The Bend Oregon General Judgment and Decree of Foreclosure is a legal process that occurs when a homeowner fails to make their mortgage payments, resulting in the lender seeking to take possession of the property. This comprehensive description will provide an understanding of the foreclosure process in Bend, Oregon, how it works, and its various types. In Bend, Oregon, a General Judgment and Decree of Foreclosure is issued by the court after the completion of a foreclosure lawsuit. It serves as a final ruling on the case, granting the lender the right to foreclose on the property and sell it at a public auction. The judgment indicates that the borrower has failed to fulfill their financial obligations, and the lender is now legally permitted to proceed with the foreclosure process. Different types of Bend Oregon General Judgment and Decree of Foreclosure include: 1. Judicial Foreclosure: This is the most common type of foreclosure process in Bend, Oregon. It requires the lender to file a lawsuit against the homeowner, resulting in a judicial review of the case. If the court determines that the borrower has defaulted on their mortgage, a General Judgment and Decree of Foreclosure is issued, allowing the property to be sold to recover the outstanding loan amount. 2. Non-judicial Foreclosure: Oregon state law allows for non-judicial foreclosures when a power of sale clause is included in the mortgage or deed of trust. In this case, the lender is not required to file a lawsuit but must follow a specific set of procedures outlined in Oregon Revised Statutes. Once these procedures are completed, a General Judgment and Decree of Foreclosure is issued, allowing the property to be sold. 3. Deficiency Judgment: In some cases, the sale of a foreclosed property may not fully cover the outstanding mortgage debt. If there is a shortfall between the sale proceeds and the remaining loan balance, the lender may seek a deficiency judgment against the borrower. This judgment grants them the right to collect the remaining debt from the borrower through various means, such as wage garnishment or asset seizure. It is essential for homeowners facing foreclosure in Bend, Oregon, to consult with a qualified attorney who specializes in real estate and foreclosure law. Understanding the different types of General Judgment and Decree of Foreclosure is crucial to determine the specific legal scenario one may find themselves in. Seeking legal advice can help borrowers explore possible alternatives to foreclosure, negotiate with lenders, or ensure their rights are protected throughout the process.

Bend Oregon General Judgment and Decree of Foreclosure

State:

Oregon

City:

Bend

Control #:

OR-HJ-076-17

Format:

