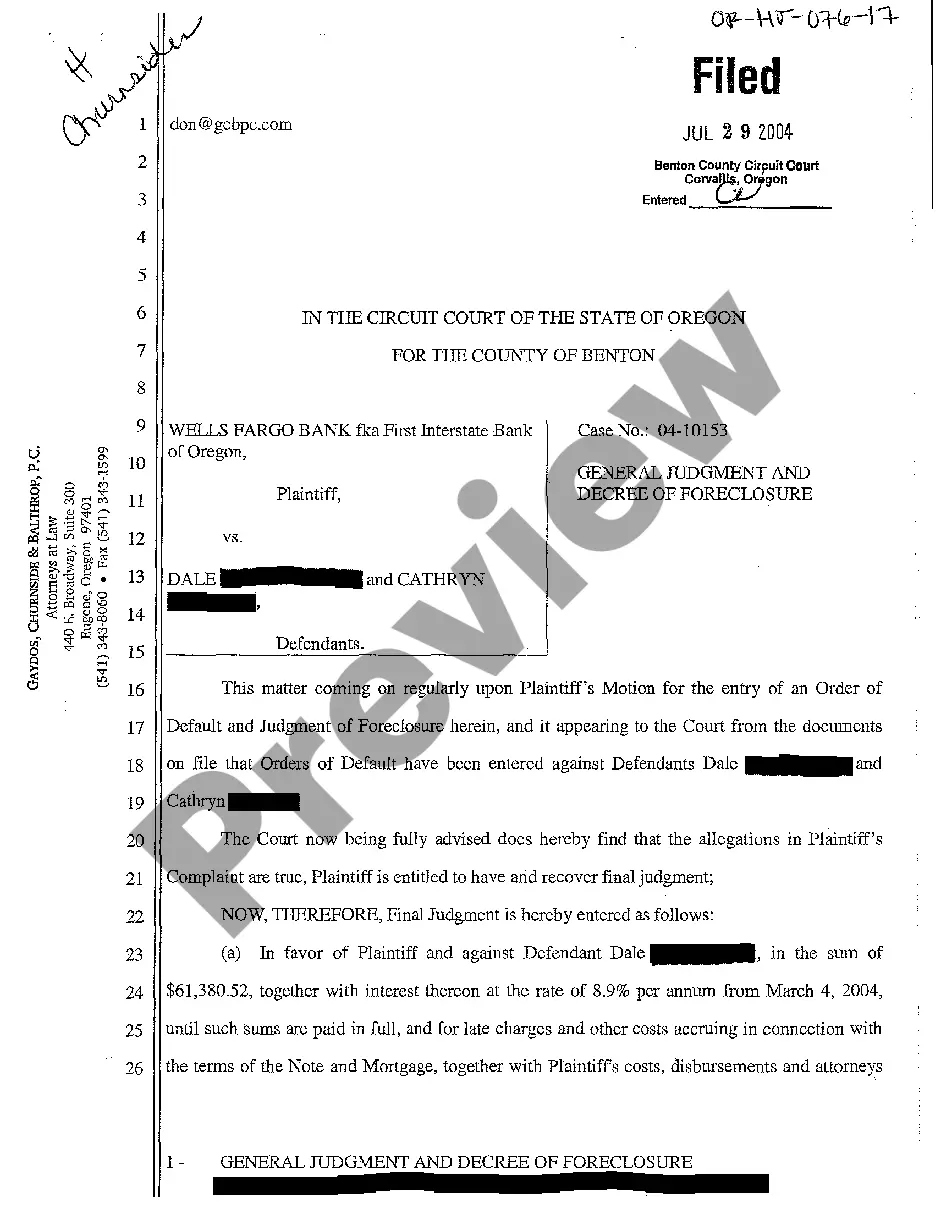

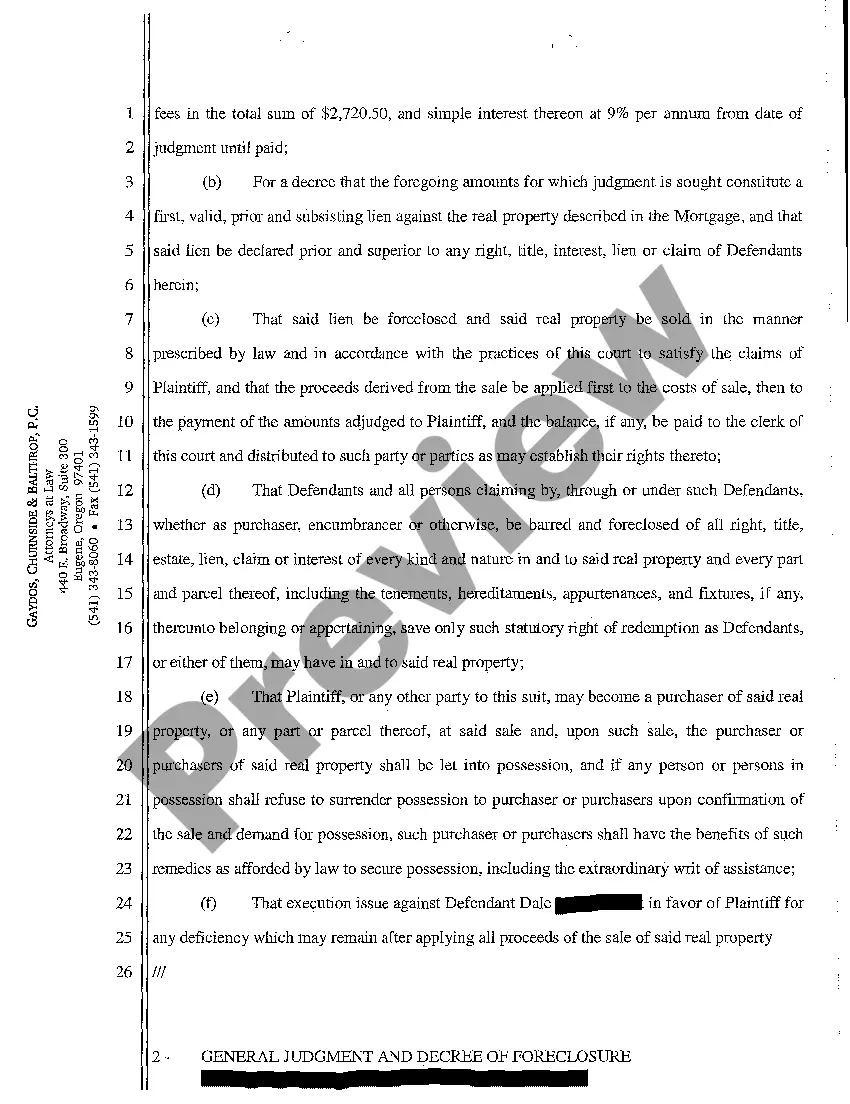

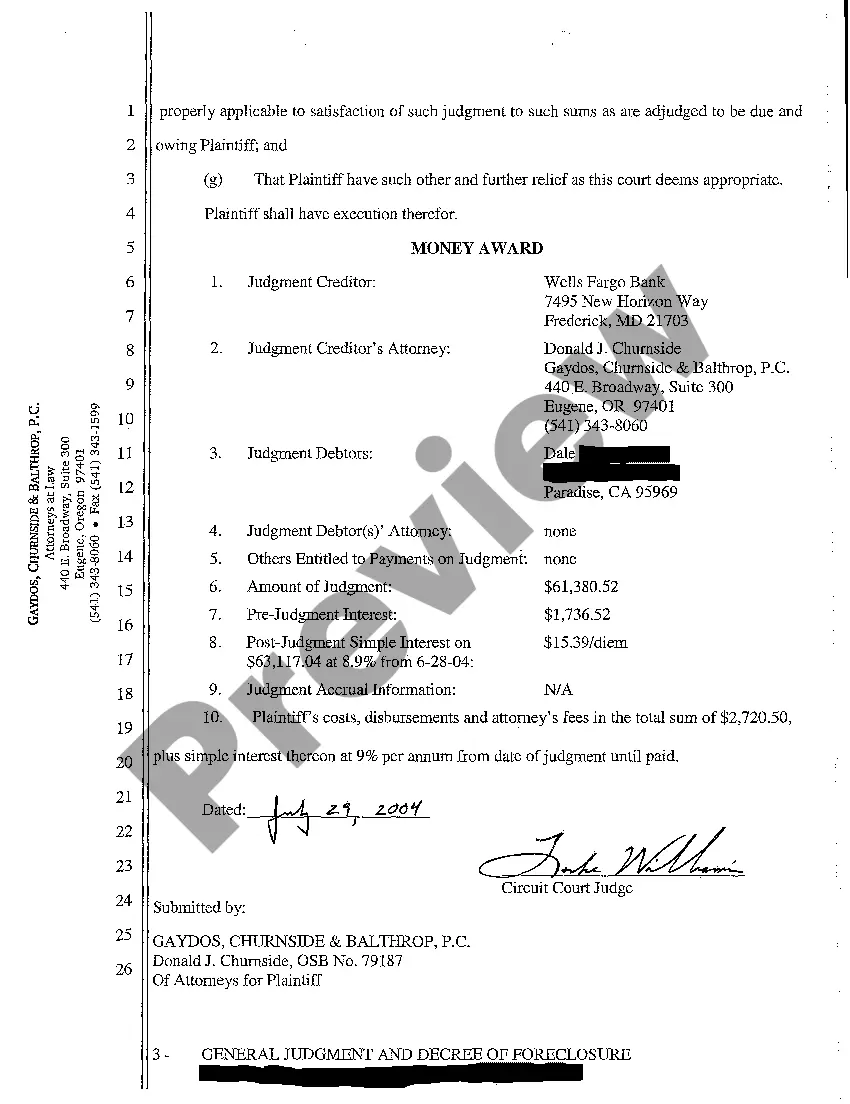

Gresham Oregon General Judgment and Decree of Foreclosure is a legal process that occurs when a homeowner fails to make mortgage payments and defaults on their loan. It is a court-ordered action where the lender seeks to recover the outstanding loan amount by forcing the sale of the property through foreclosure. This process involves specific steps, including filing a lawsuit, providing notice to all parties involved, and obtaining a judgment from the court. In Gresham, Oregon, there are different types of General Judgment and Decree of Foreclosure, depending on the specific circumstances and the type of property involved. Here are some key variations of Gresham Oregon General Judgment and Decree of Foreclosure: 1. Residential Foreclosure: This type of foreclosure applies to residential properties such as houses, townhouses, and condominiums. When homeowners default on their mortgage payments, lenders can initiate a foreclosure proceeding to recover their investment. 