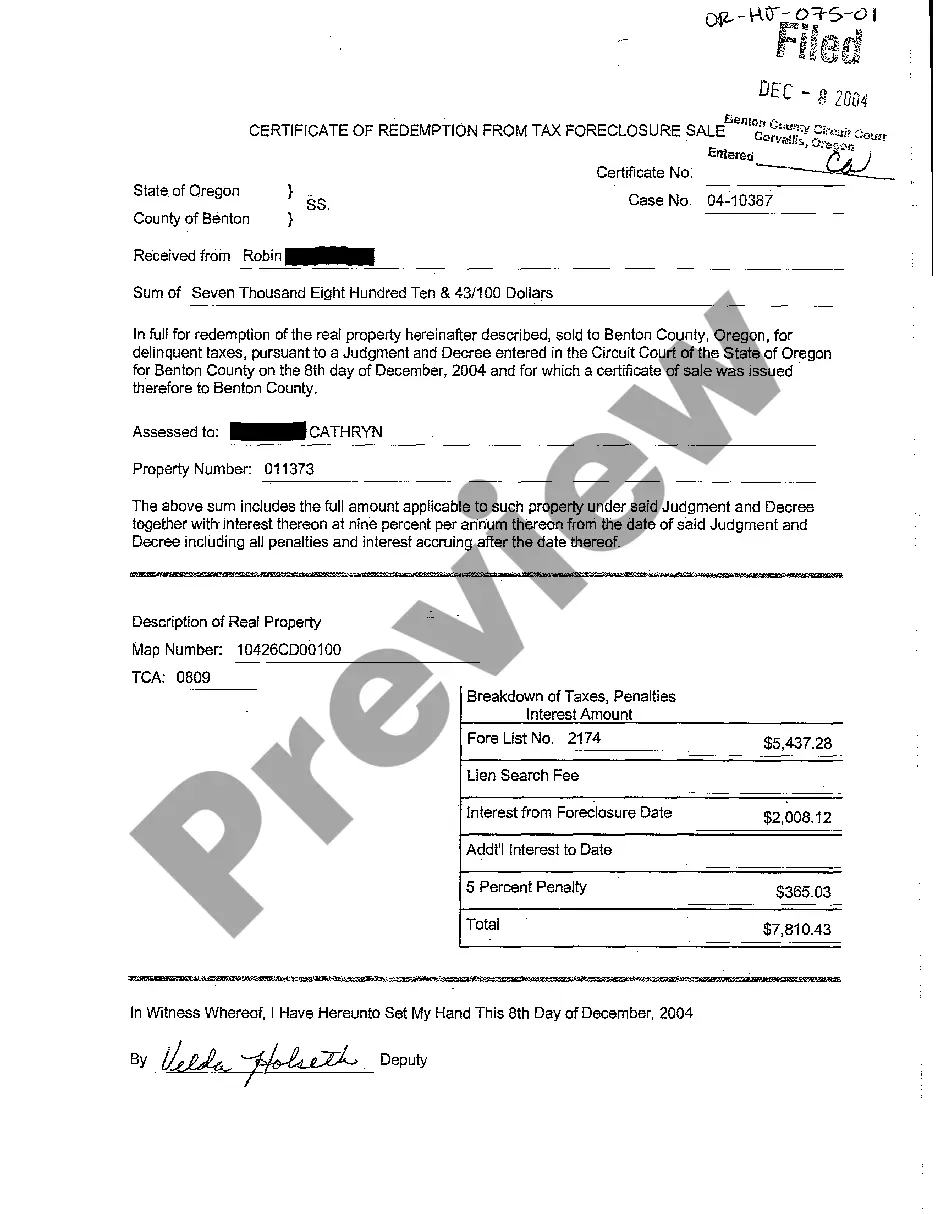

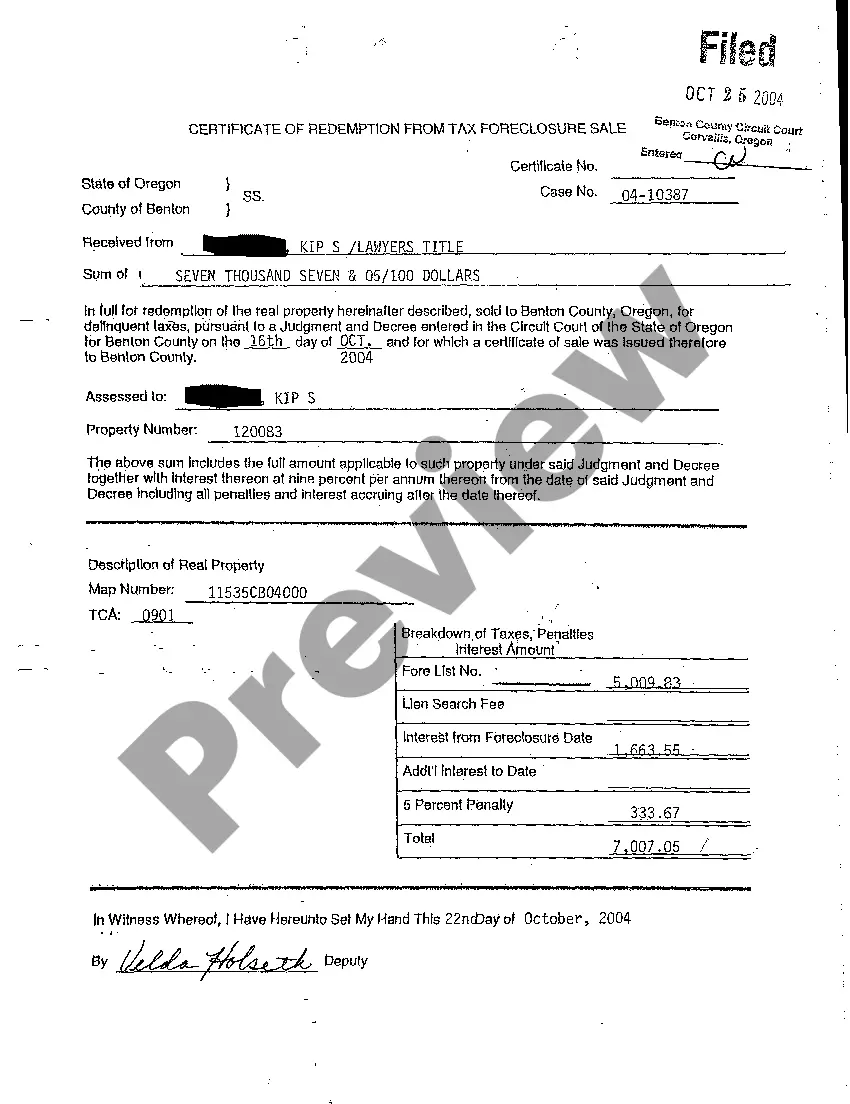

The Bend Oregon Certificate of Redemption from Tax Foreclosure Sale is an essential legal document that allows a property owner to reclaim their property after it has been sold due to delinquent taxes. This certificate serves as proof of payment and redemption, indicating that the property owner has settled the outstanding tax debt and regained full ownership rights. In Bend, Oregon, there are primarily two types of Certificates of Redemption that property owners can obtain: the Original Certificate of Redemption and the Final Certificate of Redemption. The Original Certificate of Redemption is issued to property owners who have successfully paid off their outstanding tax debt within a specified period after the tax foreclosure sale. This document signifies that the original property owner has formally redeemed the property and regained complete control over it. On the other hand, if the property owner fails to redeem the property within the specified timeframe, the Bend Oregon Certificate of Redemption will be considered a Final Certificate of Redemption. This type of certificate denotes that the redemption period has elapsed, and the property has permanently transferred to the new owner who purchased it at the tax foreclosure sale. Both the Original Certificate of Redemption and the Final Certificate of Redemption play significant roles in the Bend Oregon tax foreclosure process. These certificates establish legal documentation of property ownership status and enable property owners to exercise their rights to reclaim their property or acknowledge its permanent transfer to a new owner. It is important for property owners in Bend, Oregon, to understand the requirements and procedures for obtaining a Certificate of Redemption from Tax Foreclosure Sale to protect their property rights. Seeking legal guidance or consulting with the Descartes County Tax Office is highly recommended ensuring a smooth process and successful redemption of the property.

Bend Oregon Certificate of Redemption from Tax Foreclosure Sale

Description

How to fill out Bend Oregon Certificate Of Redemption From Tax Foreclosure Sale?

We always strive to reduce or prevent legal issues when dealing with nuanced law-related or financial matters. To do so, we sign up for legal solutions that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online catalog of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without the need of turning to a lawyer. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Bend Oregon Certificate of Redemption from Tax Foreclosure Sale or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again in the My Forms tab.

The process is equally straightforward if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Bend Oregon Certificate of Redemption from Tax Foreclosure Sale complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Bend Oregon Certificate of Redemption from Tax Foreclosure Sale would work for you, you can choose the subscription plan and make a payment.

- Then you can download the document in any suitable format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!