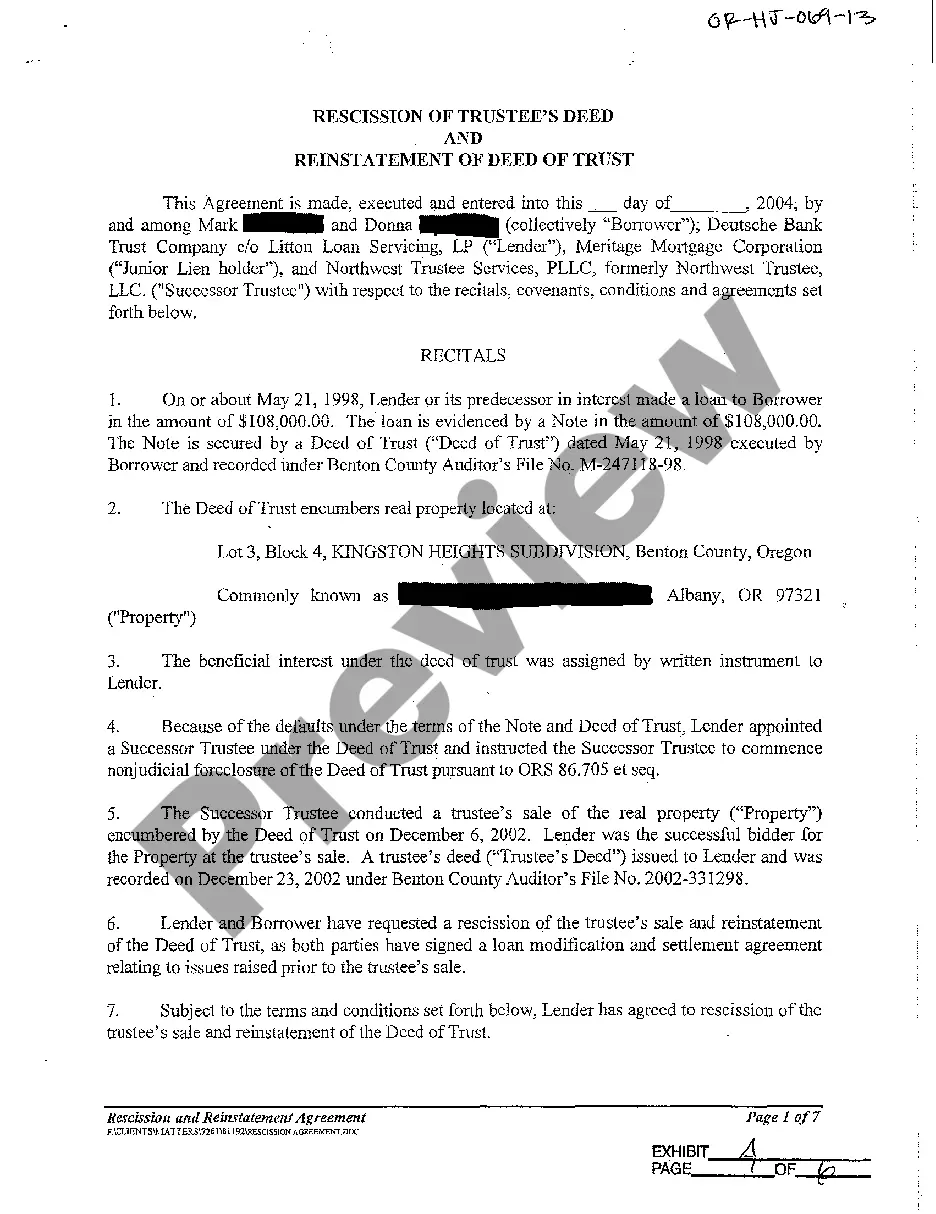

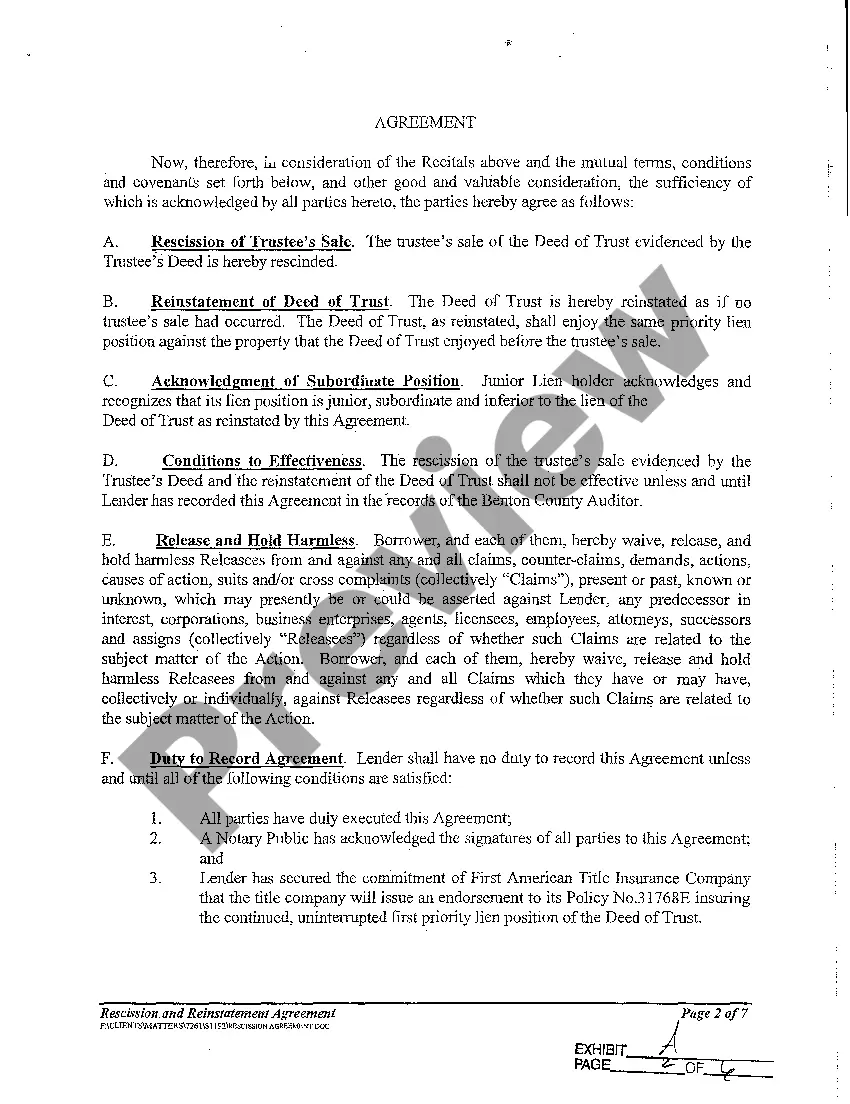

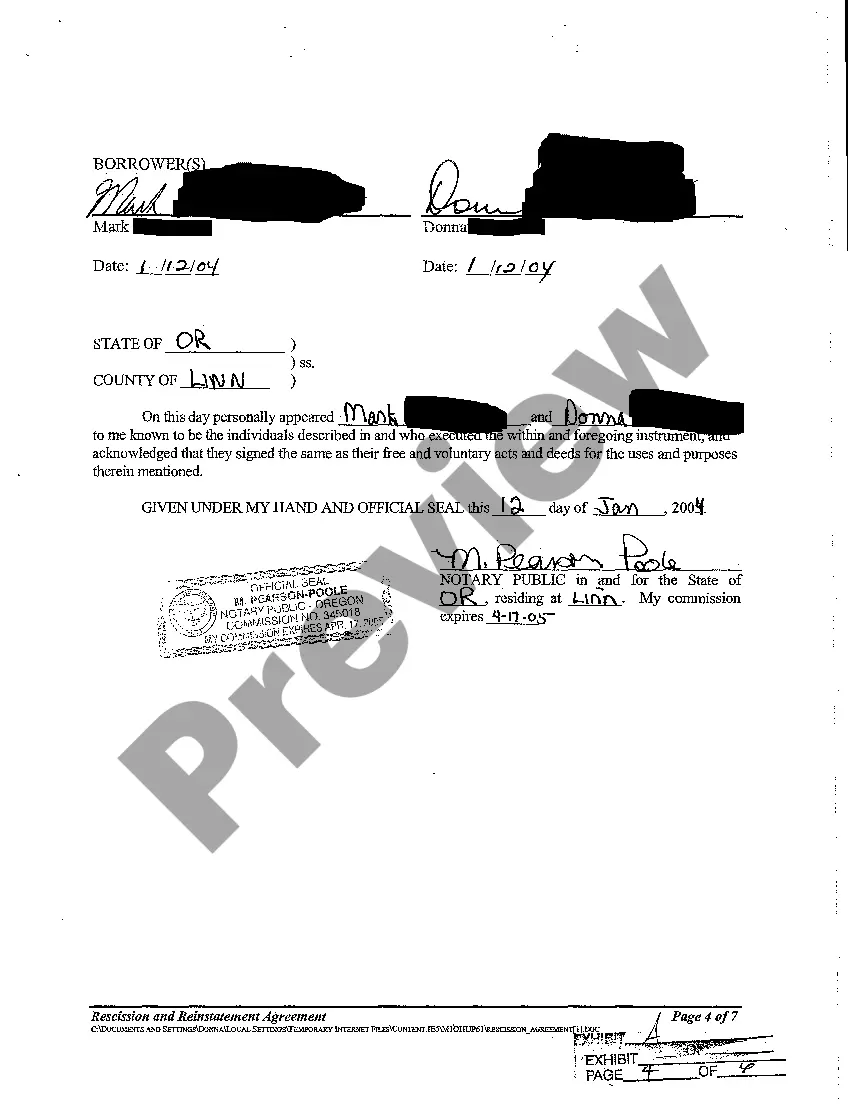

Keywords: Bend Oregon, Rescission of Trustee's Deed, Reinstatement of Deed of Trust Bend Oregon is a vibrant city nestled in picturesque Central Oregon, known for its stunning natural beauty and thriving real estate market. In the realm of real estate, one common legal process that property owners in Bend may encounter is "Rescission of Trustee's Deed" and "Reinstatement of Deed of Trust." Rescission of Trustee's Deed refers to the cancellation or invalidation of a previously executed Trustee's Deed, which transfers ownership of a property from a borrower to a trustee. This process can occur due to various reasons, such as errors in the deed, fraud, or the discovery of defects in the foreclosure process. By rescinding the Trustee's Deed, the ownership status reverts to its previous state. Conversely, Reinstatement of Deed of Trust involves reinstating the original Deed of Trust, which is a legal document