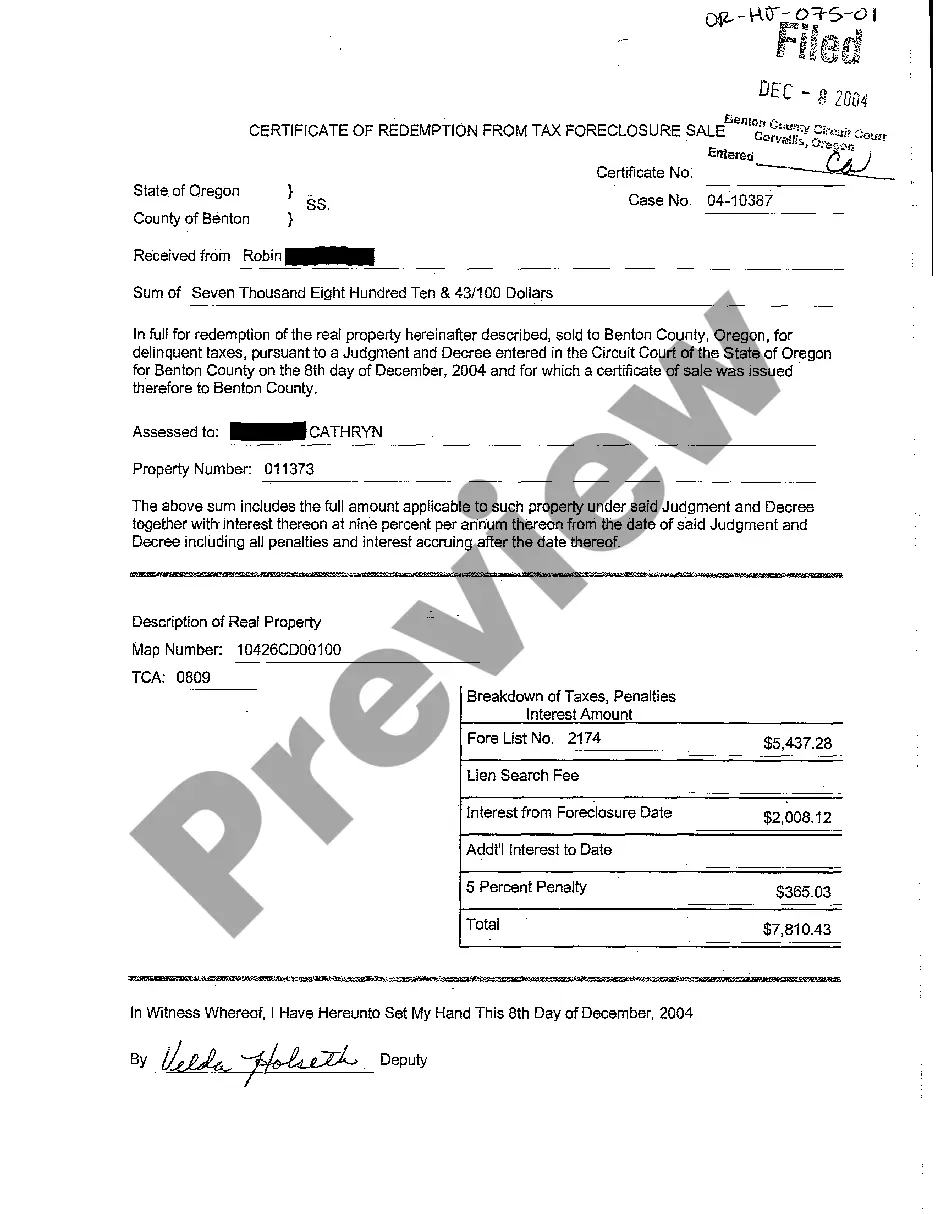

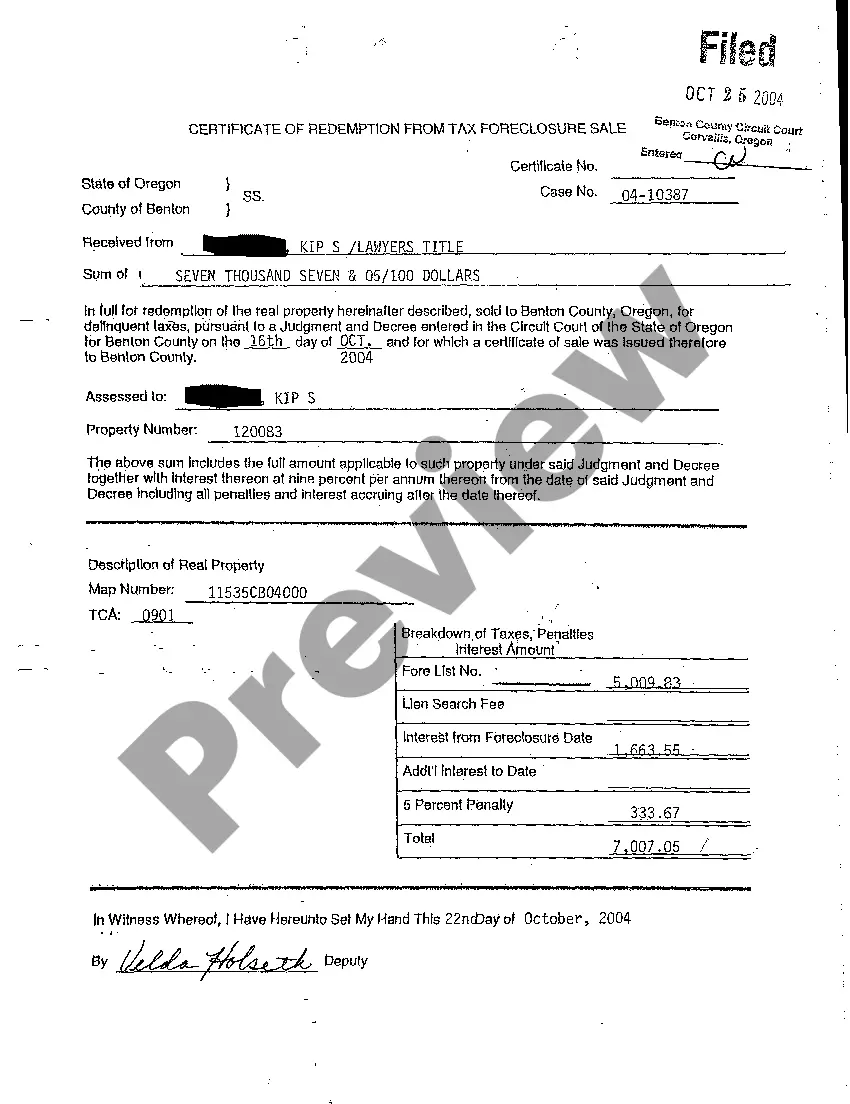

Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale is an official document issued to individuals or entities who successfully redeem their properties that were sold through tax foreclosure auctions in Gresham, Oregon. This certificate serves as proof of redemption and restores the ownership rights back to the original owner or interested party. During the tax foreclosure sale, when a property owner fails to pay their property taxes, the county government conducts a public auction to recover the unpaid taxes. The highest bidder at the auction acquires a tax lien on the property. However, the property owner still has the opportunity to redeem the property within a specific redemption period by paying the outstanding taxes, penalties, and interest accrued. Once the redemption process is completed, the Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale is issued. The Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale is essential as it provides legal documentation that the property has been reclaimed by the original owner. This certificate also proves that all outstanding taxes and penalties have been satisfied, ensuring a clear title for future transactions. It offers peace of mind to property owners, as it confirms the validity of their redemption process and prevents any further complications related to the tax foreclosure sale. Different types of Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale may include: 1. Residential Property Redemption Certificate: This certificate is issued for residential properties that have been redeemed by the original owners or interested parties after the tax foreclosure sale. 2. Commercial Property Redemption Certificate: This type of certificate is issued for commercial properties that have been redeemed by the original owners or interested parties following the tax foreclosure sale. 3. Vacant Land Redemption Certificate: This certificate pertains to vacant land that has been redeemed by the original owner or interested party after the tax foreclosure sale. 4. Multi-unit Property Redemption Certificate: This type of certificate applies to properties with multiple units, such as apartments or condominiums, that have been redeemed by the original owners or interested parties after the tax foreclosure sale. In conclusion, the Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale is a crucial document that confirms the redemption of a property after it has been sold through a tax foreclosure auction. It ensures a clear title and provides legal evidence of the redemption process. Property owners can obtain different types of redemption certificates based on the type of property being redeemed, including residential, commercial, vacant land, and multi-unit properties.

Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale

Description

How to fill out Gresham Oregon Certificate Of Redemption From Tax Foreclosure Sale?

We always want to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal solutions that, usually, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to a lawyer. We offer access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale is proper for your case, you can select the subscription plan and proceed to payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!

Form popularity

FAQ

The 120 day rule signifies that homeowners in foreclosure have a limited window of 120 days to redeem their property after it has been sold at a tax foreclosure sale. This period is crucial for property owners, as it allows them to recover their asset by fulfilling necessary financial obligations. Utilizing a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale during this time can facilitate a smoother redemption process. Staying informed about this timeframe can help you act quickly and effectively to reclaim your property.

Redemption in the context of foreclosure means the ability to buy back your property after it has been sold at a tax sale. It is a critical phase where the original owner can reclaim their asset by settling debts, including taxes owed, as well as any additional interests or costs. The Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale is essential for confirming your eligibility to redeem your property. Understanding this process can help you navigate through foreclosure and maintain ownership of your land.

In Oregon, the right of redemption allows property owners a chance to reclaim their property after a tax foreclosure sale. This means that even if your property is sold due to unpaid taxes, you can still recover it by paying the owed taxes, interest, and penalties. Specifically, a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale is important to understand, as it facilitates this process and sets the conditions for exercising this right. Knowing your rights can empower you to take action and potentially save your property.

To get out of tax foreclosure in Gresham, Oregon, you should first understand the process. You can file for a Certificate of Redemption from Tax Foreclosure Sale, which allows you to reclaim your property by paying the owed taxes and any associated fees. It’s crucial to act quickly, as there are deadlines that you must meet to secure your rights. Consider using uslegalforms for guidance, as they offer resources and templates specifically tailored to assist you in navigating a tax foreclosure situation effectively.

A certificate of redemption is a document that confirms a property owner has successfully redeemed their property by paying back delinquent taxes and associated costs. This certificate signals that the lien has been lifted and ownership is returned to the original owner. It plays an essential role in preserving property rights and is instrumental in achieving a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale.

A certificate of lien sale is an official document issued after a property tax lien sale. This certificate proves that the buyer holds the lien against the property for unpaid taxes. It outlines the amount owed, interest, and the rights of the holder. This is an important step towards getting a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale.

To redeem a tax certificate means the property owner pays the total amount owed along with any accrued interest to reclaim their property. This process ensures the investor receives their investment back with interest. Should the property owner fail to redeem the certificate, the investor can then take further legal steps to secure ownership. This can transition into obtaining a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale.

After a tax lien sale, the successful bidder receives a tax lien certificate, which represents a claim on the property. The property owner now has a specific window to redeem the property by paying back the owed taxes plus interest. If the owner fails to redeem the lien, the investor can pursue further actions. Hence, understanding this process is crucial for obtaining a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale.

To stop property tax foreclosure in Texas, you have several options, including paying your overdue taxes or negotiating a payment plan with your tax collector. Another effective route is to apply for a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale, which allows you to recover your property after it has been sold. Consulting platforms like US Legal Forms can provide the templates and information you need to pursue these options effectively.

In Texas, homeowners can be behind on property taxes for several years before facing foreclosure. However, the consequences of not paying can escalate quickly, leading to a tax lien or property auction. If you find yourself in this situation, obtaining a Gresham Oregon Certificate of Redemption from Tax Foreclosure Sale can enable you to reclaim your home. Resources such as US Legal Forms can provide valuable assistance in understanding your options.