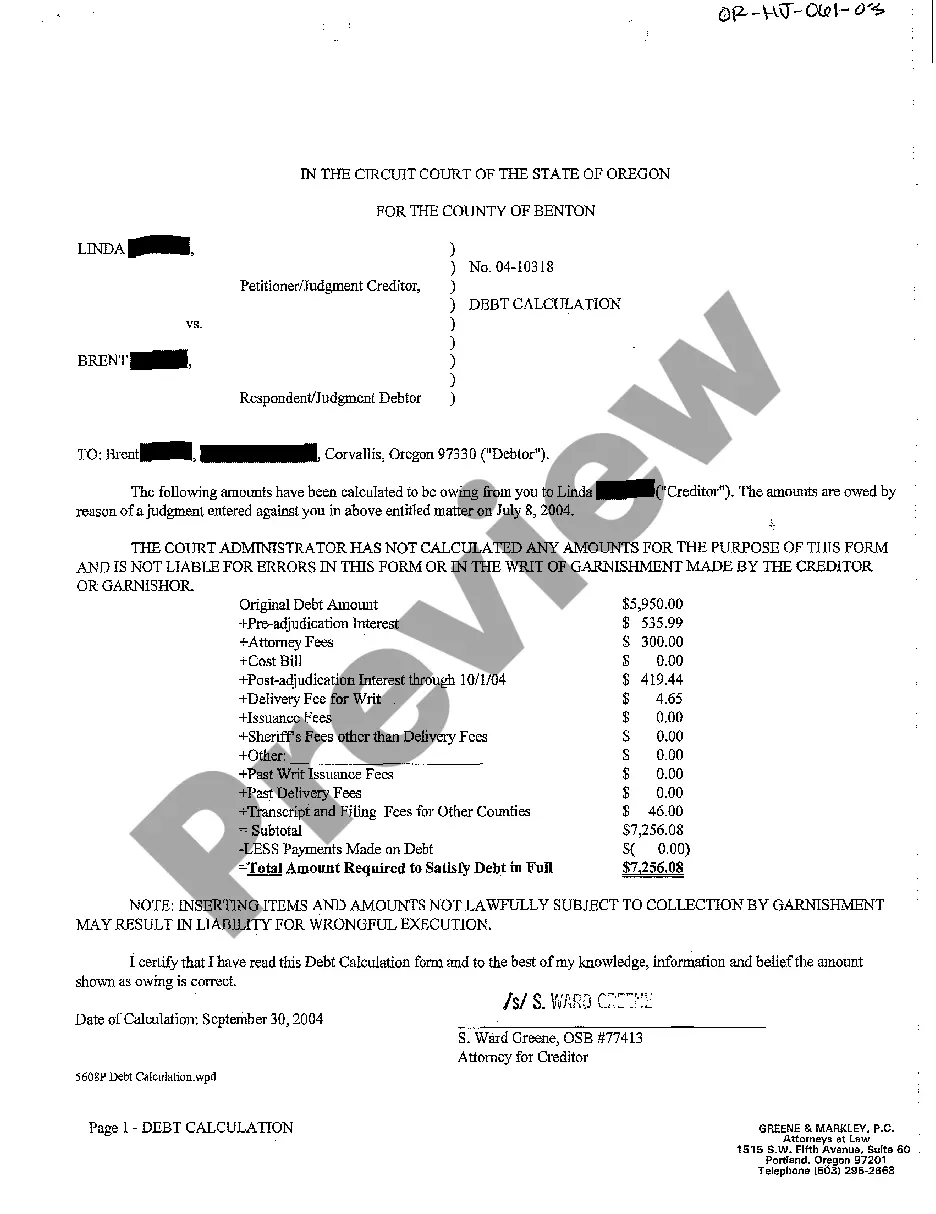

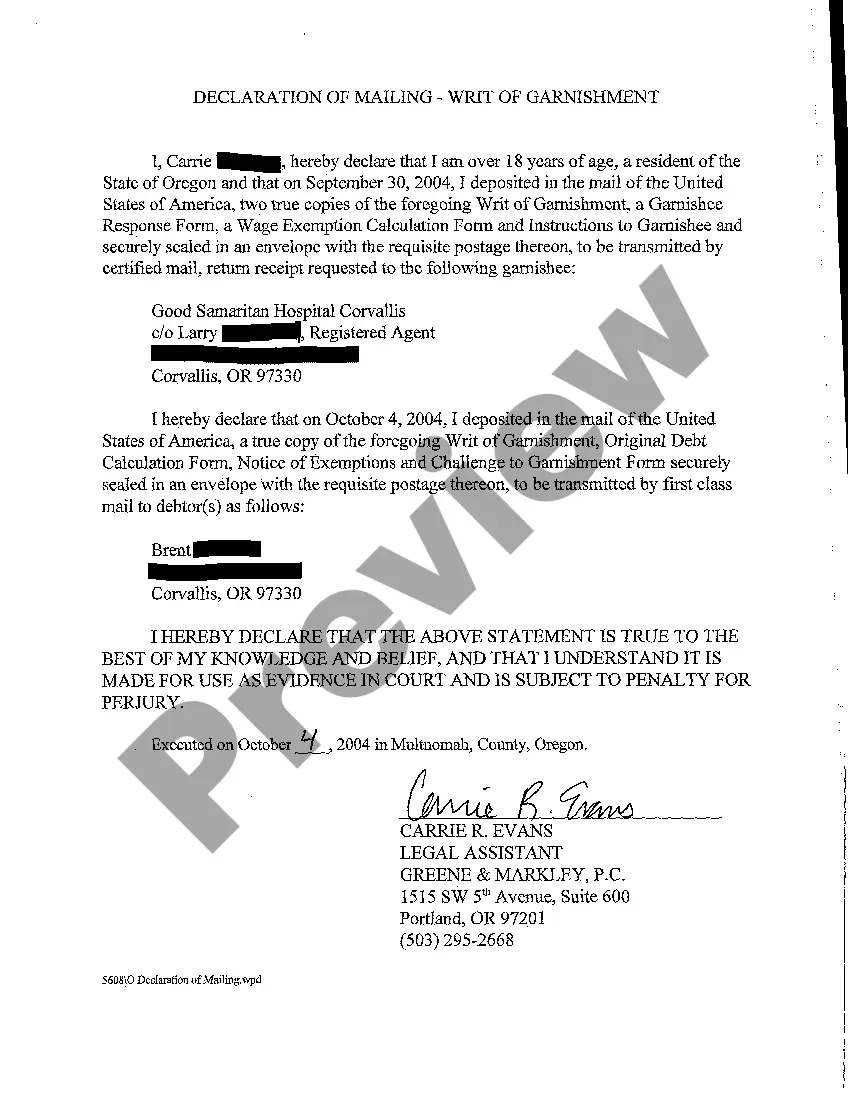

Gresham Oregon Debt Calculation is a process that involves assessing an individual or entity's financial situation in Gresham, Oregon, to determine the amount of debt they owe and develop a plan to manage and pay off that debt. This comprehensive evaluation includes analyzing various aspects of one's financial information, such as income, expenses, assets, and liabilities. With Gresham Oregon Debt Calculation, individuals gain a clear understanding of their financial standing, allowing them to make informed decisions about managing their debt effectively. This process helps individuals prioritize their debt payments, create realistic budgets, and explore potential debt relief options available to them. Gresham Oregon offers various types of debt calculation services tailored to meet specific needs: 1. Personal Debt Calculation: This type of debt calculation is designed for individuals who want to assess and manage their personal debts effectively. It involves evaluating credit card debts, student loans, medical bills, personal loans, and other types of personal liabilities. 2. Business Debt Calculation: Businesses in Gresham, Oregon, can also benefit from debt calculation services. This involves analyzing business debts, such as loans, leases, vendor credit, and lines of credit, to develop strategies for improving cash flow and reducing business liabilities. 3. Mortgage Debt Calculation: Gresham Oregon Debt Calculation can also focus on evaluating mortgage debts. This process helps homeowners analyze their mortgage obligations, interest rates, and payment terms to develop plans for refinancing, debt consolidation, or modifying the mortgage terms to ease their financial burden. 4. Credit Card Debt Calculation: Many individuals in Gresham struggle with credit card debt. Debt calculation services can assist in analyzing credit card debts, interest rates, and minimum payments to develop strategies for paying off credit card balances efficiently. 