that secures a loan against a property. This process typically occurs when a borrower resolves their default on the loan, often by paying past due amounts, penalties, and fees. Through the reinstatement, the borrower regains the trust of the lender, restoring the terms and conditions of the initial loan agreement. In Bend, there are different types of Rescission of Trustee's Deed and Reinstatement of Deed of Trust, depending on the specific circumstances and legal requirements. Some common variations include: 1. Voluntary Rescission: Occurs when both parties, the borrower and lender, mutually agree to cancel the Trustee's Deed, usually due to negotiated settlement terms or other resolutions. 2. Involuntary Rescission: Takes place when a court determines that the Trustee's Deed is invalid or unlawful, often due to procedural errors, fraudulent activities, or violations of borrower rights. 3. Judicial Reinstatement: In some cases, a borrower may seek judicial intervention to reinstate the Deed of Trust. This may arise when the borrower has rectified their default but encounters resistance from the lender. 4. Non-Judicial Reinstatement: This type of reinstatement occurs outside the court system when the borrower undertakes the necessary steps to rectify their arrears or comply with the agreed-upon terms of repayment set by the lender. It's worth noting that the Rescission of Trustee's Deed and Reinstatement of Deed of Trust processes are critical legal procedures that require careful consideration and guidance from real estate professionals, attorneys, or title companies. Each case is unique, and the specific steps and requirements can vary based on local regulations and individual circumstances. As part of the Bend Oregon real estate landscape, understanding the nuances of Rescission of Trustee's Deed and Reinstatement of Deed of Trust is essential for property owners, borrowers, and investors. Consulting knowledgeable professionals can help navigate these processes successfully and protect one's interests in the dynamic Bend real estate market.

