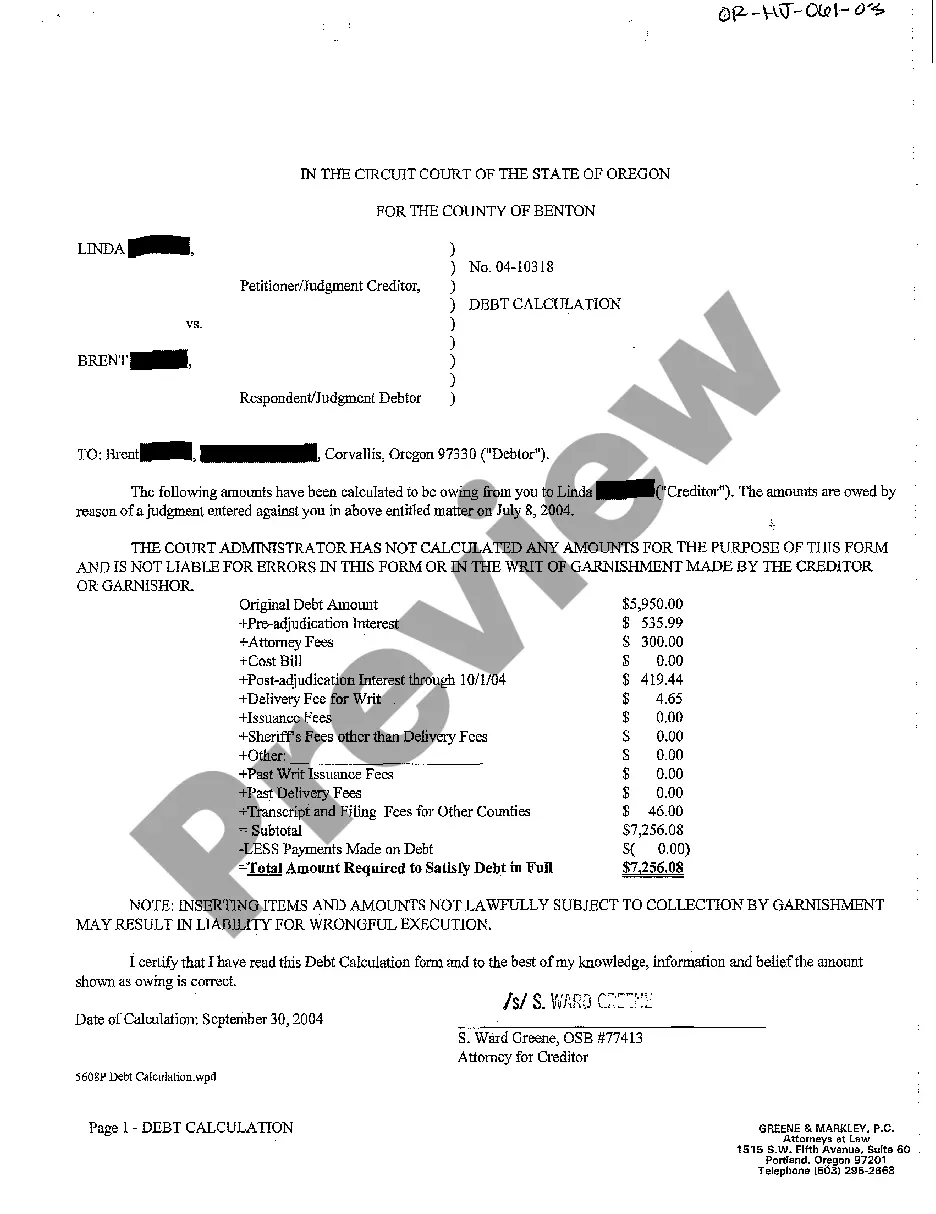

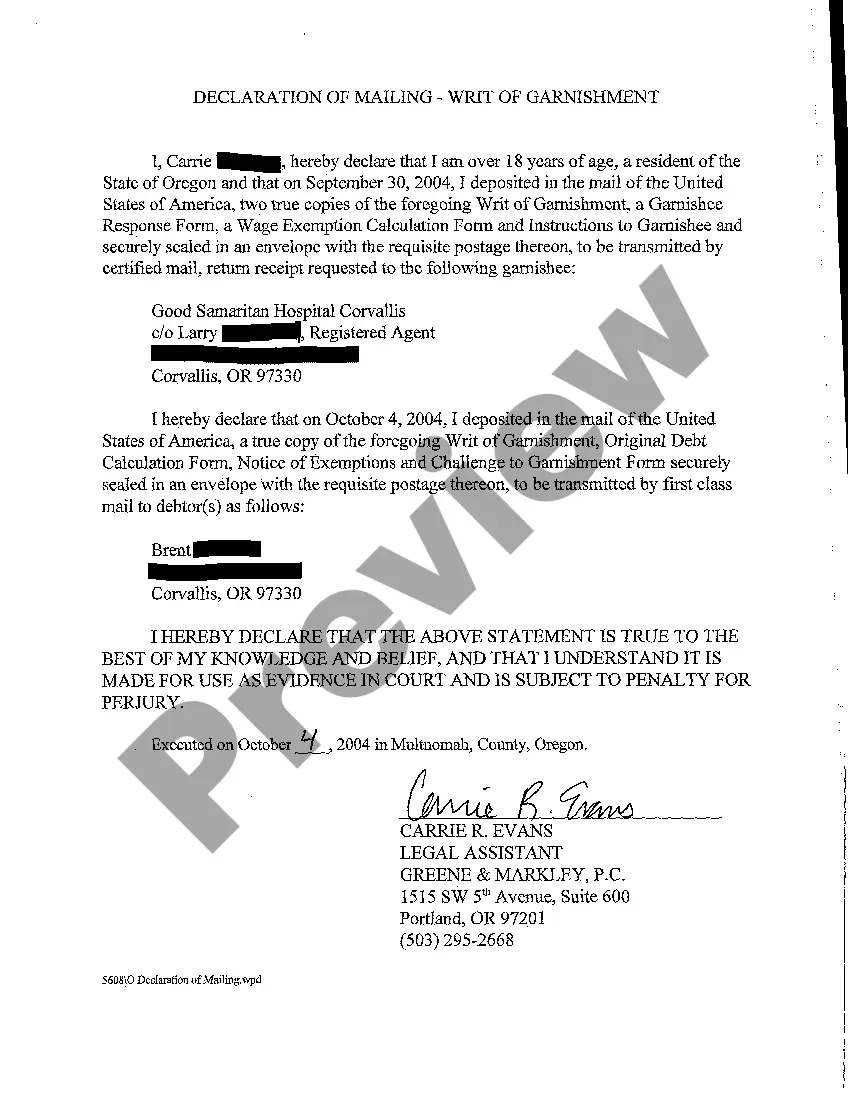

Hillsboro Oregon Debt Calculation is a financial process that involves determining and analyzing the amount of debt an individual or organization in Hillsboro, Oregon has accrued. It is an essential step in creating a comprehensive financial plan to manage and eliminate debt effectively. The primary goal of Hillsboro Oregon Debt Calculation is to accurately assess the total debt owed, including credit card debts, loans, mortgages, student loans, and any other outstanding liabilities. By calculating the precise debt amount, individuals and businesses can gain a clear picture of their financial obligations and develop strategies to reduce debt over time. There are various types of Hillsboro Oregon Debt Calculation methods available, depending on the complexity and depth of the financial situation. Let's take a closer look at a few popular approaches: 1. Total Debt Calculation: This method involves adding up all outstanding debts, including the principal amount, interest accrued, additional fees, and any penalties. It provides individuals or businesses with a holistic view of their overall debt load. 2. Debt-to-Income Ratio Calculation: This approach evaluates the level of debt relative to the individual or organization's income. By dividing the total debt by the monthly income, the debt-to-income ratio is derived. This ratio serves as an indicator of one's ability to repay the debt and manage future financial obligations. 3. Debt Snowball Calculation: The debt snowball method focuses on paying off debts systematically. This approach involves listing debts from smallest to largest and allocating any available funds to the smallest debt while making minimum payments on others. Once the smallest debt is paid off, the same amount is applied to the next smallest, leading to a snowball effect that accelerates the debt repayment process. 