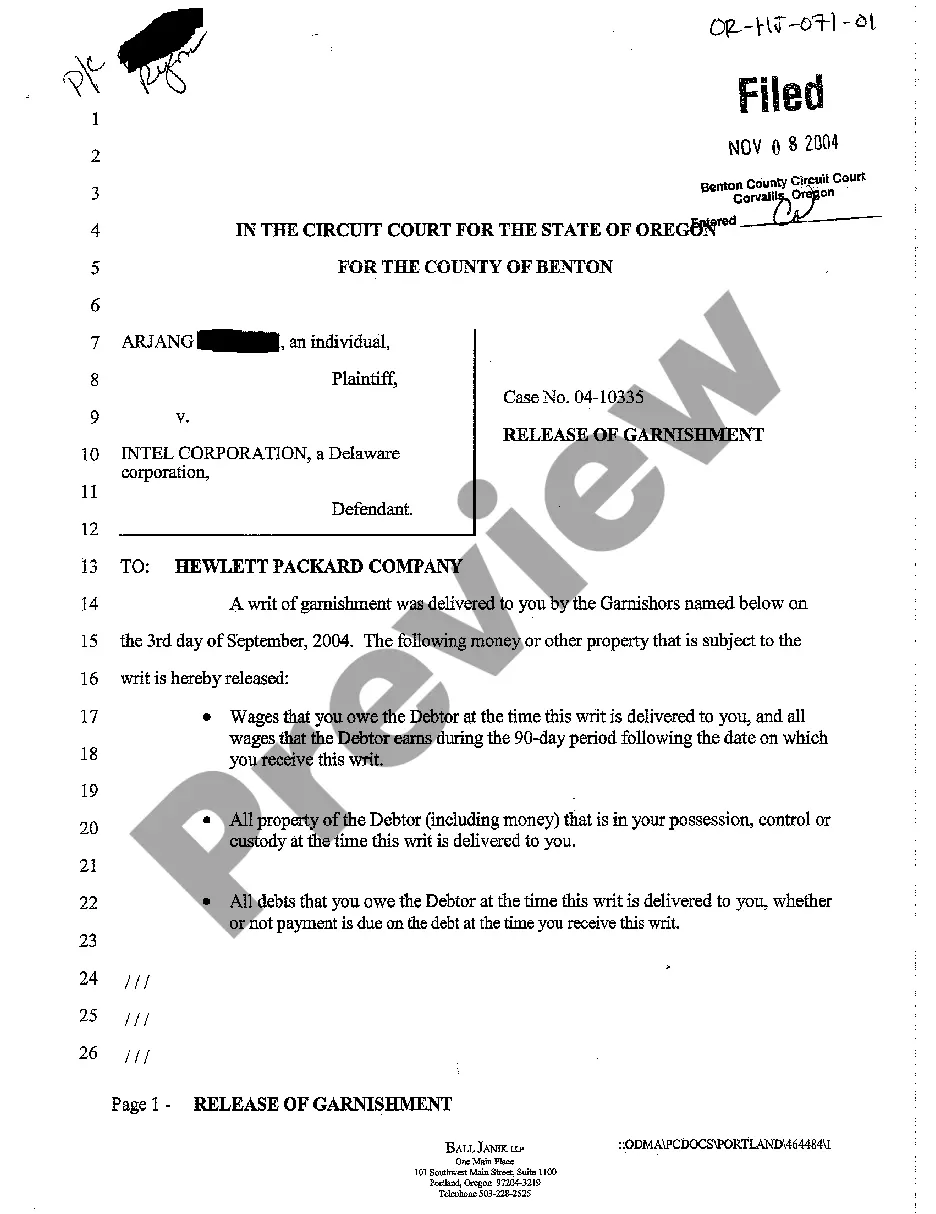

Portland Oregon Release of Garnishment is a legal process that provides debtors with relief from having their wages or bank accounts garnished. This release is crucial for individuals who have experienced a financial hardship and want to regain control of their finances. It is essential to understand the various types of Portland Oregon Release of Garnishment to ensure appropriate action is taken. 1. Wage Garnishment Release in Portland Oregon: This type of release focuses on removing the burden of wage garnishment, which occurs when a creditor obtains a court order to deduct a portion of a debtor's earnings directly from their paycheck. A Wage Garnishment Release ensures that the debtor's income is fully restored, enabling them to cover their basic living expenses and restore financial stability. 2. Bank Account Garnishment Release in Portland Oregon: This release pertains to the removal of a bank account garnishment, whereby creditors obtain court orders seizing funds directly from the debtor's bank account. A Bank Account Garnishment Release frees the debtor from the restrictions imposed on accessing their own money, allowing them to meet their financial obligations and manage their expenses effectively. 3. Property Garnishment Release in Portland Oregon: Property garnishment occurs when a creditor obtains a court order to seize and sell the debtor's property, such as a house or vehicle, to satisfy outstanding debts. A Property Garnishment Release safeguards the debtor's property from seizure, allowing them to retain ownership and prevent further financial distress. 4. Release of Garnishment on Federal Benefits in Portland Oregon: Certain types of income, such as Social Security benefits or veterans' benefits, are protected from garnishment under federal law. However, there are exceptions to this protection. A Release of Garnishment on Federal Benefits ensures that creditors cannot unlawfully garnish these benefits, thereby safeguarding the debtor's financial stability and crucial income sources. Navigating the Portland Oregon Release of Garnishment process can be complex, making it imperative to seek legal advice or assistance. By understanding the different types of releases available, debtors can pursue the appropriate action to relieve the financial burdens imposed by creditors and restore control over their personal finances.

Portland Oregon Release of Garnishment

Description

How to fill out Portland Oregon Release Of Garnishment?

Do you require a reliable and affordable legal document provider to obtain the Portland Oregon Release of Garnishment? US Legal Forms is your ideal answer.

Whether you need a simple contract to outline regulations for living with your partner or a set of forms to progress your separation or divorce through legal channels, we have you covered. Our platform presents over 85,000 current legal document templates for personal and business usage. All templates we offer are not generic and tailored to meet the specifications of particular state and county regulations.

To acquire the form, you must Log In to your account, find the desired template, and click the Download button beside it. Please remember that you can retrieve your previously obtained form templates at any moment from the My documents section.

Are you a newcomer to our site? No need to worry. You can set up an account with great ease, but before doing so, ensure that you.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is processed, download the Portland Oregon Release of Garnishment in any provided format. You can return to the website at any point and redownload the form at no cost.

