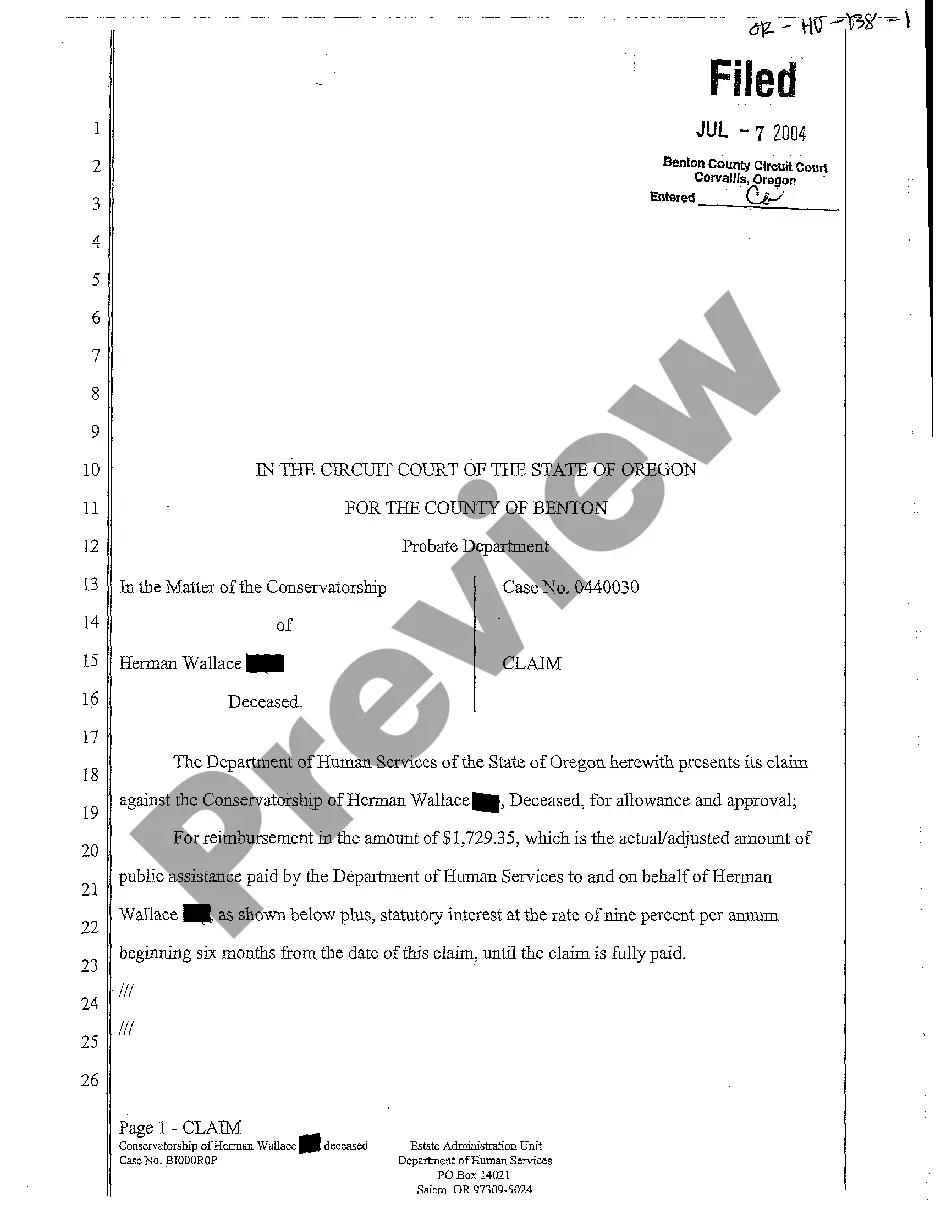

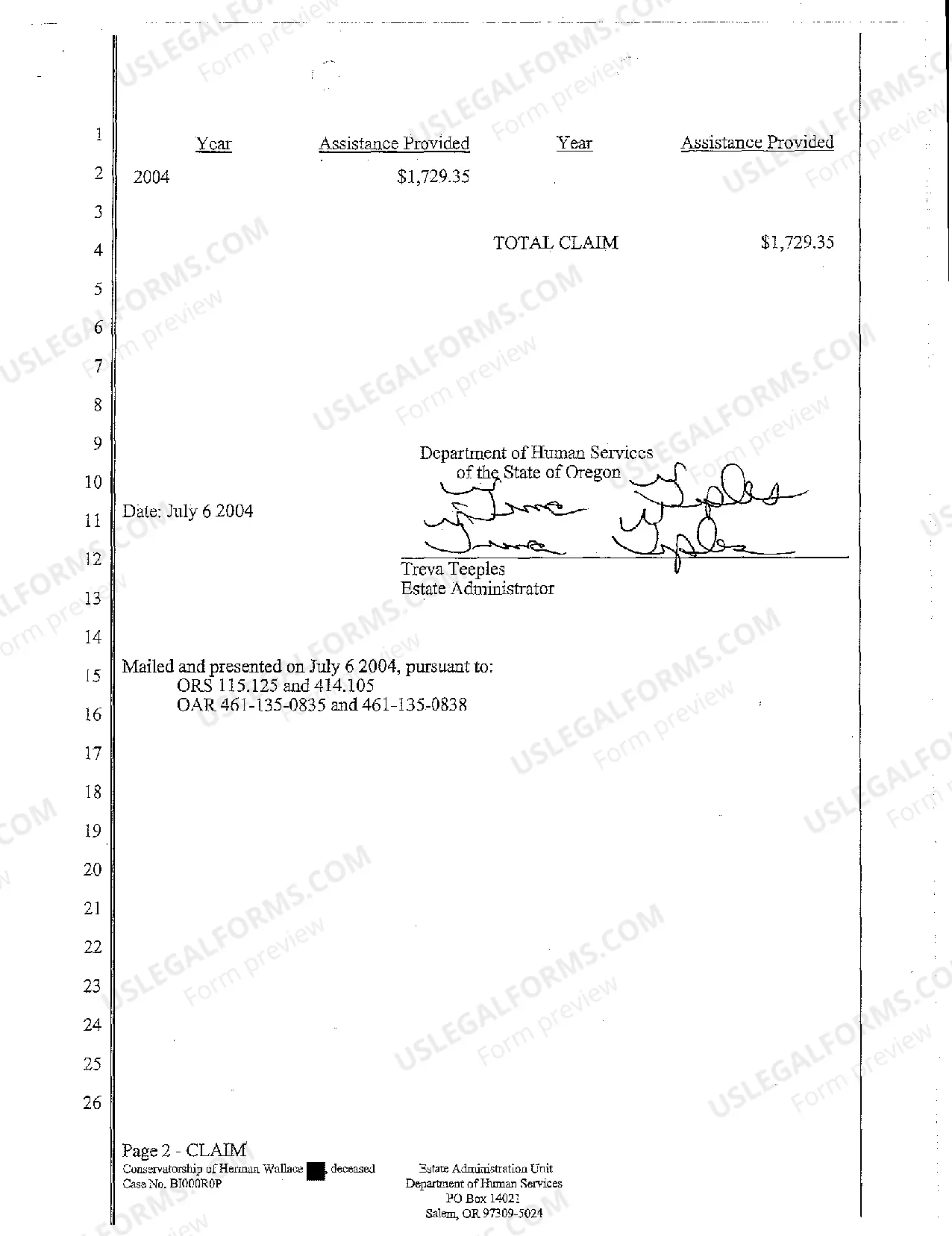

Hillsboro Oregon Claim regarding Conservator Fees

Description

How to fill out Oregon Claim Regarding Conservator Fees?

