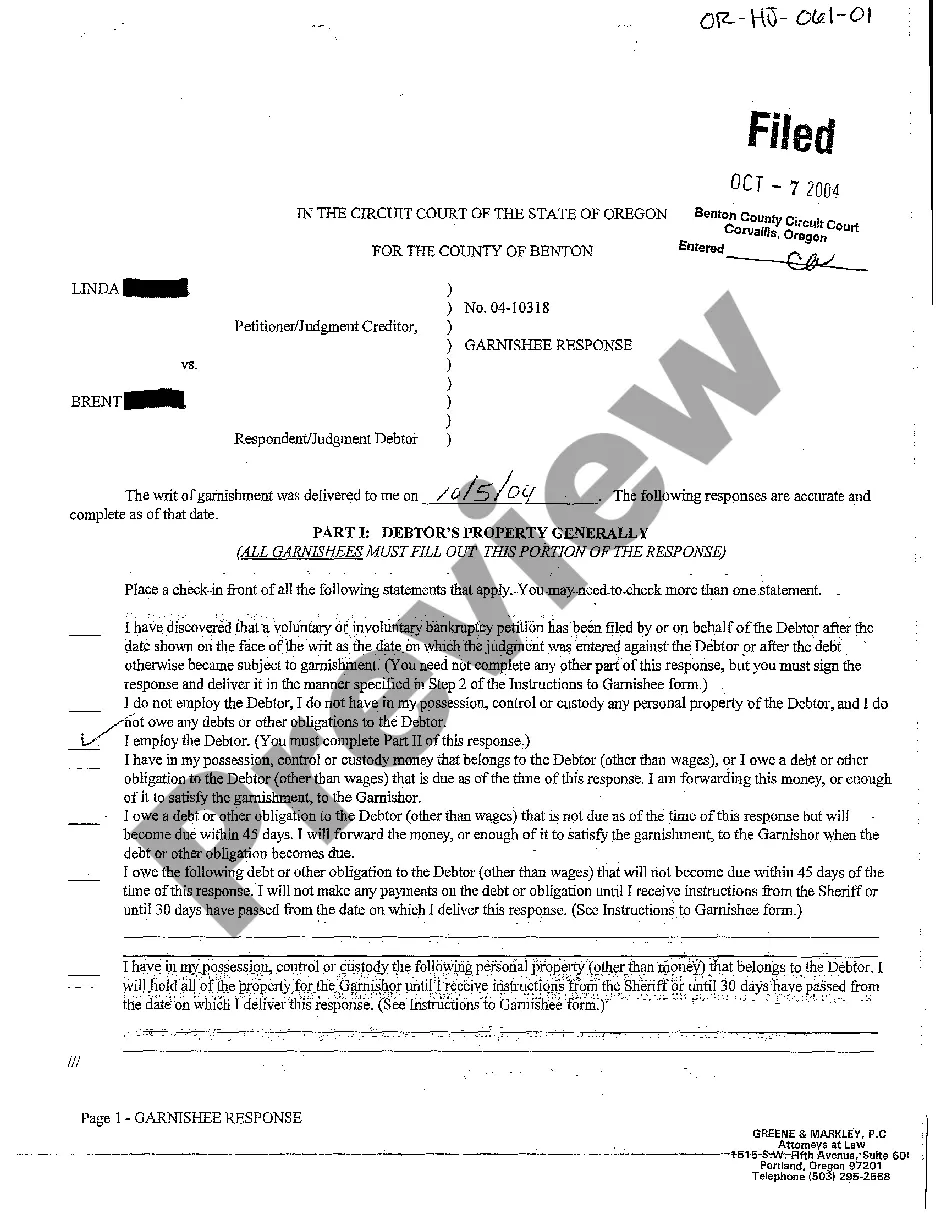

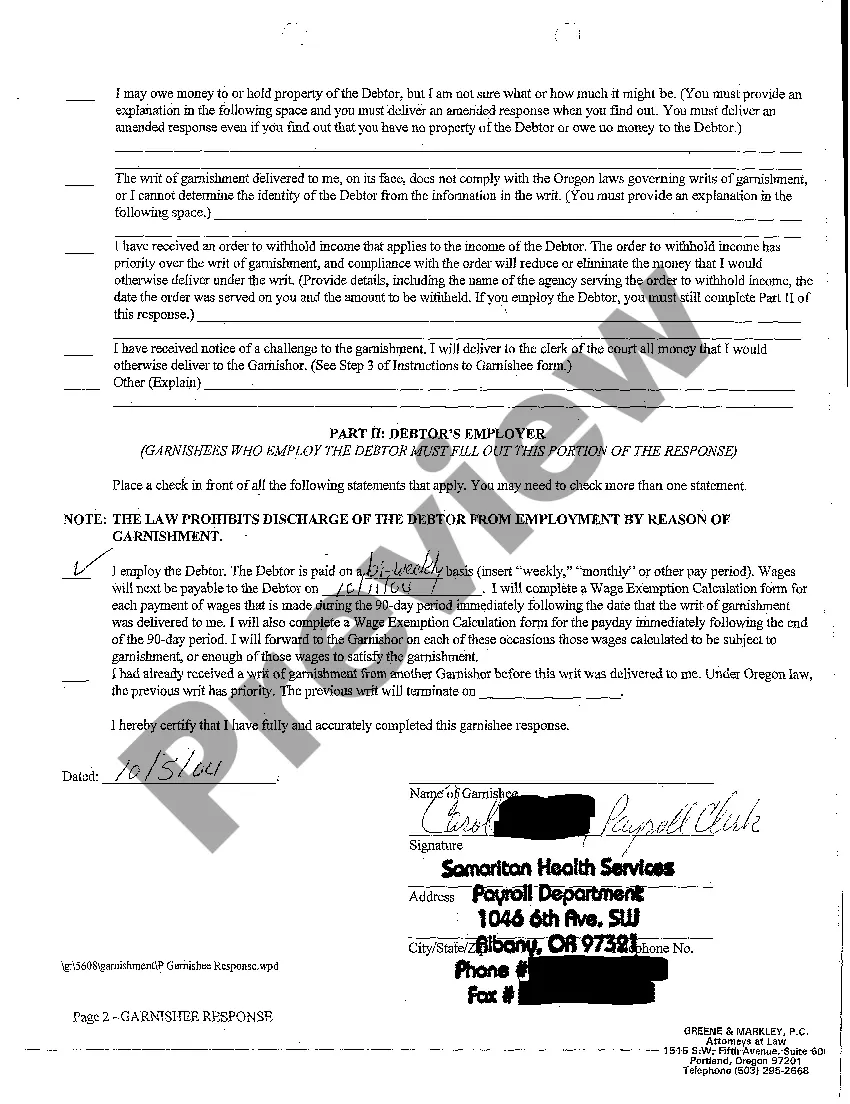

Eugene, Oregon Garnishee Response is a legal process that occurs when an individual or entity receives a garnishment order. This order mandates that the garnishee, which could be an employer, bank, or other third party holding funds on behalf of the debtor, withholds a portion of the debtor's earnings or assets to satisfy a debt owed to a creditor. In Eugene, Oregon, there are different types of garnishee responses, each with its own specific characteristics. These include: 1. Wage Garnishment Response: When an employer in Eugene, Oregon, receives a garnishment order, they must comply and deduct a certain percentage from the debtor's paycheck, as outlined in the order. The employer is then required to remit these funds directly to the creditor or the court, depending on the specifics of the garnishment order. 2. Bank Garnishment Response: If a bank located in Eugene, Oregon, is served with a garnishment order, it must freeze the funds in the debtor's account up to the amount stated in the order. The bank subsequently releases these funds to the creditor or court, depending on the circumstances. 3. Property Garnishment Response: In some cases, a garnishment order may pertain to seize certain assets or property owned by the debtor in Eugene, Oregon. The garnishee, usually a property holder or landlord, must comply with the order by turning over the specified assets to the creditor or the court. 4. Earnings Withholding Order (TWO) Response: This particular type of garnishee response is specifically related to child support payments in Eugene, Oregon. An TWO requires the garnishee, typically an employer, to withhold a specific amount of the employee's wages to fulfill their child support obligations. When served with a garnishment order in Eugene, Oregon, the garnishee is legally obligated to provide an accurate and detailed response to the court or creditor within a specified timeframe. This response typically includes providing information about the debtor's financial status, the amount of earnings or assets that can be garnished, and any relevant exemptions the debtor may qualify for under Oregon state law. It is crucial for the garnishee to understand their legal obligations and seek professional advice if necessary, as any mistakes or failure to comply with the garnishment order can result in legal consequences.

