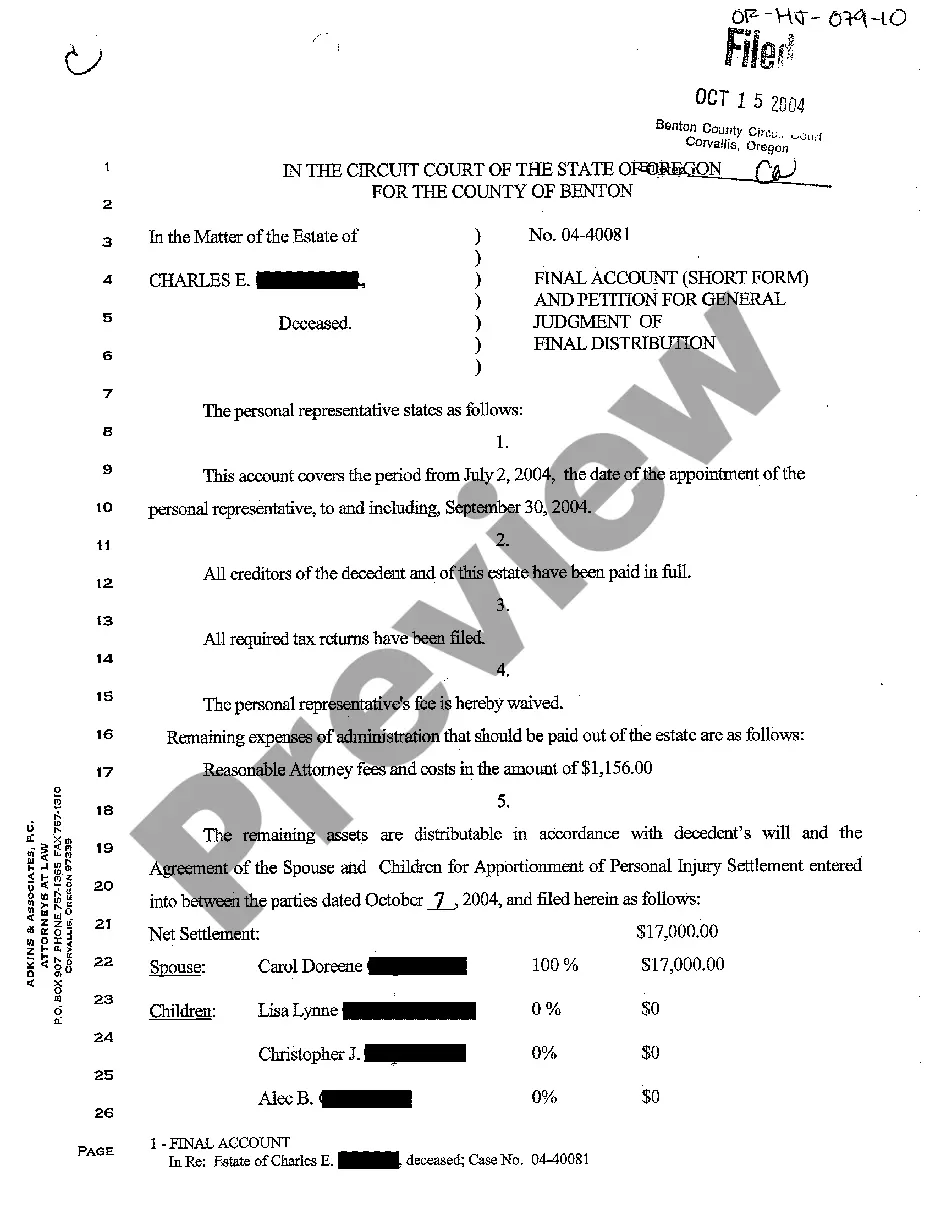

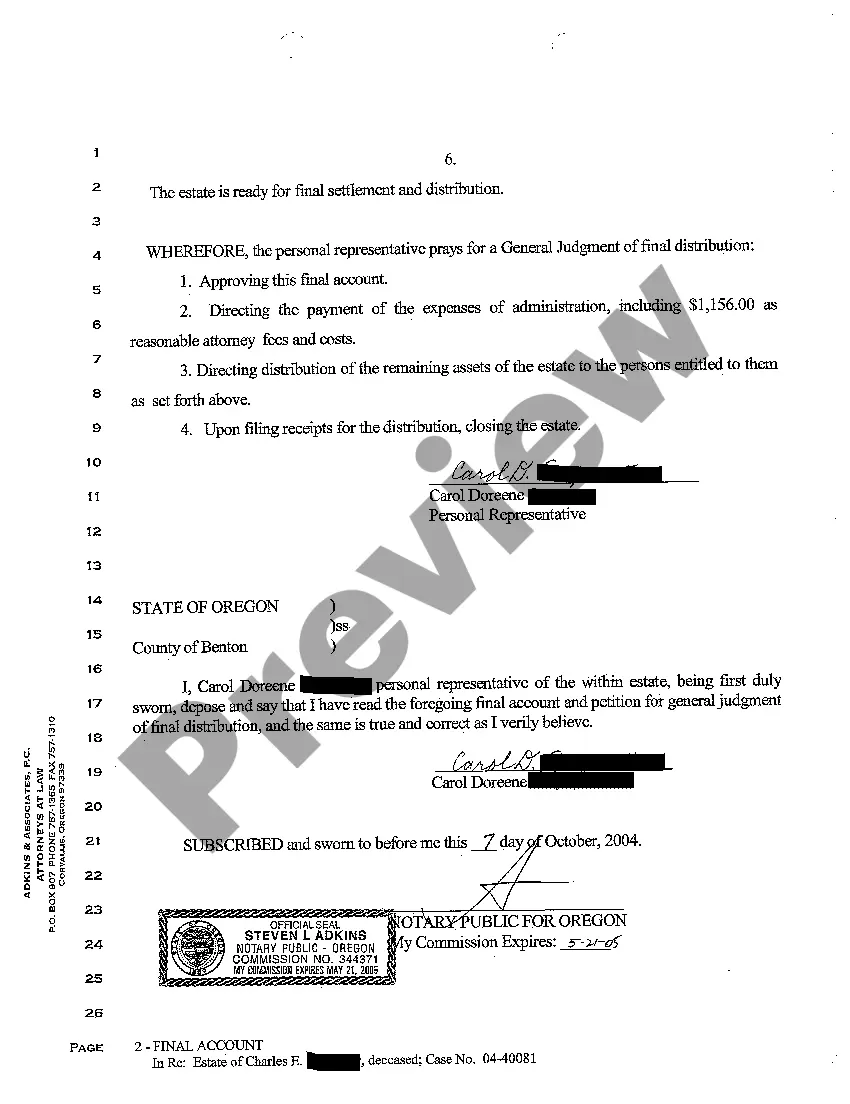

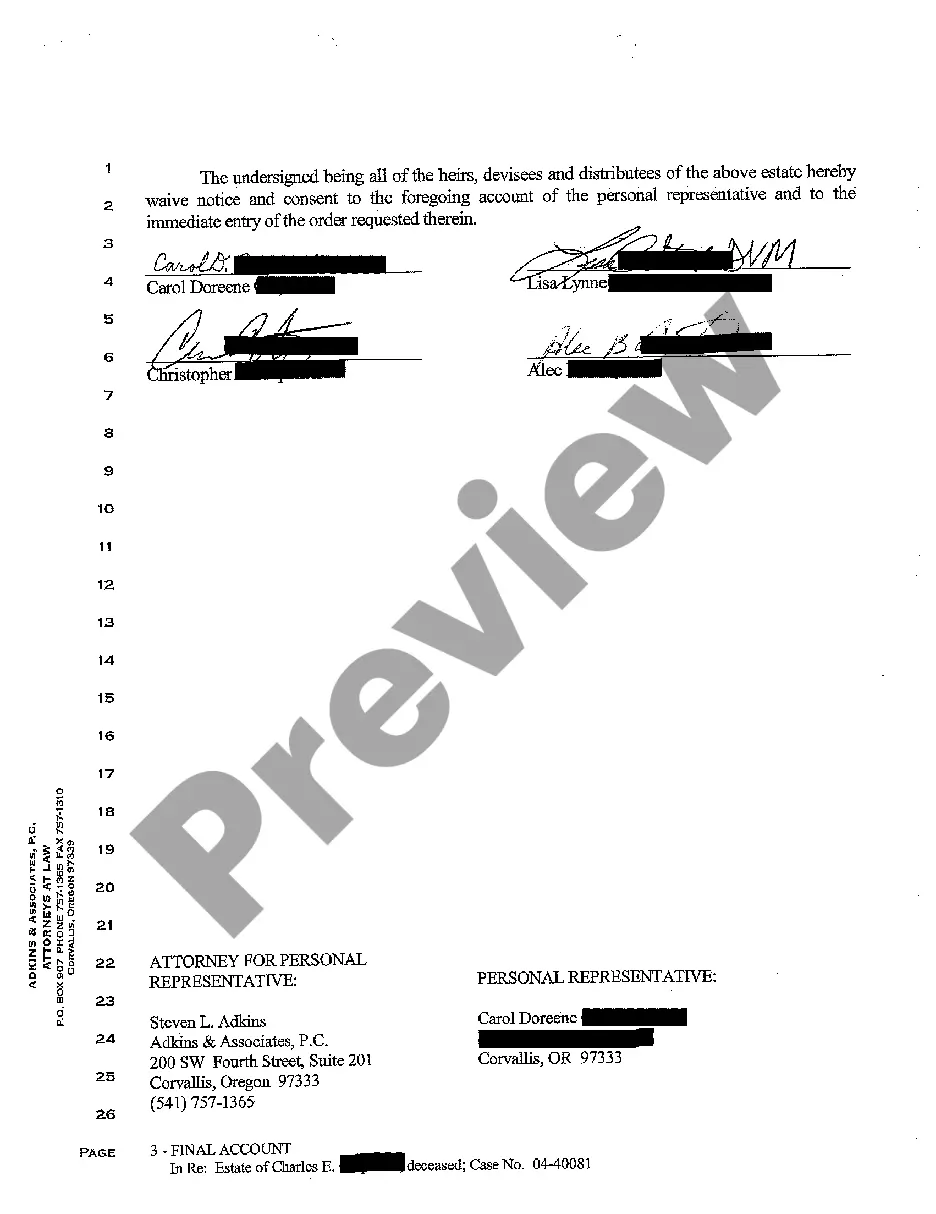

Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution is a legal document that assists individuals or entities in the final stage of the probate process. This form is specifically used in Hillsboro, Oregon, to present a final overview of an estate and request a court-ordered distribution of assets to the beneficiaries. The Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution is crucial to ensure a smooth and lawful closure of the estate administration, delivering the assets to the rightful heirs or beneficiaries. It requires attention to detail and adherence to the probate laws of Oregon. Some key components typically found in the Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution include: 1. Identifying Information: This section covers essential details such as the name of the deceased individual, the case number, the date of filing, and the names of the executor or personal representative responsible for administering the estate. 2. Assets and Liabilities: In this section, you are required to disclose all the assets and liabilities of the estate. This includes real estate properties, bank accounts, investments, personal belongings, debts, and any outstanding taxes or fees. 3. Distribution Plan: Here, you outline how you plan to distribute the assets among the heirs or beneficiaries, specifying the percentage or specific amounts each party is entitled to receive. It is crucial to ensure compliance with the deceased individual's will or the state's intestacy laws if there is no will. 4. Accounting: This segment presents a comprehensive record of the financial transactions related to the estate administration. It includes details of income received, expenses paid, and any adjustments made during the probate process. 5. Tax Considerations: The Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution also require disclosure of any potential tax liabilities related to the estate, such as estate taxes or income taxes. 