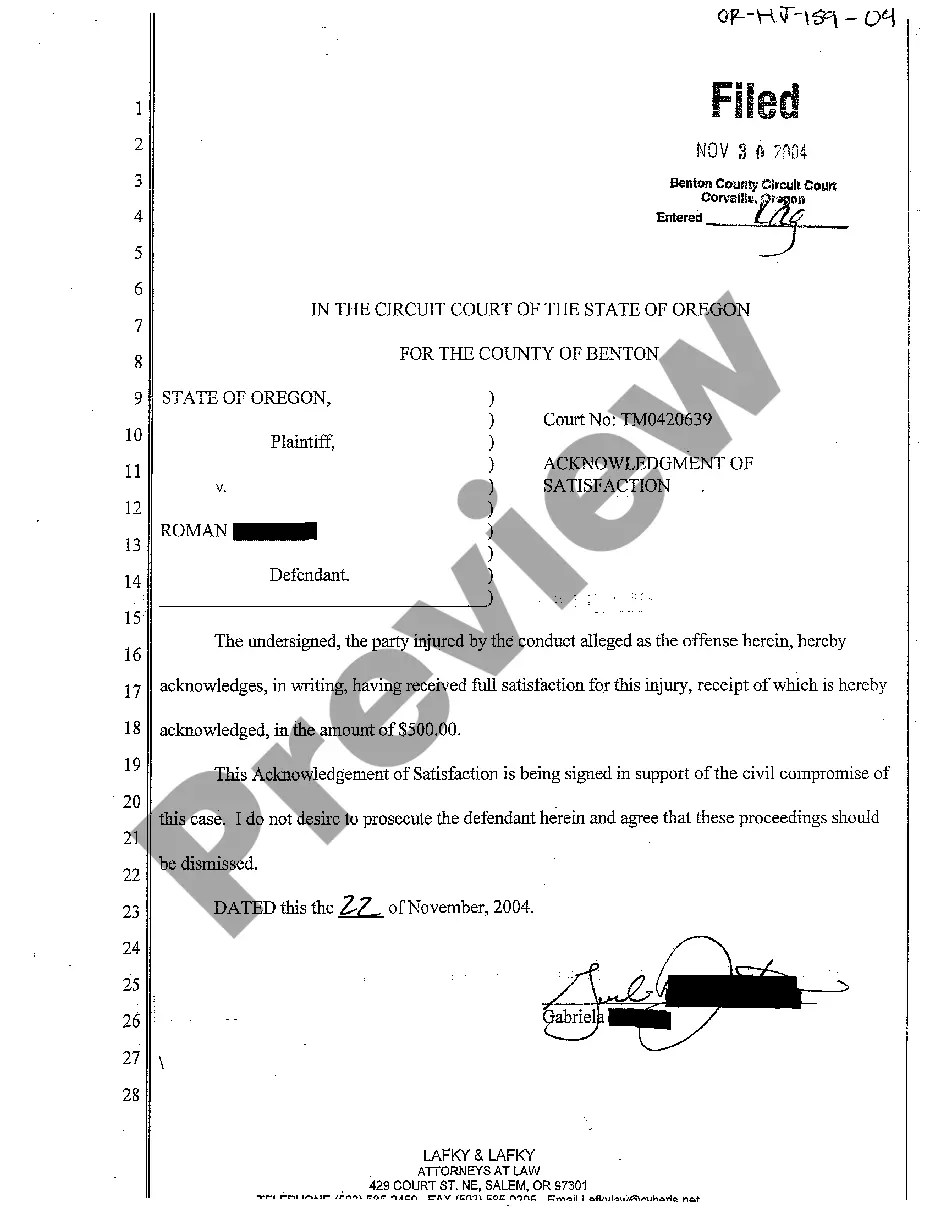

Bend Oregon Acknowledgment of Satisfaction is a legal document that serves as proof of a borrower's satisfaction with the terms and conditions of a loan agreement. This acknowledgment is crucial in mortgage transactions and real estate deals in Bend, Oregon. It confirms that the borrower has fulfilled all obligations and pays off their debt to the lender. The Bend Oregon Acknowledgment of Satisfaction serves as an official record of the borrower's acknowledgment that they have successfully repaid the loan. It protects both parties involved in the transaction by documenting that the borrower has met their financial obligations, and the lender is satisfied with the repayment. There are several types of Bend Oregon Acknowledgment of Satisfaction that may vary based on the nature of the loan or transaction, including: 1. Mortgage Acknowledgment of Satisfaction: This type of acknowledgment is commonly used in real estate transactions when a mortgage loan has been paid off in full. It ensures that the property's ownership can be transferred without any liens or encumbrances. 2. Personal Loan Acknowledgment of Satisfaction: This acknowledgment applies to personal loan agreements where an individual borrows money from another person or entity. Once the loan is repaid, this document confirms that the borrower has satisfied their debt. 3. Business Loan Acknowledgment of Satisfaction: This type of acknowledgment is used in commercial transactions where a business entity has borrowed funds. It certifies that the business has fulfilled its financial obligations and is no longer indebted to the lender. 4. Vehicle Loan Acknowledgment of Satisfaction: If a borrower takes out a loan to purchase a vehicle in Bend, Oregon, this acknowledgment confirms the repayment and satisfaction of the loan. It is typically required before the vehicle's title can be transferred to the borrower's name. The Bend Oregon Acknowledgment of Satisfaction is an essential legal document that protects the interests of both lenders and borrowers. It helps ensure transparency and clarity in financial transactions, providing a sense of security for all parties involved.

Bend Oregon Acknowledgment of Satisfaction

Description

How to fill out Bend Oregon Acknowledgment Of Satisfaction?

Are you looking for a trustworthy and affordable legal forms provider to get the Bend Oregon Acknowledgment of Satisfaction? US Legal Forms is your go-to choice.

Whether you require a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and county.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Bend Oregon Acknowledgment of Satisfaction conforms to the regulations of your state and local area.

- Read the form’s details (if available) to learn who and what the form is good for.

- Restart the search if the template isn’t suitable for your specific scenario.

Now you can register your account. Then choose the subscription plan and proceed to payment. Once the payment is done, download the Bend Oregon Acknowledgment of Satisfaction in any available format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about spending hours researching legal paperwork online once and for all.