Eugene, Oregon Garnishee Response is a legal process that occurs when an individual or entity receives a garnishment order. This order mandates that the garnishee, which could be an employer, bank, or other third party holding funds on behalf of the debtor, withholds a portion of the debtor's earnings or assets to satisfy a debt owed to a creditor. In Eugene, Oregon, there are different types of garnishee responses, each with its own specific characteristics. These include: 1. Wage Garnishment Response: When an employer in Eugene, Oregon, receives a garnishment order, they must comply and deduct a certain percentage from the debtor's paycheck, as outlined in the order. The employer is then required to remit these funds directly to the creditor or the court, depending on the specifics of the garnishment order. 2. Bank Garnishment Response: If a bank located in Eugene, Oregon, is served with a garnishment order, it must freeze the funds in the debtor's account up to the amount stated in the order. The bank subsequently releases these funds to the creditor or court, depending on the circumstances. 3. Property Garnishment Response: In some cases, a garnishment order may pertain to seize certain assets or property owned by the debtor in Eugene, Oregon. The garnishee, usually a property holder or landlord, must comply with the order by turning over the specified assets to the creditor or the court. 4. Earnings Withholding Order (TWO) Response: This particular type of garnishee response is specifically related to child support payments in Eugene, Oregon. An TWO requires the garnishee, typically an employer, to withhold a specific amount of the employee's wages to fulfill their child support obligations. When served with a garnishment order in Eugene, Oregon, the garnishee is legally obligated to provide an accurate and detailed response to the court or creditor within a specified timeframe. This response typically includes providing information about the debtor's financial status, the amount of earnings or assets that can be garnished, and any relevant exemptions the debtor may qualify for under Oregon state law. It is crucial for the garnishee to understand their legal obligations and seek professional advice if necessary, as any mistakes or failure to comply with the garnishment order can result in legal consequences.