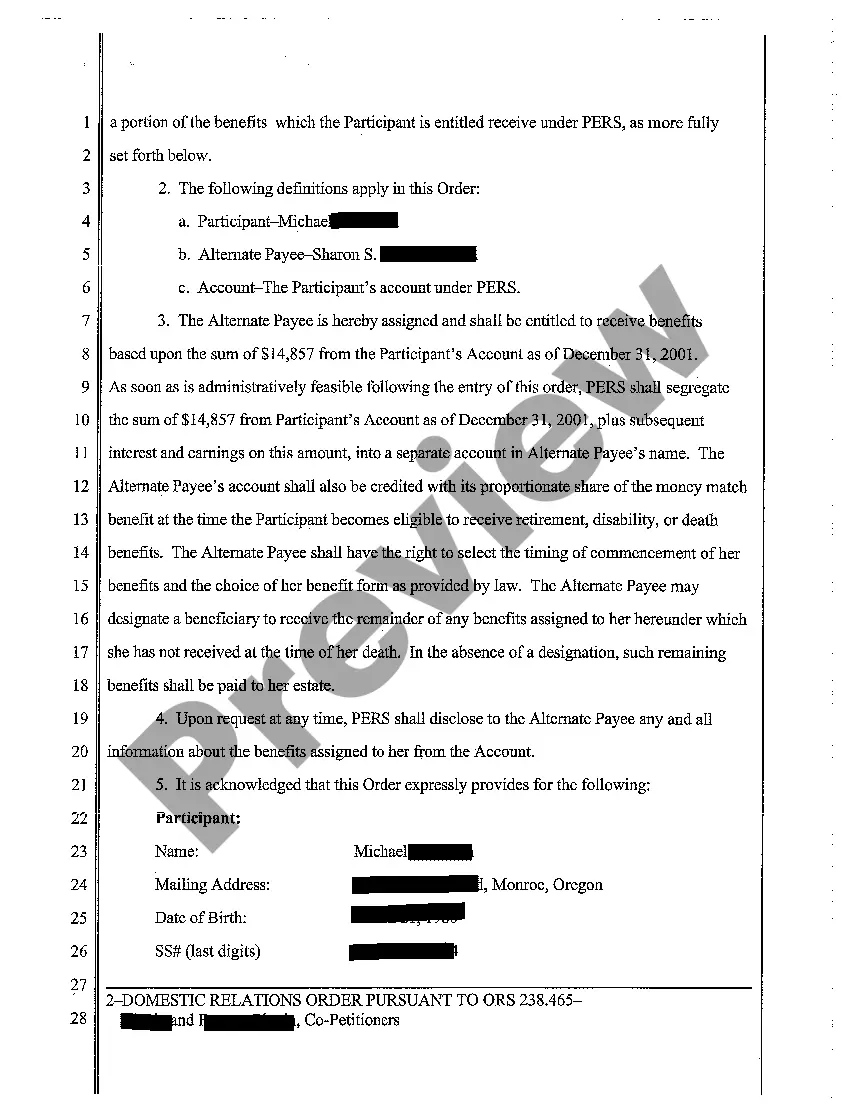

In Portland, Oregon, a Domestic Relations Order (DO) plays a crucial role in dividing a husband's Public Employees Retirement System (PEERS) account pursuant to ORS 238.465. This legal document outlines the specific criteria and procedures for separating the retirement funds in cases of divorce, separation, or dissolution of marriage. There are several types of Portland Oregon Domestic Relations Orders Dividing Husband's PEERS Account, each serving a unique purpose. 1. Initial DO: An initial DO is typically filed during the divorce or separation process to establish the method and formula for dividing the husband's PEERS account. It outlines the division percentages, valuation methods, and other relevant details based on the applicable laws and guidelines provided by ORS 238.465. This order sets the foundation for the ultimate distribution of retirement benefits. 2. Amendment DO: An amendment DO is filed when modifications or adjustments need to be made to the initial DO. Changes may include adjusting distribution percentages, accounting for post-divorce changes in PEERS account value, or incorporating new legislation affecting retirement benefits. Amendments ensure accuracy and fairness to both parties involved. 3. Final DO: A final DO is crucial to implement the agreed-upon division of the husband's PEERS account as determined by the initial DO and any subsequent amendments. It finalizes the separation of retirement benefits and specifies the distribution methods, such as direct payment to the ex-spouse or rollover into an alternate retirement account. 4. Contempt DO: In cases where one party fails to comply with the provisions outlined in the initial or amended DO, a contempt DO may be sought for enforcement. This type of DO aims to hold the non-compliant party accountable for their actions or lack thereof, possibly resulting in penalties or corrective measures to ensure proper division of the PEERS account. 5. Qualified Domestic Relations Order (QDR): While not specific to Oregon law, a QDR may be used in the context of dividing a husband's PEERS account. It is a specialized DO that meets federal standards under the Employee Retirement Income Security Act (ERICA) and allows for the tax-free transfer of retirement benefits to the ex-spouse's individual retirement account or another eligible plan. When navigating the complexities of Portland Oregon Domestic Relations Orders Dividing Husband's PEERS Account Pursuant to ORS 238.465, it is crucial to consult with an experienced family law attorney to ensure compliance with the applicable laws and to protect your rights and financial interests.

