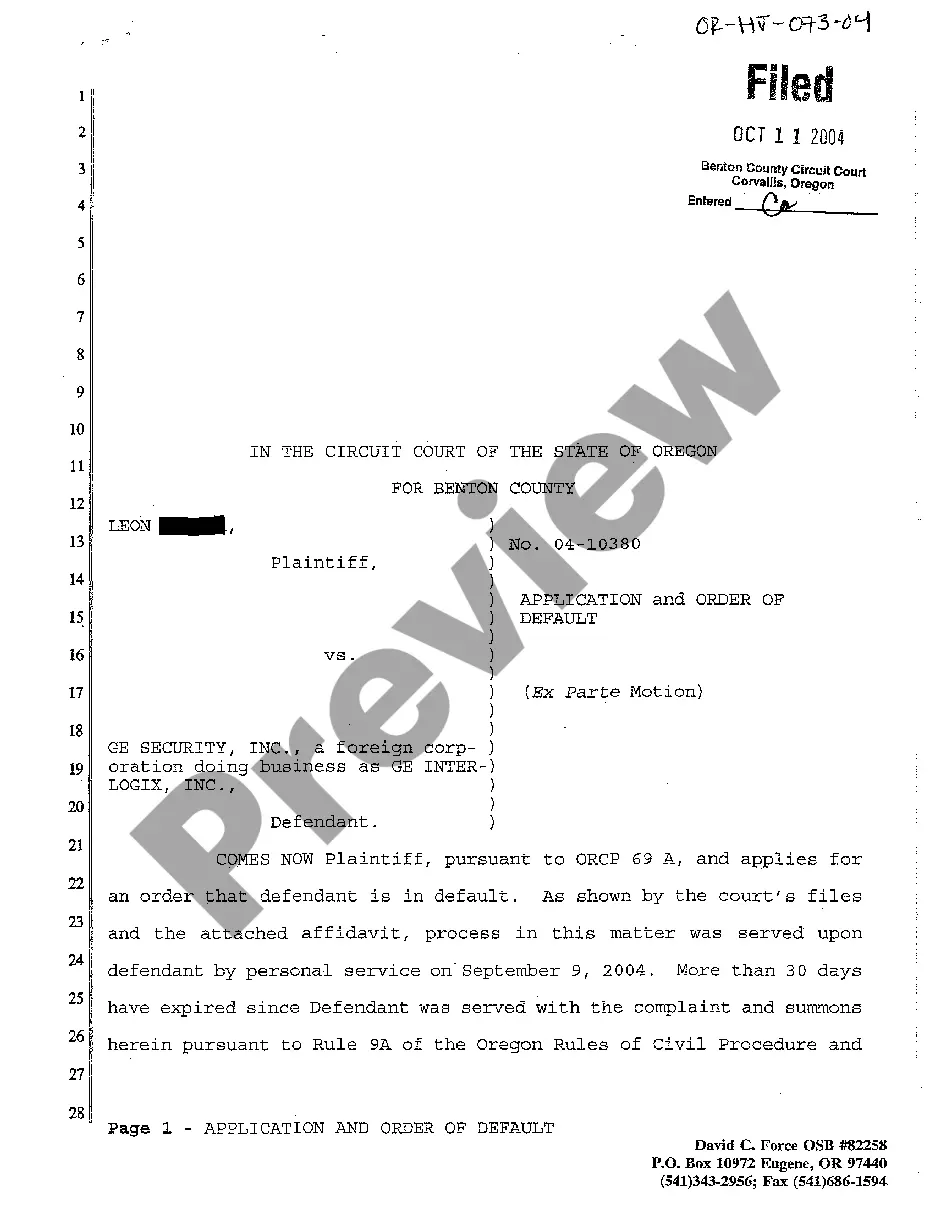

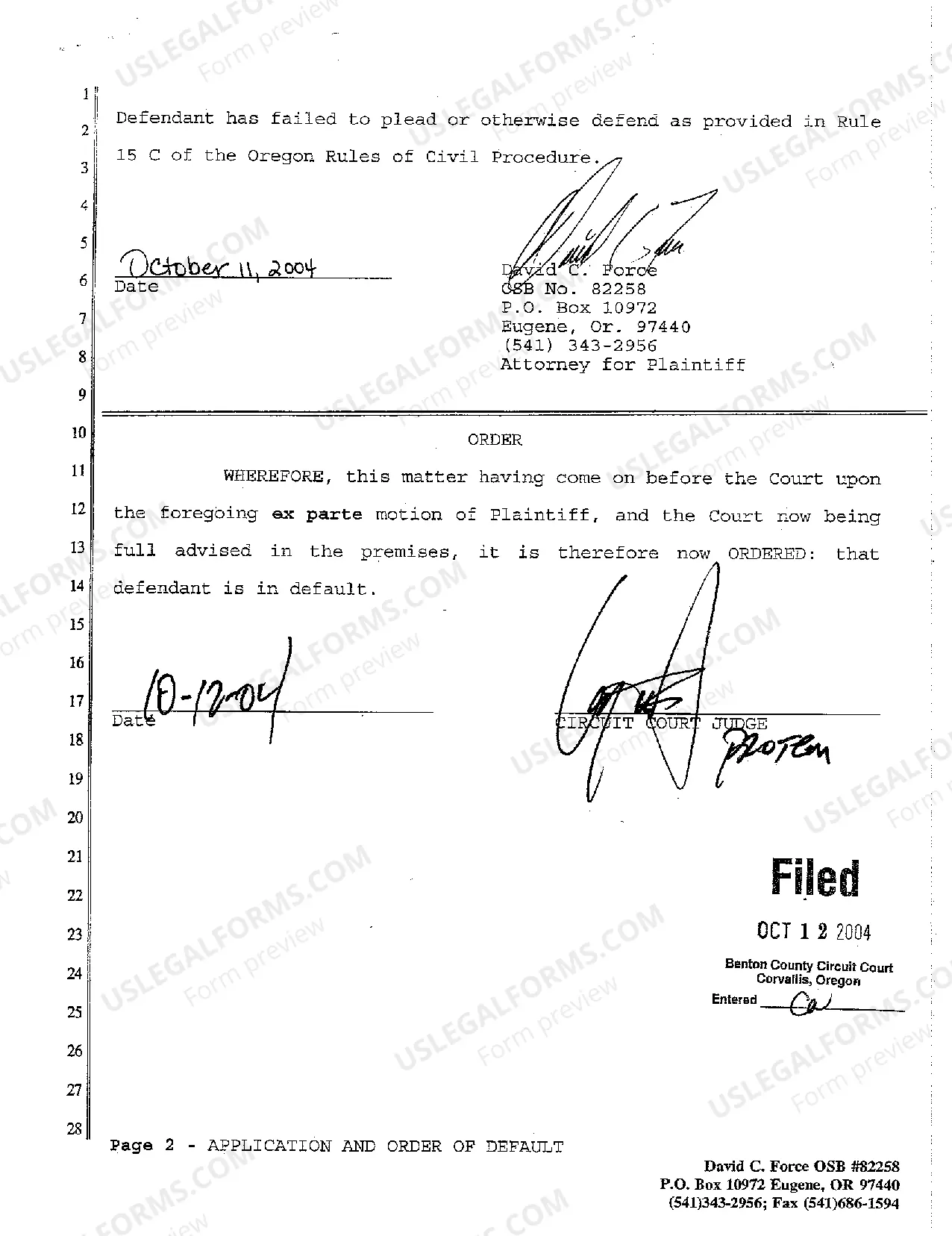

Title: Understanding Bend Oregon Application and Order of Default: A Comprehensive Guide Introduction: In Bend, Oregon, the Application and Order of Default process is a legal procedure used in foreclosure cases. This detailed description aims to provide a comprehensive understanding of what Bend Oregon Application and Order of Default entail, including various types of applications and orders that one may encounter in this context. 1. What is a Bend Oregon Application? Bend Oregon Application is a formal request submitted by the lender or foreclosing party to initiate the foreclosure process. This application typically includes essential details such as the borrower's name, property description, loan specifics, and justifiable grounds for foreclosure. The application marks the first step in the foreclosure process, highlighting the lender's intent to initiate legal action against the borrower in cases of default. Types of Bend Oregon Applications: a) Notice of Default Application: This application serves as the initial notice to the borrower, informing them of their defaulted loan status and the potential consequences if they fail to address the default within the specified timeframe. b) Application to Cure Default: Borrowers who wish to rectify their default may submit an Application to Cure Default, explaining their plans to bring their loan payments up to date and halt the foreclosure proceedings. c) Counterclaim Application: In certain circumstances, borrowers may file a Counterclaim Application to challenge the legality or validity of the foreclosure process initiated by the lender. This type of application aims to halt further proceedings until the counterclaim is addressed and resolved. 2. What is an Order of Default? An Order of Default, sometimes referred to as a Default Judgement, is a legal ruling made by the court when the borrower fails to respond to the Application or fails to cure the default within the given timeframe. This order signifies that the borrower has defaulted on their loan and opens the gateway for further legal action by the lender. Types