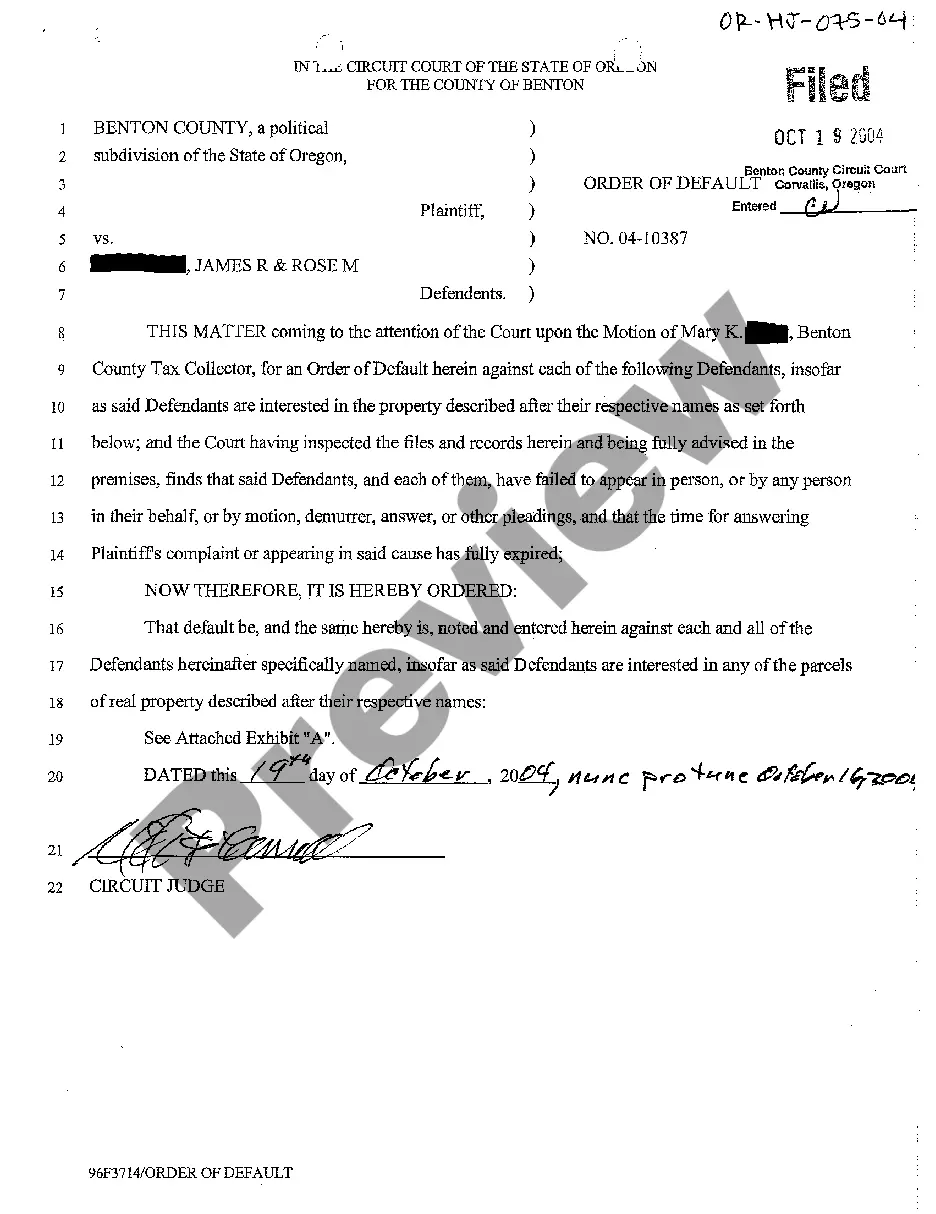

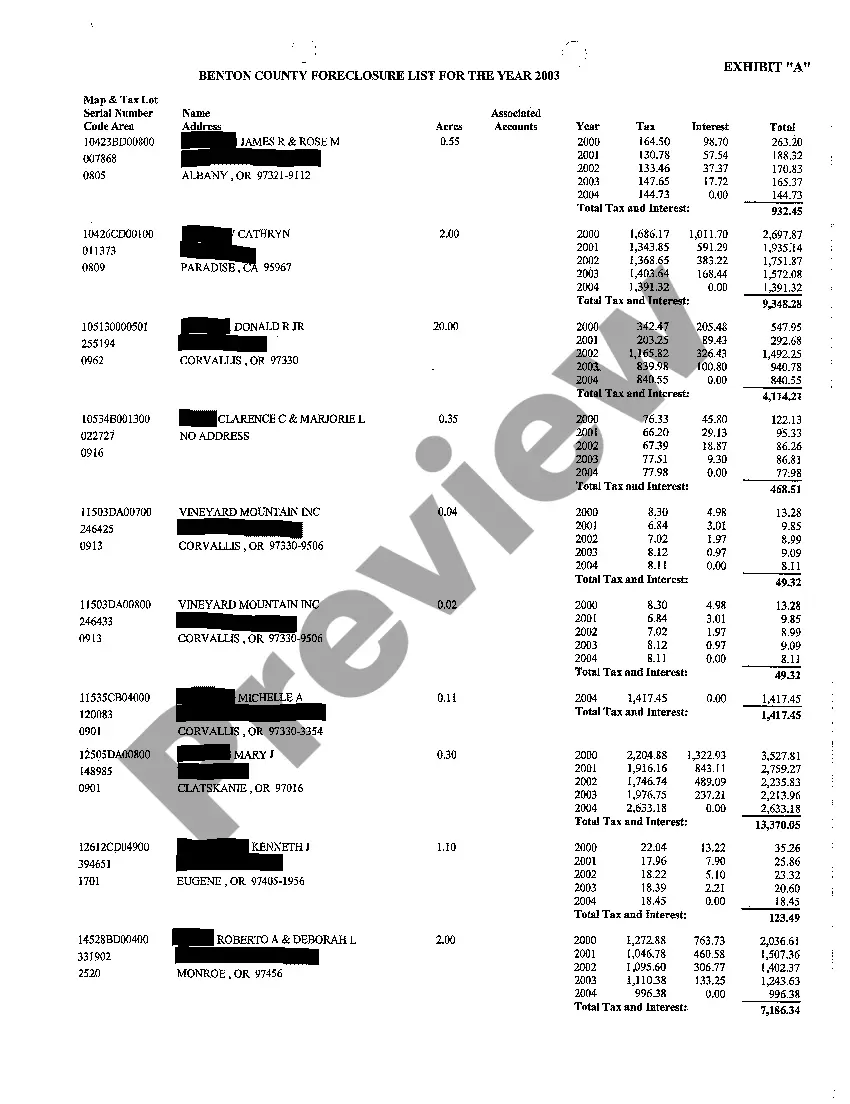

Gresham Oregon Order of Default is a legal term that refers to a specific court order often seen in cases involving debt collection. When an individual fails to make required payments on a debt, the creditor may seek legal recourse by filing a lawsuit against them. In Gresham, Oregon, if the debtor fails to respond to the lawsuit within the appropriate time frame or fails to appear in court, the court may issue an Order of Default. This order signifies that the debtor has defaulted on their debt and the court will proceed with judgment in favor of the creditor. The Order of Default can have serious consequences for the debtor, as it allows the creditor to pursue various debt collection actions, such as wage garnishment, bank account seizure, or property liens to satisfy the outstanding debt. There may be different types of Gresham Oregon Orders of Default depending on the nature of the debt or the specific circumstances of the case. Some common types include: 1. Money Judgment: This type of Order of Default allows the creditor to obtain a monetary judgment against the debtor, enabling them to seize assets or garnish wages to collect what is owed. 2. Repossession Order: In cases involving debts secured by collateral, such as a car or property, a repossession order may be issued as a type of Order of Default. This grants the creditor the legal right to repossess and sell the collateral to recover the outstanding debt. 3. Eviction Order: In situations where the debtor has failed to pay rent, a landlord might seek an eviction order as an Order of Default to legally remove the tenant from the property. 4. Foreclosure Order: For debts secured by real estate, such as a mortgage, a foreclosure order may be issued as an Order of Default. This allows the lender to take possession of the property and sell it to recover the unpaid debt. It is crucial for individuals facing a Gresham Oregon Order of Default to understand their legal rights and options. Seeking legal advice from an attorney experienced in debt collection matters can help debtors navigate the process and potentially negotiate more favorable terms with their creditors.

Gresham Oregon Order of Default

Description

How to fill out Gresham Oregon Order Of Default?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Gresham Oregon Order of Default becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Gresham Oregon Order of Default takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve chosen the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Gresham Oregon Order of Default. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