PDF

Instant download

This form is available by subscription

Description

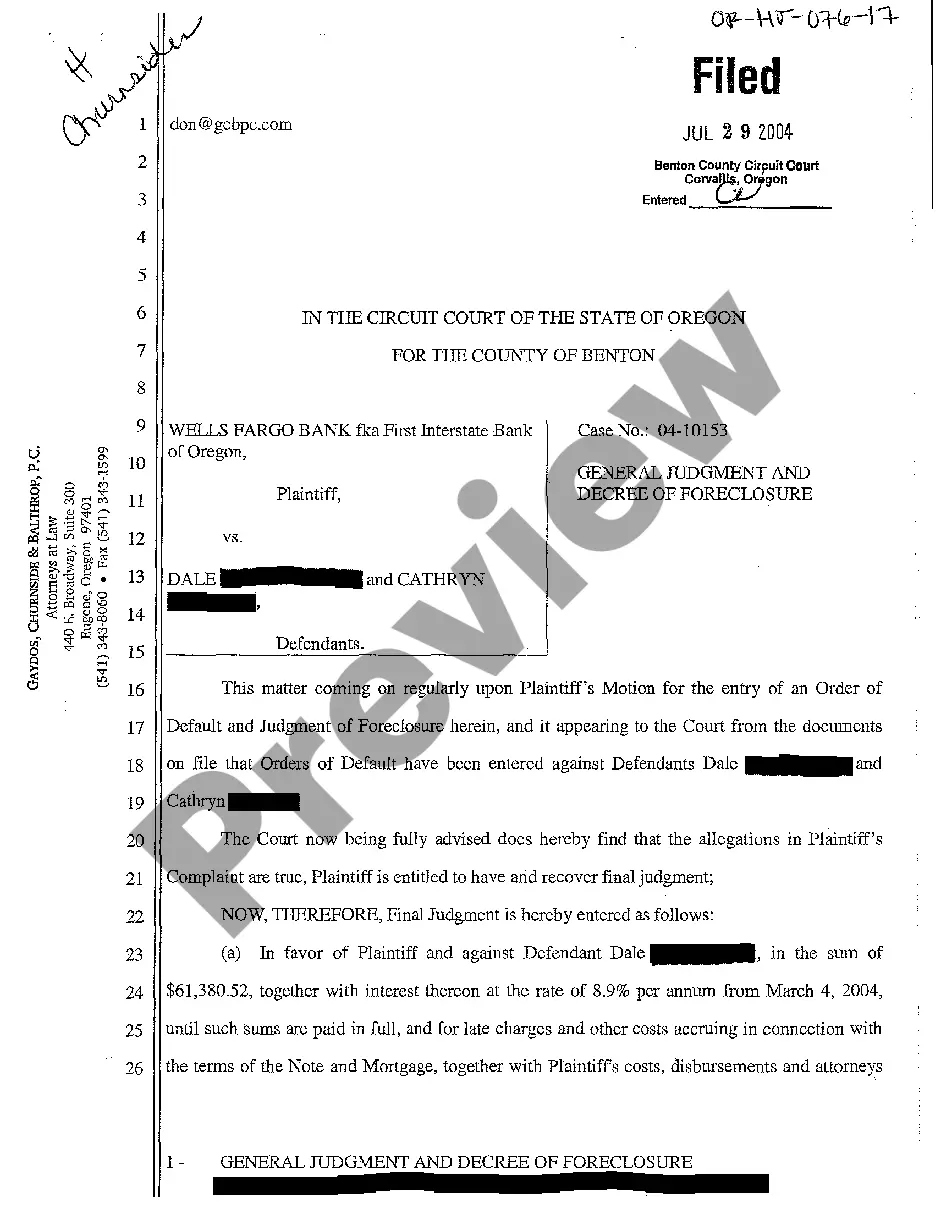

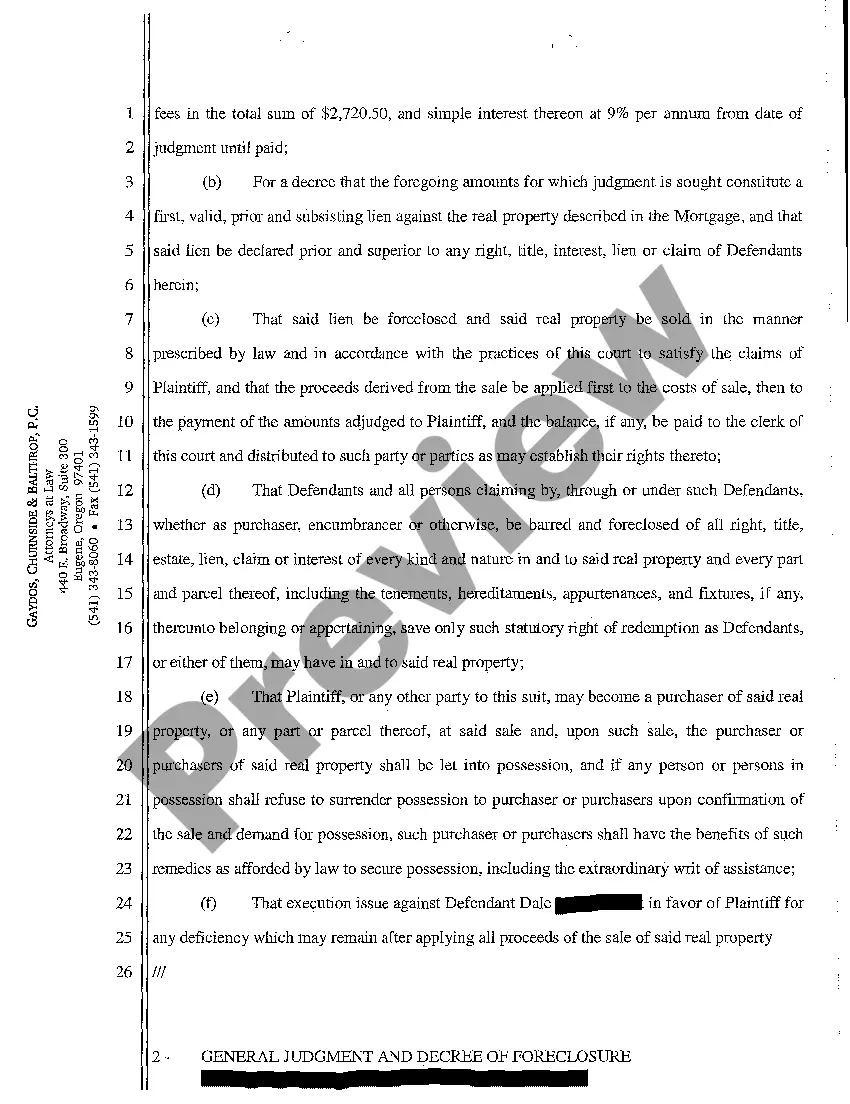

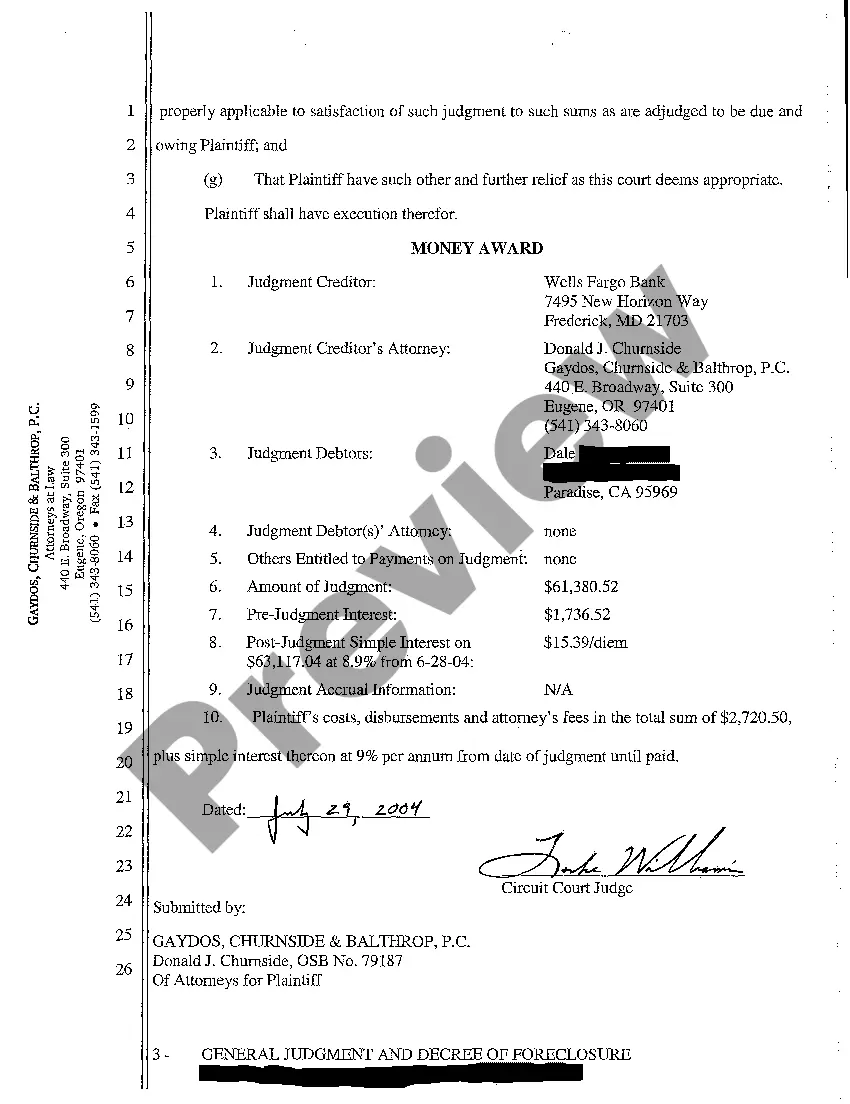

A04 General Judgment and Decree of Foreclosure

The Bend Oregon General Judgment and Decree of Foreclosure is a legal process that occurs when a homeowner fails to make their mortgage payments, resulting in the lender seeking to take possession of the property. This comprehensive description will provide an understanding of the foreclosure process in Bend, Oregon, how it works, and its various types. In Bend, Oregon, a General Judgment and Decree of Foreclosure is issued by the court after the completion of a foreclosure lawsuit. It serves as a final ruling on the case, granting the lender the right to foreclose on the property and sell it at a public auction. The judgment indicates that the borrower has failed to fulfill their financial obligations, and the lender is now legally permitted to proceed with the foreclosure process. Different types of Bend Oregon General Judgment and Decree of Foreclosure include: 1. Judicial Foreclosure: This is the most common type of foreclosure process in Bend, Oregon. It requires the lender to file a lawsuit against the homeowner, resulting in a judicial review of the case. If the court determines that the borrower has defaulted on their mortgage, a General Judgment and Decree of Foreclosure is issued, allowing the property to be sold to recover the outstanding loan amount. 