of Order of Defaults: a) Default Judgment of Foreclosure: If the borrower fails to respond or rectify the default, the court may issue a Default Judgment of Foreclosure. This ruling allows the lender to proceed with the foreclosure process and auction the property to recoup the outstanding debt owed. b) Default Judgment Dismissal: In some cases, borrowers may successfully challenge the foreclosure process and have the Default Judgment dismissed. This dismissal halts the foreclosure proceedings and may require the lender and borrower to renegotiate the terms of the loan or explore alternative solutions. Conclusion: Bend Oregon Application and Order of Default play crucial roles in the foreclosure process, marking the initial steps taken by lenders and borrowers in resolving defaulted loans. Understanding the various types of applications and the potential outcomes of default judgements is essential for both borrowers and lenders to navigate this legal process effectively. Seeking legal counsel and exploring options for loan modification or repayment plans are advised steps to take when faced with potential foreclosure.

Title: Understanding Bend Oregon Application and Order of Default: A Comprehensive Guide Introduction: In Bend, Oregon, the Application and Order of Default process is a legal procedure used in foreclosure cases. This detailed description aims to provide a comprehensive understanding of what Bend Oregon Application and Order of Default entail, including various types of applications and orders that one may encounter in this context. 1. What is a Bend Oregon Application? Bend Oregon Application is a formal request submitted by the lender or foreclosing party to initiate the foreclosure process. This application typically includes essential details such as the borrower's name, property description, loan specifics, and justifiable grounds for foreclosure. The application marks the first step in the foreclosure process, highlighting the lender's intent to initiate legal action against the borrower in cases of default. Types of Bend Oregon Applications: a) Notice of Default Application: This application serves as the initial notice to the