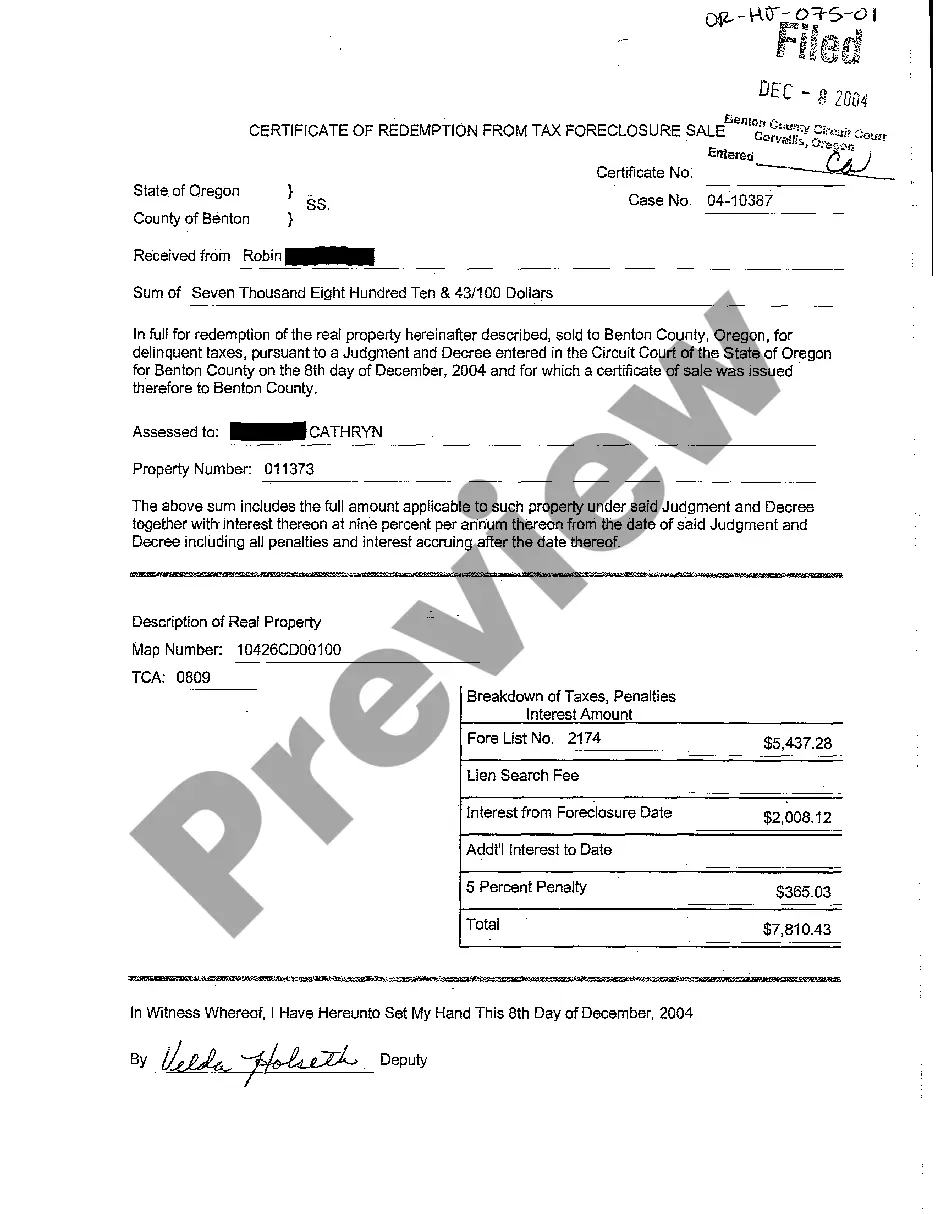

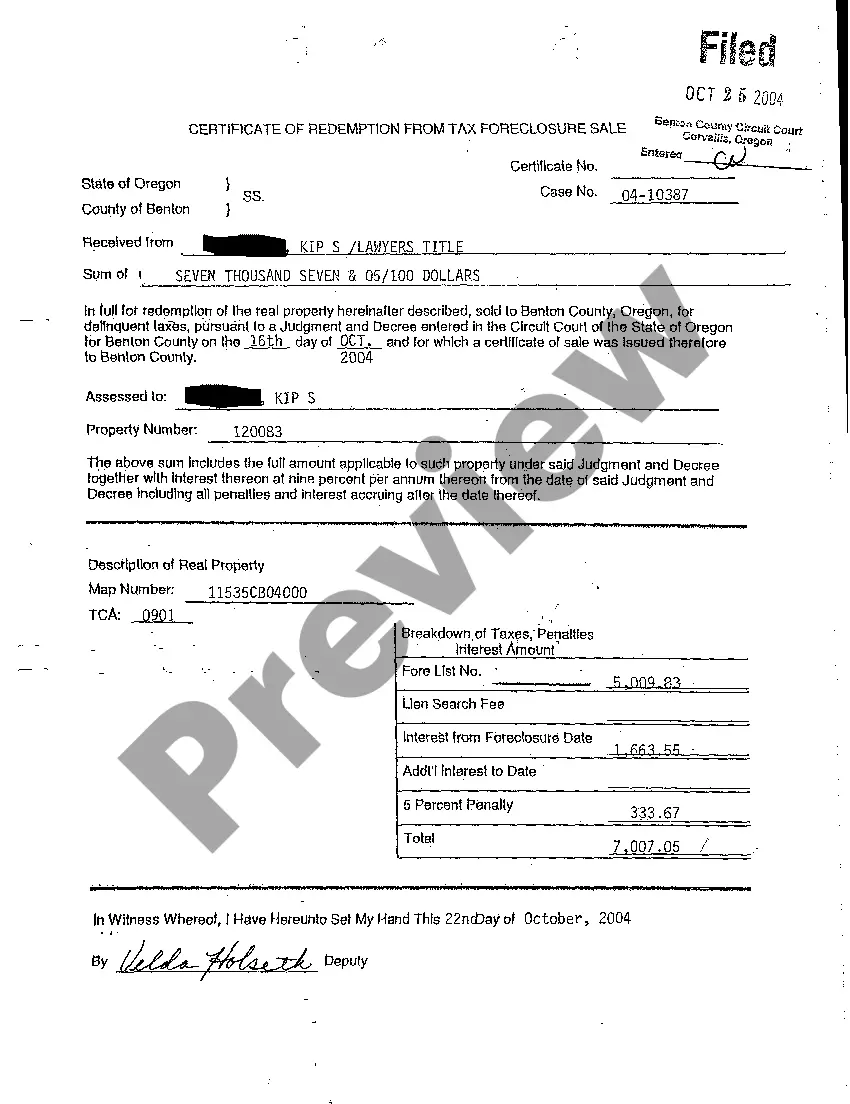

The Portland Oregon Certificate of Redemption from Tax Foreclosure Sale is a legal document that allows property owners to reclaim their property after it has been sold in a tax foreclosure sale due to unpaid property taxes. This certificate serves as proof of payment for the outstanding tax amount, penalties, and interest that were incurred during the foreclosure process. Keywords: Portland Oregon, Certificate of Redemption, Tax Foreclosure Sale, property owners, reclaim, unpaid property taxes, legal document, outstanding tax amount, penalties, interest, foreclosure process. There are two main types of Portland Oregon Certificates of Redemption from Tax Foreclosure Sale: 1. Regular Certificate of Redemption: This type of certificate is issued when the property owner successfully pays off the outstanding property taxes, penalties, and interest before the expiration of the redemption period. The redemption period usually lasts for one year from the date of the tax foreclosure sale. By obtaining this certificate, the property owner can secure their property rights and regain full ownership and control over their property. 2. Certificate of Redemption by Assignment: In some cases, the property owner may not be able to financially cover the full redemption amount. In such situations, they have the option to assign their redemption rights to a third party, often known as a redemption investor. The redemption investor pays the redemption amount on behalf of the property owner and, in return, receives the Certificate of Redemption by Assignment. This allows the redemption investor to acquire an interest in the property and potentially profit from it in the future. It is important to note that the Certificate of Redemption from Tax Foreclosure Sale is a crucial document for property owners who wish to reclaim their property or transfer their redemption rights. This document should be obtained through the appropriate legal channels and in compliance with the laws and regulations of Portland, Oregon. Consulting with a qualified real estate attorney or tax professional is highly recommended navigating the complexities of the redemption process and ensure a successful redemption.

Portland Oregon Certificate of Redemption from Tax Foreclosure Sale

Description

How to fill out Portland Oregon Certificate Of Redemption From Tax Foreclosure Sale?

We always strive to reduce or prevent legal issues when dealing with nuanced legal or financial matters. To do so, we sign up for legal services that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without using services of a lawyer. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Portland Oregon Certificate of Redemption from Tax Foreclosure Sale or any other document quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is equally easy if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Portland Oregon Certificate of Redemption from Tax Foreclosure Sale complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you check out the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Portland Oregon Certificate of Redemption from Tax Foreclosure Sale is suitable for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!