendant fails to honor their credit card payment obligations for an extended period, the plaintiff may file a complaint for defaulting on the credit card account. In this complaint, the plaintiff seeks repayment of the outstanding balance, interest, and associated costs incurred due to the defendant's breach of the credit card agreement. 4. Hillsboro Oregon Plaintiff's Complaint for Violation of Interest Rate Terms: In some cases, the plaintiff may allege that the defendant violated the agreed-upon interest rate terms outlined in the credit card agreement. The plaintiff may claim excessive interest rates or unauthorized changes to the terms, seeking relief in the form of corrected interest charges and potential compensation for any financial harm suffered. 5. Hillsboro Oregon Plaintiff's Complaint for Termination of Credit Agreement: If the defendant breaches the credit card agreement to such an extent that the plaintiff seeks termination of the agreement, this type of complaint may be filed. The plaintiff will provide evidence of the defendant's failure to adhere to the terms, requesting termination, and potentially seeking compensation for any associated damages. Note: It is important to consult legal professionals or attorneys in Hillsboro, Oregon, for accurate advice and guidance regarding specific cases of Plaintiff's Complaint for Breach of Credit Card Agreement.

Hillsboro Oregon Plaintiff's Complaint for Breach of Credit Card Agreement

Description

How to fill out Hillsboro Oregon Plaintiff's Complaint For Breach Of Credit Card Agreement?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Hillsboro Oregon Plaintiff's Complaint for Breach of Credit Card Agreement becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, getting the Hillsboro Oregon Plaintiff's Complaint for Breach of Credit Card Agreement takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of additional actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

