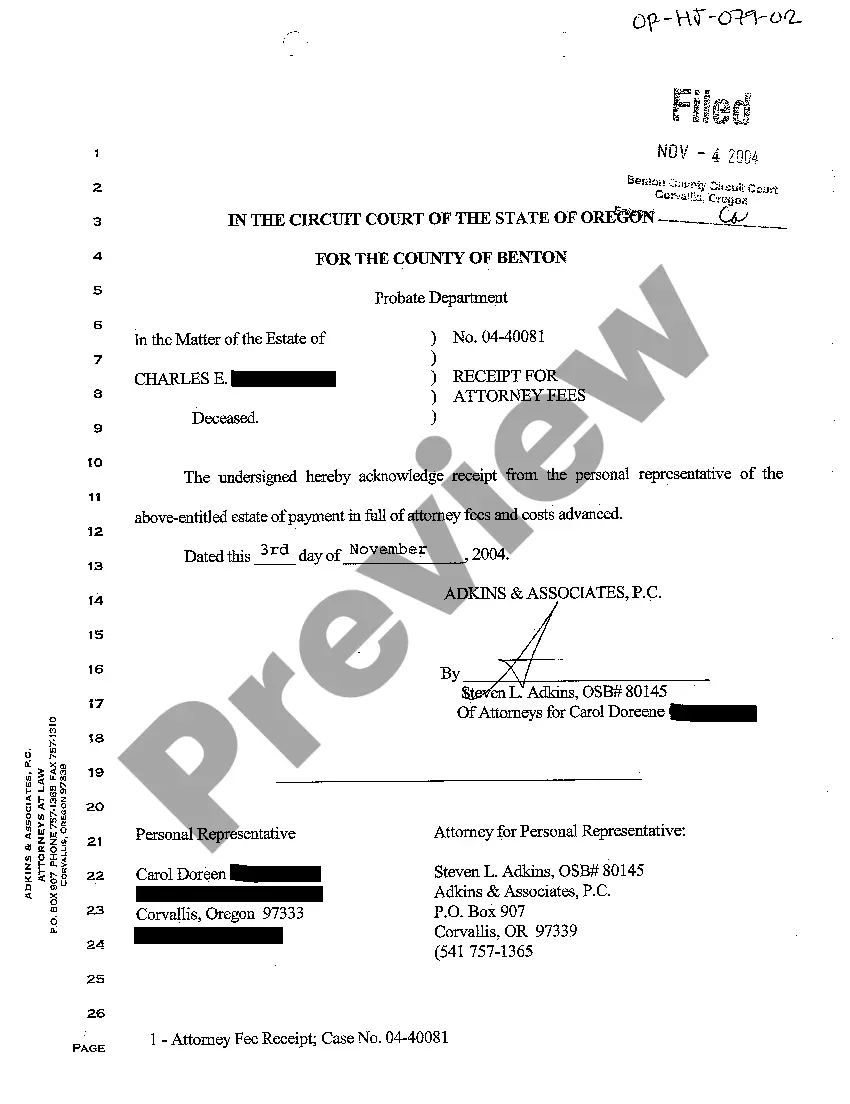

Portland Oregon Receipt for Attorney Fees is a legal document that serves as proof of payment for legal services rendered by an attorney in the city of Portland, Oregon. This receipt is often requested by clients for their records, reimbursement purposes, or to provide evidence of payment in legal proceedings. The Portland Oregon Receipt for Attorney Fees typically contains various key details, including the date of payment, the name and contact information of the client, the name and contact information of the attorney or law firm, a detailed description of the legal services provided, and the amount paid for those services. It may also include any applicable taxes, retainer fees, or other additional charges. This receipt is essential for clients to keep track of their financial transactions with their attorney and to ensure transparency and accountability in legal fee arrangements. It also serves as evidence that the attorney has received the agreed-upon payment for their services. Different types of Portland Oregon Receipt for Attorney Fees might include variations such as: 1. Hourly Rate Receipt: This type of receipt is used when an attorney charges their clients based on an hourly rate for the time spent on their case. It includes details about the number of hours worked, the hourly rate, and the total amount due. 2. Flat Fee Receipt: In cases where an attorney charges a fixed or flat fee for their services, this receipt clearly states the agreed-upon fee and the scope of services covered by that fee. 3. Retainer Receipt: Attorneys often require clients to pay an upfront retainer fee, which serves as a deposit to secure their services. A retainer receipt outlines the retainer amount paid, services covered by the retainer, and any remaining balance. 4. Contingency Fee Receipt: In certain legal matters, attorneys may work on a contingency fee basis, meaning they receive payment only if the client wins their case or receives a settlement. This receipt specifies the contingency fee percentage and the outcome required for the attorney to receive payment. 5. Additional Expenses Receipt: If an attorney incurs additional expenses on behalf of the client, such as court filing fees, expert witness fees, or travel expenses, a separate receipt may be issued to account for these costs. In conclusion, the Portland Oregon Receipt for Attorney Fees is a crucial document that ensures transparency and record-keeping in attorney-client financial transactions. Different types of receipts cater to various fee structures, such as hourly rates, flat fees, retainers, contingency fees, and additional expenses.

Portland Oregon Receipt for Attorney Fees

Description

How to fill out Portland Oregon Receipt For Attorney Fees?

If you’ve previously utilized our service, Log In to your account and download the Portland Oregon Receipt for Attorney Fees onto your device by clicking the Download button. Ensure your subscription is active. If it isn't, renew it according to your payment plan.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your document.

