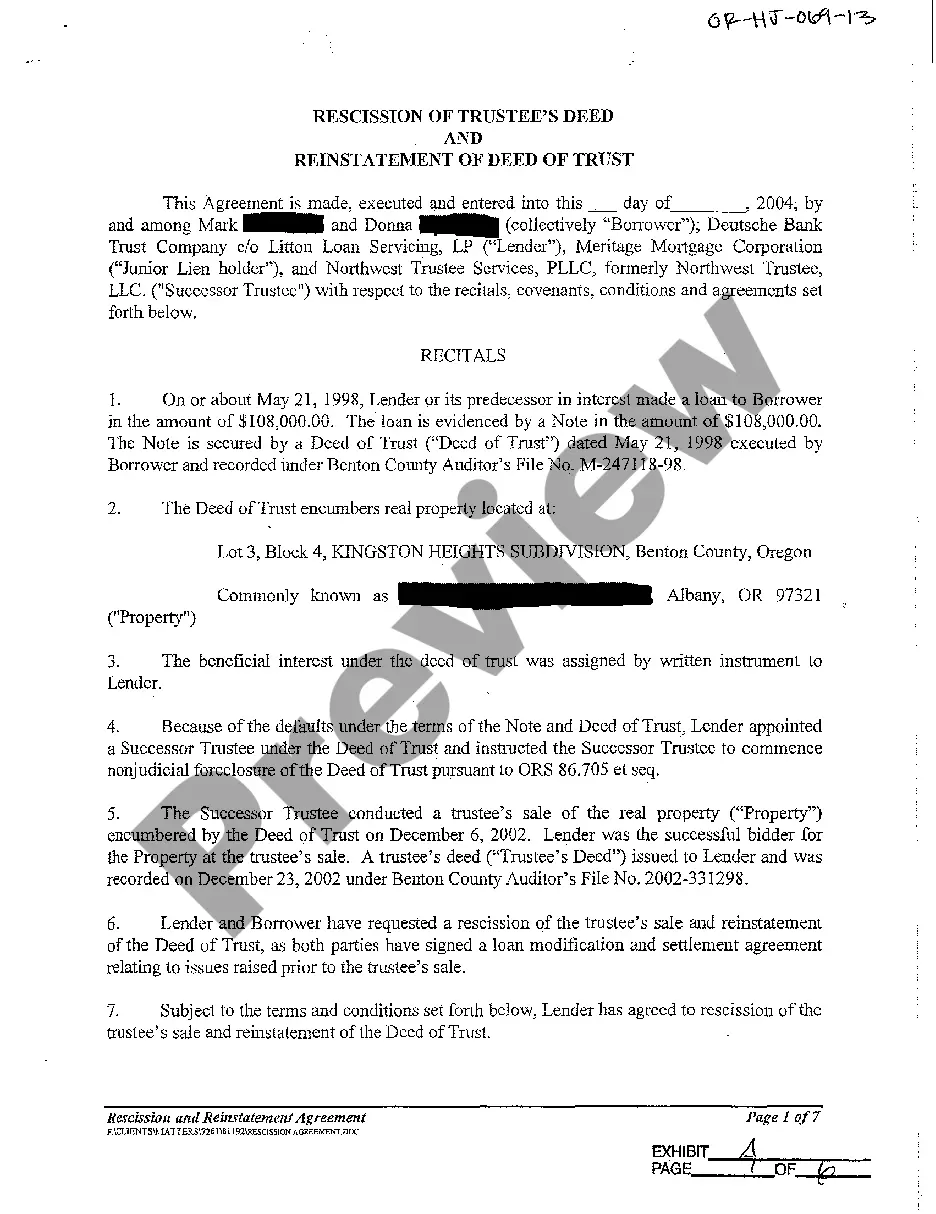

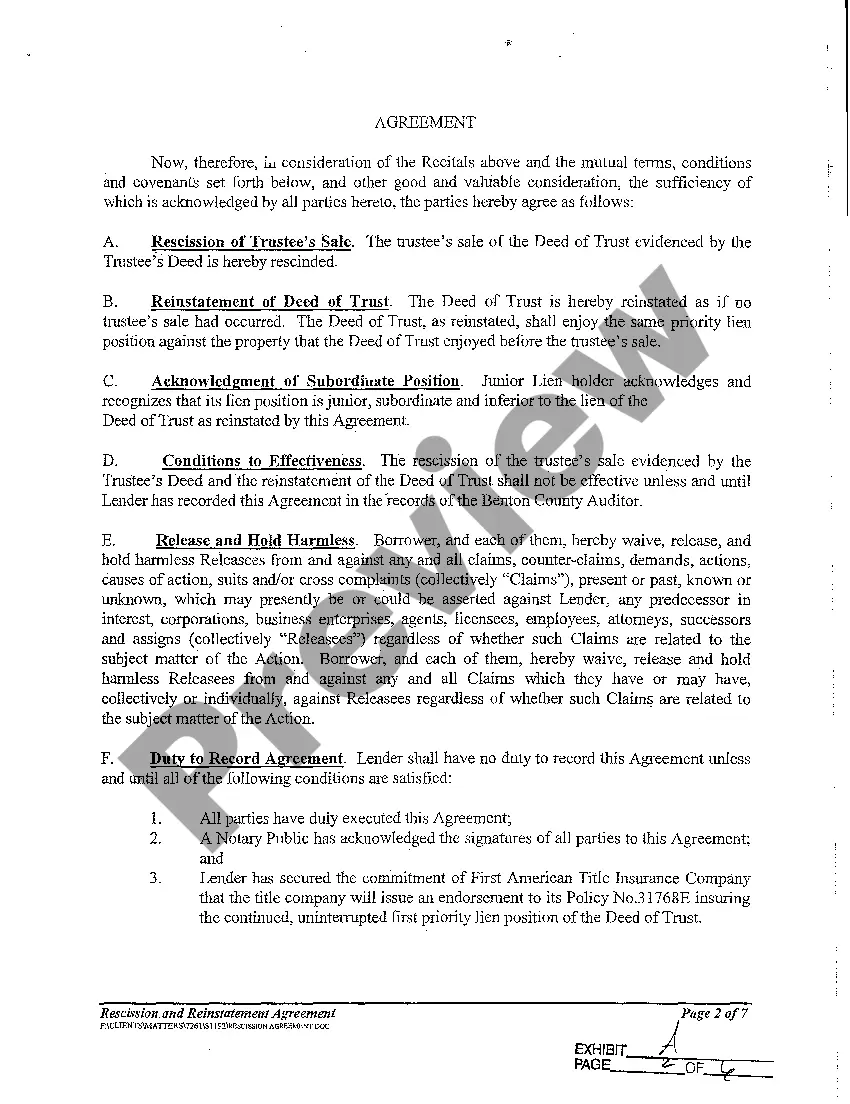

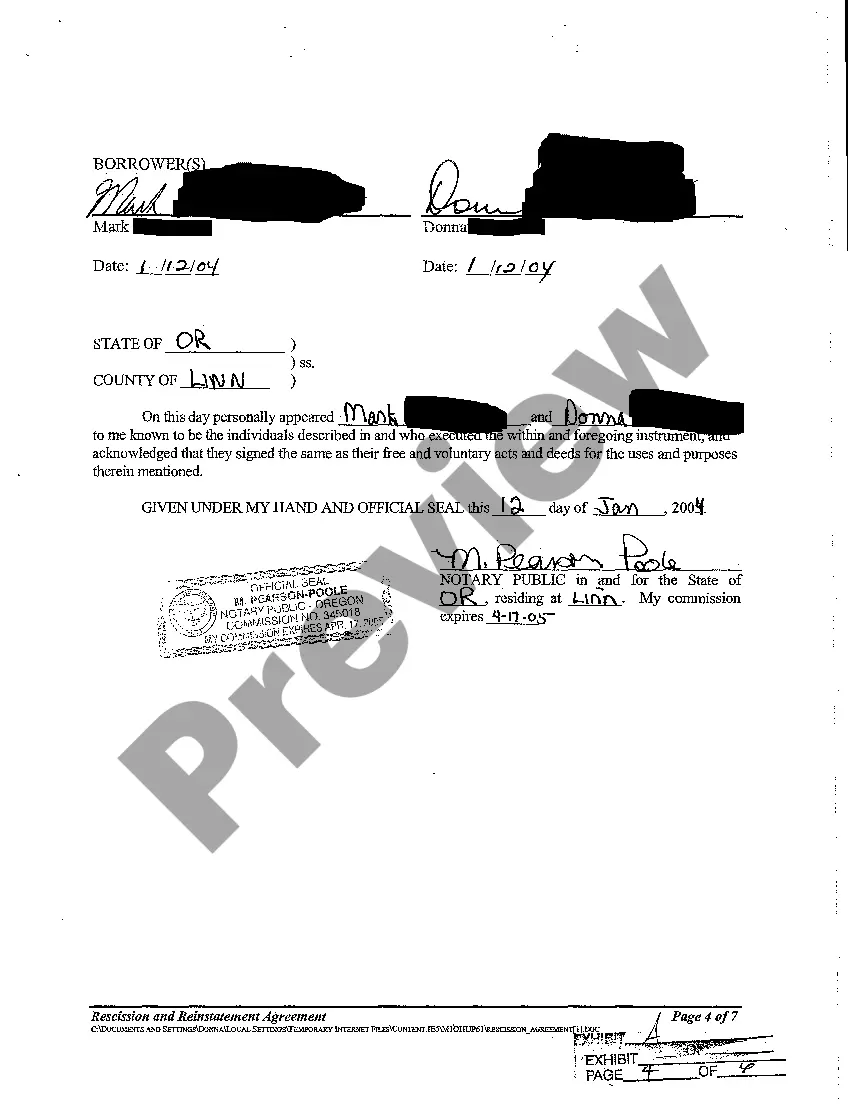

Keywords: Eugene Oregon, rescission of trustee's deed, reinstatement of deed of trust, types Eugene Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust In Eugene, Oregon, the process of rescission of a trustee's deed and reinstatement of a deed of trust is an important legal procedure that can occur under certain circumstances regarding real estate property. Let's delve into the details and explore the different types of rescission and reinstatement that may arise. Rescission of Trustee's Deed: Rescission of a trustee's deed is a legal action that can take place in the event of an invalid or defective trustee's deed. When a trustee's deed is deemed null and void due to errors or irregularities, the rescission process becomes necessary to correct the situation. It is vital for property owners to understand that a rescission of trustee's deed does not automatically restore ownership but rather seeks to reverse the legal consequences that resulted from a flawed trustee's deed. Reinstatement of Deed of Trust: The reinstatement of a deed of trust occurs when a borrower cures a default and brings their loan current. In the context of Eugene, Oregon, if a borrower falls behind on their mortgage payments and defaults on the deed of trust, they would have the option to reinstate the deed of trust through a reinstatement process. By fulfilling the required conditions and making all delinquent payments, the borrower can reinstate the deed of trust, which effectively revives the original terms of the loan agreement. Types of Rescission of Trustee's Deed and Reinstatement of Deed of Trust: 1. Mutual Rescission of Trustee's Deed: Under mutual rescission, all parties involved in the original trustee's deed voluntarily agree to nullify the deed's legal effects. This can occur when both the granter and the grantee realize an error or defect in the deed and decide to rectify it jointly. 