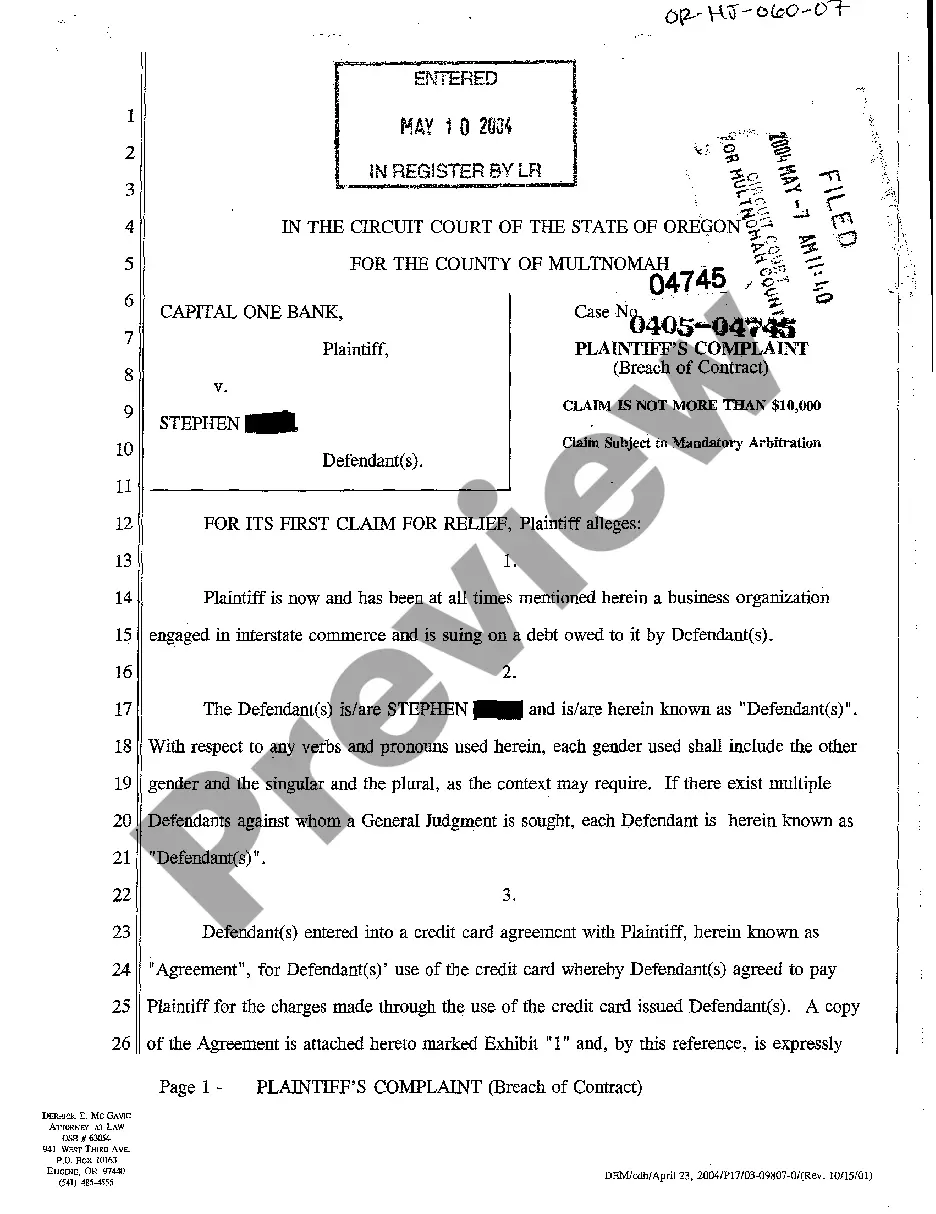

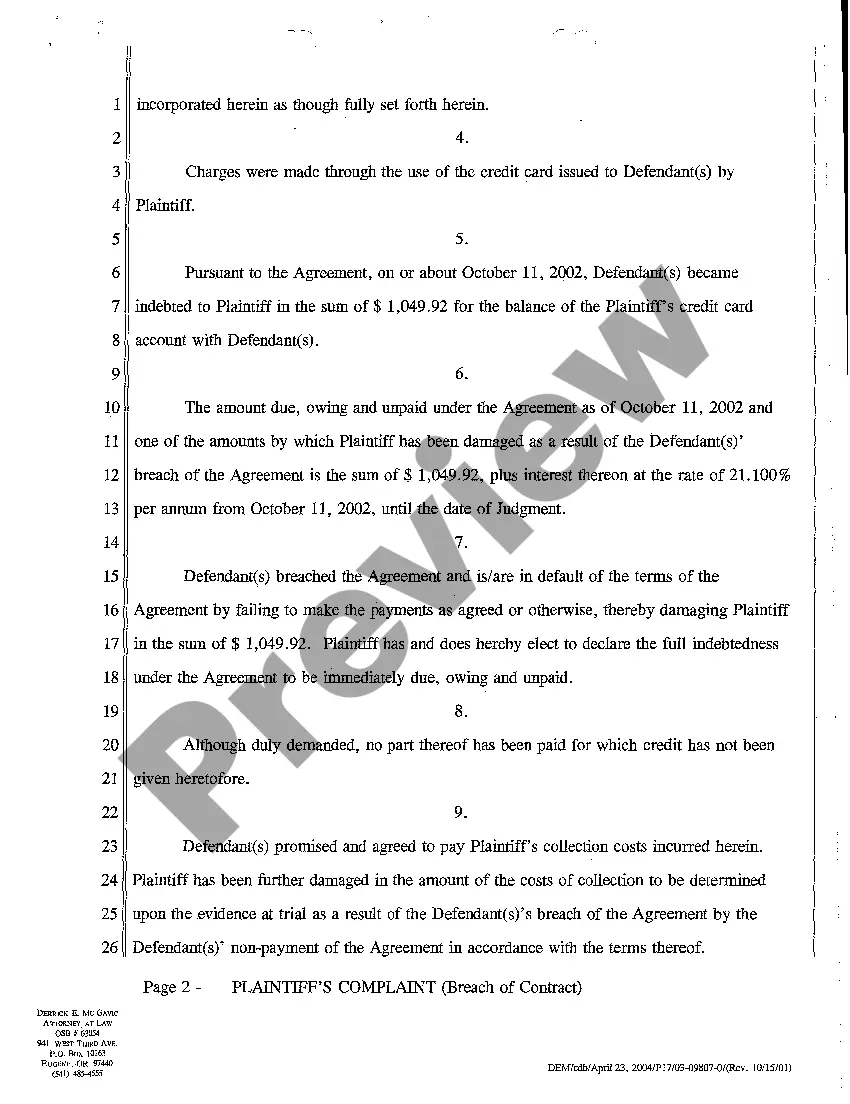

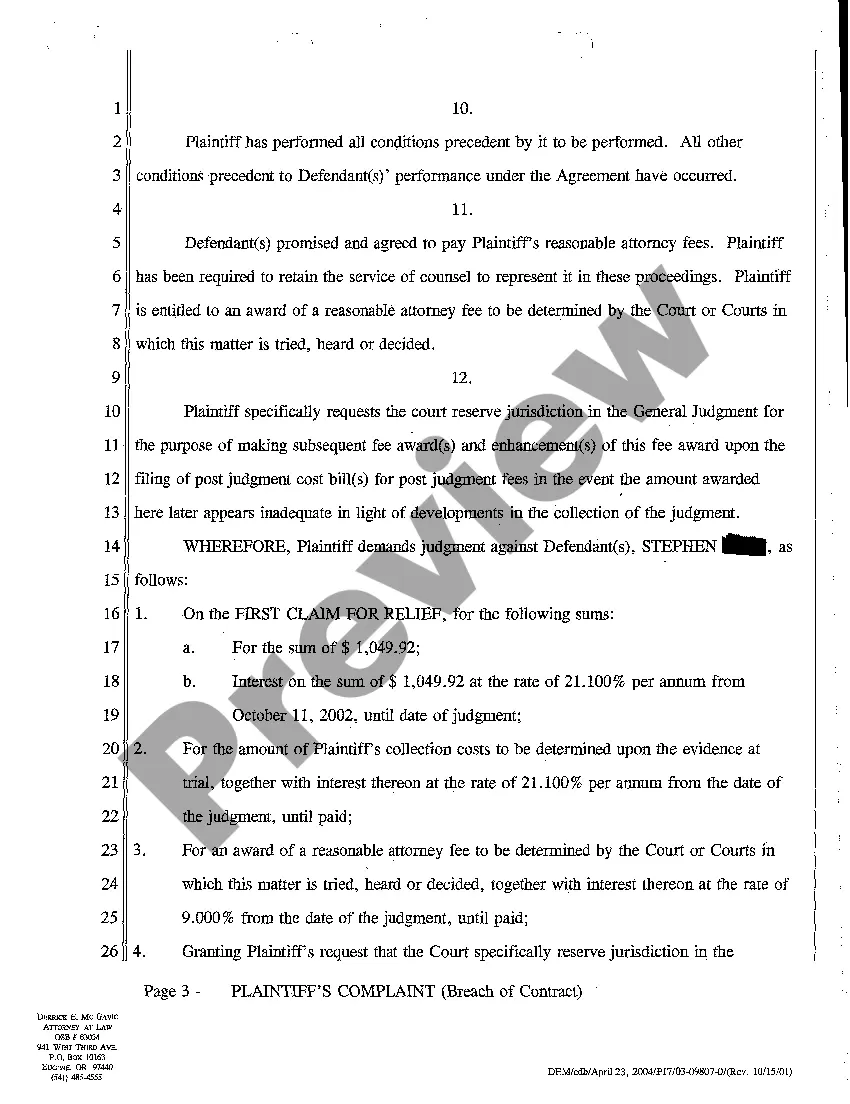