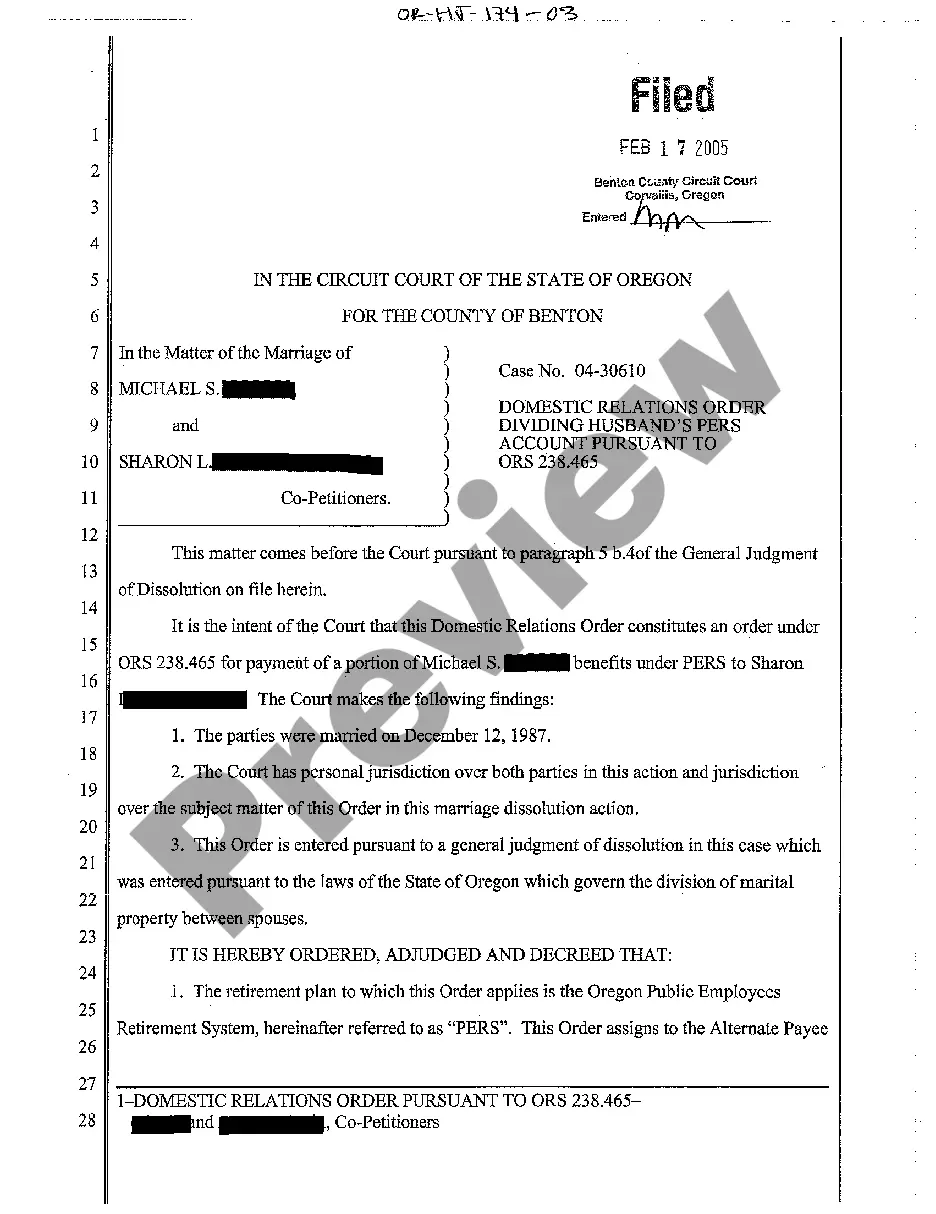

Portland Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465

Description

How to fill out Portland Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant To ORS 238.465?

We always want to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we apply for legal solutions that, usually, are extremely costly. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We offer access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Portland Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465 or any other form easily and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re new to the platform! You can register your account within minutes.

- Make sure to check if the Portland Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465 adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Portland Oregon Domestic Relations Order Dividing Husband's PERS Account Pursuant to ORS 238.465 is suitable for you, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!