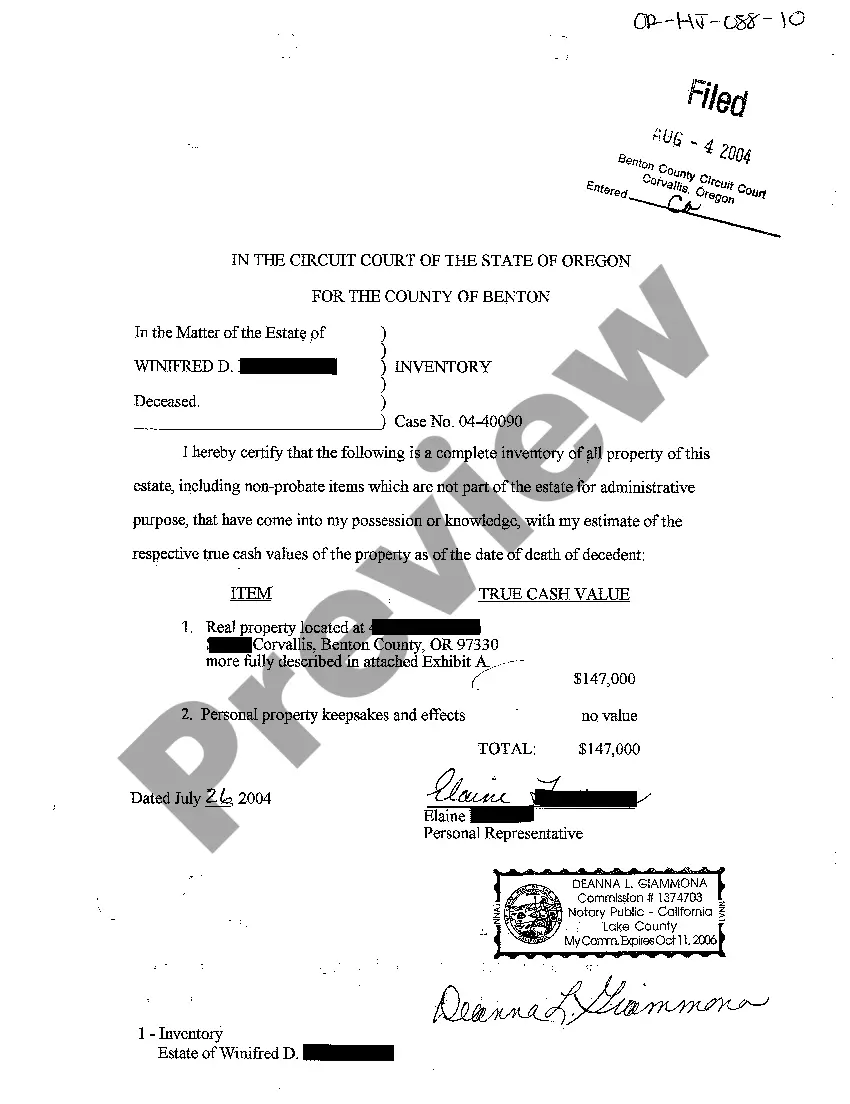

Hillsboro Oregon Inventory of Estate is a comprehensive list that documents the assets, properties, and personal belongings of an individual at the time of their death or incapacitation. It provides a detailed description of the deceased's or incapacitated individual's estate, including both tangible and intangible assets. This inventory is an essential component of the probate process and is created to ensure an orderly distribution of assets according to the individual's will or Oregon state laws. The Hillsboro Oregon Inventory of Estate encompasses various types of assets, including real estate properties, bank accounts, investment portfolios, vehicles, personal belongings, jewelry, antiques, artwork, business interests, and any other valuable possessions. The inventory aims to assess the estate's overall value and determine the distribution of assets among beneficiaries, creditors, and tax authorities. There are no specific different types of Hillsboro Oregon Inventory of Estate as the process itself applies to all individuals within the jurisdiction of Hillsboro, Oregon. However, the content and extent of the inventory may vary depending on the complexity and size of the estate. Estates with extensive holdings or high net worth might require more detailed documentation and professional assistance from estate planners, lawyers, or accountants to ensure accurate valuation and appropriate distribution. When preparing a Hillsboro Oregon Inventory of Estate, it is crucial to consider using relevant keywords to enhance searchability and clarity. Some applicable keywords to include in the description of the inventory could be "Hillsboro Oregon estate inventory," "estate assets in Hillsboro Oregon," "estate valuation in Hillsboro Oregon," "probate process in Hillsboro Oregon," "Hillsboro estate distribution," "tangible assets in Hillsboro Oregon," "intangible assets in Hillsboro Oregon," and "Hillsboro Oregon estate planning."

Hillsboro Oregon Inventory of Estate

Description

How to fill out Hillsboro Oregon Inventory Of Estate?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Hillsboro Oregon Inventory of Estate gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Hillsboro Oregon Inventory of Estate takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a couple of more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Hillsboro Oregon Inventory of Estate. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!

Form popularity

FAQ

The administration of a probate estate takes a minimum of 4 Months in Oregon. The typical amount of time is closer to 7 to 10 months depending on the nature of the assets and the backlog at the court house.

Other deadlines exist that must be followed. For instance, a list of assets must be provided within 90 days after the executor was appointed.

Oregon has a simplified probate process for small estates. To use it, you (as an inheritor) file a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

The Affidavit must be filled out correctly and the mailings completed as required, one copy to Department of Human Services and one copy to the Oregon Health Authority. The filing fee for a Small Estate is $124.00.

The administration of a probate estate takes a minimum of 4 Months in Oregon. The typical amount of time is closer to 7 to 10 months depending on the nature of the assets and the backlog at the court house.

Executors' year However, many beneficiaries don't realise that executors and administrators have twelve months before they are obliged to distribute the estate to the beneficiaries. Time runs from the date of death.

The Oregon Probate Process The Executor of the estate files a petition with the court to open probate. The court appoints an Executor of Estate or Personal Representative. The Executor of the Estate notifies the heirs and publishes notice of probate for creditors.

6-9 months is how long probate typically takes in Oregon Once the four-month discovery and notice period is complete, the probate court and PR begin overseeing the settling of the estate. For example, valid creditors receive payment and settlement from out of the estate's assets.

The executor will need to wait until the 2 month time limit is up, before distributing the estate. Six month limit to bring a claim ? in other cases, it can be sensible for the executors not to pay any beneficiaries until at least 6 months after receiving the grant of probate.