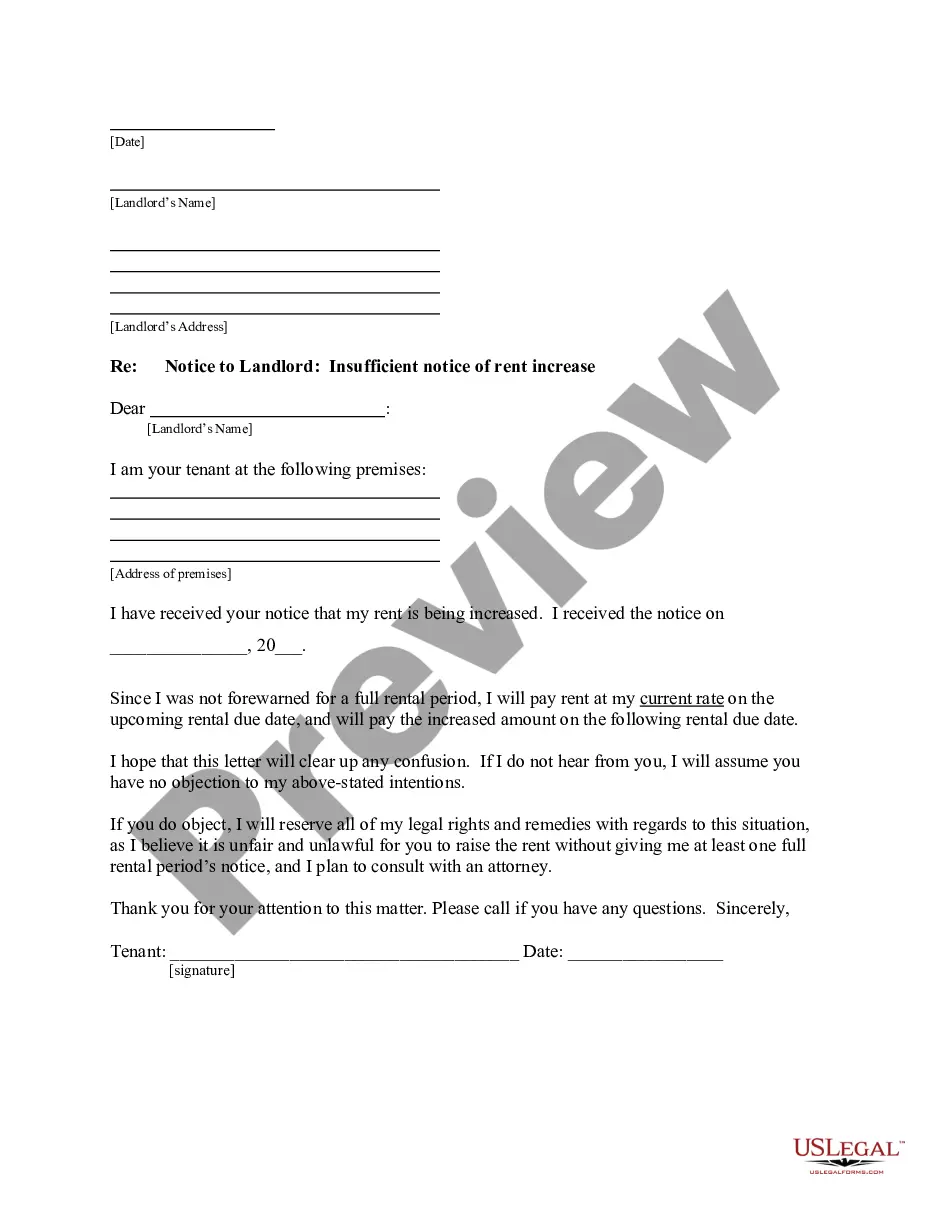

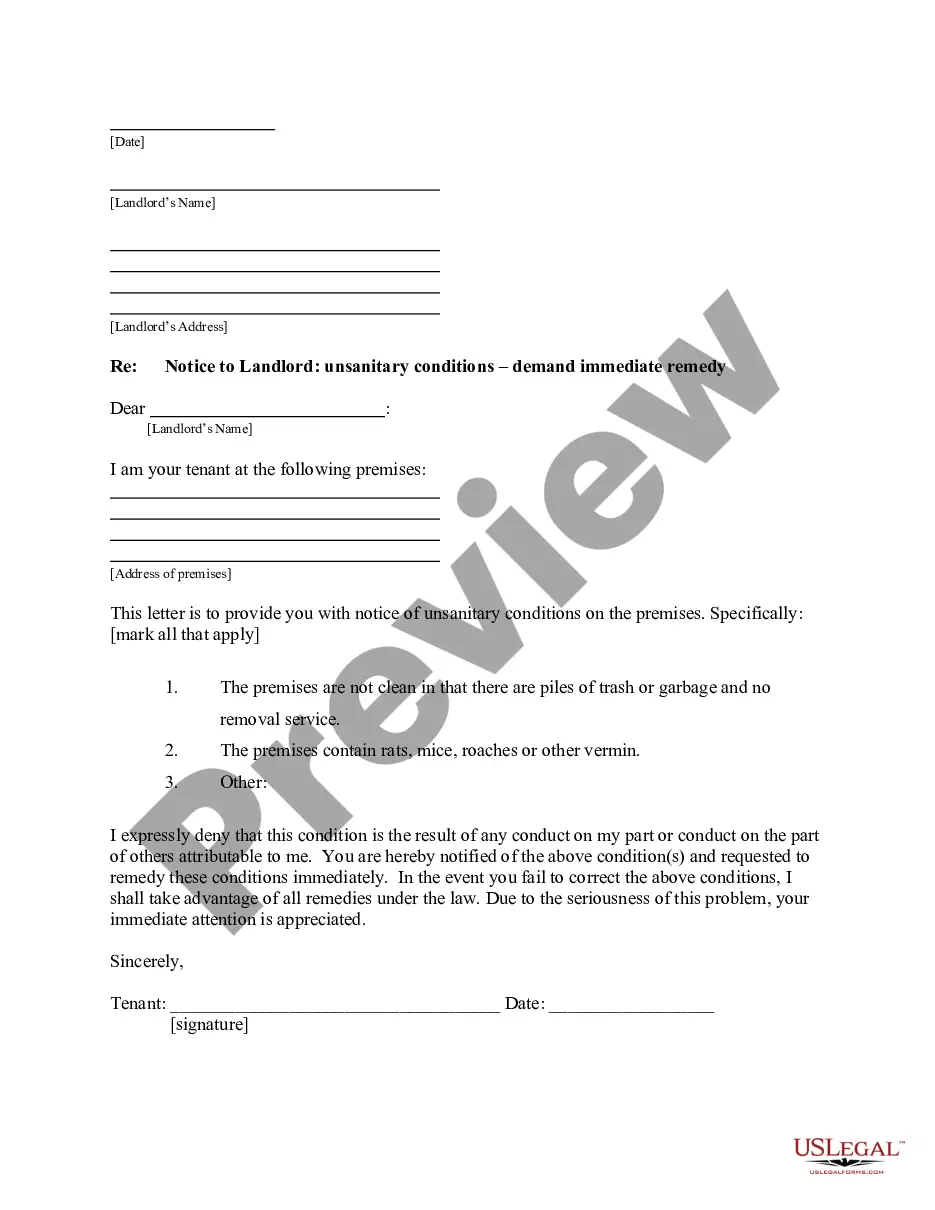

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Hillsboro Oregon Plaintiff's Complaint for Breach of Credit Card Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!