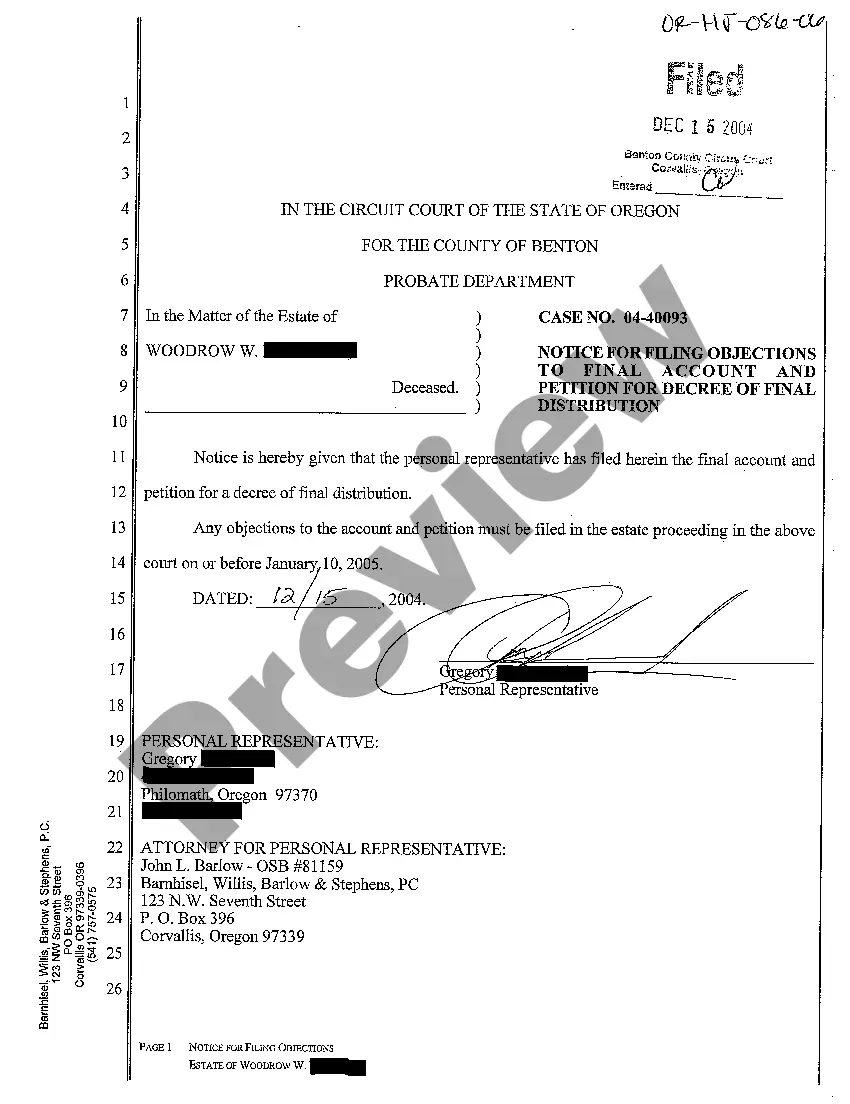

Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution is a legal document that serves as a notification to interested parties regarding an estate's final accounting and the proposed distribution of assets. This notice provides an opportunity for individuals to voice any objections they may have concerning the presented information. The purpose of the Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution is to ensure transparency and fairness in the probate process. It allows interested parties to review the estate's financial records, identify any discrepancies, and voice their concerns or objections if they believe the proposed distribution is unjust or does not adhere to applicable estate laws. The notice contains important details, including the name of the deceased, the estate file number, the name and contact information of the personal representative overseeing the estate, and the proposed final account and distribution plan. It also specifies the deadline for filing objections, typically within a certain number of days from the date of the notice publication. It is vital for anyone planning to file an objection to carefully review the final account and distribution plan included in the notice. This ensures that objections raised are informed and substantiated by specific concerns related to the estate's financial affairs or the fair distribution of assets. Common objections may include disputes over the valuation of certain assets, allegations of improper asset management, concerns regarding the legitimacy of creditors' claims, or challenges regarding the distribution plan's compliance with state laws. Different types of Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution may vary based on the specific circumstances of the estate. For example, variations may occur when there are multiple beneficiaries involved, complicated asset division, or when there are disputes among interested parties. Regardless of the specific case, the purpose and essential elements of these notices remain consistent. In summary, Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution is a critical legal document that empowers interested parties to raise objections or concerns regarding an estate's final accounting and proposed distribution plan. It promotes transparency, fairness, and adherence to applicable estate laws, and allows for a thorough review of financial records to ensure a just and equitable distribution.

Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution is a legal document that serves as a notification to interested parties regarding an estate's final accounting and the proposed distribution of assets. This notice provides an opportunity for individuals to voice any objections they may have concerning the presented information. The purpose of the Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution is to ensure transparency and fairness in the probate process. It allows interested parties to review the estate's financial records, identify any discrepancies, and voice their concerns or objections if they believe the proposed distribution is unjust or does not adhere to applicable estate laws. The notice contains important details, including the name of the deceased, the estate file number, the name and contact information of the personal representative overseeing the estate, and the proposed final account and distribution plan. It also specifies the deadline for filing objections, typically within a certain number of days from the date of the notice publication. It is vital for anyone planning to file an objection to carefully review the final account and distribution plan included in the notice. This ensures that objections raised are informed and substantiated by specific concerns related to the estate's financial affairs or the fair distribution of assets. Common objections may include disputes over the valuation of certain assets, allegations of improper asset management, concerns regarding the legitimacy of creditors' claims, or challenges regarding the distribution plan's compliance with state laws. Different types of Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution may vary based on the specific circumstances of the estate. For example, variations may occur when there are multiple beneficiaries involved, complicated asset division, or when there are disputes among interested parties. Regardless of the specific case, the purpose and essential elements of these notices remain consistent. In summary, Portland Oregon Notice for Filing Objections to Final Account and Petition for Decree of Final Distribution is a critical legal document that empowers interested parties to raise objections or concerns regarding an estate's final accounting and proposed distribution plan. It promotes transparency, fairness, and adherence to applicable estate laws, and allows for a thorough review of financial records to ensure a just and equitable distribution.