Finding authentic templates tailored to your state regulations can be challenging unless you utilize the US Legal Forms database.

It’s an online collection of over 85,000 legal forms catering to both personal and business requirements as well as various real-world situations.

All documents are properly categorized by their usage area and jurisdiction, making it as straightforward as pie to find the Hillsboro Oregon Claim concerning Conservator Fees.

Maintaining organized documentation in compliance with legal standards holds great importance. Take advantage of the US Legal Forms library to always have crucial document templates readily available for any requirements!

- Examine the Preview mode and form description.

- Ensure you've selected the correct one that satisfies your needs and fully aligns with your local regulatory requirements.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

To object to attorney fees in Oregon, you must first gather all relevant documentation to support your claim. This documentation should detail why you believe the fees are excessive or unjustified. For matters like a Hillsboro Oregon Claim regarding Conservator Fees, it's wise to consult with a knowledgeable attorney who can help you articulate your objections effectively. They can also assist you in filing the necessary paperwork to ensure your concerns are heard.

Obtaining a conservatorship can vary in complexity depending on individual circumstances. Generally, you must submit a petition and provide evidence of the need for conservatorship, which can involve legal proceedings. If you're planning to file a Hillsboro Oregon Claim regarding Conservator Fees, collaborating with legal experts can simplify the process and clarify your responsibilities. They can guide you through necessary steps, making the journey smoother.

In general, conservator fees are not tax-deductible for the individual under conservatorship. However, if the fees are considered necessary expenses in managing the estate or funds, a Hillsboro Oregon Claim regarding Conservator Fees may provide some tax insights. It’s beneficial to seek advice from a tax professional to clarify your specific situation. This can help you make informed decisions regarding financial planning.

One disadvantage of conservatorship is the potential for loss of autonomy, as a conservator makes decisions on behalf of the individual. Additionally, conservatorship may involve ongoing fees and expenses that can impact the person's finances. If you're considering a Hillsboro Oregon Claim regarding Conservator Fees, it's crucial to weigh these factors carefully. You may also want to consult an experienced legal professional to understand the implications fully.

While it may be difficult to avoid taxes altogether on executor fees, there are ways to minimize taxable income. Utilizing deductions related to the estate administration can lower your taxable amount. Hiring a professional to navigate the nuances of estate tax in Hillsboro may also be beneficial. This strategic approach helps keep your financial obligations manageable.

In Oregon, a conservator manages the financial affairs of a person unable to do so, while a guardian makes personal and medical decisions for that individual. The distinction is essential for individuals dealing with Hillsboro Oregon Claims regarding Conservator Fees. Both roles come with distinct responsibilities and legal requirements. Understanding these differences ensures the appropriate protection for those in need.

Yes, executor fees must be reported to the IRS as part of the executor's income. In the context of a Hillsboro Oregon Claim regarding Conservator Fees, these fees could influence overall probate costs. Executors should maintain detailed records of their fees and other related expenses. Proper documentation aids in simplifying tax filing processes.

In Hillsboro, Oregon, conservatorship accounts are treated similarly to other trust accounts for tax purposes. The income generated from these accounts typically gets reported on the tax return of the individual under conservatorship. It's important to consider consulting a tax advisor for accurate tax obligations related to conservator fees. Understanding how taxation works helps ensure compliance with IRS regulations.

A conservator in Oregon has the authority to manage and oversee an individual's financial affairs, including paying bills, managing investments, and making financial decisions. This legal authority helps safeguard the assets of someone who cannot handle their finances. If you have concerns about your situation, a Hillsboro Oregon Claim regarding Conservator Fees can provide valuable direction.

Yes, conservator fees in Oregon may be subject to taxation, depending on various factors such as the source of the funds. It's essential to consult with a tax professional to clarify any obligations you may have. For those dealing with a Hillsboro Oregon Claim regarding Conservator Fees, understanding tax implications is vital.