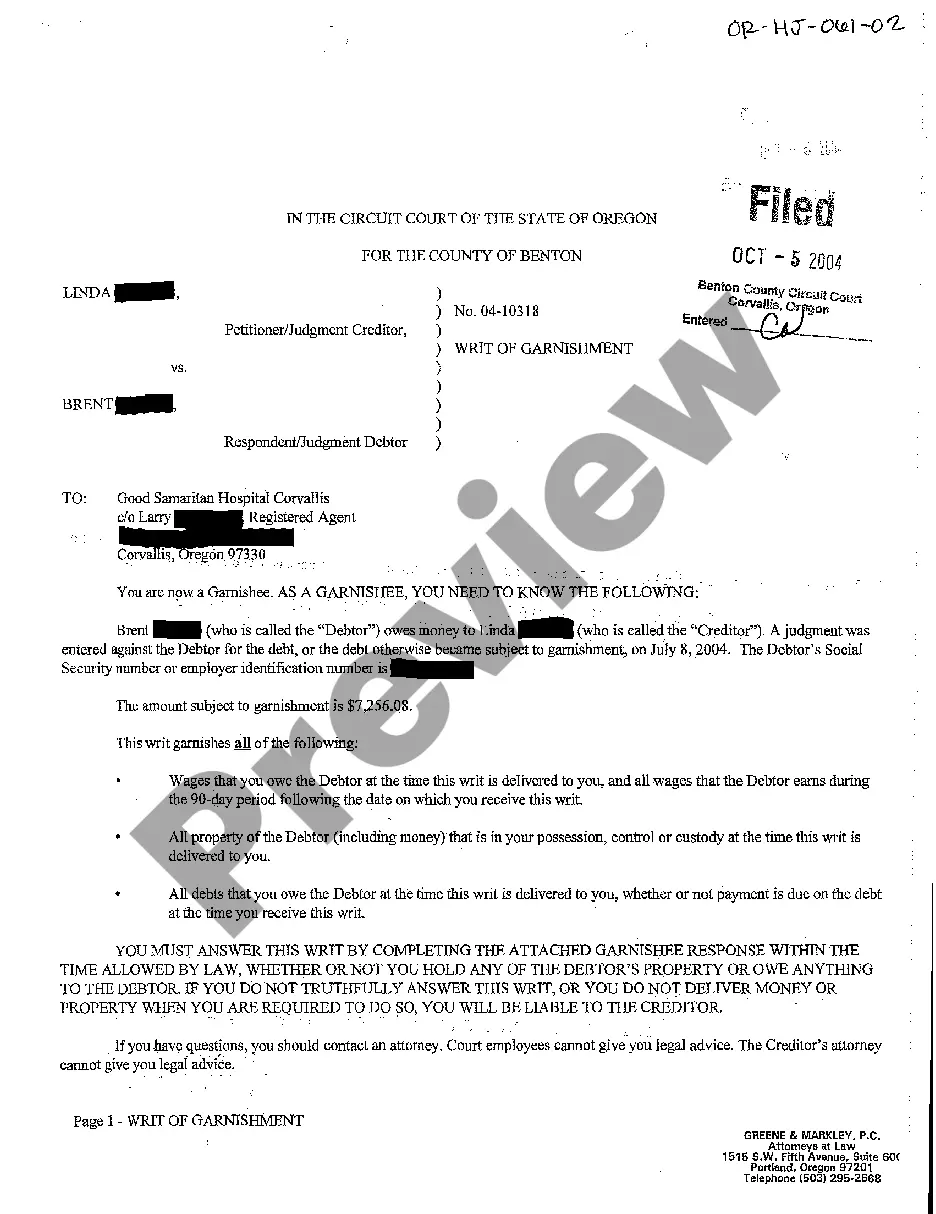

Gresham Oregon Writ of Garnishment is a legal process used to collect a debt owed by a person or entity. It is a court order that allows a creditor to seize funds or assets from the debtor to satisfy their outstanding debt. Garnishment is typically initiated by a creditor when the debtor fails to repay the debt voluntarily. In Gresham, Oregon, there are different types of Writ of Garnishment, each with specific rules and procedures. The most common types include: 1. Wage Garnishment: This type of garnishment allows a creditor to collect a portion of the debtor's wages or salary directly from their employer. In Gresham, Oregon, the maximum amount that can be garnished from wages is typically limited to 25% of the debtor's disposable income. 2. Bank Account Garnishment: Also known as a bank levy, this type of garnishment allows a creditor to seize funds directly from the debtor's bank account. In Gresham, Oregon, a creditor needs to obtain a court order to freeze the debtor's bank account and collect the owed amount. 3. Property or Asset Garnishment: If the debtor owns valuable assets, such as real estate, vehicles, or other personal property, a creditor may seek a writ of garnishment to seize and sell these assets to satisfy the debt. In Gresham, Oregon, there are specific rules and exemptions that protect certain types of property from being garnished. 4. Federal Government Garnishment: In cases where the debtor owes a debt to a federal agency, such as unpaid taxes or defaulted student loans, the federal government may also initiate garnishment proceedings in Gresham, Oregon. The rules and procedures for federal government garnishment may differ from standard garnishment procedures. It is essential for debtors in Gresham, Oregon, to be aware of their rights and legal protections when facing a writ of garnishment. In some cases, exemptions or limitations may apply, safeguarding certain income or assets from being garnished. Consulting with a qualified attorney experienced in debt collection laws can provide valuable guidance and representation throughout the garnishment process.

Gresham Oregon Writ of Garnishment

Description

How to fill out Gresham Oregon Writ Of Garnishment?

No matter what social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any legal education to draft such papers from scratch, mostly due to the convoluted terminology and legal nuances they come with. This is where US Legal Forms can save the day. Our service offers a huge library with over 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you require the Gresham Oregon Writ of Garnishment or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Gresham Oregon Writ of Garnishment quickly using our reliable service. If you are presently an existing customer, you can go on and log in to your account to get the needed form.

Nevertheless, if you are a novice to our library, make sure to follow these steps before downloading the Gresham Oregon Writ of Garnishment:

- Be sure the template you have chosen is suitable for your area because the rules of one state or county do not work for another state or county.

- Review the form and go through a short outline (if provided) of cases the paper can be used for.

- If the form you picked doesn’t meet your needs, you can start over and look for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Gresham Oregon Writ of Garnishment as soon as the payment is done.

You’re all set! Now you can go on and print out the form or fill it out online. If you have any issues getting your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.