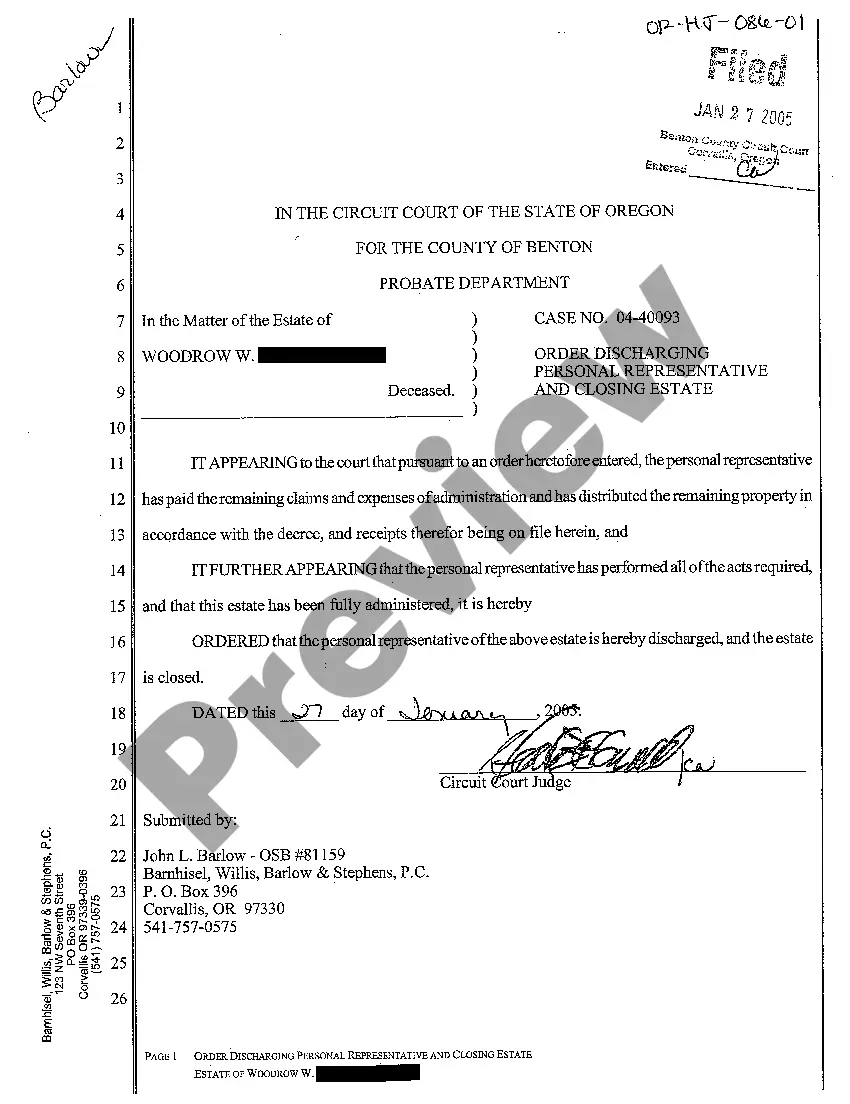

Title: Understanding Eugene Oregon Order Discharging Personal Representative and Closing Estate: A Comprehensive Guide Introduction: In Eugene, Oregon, the process of discharging a personal representative and closing an estate involves a series of legal procedures to ensure the smooth transfer of assets and finalize the deceased's affairs. This article aims to provide a detailed description of the different types of Eugene Oregon orders issued during the process, along with relevant keywords. 1. Eugene Oregon Probate Process: — Eugene Oregon: Located in Lane County, Oregon, Eugene is a city known for its vibrant culture, picturesque landscapes, and active community. — Probate Process: The legal procedure which oversees the distribution of a deceased person's estate, ensuring creditors are paid, and assets are transferred. 2. Role of Personal Representative: — Personal Representative: The individual appointed by the probate court to administer the estate and carry out various duties, including collecting assets, paying debts, and distributing the remaining estate. — Duties of a Personal Representative: Managing estate finances, filing necessary tax returns, paying creditors, and ultimately distributing the estate according to the deceased person's will or state law. 3. Eugene Oregon Order Discharging Personal Representative: — Order Discharging Personal Representative: A court-issued document that relieves the personal representative of their duties once the estate has been settled. — Key Steps for Discharging a Personal Representative: Finalizing financial matters, submitting an accounting statement, obtaining approval from beneficiaries, and filing a Petition for Discharge. 4. Eugene Oregon Order Closing Estate: — Order Closing Estate: A court decree officially closing the probate case and deeming the estate administration complete. — Key Terminating Steps: Satisfying creditors' claims, filing necessary tax returns, obtaining necessary consents or waivers, and distributing remaining estate assets to beneficiaries. 5. Different Types of Eugene Oregon Orders: — Order Approving Final Account and Distribution: This order confirms the personal representative's final accounting of the estate's financial transactions and the proposed distribution plan to the beneficiaries. — Order of Complete Settlement: Issued when all debts, tax obligations, and expenses of the estate have been addressed, and distribution is ready to occur. — Order of Final Discharge: This order releases the personal representative from their official duties officially, marking the end of their role in the estate administration. — Order Closing Estate Without Administration: In cases where the estate consists of minimal assets or is designated as 'small estate,' this simplified process allows for the closure of the estate without undergoing full probate proceedings. Conclusion: Navigating the Eugene Oregon order discharging personal representative and closing estate process requires adherence to legal requirements, thorough record-keeping, and fulfilling fiduciary responsibilities. By understanding the different types of orders involved and the respective steps within each, individuals can ensure a smooth and efficient estate settlement process in Eugene, Oregon.