5. Student Loan Debt Calculation: Gresham Oregon Debt Calculation also encompasses assessing and managing student loan debts. By evaluating loan amounts, interest rates, and repayment plans, individuals can explore options like loan consolidation, income-driven repayment plans, or other strategies to alleviate the burden of student loan debt. Overall, Gresham Oregon Debt Calculation services offer valuable insights and assistance in managing various types of debts. This process enables individuals and businesses from Gresham, Oregon, to develop effective plans to reduce their debt burden and achieve financial stability.

Gresham Oregon Debt Calculation

Description

How to fill out Gresham Oregon Debt Calculation?

Regardless of social or professional status, completing law-related documents is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for a person without any legal background to draft this sort of papers from scratch, mostly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our platform offers a massive library with over 85,000 ready-to-use state-specific documents that work for pretty much any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you want the Gresham Oregon Debt Calculation or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Gresham Oregon Debt Calculation quickly using our trusted platform. In case you are already an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are a novice to our platform, ensure that you follow these steps prior to obtaining the Gresham Oregon Debt Calculation:

- Ensure the form you have found is specific to your location since the rules of one state or county do not work for another state or county.

- Review the form and go through a quick description (if available) of scenarios the document can be used for.

- If the one you selected doesn’t meet your requirements, you can start again and search for the necessary document.

- Click Buy now and choose the subscription option you prefer the best.

- with your credentials or create one from scratch.

- Select the payment method and proceed to download the Gresham Oregon Debt Calculation as soon as the payment is completed.

You’re good to go! Now you can go on and print the form or complete it online. In case you have any problems getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.