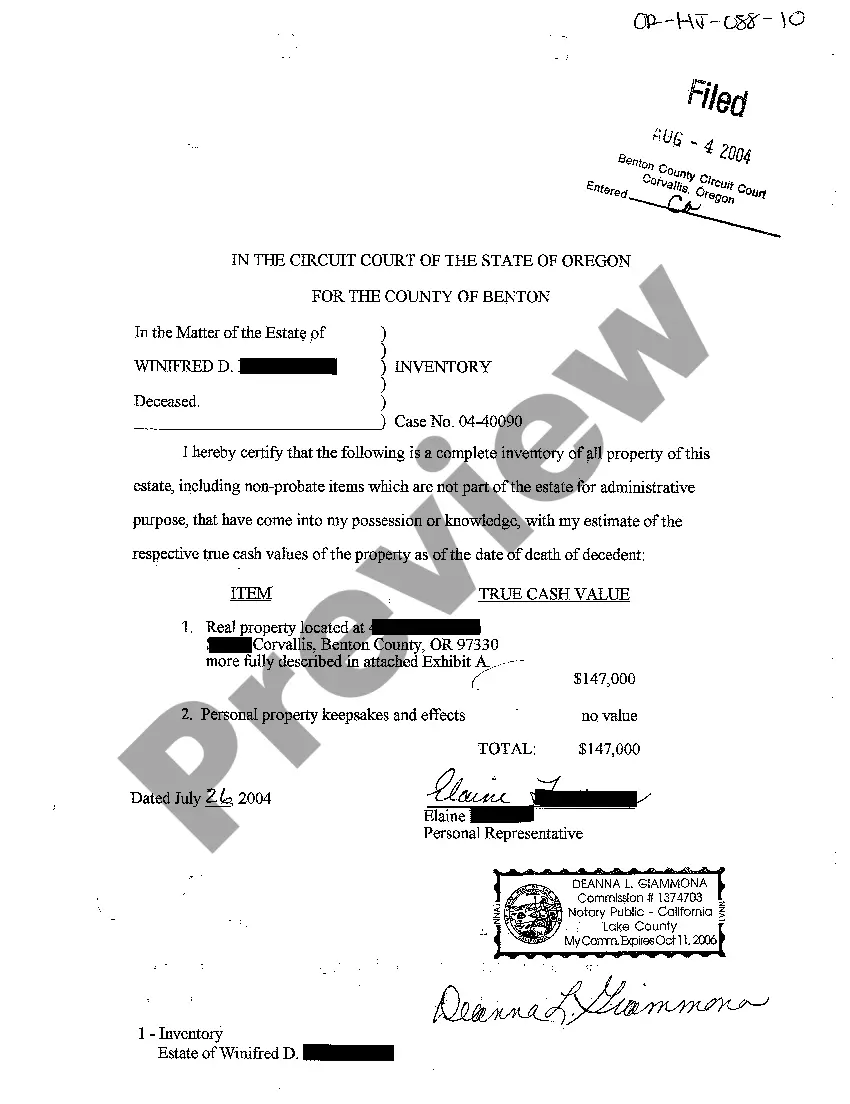

Eugene Oregon Inventory of Estate is a comprehensive collection of possessions, assets, and properties that is maintained and documented by estate administrators or legal representatives. This inventory serves as a crucial resource in the probate process, providing a detailed account of an individual's estate and ensuring fair distribution and management of assets according to the state laws. The Eugene Oregon Inventory of Estate includes various types of assets, ranging from personal belongings and real estate to financial investments and liabilities. Key items typically included in this inventory are: 1. Real Estate: This comprises residential, commercial, or vacant properties owned by the deceased. It covers details such as addresses, legal descriptions, appraisals, and any outstanding mortgages or liens. 2. Personal Property: This entails all tangible possessions like furniture, jewelry, electronics, vehicles, artwork, collectibles, and other household items of value. Each item is carefully listed, often with descriptions and estimated values. 3. Financial Accounts: These encompass bank accounts, retirement funds, stocks, bonds, mutual funds, and other investments the deceased held. The inventory presents details of the institutions, account numbers, balances, and any associated documents like statements or certificates. 4. Insurance Policies: This involves life insurance policies, health insurance, property insurance, and any other insurance coverage the deceased held, along with their corresponding policy numbers, beneficiaries, and coverage details. 5. Debts and Liabilities: This segment contains details of any debts or obligations the deceased had, including outstanding mortgages, loans, credit card balances, tax liabilities, or legal claims. 6. Business Interests: If the deceased was a business owner, the inventory may record information about partnerships, sole proprietorship, or shares of stock owned in various companies. This includes relevant documents like business contracts, licenses, or permits. 7. Trusts and Wills: In case the deceased had established a trust or drafted a will, the inventory would provide information about these legal instruments, including the location of the document and the appointed executor or trustee. Eugene Oregon Inventory of Estate is crucial for the probate process, helping ensure transparency and accountability. It facilitates asset valuation, identifies potential problems or issues, and assists in the fair distribution of assets among beneficiaries. This inventory may be prepared by the estate administrator or a hired professional, such as a probate attorney or a certified public accountant, with meticulous attention to detail and adherence to legal requirements. Different types of Eugene Oregon Inventory of Estate may exist based on the complexity and size of the estate. For instance, there could be inventories for simple estates with minimal assets and liabilities, as well as inventories for larger, more intricate estates involving numerous properties, multiple business interests, or extensive investment portfolios. The complexity of the estate often determines the depth of documentation required and the level of professional assistance sought to ensure an accurate and comprehensive inventory.

Eugene Oregon Inventory of Estate

Description

How to fill out Eugene Oregon Inventory Of Estate?

Are you looking for a reliable and affordable legal forms provider to get the Eugene Oregon Inventory of Estate? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a set of documents to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of separate state and county.

To download the document, you need to log in account, find the required template, and click the Download button next to it. Please take into account that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Eugene Oregon Inventory of Estate conforms to the regulations of your state and local area.

- Read the form’s details (if provided) to learn who and what the document is good for.

- Start the search over in case the template isn’t good for your legal situation.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Eugene Oregon Inventory of Estate in any provided file format. You can get back to the website at any time and redownload the document without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours learning about legal papers online once and for all.