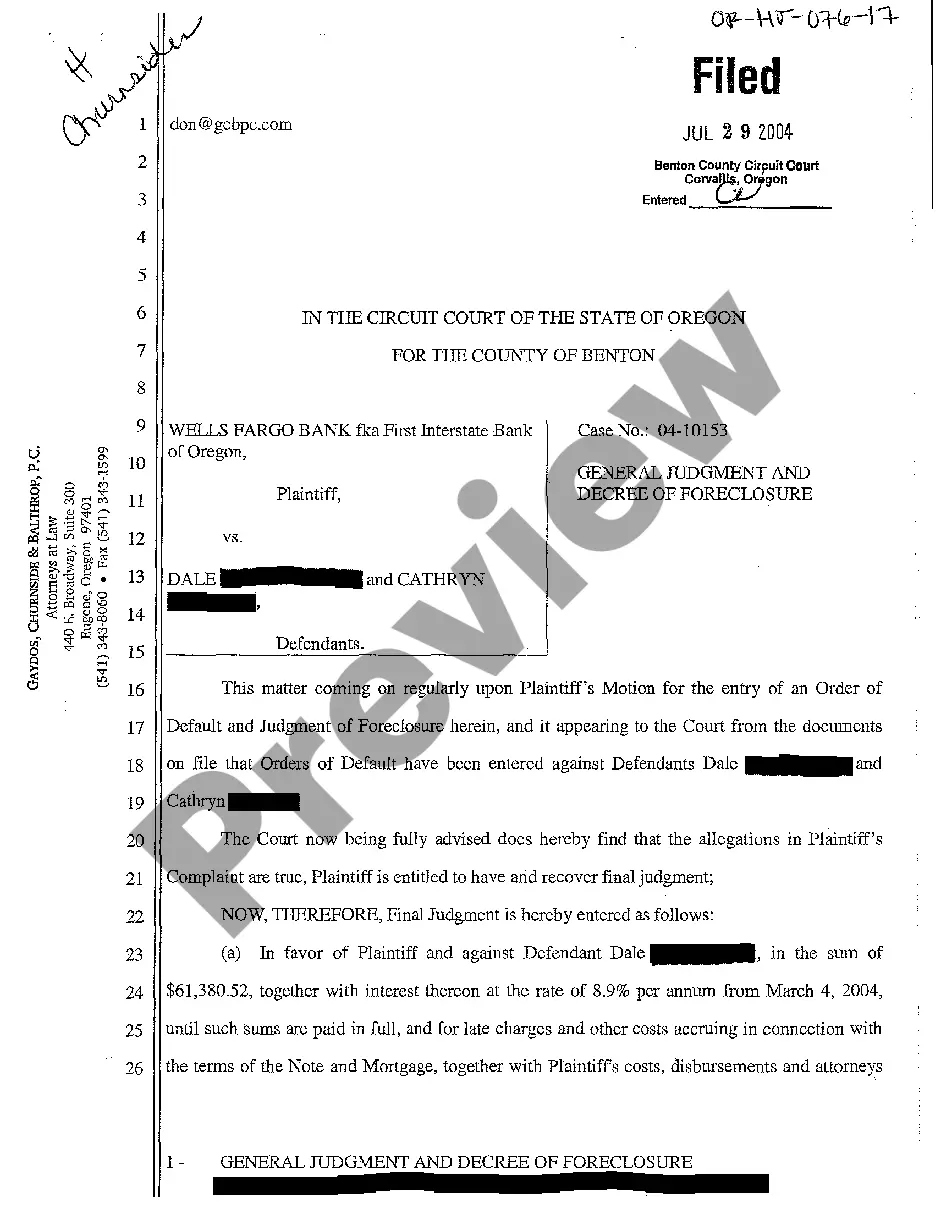

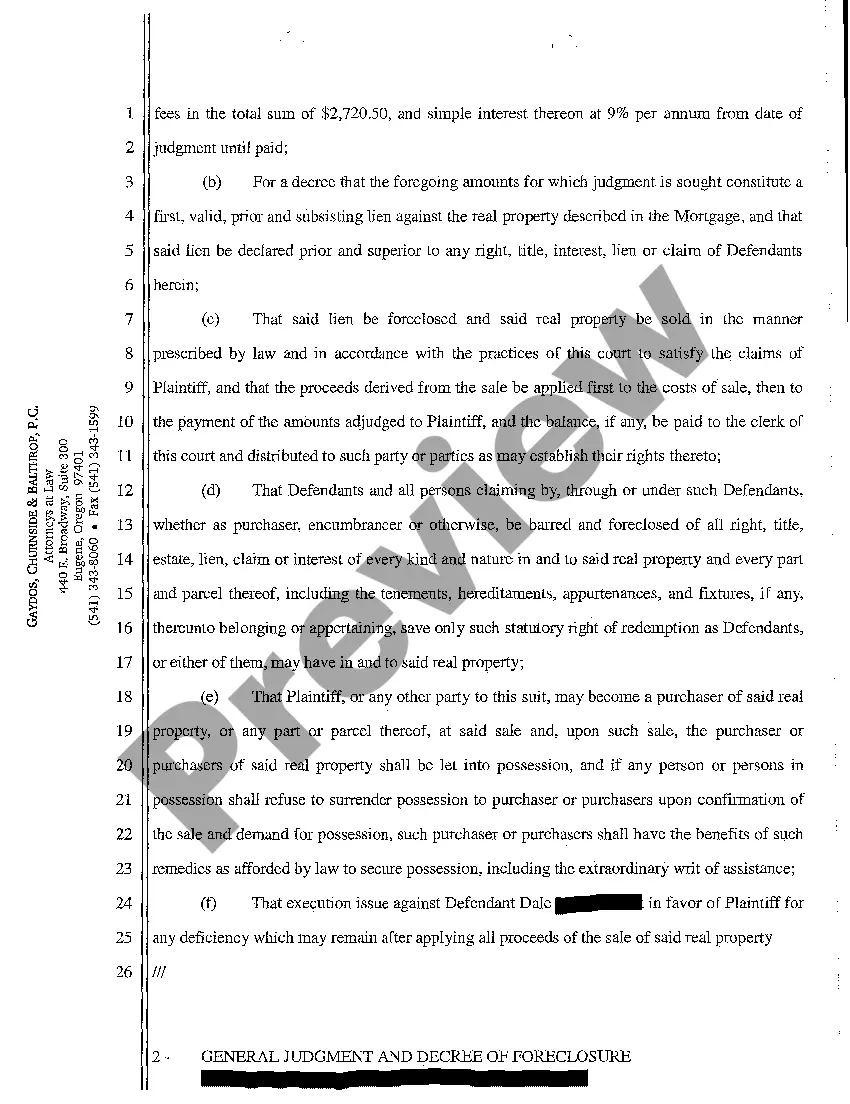

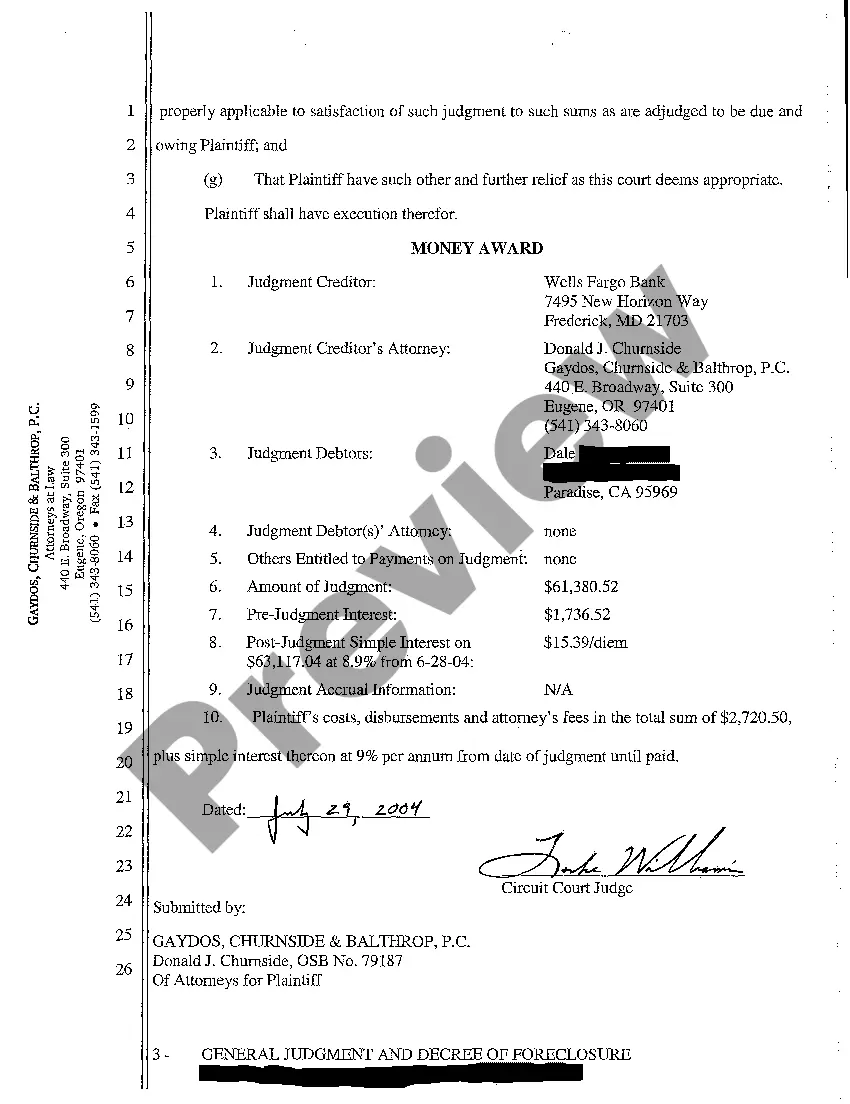

Title: Understanding Portland Oregon General Judgment and Decree of Foreclosure: Types, Importance, and Process Introduction: In Portland, Oregon, the General Judgment and Decree of Foreclosure is a vital legal document that serves as the final step in the foreclosure process. It grants the lender the right to sell the property and recoup the debt owed by the borrower. This comprehensive guide provides detailed insights into the various types of General Judgment and Decree of Foreclosure in Portland, their significance, and the overall foreclosure process. 1. Portland Oregon General Judgment and Decree of Foreclosure Overview: The Portland Oregon General Judgment and Decree of Foreclosure refer to a legally binding court order that authorizes the sale of a property following a foreclosure lawsuit. It ensures that the lender, often a bank or mortgage company, recovers their investment when the borrower defaults on their loan payments. 2. Types of General Judgment and Decree of Foreclosure in Portland, Oregon: a. Judicial Foreclosure: In this type, the lender files a lawsuit in court to obtain the General Judgment and Decree of Foreclosure. The court oversees the process, ensuring all legal requirements are met, and eventually issues the judgment, which allows the public sale of the property. b. Non-Judicial Foreclosure: Also known as "trustee's sale," this type of foreclosure does not involve filing a lawsuit. Instead, it follows a predetermined process outlined in the deed of trust or mortgage. The lender, through a trustee, initiates the foreclosure proceedings, culminating in the issuance of the General Judgment and Decree of Foreclosure. 