Title: Gresham Oregon Letters Testamentary: A Comprehensive Overview and Types Introduction: Gresham, Oregon Letters Testamentary play a crucial role in the probate process, ensuring the orderly distribution of a deceased person's assets according to their last will and testament. This article aims to provide a detailed description of what Gresham Oregon Letters Testamentary are, their significance, and explore any potential variations or types. 1. Understanding Gresham Oregon Letters Testamentary: Gresham Oregon Letters Testamentary refer to the legal document issued by the Gresham probate court to the appointed personal representative or executor named in a decedent's will. These letters bestow authority upon the individual, empowering them to manage and distribute the estate as outlined in the will. 2. Importance and Responsibilities of the Personal Representative: The personal representative or executor assumes fiduciary responsibilities, such as: a. Asset Inventory and Appraisal: The personal representative must compile a comprehensive inventory of the deceased person's assets, including real estate, bank accounts, investments, personal belongings, etc. The assets' accurate valuation is crucial for proper distribution. b. Debt and Taxes: The executor is responsible for identifying and settling any outstanding debts of the deceased. They must also ensure proper tax filings and payment from the estate as required by local laws. c. Asset Distribution: The personal representative's primary role is to distribute the estate's assets according to the decedent's wishes as outlined in the will. They must follow the legal requirements, obtain necessary court approvals, and ensure fairness and equity during distribution. 3. Potential Types of Gresham Oregon Letters Testamentary: While there might not be different types of Gresham Oregon Letters Testamentary per se, variations can arise based on specific circumstances or scenarios. Some notable examples include: a. Regular Letters Testamentary: Typically issued in standard probate cases where the will is uncontested, and the appointed personal representative carries out the distribution according to the will's terms. b. Limited Letters Testamentary: In certain cases, the court may limit the personal representative's authority or their role to specific tasks or assets, if deemed necessary or requested by parties involved. c. Ancillary Letters Testamentary: If the decedent owned property or assets in Gresham, Oregon, but was not a permanent resident, ancillary letters testamentary might be necessary for the personal representative to administer the Gresham-based assets. Conclusion: Gresham Oregon Letters Testamentary are pivotal in ensuring a smooth and legal transfer of assets following a person's passing. The appointed personal representative plays a crucial role in fulfilling fiduciary duties and safeguarding the integrity of the probate process. By understanding the scope and significance of these letters, individuals involved can navigate the Gresham probate laws confidently, ensuring compliance and a fair distribution of the estate.