You have lifelong access to each document you have purchased: you can locate it in your profile under the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to quickly find and save any template for your personal or professional needs!

- Ensure you’ve found a suitable document. Review the description and use the Preview option, if available, to verify if it meets your requirements. If it doesn’t suit you, make use of the Search tab above to find the right one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and process a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Portland Oregon Receipt for Attorney Fees. Choose the file format for your document and save it to your device.

- Complete your sample. Print it or take advantage of professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Do I need a lawyer to prepare a Power of Attorney? There is no legal requirement that a Power of Attorney be prepared or reviewed by a lawyer. However, if you are going to give important powers to an agent, it is wise to get individual legal advice before signing a complicated form.

How much might I typically need to pay for a lawyer to help me get a Power of Attorney form in Oregon? The cost of working with the average lawyer to draft a Power of Attorney might range anywhere between $200 and $500, based on your location.

The fee range can be from 25 percent to 40 percent and may even differ from those figures. The typical fee is 33 1/3 percent of the gross amounts recovered. The actual contingency fee is a matter of negotiation between the attorney and client.

Factors to be considered as guides in determining the reasonableness of a fee include the following: (1) The time and labor required, the novelty and difficulty of the questions involved, and the skill requisite to perform the legal service properly.

Factors Affecting Attorney Fees The lawyer's experience or specialization in that area of law. The complexity of the case. The number of hours the lawyer expects to work on the case. The number of additional lawyers or support staff the lawyer will need to adequately represent a client.

On the check, write the case number, client name and case description. (This is good risk management if you ever need to re-create your trust accounting records.) Scan or copy the check and save a copy in the client's file. Deposit the check into the firm's trust account.

While Oregon's power of attorney laws are silent on notarization, signing your POA in the presence of a notary public is very strongly recommended. Many financial institutions will not want to rely on a POA unless it has been notarized?a process that helps to authenticate the document.

The average hourly rate for a lawyer in Oregon is between $92 and $361 per hour.

Despite its name, ?power of attorney? is not blindly choosing an attorney to have power over your entire legal and financial life. In fact, the process doesn't appoint a lawyer at all! A Power of attorney is a legal document that allows another person (referred to as an agent or attorney-in-fact) to act on your behalf.

Under Oregon law, someone must have special authority to act for another person. You accomplish this through a written document authorizing another person to act on your behalf. You must sign the document before you are incapacitated.