3. Importance of the General Judgment and Decree of Foreclosure: a. Foreclosure Finality: The General Judgment and Decree of Foreclosure bring the foreclosure process to an end, providing closure for both the lender and the borrower. It establishes the lender's right to retake possession of the property and sell it to repay the mortgage debt. b. Property Sale Authorization: This legal document gives the lender the authority to sell the foreclosed property through a public auction or private sale, ensuring they can recover their financial losses. c. Legal Clarity and Protection: The General Judgment and Decree of Foreclosure provides legal clarity by confirming the lender's right to pursue deficiency judgments (if allowed by law) to collect any remaining debt from the borrower. 4. The Foreclosure Process in Portland, Oregon: a. Pre-Foreclosure: Occurs when the borrower fails to make timely mortgage payments, leading to a default notice being sent by the lender. b. Foreclosure Lawsuit: If the borrower doesn't rectify the default, the lender initiates a lawsuit seeking the General Judgment and Decree of Foreclosure. This involves gathering evidence, filing the complaint, and ensuring all legal requirements are met. c. Foreclosure Sale: Following the issuance of the General Judgment and Decree of Foreclosure, the lender schedules a public auction or private sale, where the property is sold to the highest bidder. d. Post-Foreclosure: After the sale, the lender either regains possession of the property or transfers ownership to the new buyer. At this stage, the borrower may face eviction, and any remaining debt may be pursued through a deficiency judgment. Conclusion: Navigating the Portland Oregon General Judgment and Decree of Foreclosure is crucial for both lenders and borrowers in understanding the legal process and the resulting consequences. Knowing the different types, significance, and the overall foreclosure process helps individuals make informed decisions and take necessary actions during these challenging times.

Portland Oregon General Judgment and Decree of Foreclosure

Description

How to fill out Portland Oregon General Judgment And Decree Of Foreclosure?

If you are searching for a valid form template, it’s extremely hard to choose a more convenient service than the US Legal Forms site – probably the most extensive libraries on the internet. With this library, you can get thousands of document samples for business and individual purposes by categories and states, or keywords. With our high-quality search function, discovering the latest Portland Oregon General Judgment and Decree of Foreclosure is as easy as 1-2-3. Moreover, the relevance of every file is confirmed by a team of expert lawyers that regularly check the templates on our website and update them in accordance with the most recent state and county laws.

If you already know about our system and have an account, all you should do to get the Portland Oregon General Judgment and Decree of Foreclosure is to log in to your profile and click the Download button.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the sample you require. Check its explanation and use the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, utilize the Search option near the top of the screen to discover the appropriate file.

- Confirm your decision. Click the Buy now button. Next, pick the preferred pricing plan and provide credentials to sign up for an account.

- Make the financial transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Get the template. Choose the format and download it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Portland Oregon General Judgment and Decree of Foreclosure.

Every single template you add to your profile does not have an expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to have an extra version for editing or creating a hard copy, you may return and download it once more at any time.

Make use of the US Legal Forms extensive catalogue to get access to the Portland Oregon General Judgment and Decree of Foreclosure you were looking for and thousands of other professional and state-specific templates in a single place!