Gresham Oregon Qualified Domestic Relations Order

Description

How to fill out Oregon Qualified Domestic Relations Order?

Locating validated templates that are tailored to your regional regulations can be challenging unless you access the US Legal Forms library. It’s a digital collection of over 85,000 legal documents for both personal and business requirements and various real-world situations.

For those already familiar with our collection and have utilized it previously, acquiring the Gresham Oregon Qualified Domestic Relations Order requires just a few clicks. All it takes is to Log In to your account, choose the document, and click Download to store it on your device. This procedure will involve just a few more steps for new users.

Follow the instructions below to begin with the most comprehensive online form collection.

Maintaining documents orderly and in compliance with legal standards is significantly important. Utilize the US Legal Forms library to always have vital document templates at your fingertips for any needs!

- Review the Preview mode and form description. Ensure that you’ve selected the correct one that fulfills your requirements and aligns perfectly with your local jurisdiction criteria.

- Look for another template, if necessary. Immediately after spotting any discrepancy, use the Search tab above to find the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document. Click the Buy Now button and select your desired subscription plan. You should create an account to gain access to the library’s resources.

- Finalize your purchase. Enter your credit card information or utilize your PayPal account to complete the payment for the service.

- Download the Gresham Oregon Qualified Domestic Relations Order. Store the template on your device to continue with its completion and access it in the My documents section of your profile anytime you need it again.