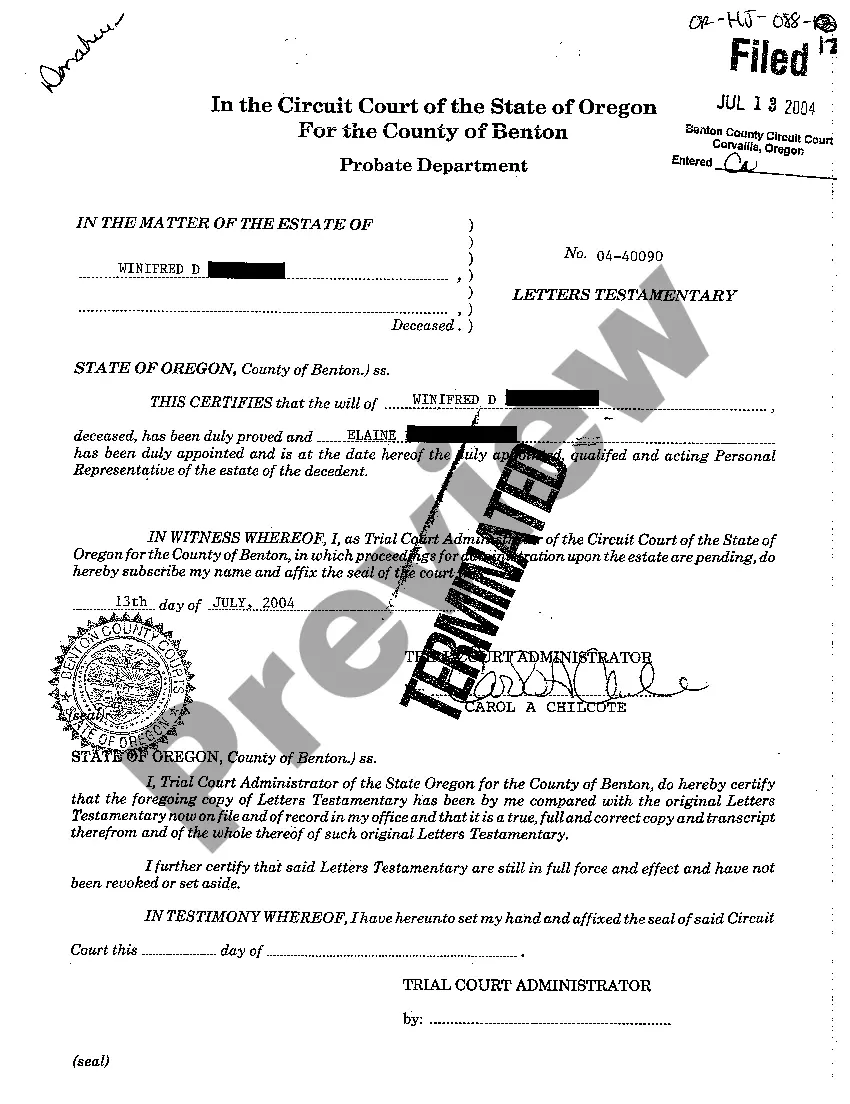

Gresham Oregon Letters Testamentary

State:

Oregon

City:

Gresham

Control #:

OR-HJ-088-12

Format:

PDF

Instant download

This form is available by subscription

Description

A03 Letters Testamentary

Title: Gresham Oregon Letters Testamentary: A Comprehensive Overview and Types Introduction: Gresham, Oregon Letters Testamentary play a crucial role in the probate process, ensuring the orderly distribution of a deceased person's assets according to their last will and testament. This article aims to provide a detailed description of what Gresham Oregon Letters Testamentary are, their significance, and explore any potential variations or types. 1. Understanding Gresham Oregon Letters Testamentary: Gresham Oregon Letters Testamentary refer to the legal document issued by the Gresham probate court to the appointed personal representative or executor named in a decedent's will. These letters bestow authority upon the individual, empowering them to manage and distribute the estate as outlined in the will. 2. Importance and Responsibilities of the Personal Representative: The personal representative or executor assumes fiduciary responsibilities, such as: a. Asset Inventory and Appraisal: The personal representative must compile a comprehensive inventory of the deceased person's assets, including real estate, bank accounts, investments, personal belongings, etc. The assets' accurate valuation is crucial for proper distribution. b. Debt and Taxes: The executor is responsible for identifying and settling any outstanding debts of the deceased. They must also ensure proper tax filings and payment from the estate as required by local laws. c. Asset Distribution: The personal representative's primary role is to distribute the estate's assets according to the decedent's wishes as outlined in the will. They must follow the legal requirements, obtain necessary court approvals, and ensure fairness and equity during distribution. 3. Potential Types of Gresham Oregon Letters Testamentary: While there might not be different types of Gresham Oregon Letters Testamentary per se, variations can arise based on specific circumstances or scenarios. Some notable examples include: a. Regular Letters Testamentary: Typically issued in standard probate cases where the will is uncontested, and the appointed personal representative carries out the distribution according to the will's terms. b. Limited Letters Testamentary: In certain cases, the court may limit the personal representative's authority or their role to specific tasks or assets, if deemed necessary or requested by parties involved. c. Ancillary Letters Testamentary: If the decedent owned property or assets in Gresham, Oregon, but was not a permanent resident, ancillary letters testamentary might be necessary for the personal representative to administer the Gresham-based assets. Conclusion: Gresham Oregon Letters Testamentary are pivotal in ensuring a smooth and legal transfer of assets following a person's passing. The appointed personal representative plays a crucial role in fulfilling fiduciary duties and safeguarding the integrity of the probate process. By understanding the scope and significance of these letters, individuals involved can navigate the Gresham probate laws confidently, ensuring compliance and a fair distribution of the estate.

How to fill out Gresham Oregon Letters Testamentary?

If you’ve already utilized our service before, log in to your account and download the Gresham Oregon Letters Testamentary on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Gresham Oregon Letters Testamentary. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!