2. Non-judicial Foreclosure: Oregon state law allows for non-judicial foreclosures when a power of sale clause is included in the mortgage or deed of trust. In this case, the lender is not required to file a lawsuit but must follow a specific set of procedures outlined in Oregon Revised Statutes. Once these procedures are completed, a General Judgment and Decree of Foreclosure is issued, allowing the property to be sold. 3. Deficiency Judgment: In some cases, the sale of a foreclosed property may not fully cover the outstanding mortgage debt. If there is a shortfall between the sale proceeds and the remaining loan balance, the lender may seek a deficiency judgment against the borrower. This judgment grants them the right to collect the remaining debt from the borrower through various means, such as wage garnishment or asset seizure. It is essential for homeowners facing foreclosure in Bend, Oregon, to consult with a qualified attorney who specializes in real estate and foreclosure law. Understanding the different types of General Judgment and Decree of Foreclosure is crucial to determine the specific legal scenario one may find themselves in. Seeking legal advice can help borrowers explore possible alternatives to foreclosure, negotiate with lenders, or ensure their rights are protected throughout the process.

Free preview

How to fill out Bend Oregon General Judgment And Decree Of Foreclosure?

If you’ve already used our service before, log in to your account and save the Bend Oregon General Judgment and Decree of Foreclosure on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Bend Oregon General Judgment and Decree of Foreclosure. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!