Eugene Oregon Order Discharging Personal Representative and Closing Estate

State:

Oregon

City:

Eugene

Control #:

OR-HJ-086-01

Format:

PDF

Instant download

This form is available by subscription

Description

A19 Order Discharging Personal Representative and Closing Estate

Title: Understanding Eugene Oregon Order Discharging Personal Representative and Closing Estate: A Comprehensive Guide Introduction: In Eugene, Oregon, the process of discharging a personal representative and closing an estate involves a series of legal procedures to ensure the smooth transfer of assets and finalize the deceased's affairs. This article aims to provide a detailed description of the different types of Eugene Oregon orders issued during the process, along with relevant keywords. 1. Eugene Oregon Probate Process: — Eugene Oregon: Located in Lane County, Oregon, Eugene is a city known for its vibrant culture, picturesque landscapes, and active community. — Probate Process: The legal procedure which oversees the distribution of a deceased person's estate, ensuring creditors are paid, and assets are transferred. 2. Role of Personal Representative: — Personal Representative: The individual appointed by the probate court to administer the estate and carry out various duties, including collecting assets, paying debts, and distributing the remaining estate. — Duties of a Personal Representative: Managing estate finances, filing necessary tax returns, paying creditors, and ultimately distributing the estate according to the deceased person's will or state law. 3. Eugene Oregon Order Discharging Personal Representative: — Order Discharging Personal Representative: A court-issued document that relieves the personal representative of their duties once the estate has been settled. — Key Steps for Discharging a Personal Representative: Finalizing financial matters, submitting an accounting statement, obtaining approval from beneficiaries, and filing a Petition for Discharge. 4. Eugene Oregon Order Closing Estate: — Order Closing Estate: A court decree officially closing the probate case and deeming the estate administration complete. — Key Terminating Steps: Satisfying creditors' claims, filing necessary tax returns, obtaining necessary consents or waivers, and distributing remaining estate assets to beneficiaries. 5. Different Types of Eugene Oregon Orders: — Order Approving Final Account and Distribution: This order confirms the personal representative's final accounting of the estate's financial transactions and the proposed distribution plan to the beneficiaries. — Order of Complete Settlement: Issued when all debts, tax obligations, and expenses of the estate have been addressed, and distribution is ready to occur. — Order of Final Discharge: This order releases the personal representative from their official duties officially, marking the end of their role in the estate administration. — Order Closing Estate Without Administration: In cases where the estate consists of minimal assets or is designated as 'small estate,' this simplified process allows for the closure of the estate without undergoing full probate proceedings. Conclusion: Navigating the Eugene Oregon order discharging personal representative and closing estate process requires adherence to legal requirements, thorough record-keeping, and fulfilling fiduciary responsibilities. By understanding the different types of orders involved and the respective steps within each, individuals can ensure a smooth and efficient estate settlement process in Eugene, Oregon.

How to fill out Eugene Oregon Order Discharging Personal Representative And Closing Estate?

If you’ve already utilized our service before, log in to your account and save the Eugene Oregon Order Discharging Personal Representative and Closing Estate on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Eugene Oregon Order Discharging Personal Representative and Closing Estate. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!