2. Judicial Rescission of Trustee's Deed: In some cases, if parties cannot mutually agree on the rescission, the matter may be brought before a court. A judge may review the evidence, consider the legal arguments, and issue a decree for the rescission of the trustee's deed based on legal grounds, such as fraud, misrepresentation, or other valid reasons. 3. Property Owner's Reinstatement of Deed of Trust: For homeowners facing a potential foreclosure due to a default on their deed of trust, the option of reinstatement can help them avoid this outcome. By paying off all arrears, late fees, and any associated costs, the borrower demonstrates their commitment to fulfilling their loan obligations and can reinstate the deed of trust, thus preventing foreclosure. 4. Negotiated Reinstatement of Deed of Trust: In some situations, borrowers may negotiate a reinstatement plan with their lender, allowing for a more flexible approach in resolving delinquencies. This may involve modifying the loan terms, restructuring the payment schedule, or adding arrears to the end of the loan, enabling the borrower to make up missed payments and bring the deed of trust current. Understanding the intricacies of Eugene Oregon's rescission of trustee's deed and reinstatement of deed of trust is crucial for both property owners and lenders alike. Properly navigating these processes can ensure the protection of property rights, mitigate foreclosure risks, and provide opportunities for resolution and stability in real estate transactions in the Eugene, Oregon area.

Eugene Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust

Description

How to fill out Eugene Oregon Rescission Of Trustee's Deed And Reinstatement Of Deed Of Trust?