6. Signatures and Verifications: This form must be signed and verified by the executor or personal representative, confirming the accuracy and completeness of the information provided. Different variations or specific types of Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution may exist based on the size or complexity of the estate being administered. For instance, if the estate includes multiple properties or extensive investments, additional disclosures might be required. It is crucial to consult with an attorney or legal professional familiar with Oregon probate laws to ensure the correct completion of the Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution. Properly filling out this document will facilitate the timely and lawful conclusion of the estate administration process, allowing the rightful heirs or beneficiaries to receive their allocated assets efficiently.

Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution

State:

Oregon

City:

Hillsboro

Control #:

OR-HJ-079-10

Format:

PDF

Instant download

This form is available by subscription

Description

A10 Final Account Short Form and Petition for General Judgment of Final Distribution

Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution is a legal document that assists individuals or entities in the final stage of the probate process. This form is specifically used in Hillsboro, Oregon, to present a final overview of an estate and request a court-ordered distribution of assets to the beneficiaries. The Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution is crucial to ensure a smooth and lawful closure of the estate administration, delivering the assets to the rightful heirs or beneficiaries. It requires attention to detail and adherence to the probate laws of Oregon. Some key components typically found in the Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution include: 1. Identifying Information: This section covers essential details such as the name of the deceased individual, the case number, the date of filing, and the names of the executor or personal representative responsible for administering the estate. 