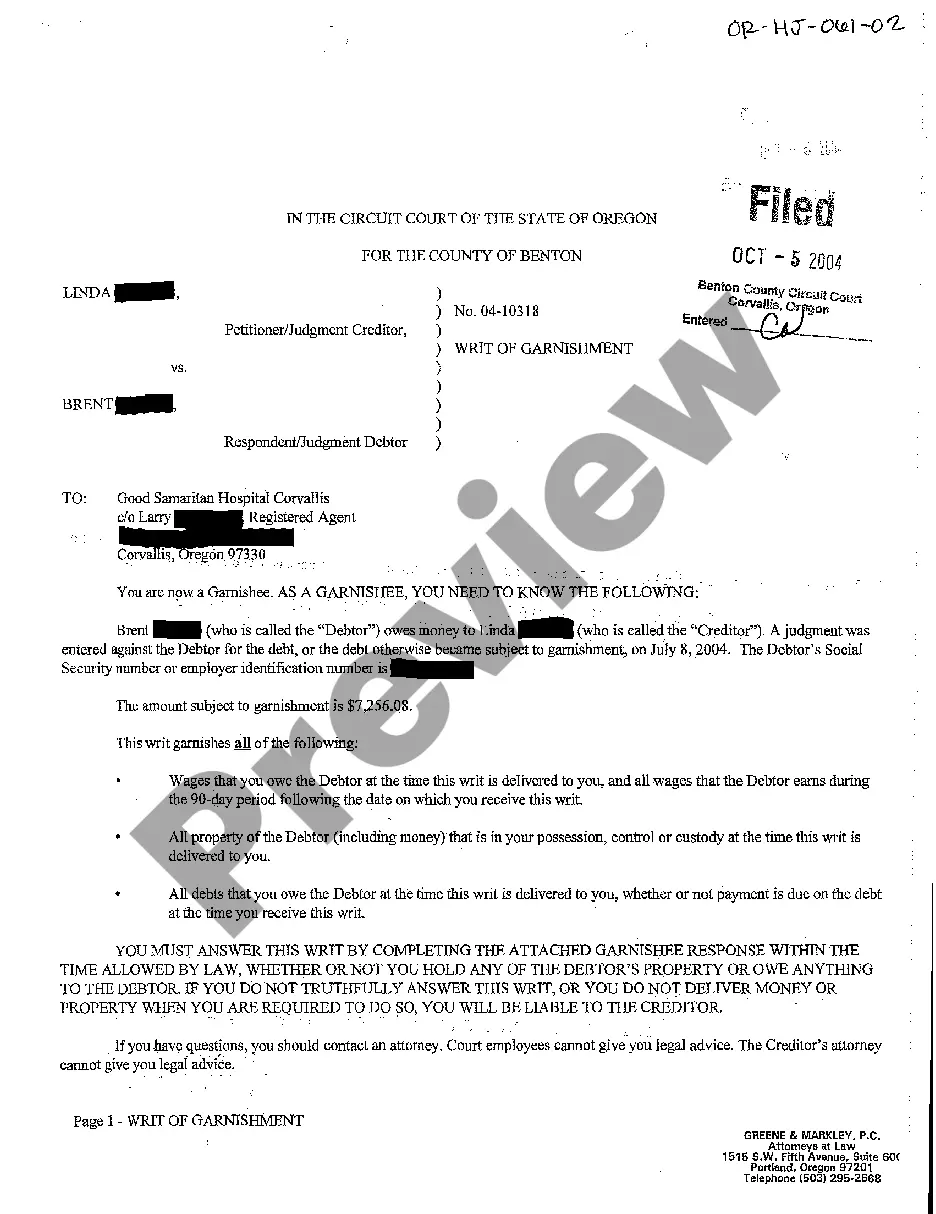

Eugene, Oregon Writ of Garnishment: A Detailed Description of the Process and its Types Understanding the Eugene, Oregon Writ of Garnishment is crucial for individuals or businesses seeking to collect outstanding debts. This legal procedure is available to creditors who have successfully obtained a judgment against a debtor, allowing them to seize a portion of the debtor's wages, bank accounts, or other assets. In Eugene, Oregon, this process follows specific guidelines and includes different types of garnishments tailored to different situations. One prominent type of Eugene, Oregon Writ of Garnishment is the Wage Garnishment. Wage garnishment allows creditors to collect debts directly from the debtor's earnings. Once approved by the court, the employer receives an order to withhold a portion of the debtor's wages, which is then sent to the creditor until the debt is satisfied. This type of garnishment follows both state and federal regulations, such as maximum limits on the amount that can be garnished from one's paycheck. Another variation is the Bank Account Garnishment, commonly used when debtors fail to pay their debts voluntarily. With a Bank Account Garnishment, creditors can freeze the debtor's bank account and collect the funds necessary to satisfy the debt. Generally, a specific amount is exempt from garnishment to ensure that the debtor can meet their basic needs, while the remaining funds can be transferred to the creditor once authorized by the court. It's important to note that Eugene, Oregon also recognizes the possibility of a Third-Party Garnishment. In this scenario, the judgment creditor can garnish funds held by a third party that is indebted to the debtor. For example, if the debtor is owed money by a client, the creditor can redirect that payment to themselves through a Third-Party Garnishment. To initiate any type of Eugene, Oregon Writ of Garnishment, creditors must ensure they follow specific procedures. Initially, they must obtain a judgment as evidence that the debt is valid and enforceable. Once the judgment is obtained, the creditor can file for garnishment with the appropriate court and serve the debtor and any necessary third parties involved. The creditor must also comply with all legal timelines and notify the debtor of their rights. Overall, the Eugene, Oregon Writ of Garnishment serves as an essential tool for creditors seeking to collect outstanding debts after obtaining a judgment against a debtor. With different types such as Wage Garnishment, Bank Account Garnishment, and Third-Party Garnishment, creditors have various options available to suit their specific circumstances. However, it is always recommended consulting with an experienced attorney or legal professional well-versed in Oregon's garnishment laws to navigate the process successfully and ethically.