4. Debt Consolidation Calculation: Debt consolidation involves combining multiple debts into a single loan or credit facility to streamline payments and potentially reduce interest rates. The debt consolidation calculation determines the new consolidated loan amount, the revised interest rate, and the repayment term, providing individuals or organizations with clarity on the potential benefits of debt consolidation. Hillsboro Oregon Debt Calculation plays a vital role in creating a customized debt management plan based on an individual or organization's specific financial situation. It helps identify the most effective strategies for debt reduction, establishes realistic repayment schedules, and enables individuals and businesses to regain control over their financial health. By meticulously calculating and evaluating debts using appropriate methods, individuals and organizations in Hillsboro, Oregon can take proactive steps towards achieving financial freedom and stability.

Hillsboro Oregon Debt Calculation

State:

Oregon

City:

Hillsboro

Control #:

OR-HJ-061-03

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Debt Calculation

Hillsboro Oregon Debt Calculation is a financial process that involves determining and analyzing the amount of debt an individual or organization in Hillsboro, Oregon has accrued. It is an essential step in creating a comprehensive financial plan to manage and eliminate debt effectively. The primary goal of Hillsboro Oregon Debt Calculation is to accurately assess the total debt owed, including credit card debts, loans, mortgages, student loans, and any other outstanding liabilities. By calculating the precise debt amount, individuals and businesses can gain a clear picture of their financial obligations and develop strategies to reduce debt over time. There are various types of Hillsboro Oregon Debt Calculation methods available, depending on the complexity and depth of the financial situation. Let's take a closer look at a few popular approaches: 1. Total Debt Calculation: This method involves adding up all outstanding debts, including the principal amount, interest accrued, additional fees, and any penalties. It provides individuals or businesses with a holistic view