2. Assets and Liabilities: In this section, you are required to disclose all the assets and liabilities of the estate. This includes real estate properties, bank accounts, investments, personal belongings, debts, and any outstanding taxes or fees. 3. Distribution Plan: Here, you outline how you plan to distribute the assets among the heirs or beneficiaries, specifying the percentage or specific amounts each party is entitled to receive. It is crucial to ensure compliance with the deceased individual's will or the state's intestacy laws if there is no will. 4. Accounting: This segment presents a comprehensive record of the financial transactions related to the estate administration. It includes details of income received, expenses paid, and any adjustments made during the probate process. 5. Tax Considerations: The Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution also require disclosure of any potential tax liabilities related to the estate, such as estate taxes or income taxes. 6. Signatures and Verifications: This form must be signed and verified by the executor or personal representative, confirming the accuracy and completeness of the information provided. Different variations or specific types of Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution may exist based on the size or complexity of the estate being administered. For instance, if the estate includes multiple properties or extensive investments, additional disclosures might be required. It is crucial to consult with an attorney or legal professional familiar with Oregon probate laws to ensure the correct completion of the Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution. Properly filling out this document will facilitate the timely and lawful conclusion of the estate administration process, allowing the rightful heirs or beneficiaries to receive their allocated assets efficiently.

Free preview

How to fill out Hillsboro Oregon Final Account Short Form And Petition For General Judgment Of Final Distribution?

If you’ve already used our service before, log in to your account and download the Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Ensure you’ve found a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Hillsboro Oregon Final Account Short Form and Petition for General Judgment of Final Distribution. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!