Form popularity

FAQ

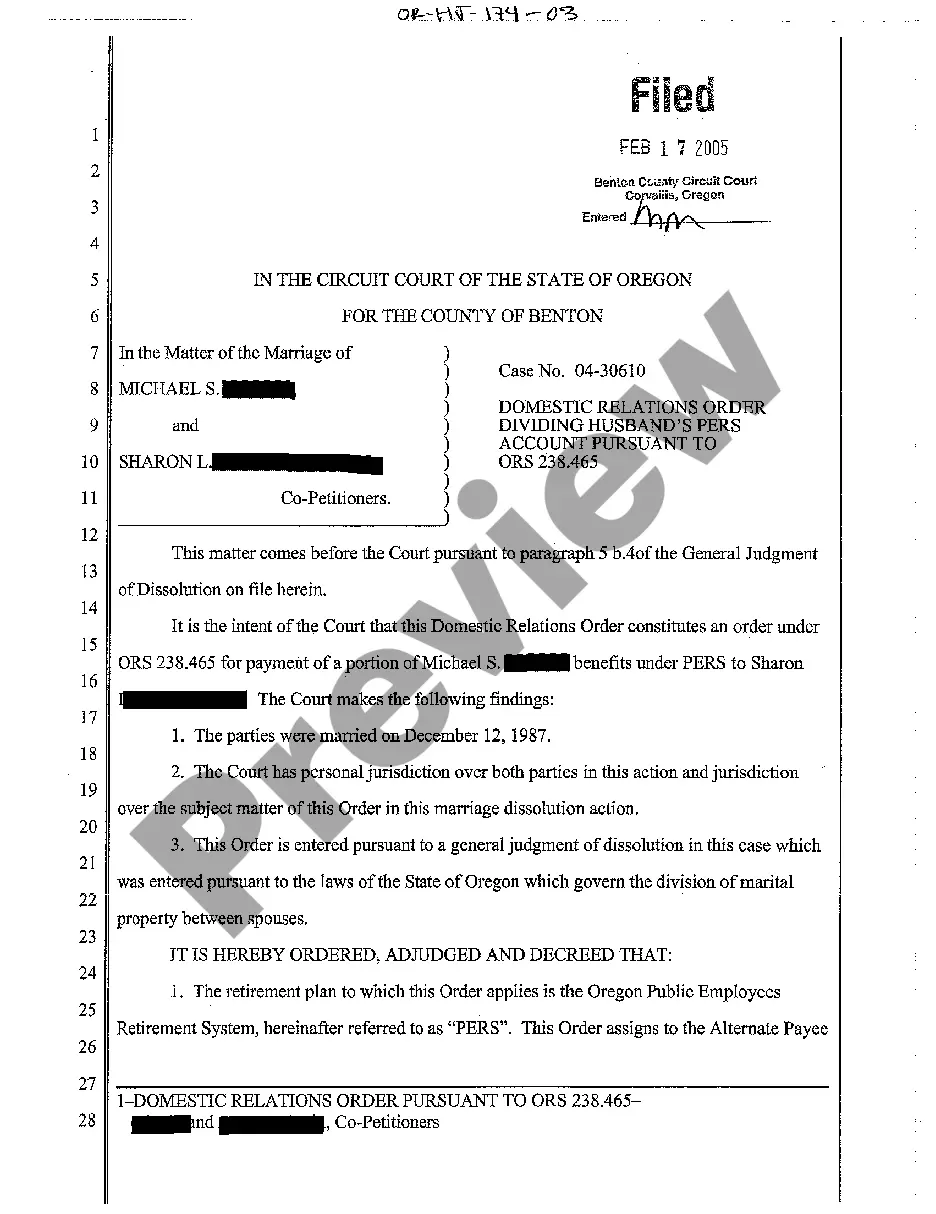

A qualified domestic relations order outlines how retirement assets will be divided between spouses during a divorce. Specifically, a Gresham Oregon Qualified Domestic Relations Order specifies the amount or percentage of the retirement benefits allocated to the non-member spouse. It is crucial for preventing tax issues and ensuring smooth transfers of funds. By implementing a QDRO, you guarantee clarity and fairness in your financial settlement post-divorce.

A qualified domestic relations order in Wisconsin serves the same purpose as a Gresham Oregon Qualified Domestic Relations Order, facilitating the division of retirement assets after a divorce. It provides a legal mechanism for one spouse to receive a portion of the other spouse's retirement benefits. While the specifics may vary by state, the fundamental idea remains the same: ensuring equitable distribution. This order helps protect both spouses' rights and interests in retirement savings.

Once the judge signs a Gresham Oregon Qualified Domestic Relations Order, it becomes a legally binding document. The order is then sent to the retirement plan administrator, who will implement the terms outlined in the QDRO. This ensures that the appropriate portion of retirement benefits is allocated to the non-member spouse. Subsequently, both parties can expect to receive their respective shares as stipulated in the agreement.

The purpose of a Gresham Oregon Qualified Domestic Relations Order is to divide retirement benefits between spouses during divorce proceedings. This legal order ensures that one spouse receives a portion of the other's retirement plan. By having a QDRO in place, both parties can secure their financial futures after divorce, allowing for a fair distribution of assets. It also helps prevent any tax penalties that might arise from early withdrawal of retirement funds.

Filling out a Qualified Domestic Relations Order involves several steps, starting with collecting relevant information about the retirement plan. You'll need to provide details on both the participant and the alternate payee. For specific assistance, consider using resources like US Legal Forms, which offer clear instructions and templates tailored for Gresham, Oregon, to streamline your filing process.

While an attorney is not strictly required to draft a QDRO, having one can greatly help navigate the complexities of the process. An attorney ensures that the document complies with both legal and plan-specific requirements. If you are in Gresham, Oregon, consulting with a legal professional can lead to a smoother experience.

The preparation of a Qualified Domestic Relations Order is typically handled by an attorney specializing in family law or a qualified financial professional. This expert will ensure the QDRO meets all the necessary legal criteria. Using platforms like US Legal Forms can simplify this process by providing templates tailored for Gresham, Oregon.

A Qualified Domestic Relations Order can be drafted by various professionals, including attorneys or financial advisors. It is crucial to work with someone familiar with the requirements specific to your state, such as Gresham, Oregon. This ensures the document adheres to both legal standards and the retirement plan's rules.

A Qualified Domestic Relations Order (QDRO) is a legal document that defines the rights of an alternate payee to receive a certain portion of a retirement plan. It must comply with specific federal and plan requirements to qualify. In Gresham, Oregon, valid QDROs can help ensure a fair division of retirement benefits during a divorce or separation.

The plan administrator for a Qualified Domestic Relations Order (QDRO) is typically the individual or entity that manages the retirement plan. They oversee the distribution of benefits according to the terms specified in the QDRO. If you are in Gresham, Oregon, understanding your plan administrator's role is essential for proper execution of the QDRO process.