2. Commercial Foreclosure: Commercial properties, including office buildings, retail spaces, and industrial complexes, can also be subject to foreclosure. In Gresham, Oregon, a General Judgment and Decree of Foreclosure can be obtained to force the sale of a commercial property due to an owner's default. 3. Judicial Foreclosure: In cases where a lender seeks a General Judgment and Decree of Foreclosure, a judicial foreclosure process is followed. This involves filing a lawsuit in the Gresham, Oregon court system, which requires the lender to prove the homeowner's default and the amount owed. 4. Non-Judicial Foreclosure: Alternatively, if a deed of trust exists instead of a mortgage, lenders can opt for a non-judicial foreclosure process. This allows them to follow specific procedures outlined in the deed of trust without going to court. However, in some cases, a General Judgment and Decree of Foreclosure may still be necessary. 5. Post-Foreclosure Redemption: In Gresham, Oregon, homeowners may be granted a redemption period after the General Judgment and Decree of Foreclosure is issued. This allows them to repurchase the property by paying the outstanding loan amount, interest, and associated fees within a designated time frame. Overall, Gresham Oregon General Judgment and Decree of Foreclosure is a legal process used to recover outstanding mortgage loan amounts by forcing the sale of a property. Different types of foreclosures, such as residential or commercial, may follow either a judicial or non-judicial route, with potential post-foreclosure redemption periods. It is essential for homeowners and lenders to understand the specific laws and requirements in Gresham, Oregon when dealing with General Judgment and Decree of Foreclosure cases.

Gresham Oregon General Judgment and Decree of Foreclosure

Description

How to fill out Gresham Oregon General Judgment And Decree Of Foreclosure?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We provide access to legal document templates that aren’t always openly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Gresham Oregon General Judgment and Decree of Foreclosure or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the Gresham Oregon General Judgment and Decree of Foreclosure adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve ensured that the Gresham Oregon General Judgment and Decree of Foreclosure is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!