OJCIN Online. OJCIN is the Oregon Judicial Case Information Network. It contains the judgment dockets and official Register of Actions from Oregon State Courts, including trial, appellate, and tax courts. OJCIN OnLine allows registered users to search those records.

A default judgment (or a judgment in default) is a judgment made by the court against a party because they failed to do something. For example, failing to file a document required by the court within a given period of time. Depending on the nature of your claim, a default judgment can be: A final judgment.

Default judgment?overview the defendant must have been properly served with the claim. the defendant must not have responded to the claim, whether by acknowledgment of service or defence, and. the relevant time period for responding must have expired.

A court order is enforced through contempt of court, so if someone does not comply with the court order, the judge may declare you to be disobedient. Being held in contempt, or disobedient of a court order, will result in paying money, serving jail time, or other remedies such as allowing make-up parenting time.

There are three ways to look at court records: Go to the courthouse and ask to look at paper records. Go to the courthouse and look at electronic court records. If your court offers it, look at electronic records over the internet.

To obtain access to court files visit the court during regular business hours at the court location that the case was filed. To request copies from a court file or request audio copies of proceedings send a written request and include the following information: The complete name of the person or persons involved.

Search Oregon Arrest and Criminal Records Online. See . Platform 2 is termed OJCIN (Oregon Judicial Case Information Network). See . It is a paid platform.

OJCIN Online. OJCIN is the Oregon Judicial Case Information Network. It contains the judgment dockets and official Register of Actions from Oregon State Courts, including trial, appellate, and tax courts. OJCIN OnLine allows registered users to search those records.

It is up to you to find out where the defendant has assets (property) that can be seized to pay your judgment. If you have received a judgment and the defendant refuses to pay it, you may be able to have his or her wages or bank account garnished. The court does not provide garnishment forms.

To request a default judgment, you must file a Motion for Default Judgment & Defendant Status Declaration with the court within a certain number of days from the date of service or your case may be dismissed after written notice to you. You may have to re-file your claim and pay filing fees again if this happens.