Portland Oregon Order of Default refers to a legal process that occurs in the city of Portland, Oregon when a borrower fails to repay their loans or meet their financial obligations. In such cases, lenders or financial institutions may take legal action to recover the outstanding debt owed by the borrower. The Order of Default is a formal declaration made by the court to mark the borrower's failure to comply with the terms of their loan agreement. The Portland Oregon Order of Default can be issued in various types of financial cases depending on the nature of the loan or debt. Some different types of Order of Default that can be encountered in Portland, Oregon include: 1. Mortgage Default: This occurs when a homeowner fails to make their monthly mortgage payments, leading to the initiation of foreclosure proceedings by the lender. A Portland Oregon Order of Default may be issued by the court, paving the way for the foreclosure process to begin. 2. Student Loan Default: Students who fail to make their scheduled loan payments may face the consequences of an Order of Default. This may result in the loss of certain privileges, credit score damage, and potential legal actions taken by the lender or the government. 3. Personal Loan Default: When an individual neglects to make the repayments on a personal loan, the lender can pursue legal action to recover the debt. A Portland Oregon Order of Default may be sought by the lender to enforce their rights and potentially compel the borrower to meet their financial obligations. 4. Credit Card Default: Credit card debt that remains unpaid for a significant period can lead to an Order of Default being filed against the borrower. This legal action can result in the initiation of debt collection efforts to recover the outstanding debt. 5. Auto Loan Default: Failure to make timely payments on an auto loan can lead to the lender seeking an Order of Default to repossess the vehicle as collateral. The court's decision authorizes the lender to take possession of the vehicle and sell it to recover the unpaid loan amount. It is important for borrowers to be aware of their rights and responsibilities in order to avoid a Portland Oregon Order of Default. Taking timely actions, such as seeking financial counseling, negotiating with lenders, or pursuing debt consolidation or restructuring options, can help borrowers prevent default and navigate through challenging financial situations effectively.