of their overall debt load. 2. Debt-to-Income Ratio Calculation: This approach evaluates the level of debt relative to the individual or organization's income. By dividing the total debt by the monthly income, the debt-to-income ratio is derived. This ratio serves as an indicator of one's ability to repay the debt and manage future financial obligations. 3. Debt Snowball Calculation: The debt snowball method focuses on paying off debts systematically. This approach involves listing debts from smallest to largest and allocating any available funds to the smallest debt while making minimum payments on others. Once the smallest debt is paid off, the same amount is applied to the next smallest, leading to a snowball effect that accelerates the debt repayment process. 4. Debt Consolidation Calculation: Debt consolidation involves combining multiple debts into a single loan or credit facility to streamline payments and potentially reduce interest rates. The debt consolidation calculation determines the new consolidated loan amount, the revised interest rate, and the repayment term, providing individuals or organizations with clarity on the potential benefits of debt consolidation. Hillsboro Oregon Debt Calculation plays a vital role in creating a customized debt management plan based on an individual or organization's specific financial situation. It helps identify the most effective strategies for debt reduction, establishes realistic repayment schedules, and enables individuals and businesses to regain control over their financial health. By meticulously calculating and evaluating debts using appropriate methods, individuals and organizations in Hillsboro, Oregon can take proactive steps towards achieving financial freedom and stability.

Free preview

How to fill out Hillsboro Oregon Debt Calculation?

If you’ve already used our service before, log in to your account and download the Hillsboro Oregon Debt Calculation on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Hillsboro Oregon Debt Calculation. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!