Gresham, Oregon Supplemental Judgment for Hewlett Packard Company 401K Plan In Gresham, Oregon, a supplemental judgment has been issued for the Hewlett Packard Company 401K Plan, providing important financial provisions for plan participants. This supplemental judgment aims to enhance and clarify the benefits offered by the 401K plan, ensuring the financial well-being of those involved. The Gresham, Oregon Supplemental Judgment for Hewlett Packard Company 401K Plan encompasses various aspects, including investment options, contribution limits, employer matching, and eligibility criteria. It serves as an integral component of the overall retirement package, guaranteeing a secure retirement for employees. One type of Gresham, Oregon Supplemental Judgment for Hewlett Packard Company 401K Plan is the "Investment Option Expansion." Under this provision, plan participants gain access to a more diverse range of investment options, allowing them to tailor their retirement savings strategy to their individual risk tolerance and long-term goals. With increased investment choices, individuals can create a well-balanced portfolio that maximizes potential returns. Another type of Gresham, Oregon Supplemental Judgment for Hewlett Packard Company 401K Plan is the "Contribution Limit Increase." This provision raises the maximum amount an employee can contribute to their 401K account annually, enabling individuals to accelerate their retirement savings. By taking advantage of this benefit, employees can make the most of their pre-tax contributions and potentially enjoy tax advantages down the line. The "Employer Matching Enhancement" is an additional feature of the Gresham, Oregon Supplemental Judgment for Hewlett Packard Company 401K Plan. It outlines improvements to the employer's contribution matching program, whereby Hewlett Packard Company matches a certain percentage of an employee's contribution, up to a specific limit. This enhancement is designed to encourage employees to save more for retirement, as the employer's matching contribution serves as an attractive incentive. Moreover, the Gresham, Oregon Supplemental Judgment for Hewlett Packard Company 401K Plan entails a refined set of eligibility criteria, ensuring that employees are well-informed about when they can begin participating in the plan. It may also outline special provisions for employees who have recently joined the plan or experienced a change in their employment status. In conclusion, the Gresham, Oregon Supplemental Judgment for Hewlett Packard Company 401K Plan holds significant importance for employees seeking a secure retirement. With its various provisions, including investment option expansion, contribution limit increases, employer matching enhancements, and eligibility criteria modifications, this supplemental judgment aims to provide comprehensive and improved benefits to plan participants.

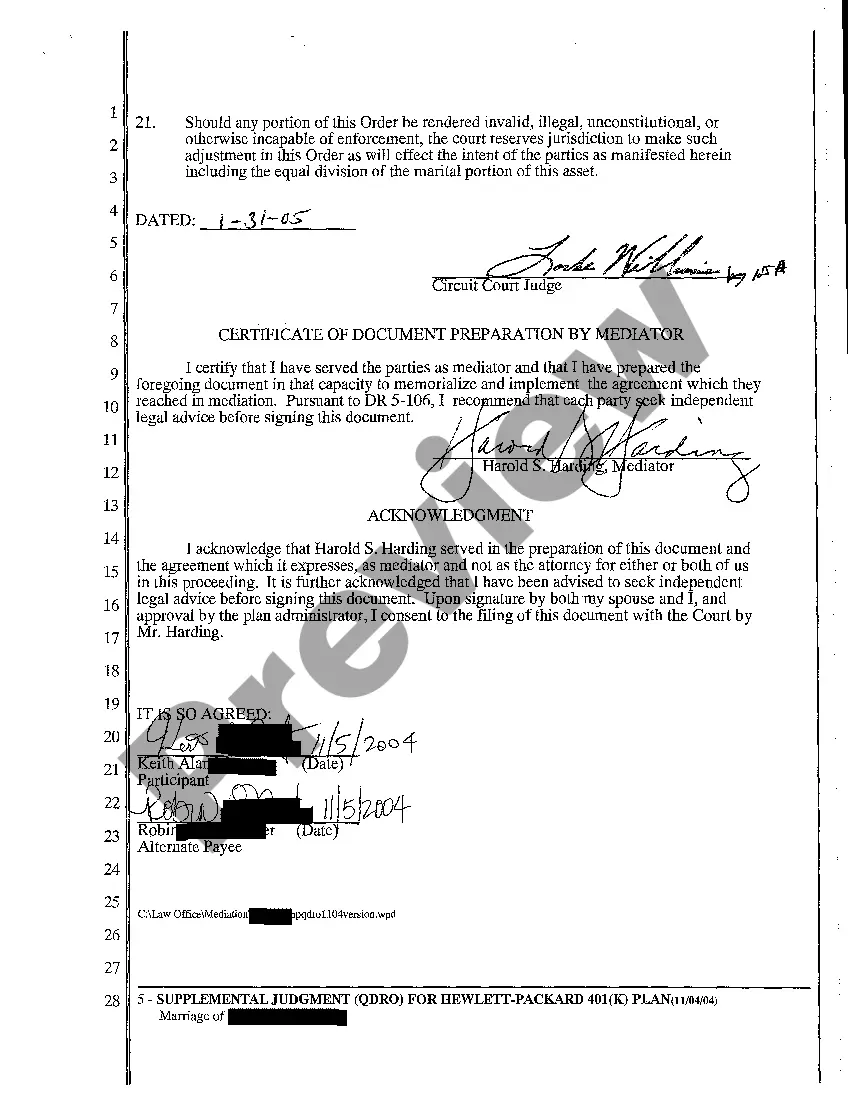

Gresham Oregon Supplemental Judgment For Hewlett Packard Company 401K Plan

Description

How to fill out Gresham Oregon Supplemental Judgment For Hewlett Packard Company 401K Plan?

Benefit from the US Legal Forms and have instant access to any form sample you need. Our useful platform with a large number of templates simplifies the way to find and obtain almost any document sample you will need. It is possible to export, fill, and certify the Gresham Oregon Supplemental Judgment For Hewlett Packard Company 401K Plan in just a couple of minutes instead of browsing the web for several hours seeking the right template.

Using our collection is a superb way to increase the safety of your document submissions. Our experienced legal professionals on a regular basis check all the records to make certain that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you obtain the Gresham Oregon Supplemental Judgment For Hewlett Packard Company 401K Plan? If you have a profile, just log in to the account. The Download button will be enabled on all the samples you look at. Additionally, you can get all the earlier saved records in the My Forms menu.

If you haven’t registered an account yet, stick to the tips listed below:

- Find the form you need. Make sure that it is the form you were hoping to find: verify its headline and description, and use the Preview function if it is available. Otherwise, make use of the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, create an account and process your order with a credit card or PayPal.

- Save the document. Indicate the format to get the Gresham Oregon Supplemental Judgment For Hewlett Packard Company 401K Plan and revise and fill, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable template libraries on the internet. Our company is always ready to assist you in any legal process, even if it is just downloading the Gresham Oregon Supplemental Judgment For Hewlett Packard Company 401K Plan.

Feel free to take full advantage of our form catalog and make your document experience as convenient as possible!