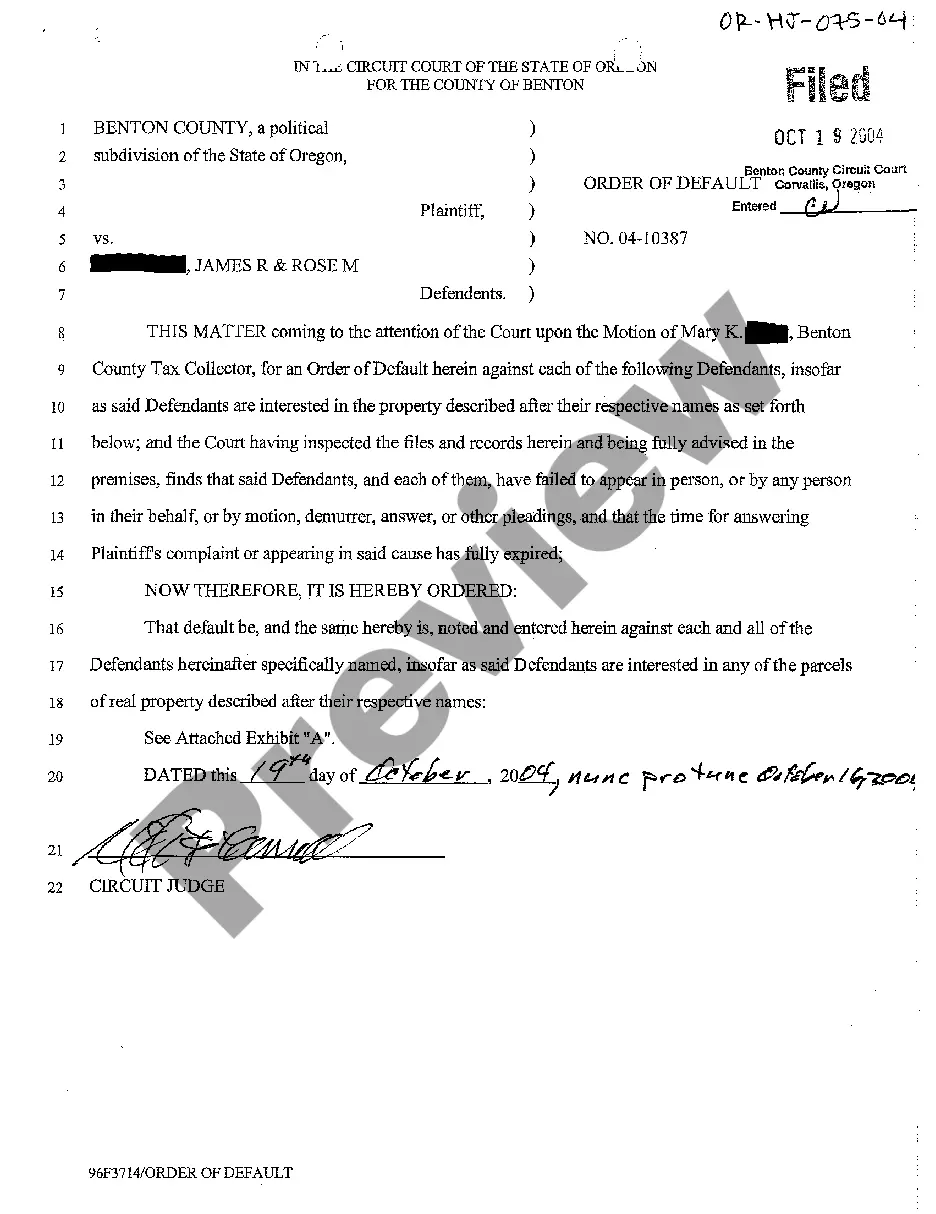

Portland Oregon Order of Default

State:

Oregon

City:

Portland

Control #:

OR-HJ-075-04

Format:

PDF

Instant download

This form is available by subscription

Description

A04 Order of Default

Portland Oregon Order of Default refers to a legal process that occurs in the city of Portland, Oregon when a borrower fails to repay their loans or meet their financial obligations. In such cases, lenders or financial institutions may take legal action to recover the outstanding debt owed by the borrower. The Order of Default is a formal declaration made by the court to mark the borrower's failure to comply with the terms of their loan agreement. The Portland Oregon Order of Default can be issued in various types of financial cases depending on the nature of the loan or debt. Some different types of Order of Default that can be encountered in Portland, Oregon include: 1. Mortgage Default: This occurs when a homeowner fails to make their monthly mortgage payments, leading to the initiation of foreclosure proceedings by the lender. A Portland Oregon Order of Default may be issued by the court, paving the way for the foreclosure process to begin. 2. Student Loan Default: Students who fail to make their scheduled loan payments may face the consequences of an Order of Default. This may result in the loss of certain privileges, credit score damage, and potential legal actions taken by the lender or the government. 3. Personal Loan Default: When an individual neglects to make the repayments on a personal loan, the lender can pursue legal action to recover the debt. A Portland Oregon Order of Default may be sought by the lender to enforce their rights and potentially compel the borrower to meet their financial obligations. 4. Credit Card Default: Credit card debt that remains unpaid for a significant period can lead to an Order of Default being filed against the borrower. This legal action can result in the initiation of debt collection efforts to recover the outstanding debt. 5. Auto Loan Default: Failure to make timely payments on an auto loan can lead to the lender seeking an Order of Default to repossess the vehicle as collateral. The court's decision authorizes the lender to take possession of the vehicle and sell it to recover the unpaid loan amount. It is important for borrowers to be aware of their rights and responsibilities in order to avoid a Portland Oregon Order of Default. Taking timely actions, such as seeking financial counseling, negotiating with lenders, or pursuing debt consolidation or restructuring options, can help borrowers prevent default and navigate through challenging financial situations effectively.

Free preview

How to fill out Portland Oregon Order Of Default?

If you’ve already utilized our service before, log in to your account and save the Portland Oregon Order of Default on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Portland Oregon Order of Default. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!