If you are looking for a valid form template, it’s impossible to choose a more convenient platform than the US Legal Forms site – one of the most extensive libraries on the web. Here you can get a large number of templates for company and personal purposes by categories and regions, or key phrases. With our high-quality search feature, discovering the most up-to-date Eugene Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust is as easy as 1-2-3. Moreover, the relevance of each and every record is proved by a group of skilled attorneys that on a regular basis check the templates on our website and revise them in accordance with the most recent state and county demands.

If you already know about our system and have an account, all you need to get the Eugene Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just follow the instructions below:

- Make sure you have chosen the sample you need. Look at its explanation and utilize the Preview function to explore its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to find the needed record.

- Affirm your choice. Select the Buy now option. Next, select your preferred pricing plan and provide credentials to sign up for an account.

- Process the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Receive the form. Indicate the format and save it to your system.

- Make changes. Fill out, revise, print, and sign the acquired Eugene Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust.

Every form you save in your account does not have an expiration date and is yours forever. You can easily access them using the My Forms menu, so if you want to get an additional version for editing or printing, feel free to return and export it again whenever you want.

Take advantage of the US Legal Forms extensive library to get access to the Eugene Oregon Rescission of Trustee's Deed and Reinstatement of Deed of Trust you were looking for and a large number of other professional and state-specific templates on a single platform!