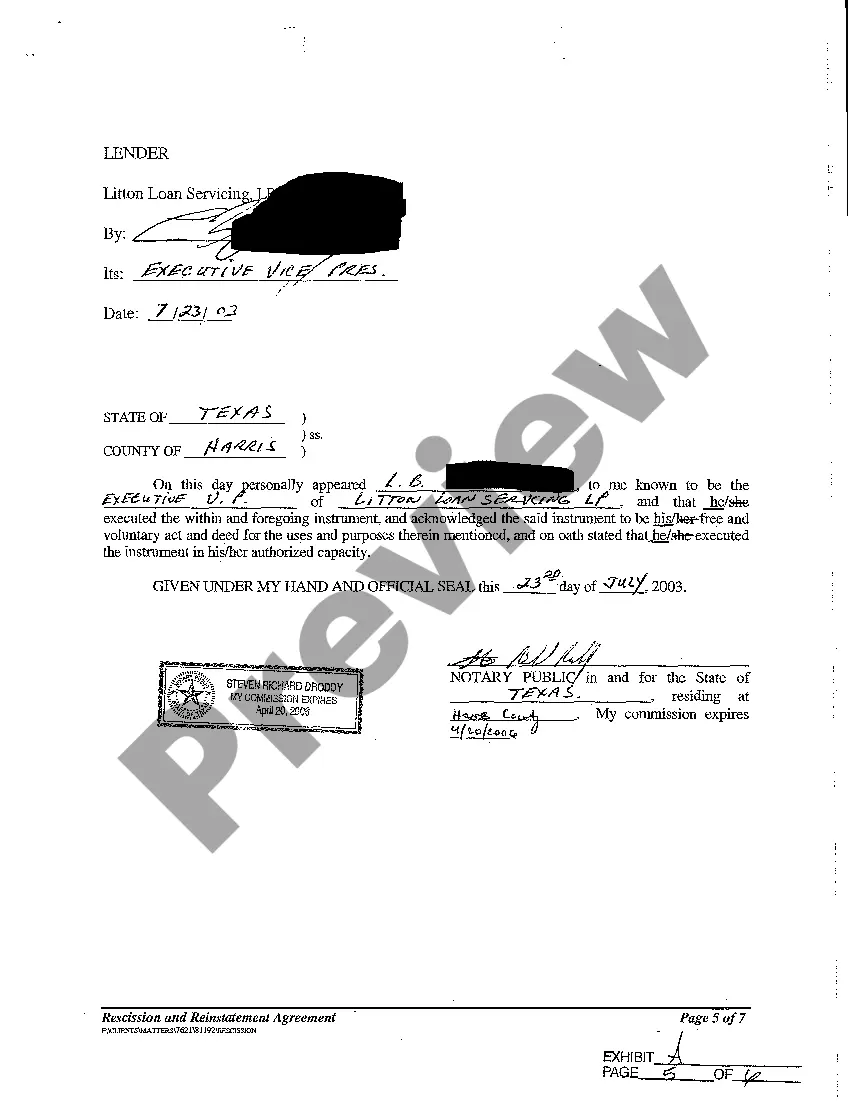

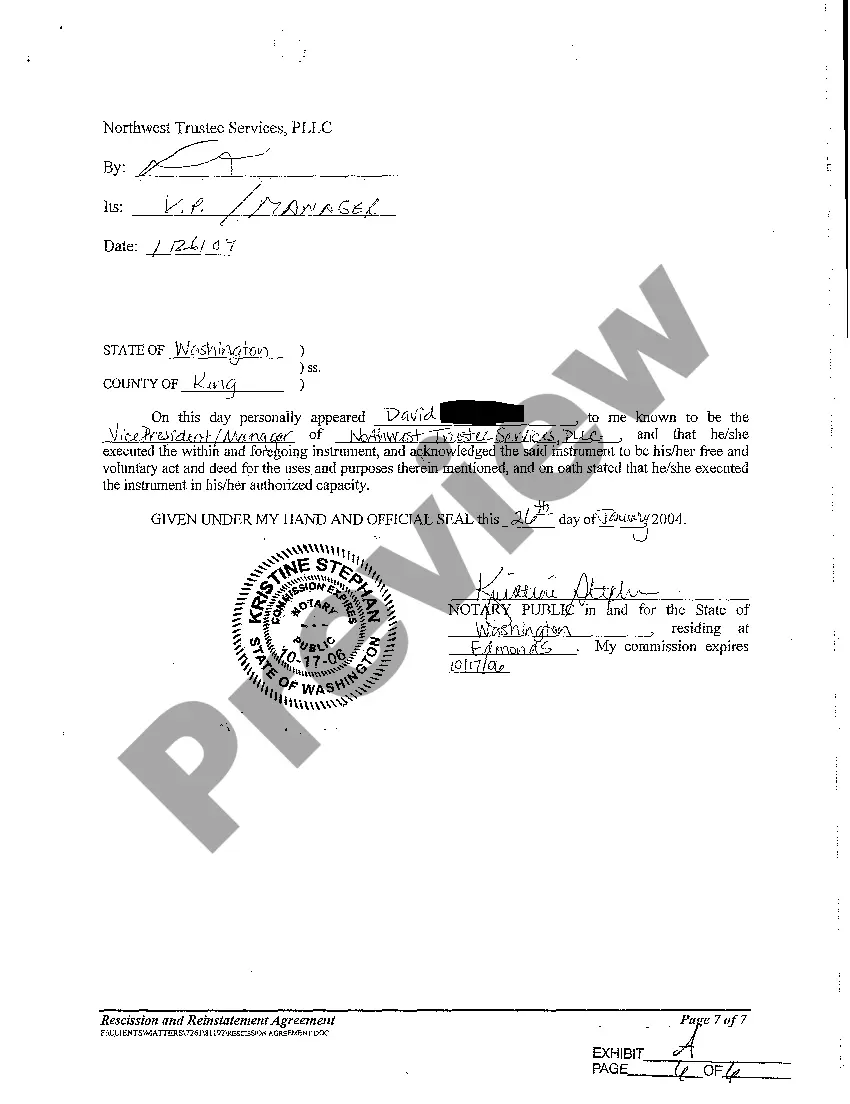

Bend Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust

Description

How to fill out Bend Oregon Rescission Of Trustee's Deed And Reinstatement Of Deed Of Trust?

We always strive to minimize or prevent legal damage when dealing with nuanced law-related or financial matters. To do so, we sign up for legal services that, usually, are extremely expensive. Nevertheless, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without using services of an attorney. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Bend Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Bend Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Bend Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust is suitable for your case, you can choose the subscription plan and make a payment.

- Then you can download the form in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!