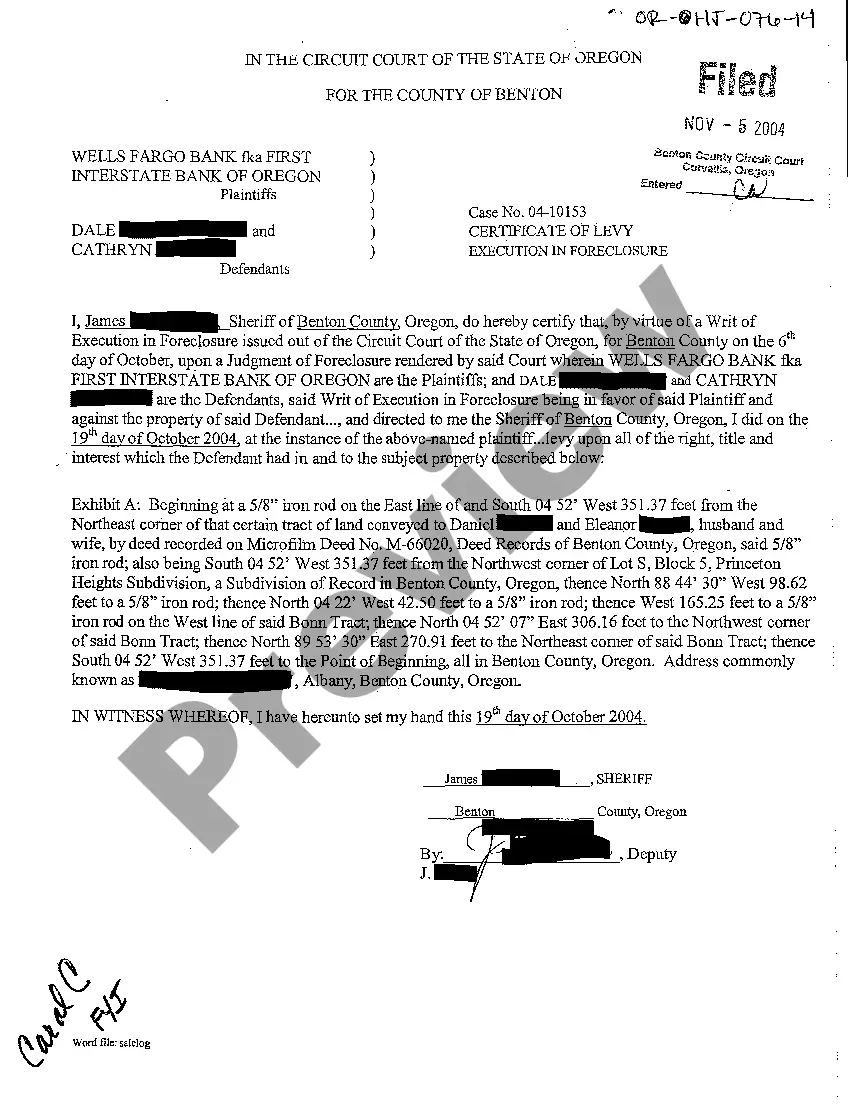

The Bend Oregon Certificate of Levy is an official document issued by the local authorities in Bend, Oregon to impose a tax or collect outstanding debts. This certificate is a legal authorization to seize and sell a property or assets to satisfy a tax debt when other collection methods have been unsuccessful. Keywords: Bend Oregon, Certificate of Levy, tax debt, local authorities, property, assets, outstanding debts, collection methods. There are two primary types of Bend Oregon Certificate of Levy: 1. Property Tax Levy: This type of certificate is issued when an individual or business fails to pay their property taxes in Bend, Oregon. The local authorities, typically the county government, can issue a Certificate of Levy to claim the delinquent tax amount by selling the property. The property is auctioned off to recover the unpaid taxes and other associated costs. Keywords: Property Tax, delinquent taxes, county government, auction, unpaid taxes. 2. Debt Collection Levy: This type of certificate is issued to collect outstanding debts owed to the government or other creditors in Bend, Oregon. It can be for various reasons, such as unpaid fines, court-ordered restitution, or any overdue financial obligations towards the local authorities. The Certificate of Levy allows the authorities to seize the debtor's assets, including bank accounts, vehicles, and other valuable possessions, to settle the debt. Keywords: debt collection, outstanding debts, fines, restitution, local authorities, assets, bank accounts, vehicles, possessions. In both types of Bend Oregon Certificate of Levy, the local authorities must follow proper legal procedures, including providing notice to the debtor, conducting an assessment of the delinquent taxes or debts, and following specific timelines before the actual seizure or sale of the property or assets. Keywords: legal procedures, notice to debtor, assessment, delinquent taxes, debts, seizure, sale, timelines. It is important for individuals and businesses in Bend, Oregon to address their tax obligations promptly to avoid the issuance of a Certificate of Levy, as it can lead to significant financial consequences, loss of property, and legal complications. Seeking professional advice from tax attorneys or financial experts can help navigate these issues and find suitable solutions to resolve any outstanding tax debts or debts owed to the local authorities. Keywords: tax obligations, financial consequences, loss of property, legal complications, professional advice, tax attorneys, financial experts, outstanding tax debts.

Bend Oregon Certificate of Levy

Description

How to fill out Bend Oregon Certificate Of Levy?

Do you need a trustworthy and inexpensive legal forms supplier to buy the Bend Oregon Certificate of Levy? US Legal Forms is your go-to solution.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked based on the requirements of specific state and area.

To download the form, you need to log in account, find the required form, and hit the Download button next to it. Please remember that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Bend Oregon Certificate of Levy conforms to the laws of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is intended for.

- Restart the search if the form isn’t good for your specific scenario.

Now you can register your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Bend Oregon Certificate of Levy in any available format. You can return to the website when you need and redownload the form without any extra costs.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about spending hours learning about legal papers online once and for all.