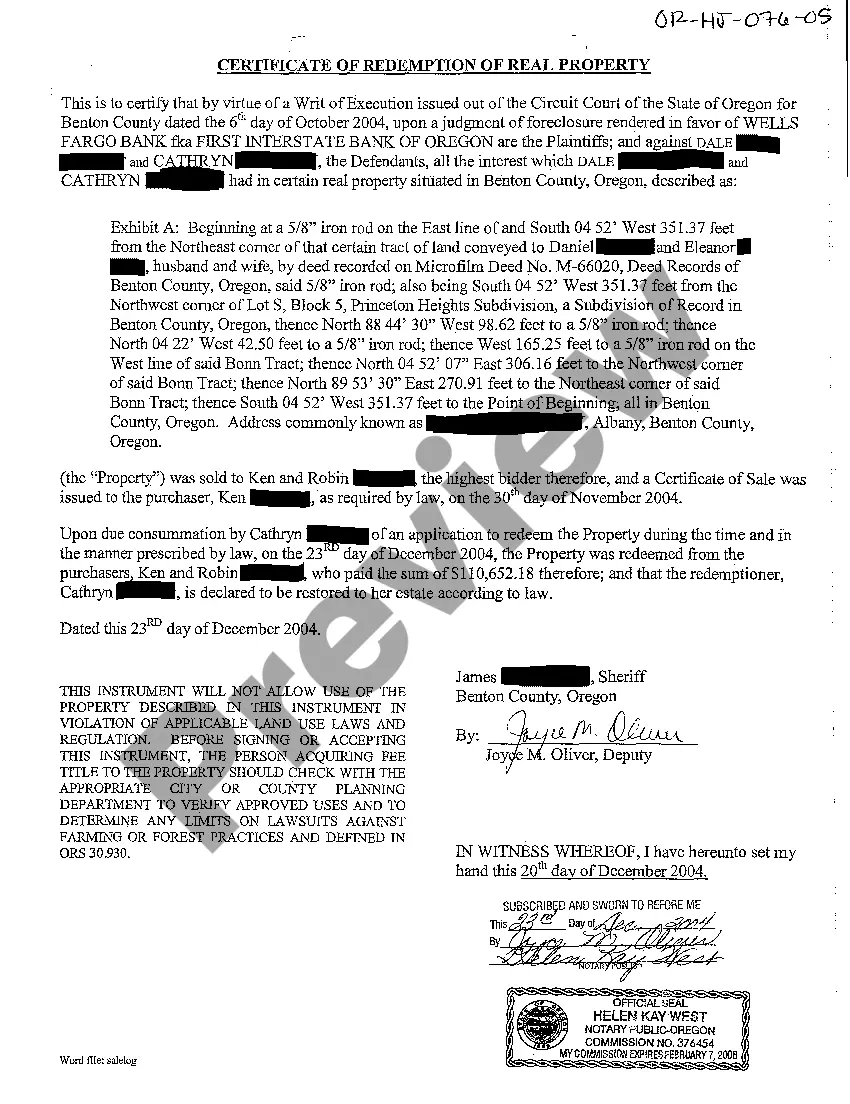

The Bend Oregon Certificate of Redemption of Real Property is a legal document that is used in the State of Oregon to redeem a property that has been foreclosed on through the tax lien process. When a property owner fails to pay their property taxes, the county government is granted the authority to place a lien on the property and eventually foreclose on it. The certificate of redemption is filed by the property owner or an eligible party who intends to pay off the tax lien and regain ownership of the property. It serves as proof that the outstanding property taxes, interest, and any associated fees have been paid in full to the county. This document is crucial for the property owner as it allows them to dissolve the tax lien and regain full control of their property. Keywords: Bend Oregon, Certificate of Redemption, Real Property, tax lien, foreclosed, property taxes, county government, interest, fees, ownership. In Bend, Oregon, there are two main types of Certificates of Redemption: Residential Certificate of Redemption and Commercial Certificate of Redemption. Each type applies to properties in their respective categories. A Residential Certificate of Redemption is utilized when a residential property, such as a single-family home or condominium, has been foreclosed upon due to unpaid property taxes. The property owner or an eligible party can file this certificate to redeem their property and resolve the tax lien. On the other hand, a Commercial Certificate of Redemption is used for commercial properties, including office buildings, retail spaces, or industrial complexes. If such a commercial property is subject to a tax lien and subsequent foreclosure, the owner can file this certificate to redeem the property and settle the outstanding taxes, interest, and fees. These certificates ensure the property owner's rights are upheld and offer them a chance to reclaim their property by paying the necessary amounts due to the county government. The Bend Oregon Certificate of Redemption of Real Property is a critical legal tool that assists in resolving tax liens and ensuring property ownership is rightfully restored. Keywords: Bend Oregon, Certificate of Redemption, Real Property, Residential Certificate of Redemption, Commercial Certificate of Redemption, tax lien, foreclosure, unpaid property taxes, residential property, commercial property, qualified party, settlement, outstanding taxes, interest, fees, county government.

Bend Oregon Certificate of Redemption of Real Property

Description

How to fill out Bend Oregon Certificate Of Redemption Of Real Property?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Bend Oregon Certificate of Redemption of Real Property gets as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Bend Oregon Certificate of Redemption of Real Property takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a couple of more steps to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Bend Oregon Certificate of Redemption of Real Property. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!