Eugene, Oregon Writ of Garnishment: A Detailed Description of the Process and its Types Understanding the Eugene, Oregon Writ of Garnishment is crucial for individuals or businesses seeking to collect outstanding debts. This legal procedure is available to creditors who have successfully obtained a judgment against a debtor, allowing them to seize a portion of the debtor's wages, bank accounts, or other assets. In Eugene, Oregon, this process follows specific guidelines and includes different types of garnishments tailored to different situations. One prominent type of Eugene, Oregon Writ of Garnishment is the Wage Garnishment. Wage garnishment allows creditors to collect debts directly from the debtor's earnings. Once approved by the court, the employer receives an order to withhold a portion of the debtor's wages, which is then sent to the creditor until the debt is satisfied. This type of garnishment follows both state and federal regulations, such as maximum limits on the amount that can be garnished from one's paycheck. Another variation is the Bank Account Garnishment, commonly used when debtors fail to pay their debts voluntarily. With a Bank Account Garnishment, creditors can freeze the debtor's bank account and collect the funds necessary to satisfy the debt. Generally, a specific amount is exempt from garnishment to ensure that the debtor can meet their basic needs, while the remaining funds can be transferred to the creditor once authorized by the court. It's important to note that Eugene, Oregon also recognizes the possibility of a Third-Party Garnishment. In this scenario, the judgment creditor can garnish funds held by a third party that is indebted to the debtor. For example, if the debtor is owed money by a client, the creditor can redirect that payment to themselves through a Third-Party Garnishment. To initiate any type of Eugene, Oregon Writ of Garnishment, creditors must ensure they follow specific procedures. Initially, they must obtain a judgment as evidence that the debt is valid and enforceable. Once the judgment is obtained, the creditor can file for garnishment with the appropriate court and serve the debtor and any necessary third parties involved. The creditor must also comply with all legal timelines and notify the debtor of their rights. Overall, the Eugene, Oregon Writ of Garnishment serves as an essential tool for creditors seeking to collect outstanding debts after obtaining a judgment against a debtor. With different types such as Wage Garnishment, Bank Account Garnishment, and Third-Party Garnishment, creditors have various options available to suit their specific circumstances. However, it is always recommended consulting with an experienced attorney or legal professional well-versed in Oregon's garnishment laws to navigate the process successfully and ethically.