borrower, informing them of their defaulted loan status and the potential consequences if they fail to address the default within the specified timeframe. b) Application to Cure Default: Borrowers who wish to rectify their default may submit an Application to Cure Default, explaining their plans to bring their loan payments up to date and halt the foreclosure proceedings. c) Counterclaim Application: In certain circumstances, borrowers may file a Counterclaim Application to challenge the legality or validity of the foreclosure process initiated by the lender. This type of application aims to halt further proceedings until the counterclaim is addressed and resolved. 2. What is an Order of Default? An Order of Default, sometimes referred to as a Default Judgement, is a legal ruling made by the court when the borrower fails to respond to the Application or fails to cure the default within the given timeframe. This order signifies that the borrower has defaulted on their loan and opens the gateway for further legal action by the lender. Types of Order of Defaults: a) Default Judgment of Foreclosure: If the borrower fails to respond or rectify the default, the court may issue a Default Judgment of Foreclosure. This ruling allows the lender to proceed with the foreclosure process and auction the property to recoup the outstanding debt owed. b) Default Judgment Dismissal: In some cases, borrowers may successfully challenge the foreclosure process and have the Default Judgment dismissed. This dismissal halts the foreclosure proceedings and may require the lender and borrower to renegotiate the terms of the loan or explore alternative solutions. Conclusion: Bend Oregon Application and Order of Default play crucial roles in the foreclosure process, marking the initial steps taken by lenders and borrowers in resolving defaulted loans. Understanding the various types of applications and the potential outcomes of default judgements is essential for both borrowers and lenders to navigate this legal process effectively. Seeking legal counsel and exploring options for loan modification or repayment plans are advised steps to take when faced with potential foreclosure.