Title: Understanding Eugene Oregon Objection to Conservator's First and Final Accounting Keywords: Eugene Oregon, objection, conservator, first and final accounting, legal procedure, beneficiaries, court, hearing Introduction: Eugene, Oregon's objection to a conservator's first and final accounting is an important legal process designed to protect the rights and interests of beneficiaries involved. This article will provide an in-depth overview of what this objection entails, addressing various types of objections and highlighting relevant keywords for clarity. 1. The Importance of First and Final Accounting: The conservator is legally required to provide a detailed summary of financial transactions, including income, expenses, and decisions made during their tenure. This accounting ensures transparency and accountability, safeguarding the beneficiaries' rights and their assets. 2. Grounds for Objecting: 2.1. Inaccurate Information: Beneficiaries may object if they suspect errors, omissions, or false representation within the accounting report. These inaccuracies could potentially compromise their interests and require clarification. 2.2. Breach of Fiduciary Duty: If the conservator is found to have acted improperly, such as misappropriating funds or making unsuitable investments, beneficiaries have the right to raise objections to protect their assets and secure proper management of their resources. 2.3. Mismanagement of Estate: If beneficiaries believe that the conservator has not handled the estate responsibly and has caused financial harm, they may file an objection to seek corrective measures and mitigate further losses. 3. Initiation of the Objection Process: To object to a conservator's first and final accounting, beneficiaries must file a formal objection with the court overseeing the conservatorship. This initiates a legal proceeding in which the court will assess the merits of the objection. 4. The Objection Hearing: Once the objection is filed, the court schedules a hearing to review the objections and any supporting evidence presented by the beneficiaries. This hearing provides an opportunity for the court to evaluate the conservator's accounting and address the beneficiaries' concerns. 5. Outcome and Resolution: In light of the objection and supporting evidence presented, the court may take various actions, such as: — Approving the accounting if no significant issues are found. — Requesting clarifications or amendments to the accounting. — Disapproving the accounting due to valid objections. — Removing the conservator and appointing a new one if serious misconduct is established. Conclusion: Eugene, Oregon's objection to a conservator's first and final accounting serves as a safeguard for beneficiaries, ensuring transparency, accuracy, and responsible management of the estate. By raising objections, beneficiaries can protect their interests and hold conservators accountable, ultimately ensuring the well-being of their assets.

Eugene Oregon Objection to Conservator's First and Final Accounting

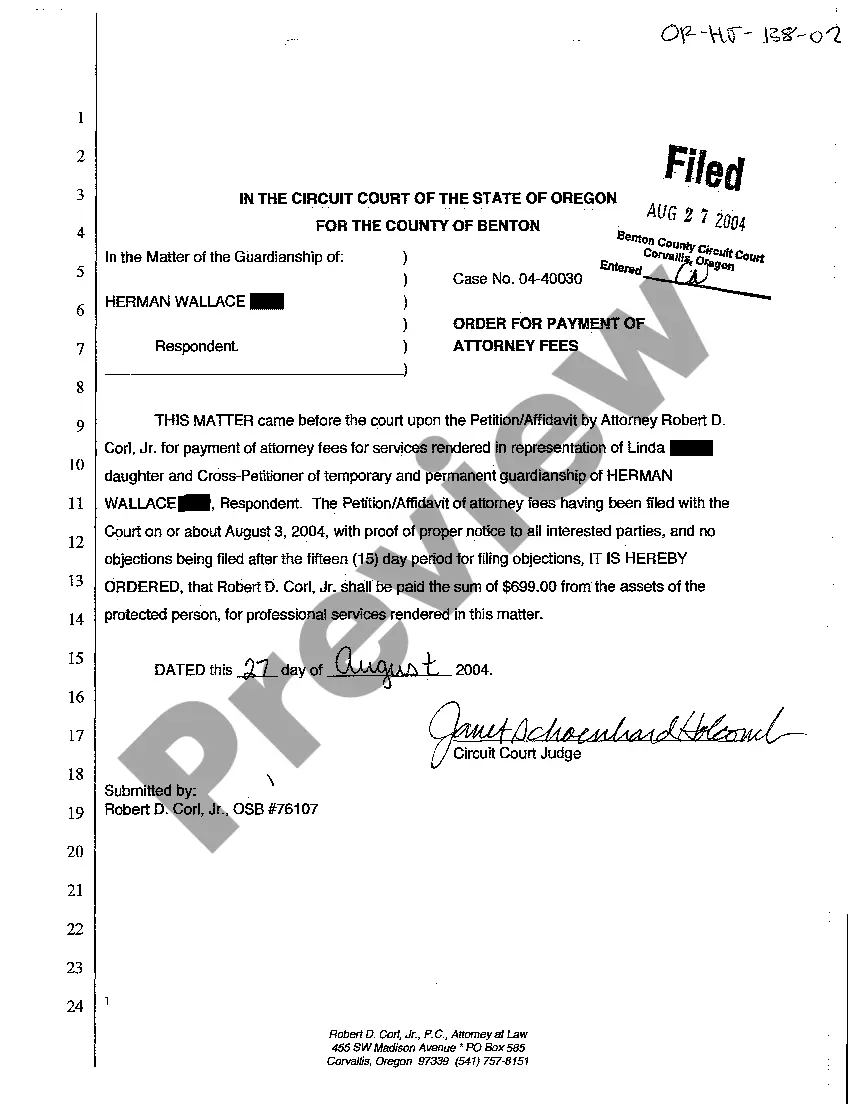

Description

How to fill out Eugene Oregon Objection To Conservator's First And Final Accounting?

If you are looking for a relevant form, it’s impossible to find a more convenient platform than the US Legal Forms website – probably the most comprehensive libraries on the web. With this library, you can get a huge number of form samples for company and individual purposes by categories and states, or key phrases. With the advanced search feature, finding the newest Eugene Oregon Objection to Conservator's First and Final Accounting is as elementary as 1-2-3. In addition, the relevance of every document is verified by a team of skilled lawyers that on a regular basis review the templates on our website and update them according to the latest state and county demands.

If you already know about our system and have a registered account, all you should do to get the Eugene Oregon Objection to Conservator's First and Final Accounting is to log in to your user profile and click the Download button.

If you use US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have discovered the form you want. Read its information and utilize the Preview option (if available) to check its content. If it doesn’t meet your needs, use the Search option near the top of the screen to get the proper record.

- Confirm your decision. Click the Buy now button. Following that, choose the preferred pricing plan and provide credentials to register an account.

- Process the purchase. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the form. Choose the format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the obtained Eugene Oregon Objection to Conservator's First and Final Accounting.

Every single form you add to your user profile does not have an expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you need to receive an additional version for modifying or creating a hard copy, you can come back and export it again whenever you want.

Take advantage of the US Legal Forms professional library to get access to the Eugene Oregon Objection to Conservator's First and Final Accounting you were seeking and a huge number of other professional and state-specific templates on a single platform!