Locating current legal forms has never been simpler. Try US Legal Forms today, and put an end to the hours wasted learning about legal documentation online once and for all.

- Verify that the Portland Oregon Release of Garnishment aligns with the regulations of your state and locality.

- Review the form’s description (if available) to understand who and what the form is designated for.

- Restart the search if the template is not appropriate for your legal case.

Form popularity

FAQ

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

A garnishor may issue a release of garnishment that covers all or any portion of the property held under a writ of garnishment. The release must be in substantially the form provided by ORS 18.842 (Release of garnishment form). The garnishor must deliver a copy of the release to the garnishee and the debtor.

File an Exemption in Oregon You must file a wage garnishment exemption form to request this relief. You can also try to use an example letter to stop wage garnishment if you have income that is protected from debt wage garnishments such as social security income.

Under Oregon law, a Wage Garnishment can last up to a maximum of 90 days from when it is delivered. It will stop earlier than that if the debt is paid in full. Unfortunately, there is no restriction under Oregon law to stop a creditor from issuing a new Wage Garnishment once the first garnishment expires.

Filing for a Claim of Exemption You will file a document with the court that gave the garnishment order. You'll describe the exemption and also provide any proof of dependents. A hearing will be scheduled where you'll have a chance to prove that your income is exempt. This is commonly known as Challenge to Garnishment.

Under Oregon law, judgment creditors can garnish 25% of your disposable income (money after deductions). There is a minimum threshold to garnishment, however. If you earn less than $254 take home per workweek in wages at a job, a judgment creditor cannot garnish your wages.

In general, if you have a contractual debt in Oregon that you have not repaid, the creditor has six years to pursue you with legal action before the Oregon statute of limitations expires. This applies to medical, credit card and mortgage debt.

The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not. An additional 5% may be garnished for support payments more than l2 weeks in arrears.

In Oregon, the statute of limitations for debt is six years. This means a creditor has up to six years to file a lawsuit to collect on the debt. The six-year statute of limitations applies to medical debt, credit card debt, and auto loan debt.

Interesting Questions

More info

They borrowed from a local pawn shop with Kitty's name on it. In order to pay the balance of her borrowed money, Rowdy contacted a local debt collector to collect his overdue balance. She told him that his debts are too large to even attempt to collect them. He complained to the State Treasurer's Office, and they denied his allegations. They offered to resolve the debt by issuing him with an EIN. The State Treasurer's Office told Rowdy that their records show he is not a resident of the state of Oregon, that he has never resided there, and that he is not of good moral character (the State Board of Examiners). Rowdy's response was a very polite “I guess this is a no-brainer to everyone, but I don't trust you to protect my reputation.” After paying off the debt, Rowdy contacted both his employer and state treasurer's office and was informed the debts were “too small” to consider processing.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.