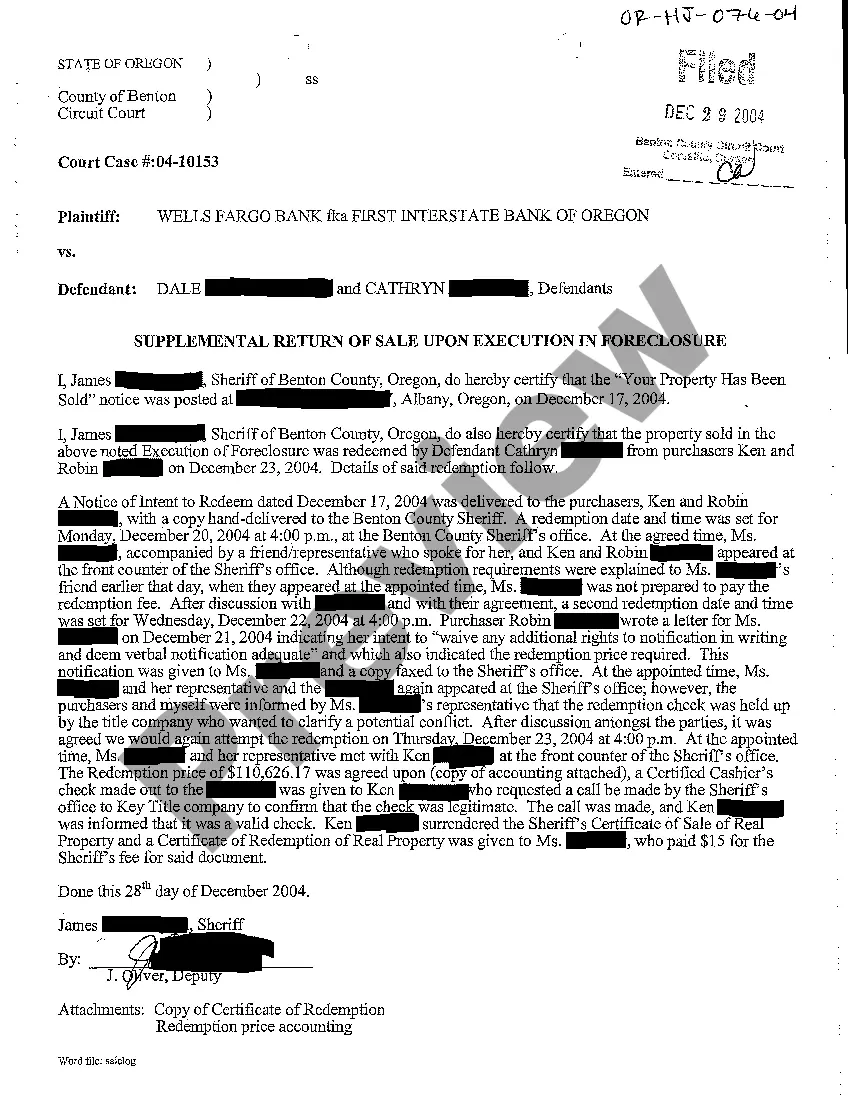

Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure is a legal document that provides detailed information regarding the sale of a foreclosed property in the city of Gresham, Oregon. This document is essential for both the parties involved in the foreclosure process and potential buyers who are interested in purchasing the property. Keywords: Gresham Oregon, Supplemental Return of Sale, Execution, Foreclosure, legal document, property, sale. There are two main types of Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure: 1. Residential Property Foreclosure: This type of Supplemental Return of Sale Upon Execution in Foreclosure pertains to residential properties, such as houses, apartments, or condominiums, that have been foreclosed upon in Gresham, Oregon. The document provides comprehensive information about the property, the foreclosure process, and the auction or sale details. 2. Commercial Property Foreclosure: This type of Supplemental Return of Sale Upon Execution in Foreclosure is specific to commercial properties, including retail spaces, office buildings, and industrial properties, which have undergone the foreclosure process in Gresham, Oregon. Similar to the residential property foreclosure document, it contains all the relevant details regarding the property, foreclosure proceedings, and the sale executed. In both types of Supplemental Return of Sale Upon Execution in Foreclosure, the document typically includes the following information: 1. Property Details: A detailed description of the foreclosed property, including its address, legal description, and any unique features or characteristics that may affect its value. 2. Foreclosure Process: A summary of the foreclosure proceedings, the reason for the foreclosure, the parties involved, and the timeline leading up to the sale or auction. 3. Sale/Auction Information: Information about the sale or auction of the foreclosed property, including the date, time, and location. It may also include the terms and conditions of the sale, such as minimum bid requirements or any other restrictions. 4. Buyer's Rights and Responsibilities: A section outlining the rights and responsibilities of the buyer who successfully purchases the foreclosed property, including any potential risks or encumbrances. 5. Legal Declarations: Statements and declarations made by the authorized party executing the foreclosure sale, certifying the accuracy of the information provided and attesting that all legal requirements have been met. It is important to consult with a legal professional or a real estate expert to ensure that all necessary documents and procedures are followed correctly when dealing with a Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure.

Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure

Description

How to fill out Gresham Oregon Supplemental Return Of Sale Upon Execution In Foreclosure?

If you are looking for a valid form template, it’s impossible to find a better place than the US Legal Forms site – one of the most extensive online libraries. Here you can find a large number of form samples for organization and individual purposes by categories and states, or key phrases. With our advanced search feature, discovering the newest Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure is as elementary as 1-2-3. Moreover, the relevance of each file is verified by a group of professional lawyers that on a regular basis check the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our system and have a registered account, all you should do to get the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have found the sample you need. Read its explanation and utilize the Preview feature to explore its content. If it doesn’t suit your needs, use the Search field at the top of the screen to get the proper document.

- Affirm your selection. Click the Buy now option. After that, select your preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Receive the template. Select the format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure.

Every template you add to your profile does not have an expiry date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you need to have an extra copy for modifying or printing, you can come back and download it once more anytime.

Take advantage of the US Legal Forms professional catalogue to gain access to the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure you were looking for and a large number of other professional and state-specific templates on a single website!

Form popularity

FAQ

A writ of execution in Oregon is a court order that allows a creditor to take possession of a debtor’s property after obtaining a judgment. This process involves the court authorizing a sheriff or another official to collect amounts owed. Understanding how a writ of execution works is essential for anyone dealing with foreclosure issues. If you're facing complexities in your Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure, exploring resources on uslegalforms can guide you through the legal landscape.

To file harassment charges in Oregon, you should gather evidence such as text messages, emails, or witness statements that document the harassment. Then, visit your local law enforcement agency or district court to file a complaint. It's crucial to present your case clearly to ensure that your rights are protected throughout the process. If your case involves financial implications, learning about Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure can help you navigate unexpected challenges.

A writ of garnishment is a legal order directing a third party to withhold funds or property to satisfy a debt. In contrast, a writ of execution allows a creditor to take possession of a debtor's property after winning a court judgment. Both are important tools for creditors in seeking repayment, but they serve different purposes. If you're dealing with issues related to debt collection, understanding these terms can assist you in managing your Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure situation.

Execution involves court orders for the sale of property to fulfill a debt, while foreclosure specifically relates to lenders reclaiming property when borrowers default on mortgage payments. Both processes have distinct legal implications. If you face either situation, understanding the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure can guide you through navigating your options.

An execution sale is a public auction where property is sold to satisfy a court judgment. This sale typically occurs when a debtor fails to repay a debt, and the court facilitates the property's sale to recover funds for the creditor. Knowing the process behind the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure can help you navigate this situation more effectively.

Choosing whether to sell or foreclose depends on your financial strategy and personal goals. Selling a property can often yield more favorable financial outcomes and is less damaging to your credit profile than foreclosure. If you're facing challenges, consider researching the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure to explore all your options.

You can request an extension on your foreclosure by contacting your lender and expressing your situation. Many lenders may offer programs to assist borrowers facing hardship. Additionally, familiarize yourself with the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure, which might provide options for delay to help protect your rights.

Foreclosure is a legal process initiated by a lender to reclaim property when the borrower defaults on their mortgage. In contrast, an execution sale occurs when a court orders the sale of a property to satisfy a judgment. Understanding the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure can clarify how these processes relate to your financial situation.

The right of redemption in Oregon allows a homeowner to recover their property even after the foreclosure sale, under specific conditions. This right often lasts for up to 180 days following the sale. Exercising this right means fulfilling financial obligations related to the property, which can be a complex process. Services like USLegalForms can assist you in managing the necessary steps for Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure.

Redemption in a foreclosure context refers to the process where the homeowner can reclaim the foreclosed property by paying off the owed amount. In Gresham Oregon, this gives you a chance to save your home after a foreclosure sale. It's an essential aspect of the Gresham Oregon Supplemental Return of Sale Upon Execution in Foreclosure, allowing you to regain ownership when acting within specified time frames.