In Hillsboro, Oregon, objections to a conservator's first and final accounting are a legal process that allows individuals to challenge the accuracy, completeness, or appropriateness of a conservator's financial statements and actions. These objections serve as a way to ensure transparency and accountability in the management of an individual's estate or assets by the appointed conservator. Some common types of objections to a conservator's first and final accounting in Hillsboro, Oregon, may include: 1. Inadequate Records: This objection contends that the conservator has failed to maintain sufficient documentation or records to support their financial transactions and activities adequately. It may challenge the adequacy or accuracy of the financial statements prepared by the conservator. 2. Misappropriation of Funds: This objection alleges that the conservator has improperly utilized or misused the individual's funds or assets. It may involve expenses that are unrelated to the individual's care or excessive fees charged by the conservator. 3. Failure to Comply with Court Orders: This objection argues that the conservator has not followed the instructions or directives issued by the court regarding the management of the individual's estate. It may include non-compliance with reporting requirements or failure to obtain court approval for certain financial transactions. 4. Conflict of Interest: This objection raises concerns about the conservator's potential conflict of interest, suggesting that their personal interests may have influenced their financial decisions or actions. It may question whether the conservator is acting in the best interests of the individual they are appointed to protect. 5. Inaccurate Valuation of Assets: This objection disputes the valuation of certain assets included in the financial statements provided by the conservator. It may challenge the fair market value assigned to properties, investments, or other valuable items, which could impact the overall accuracy of the financial accounting. 6. Lack of Investment Prudence: This objection questions the conservator's investment decisions, arguing that they have failed to act prudently or responsibly when managing the individual's investments. It may raise concerns about unnecessary risks taken or poor diversification of the investment portfolio. 7. Inappropriate Distributions: This objection challenges the appropriateness of any distributions made by the conservator, asserting that they have failed to adhere to legal requirements or have made unequal or unfair distributions amongst beneficiaries. It is important to note that each case may have unique circumstances, and objections can vary. These objections provide an opportunity for interested parties, beneficiaries, or the court to ensure that the conservator has acted diligently, ethically, and in compliance with their fiduciary duties. By considering these objections, Hillsboro, Oregon, aims to safeguard the rights and interests of individuals under conservatorship.

Hillsboro Oregon Objection to Conservator's First and Final Accounting

State:

Oregon

City:

Hillsboro

Control #:

OR-HJ-138-03

Format:

PDF

Instant download

This form is available by subscription

Description

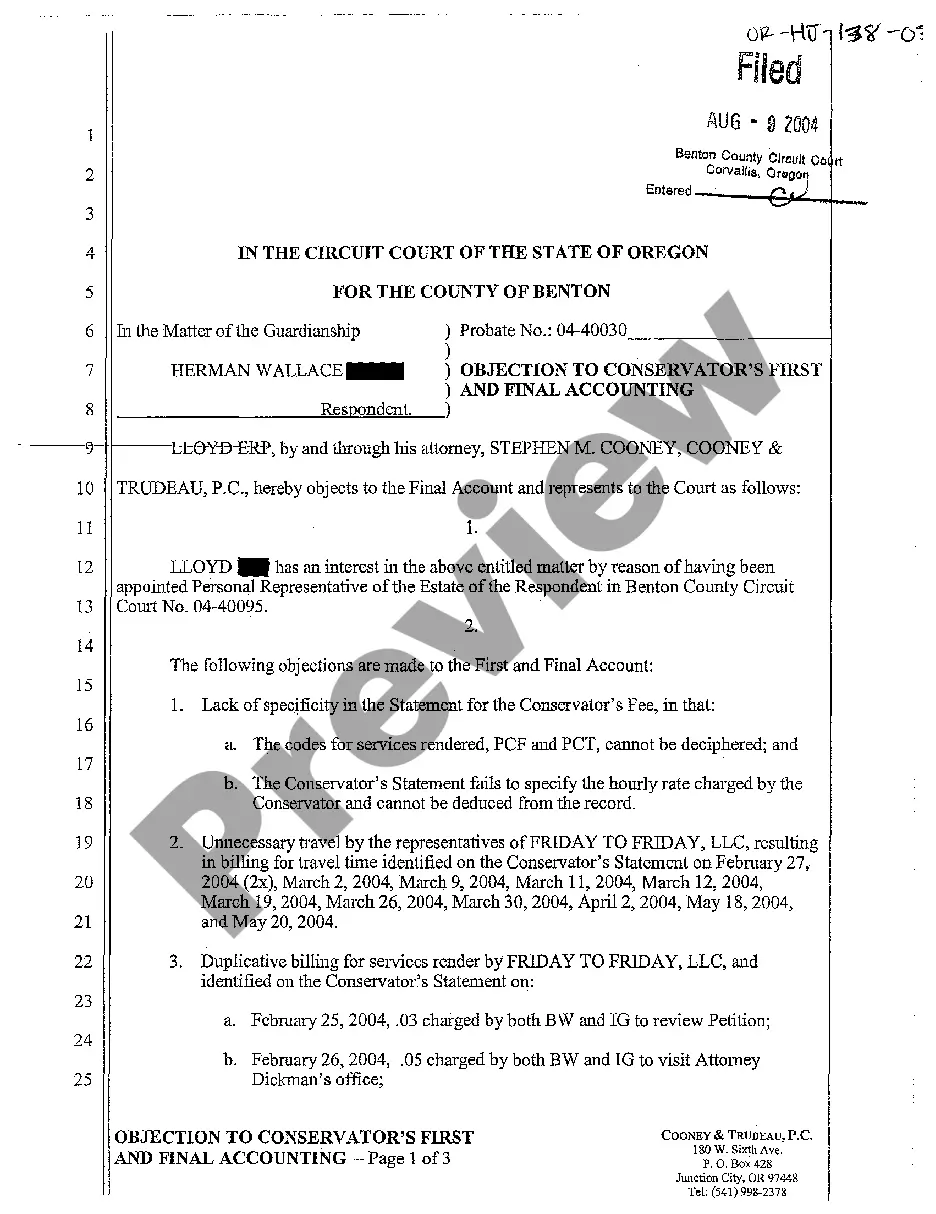

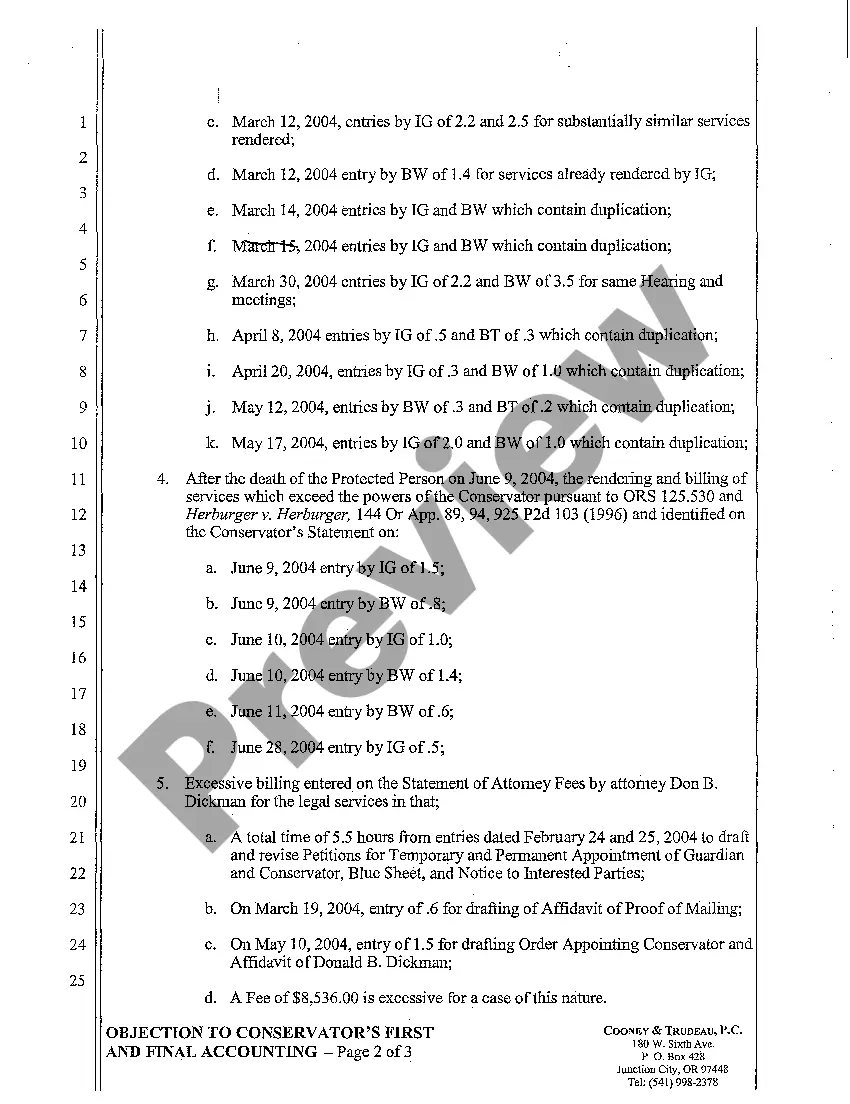

A03 Objection to Conservator's First and Final Accounting

In Hillsboro, Oregon, objections to a conservator's first and final accounting are a legal process that allows individuals to challenge the accuracy, completeness, or appropriateness of a conservator's financial statements and actions. These objections serve as a way to ensure transparency and accountability in the management of an individual's estate or assets by the appointed conservator. Some common types of objections to a conservator's first and final accounting in Hillsboro, Oregon, may include: 1. Inadequate Records: This objection contends that the conservator has failed to maintain sufficient documentation or records to support their financial transactions and activities adequately. It may challenge the adequacy or accuracy of the financial statements prepared by the conservator. 2. Misappropriation of Funds: This objection alleges that the conservator has improperly utilized or misused the individual's funds or assets. It may involve expenses that are unrelated to the individual's care or excessive fees charged by the conservator. 3. Failure to Comply with Court Orders: This objection argues that the conservator has not followed the instructions or directives issued by the court regarding the management of the individual's estate. It may include non-compliance with reporting requirements or failure to obtain court approval for certain financial transactions. 4. Conflict of Interest: This objection raises concerns about the conservator's potential conflict of interest, suggesting that their personal interests may have influenced their financial decisions or actions. It may question whether the conservator is acting in the best interests of the individual they are appointed to protect. 5. Inaccurate Valuation of Assets: This objection disputes the valuation of certain assets included in the financial statements provided by the conservator. It may challenge the fair market value assigned to properties, investments, or other valuable items, which could impact the overall accuracy of the financial accounting. 6. Lack of Investment Prudence: This objection questions the conservator's investment decisions, arguing that they have failed to act prudently or responsibly when managing the individual's investments. It may raise concerns about unnecessary risks taken or poor diversification of the investment portfolio. 7. Inappropriate Distributions: This objection challenges the appropriateness of any distributions made by the conservator, asserting that they have failed to adhere to legal requirements or have made unequal or unfair distributions amongst beneficiaries. It is important to note that each case may have unique circumstances, and objections can vary. These objections provide an opportunity for interested parties, beneficiaries, or the court to ensure that the conservator has acted diligently, ethically, and in compliance with their fiduciary duties. By considering these objections, Hillsboro, Oregon, aims to safeguard the rights and interests of individuals under conservatorship.

Free preview

How to fill out Hillsboro Oregon Objection To Conservator's First And Final Accounting?

If you’ve already utilized our service before, log in to your account and download the Hillsboro Oregon Objection to Conservator's First and Final Accounting on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Hillsboro Oregon Objection to Conservator's First and Final Accounting. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!