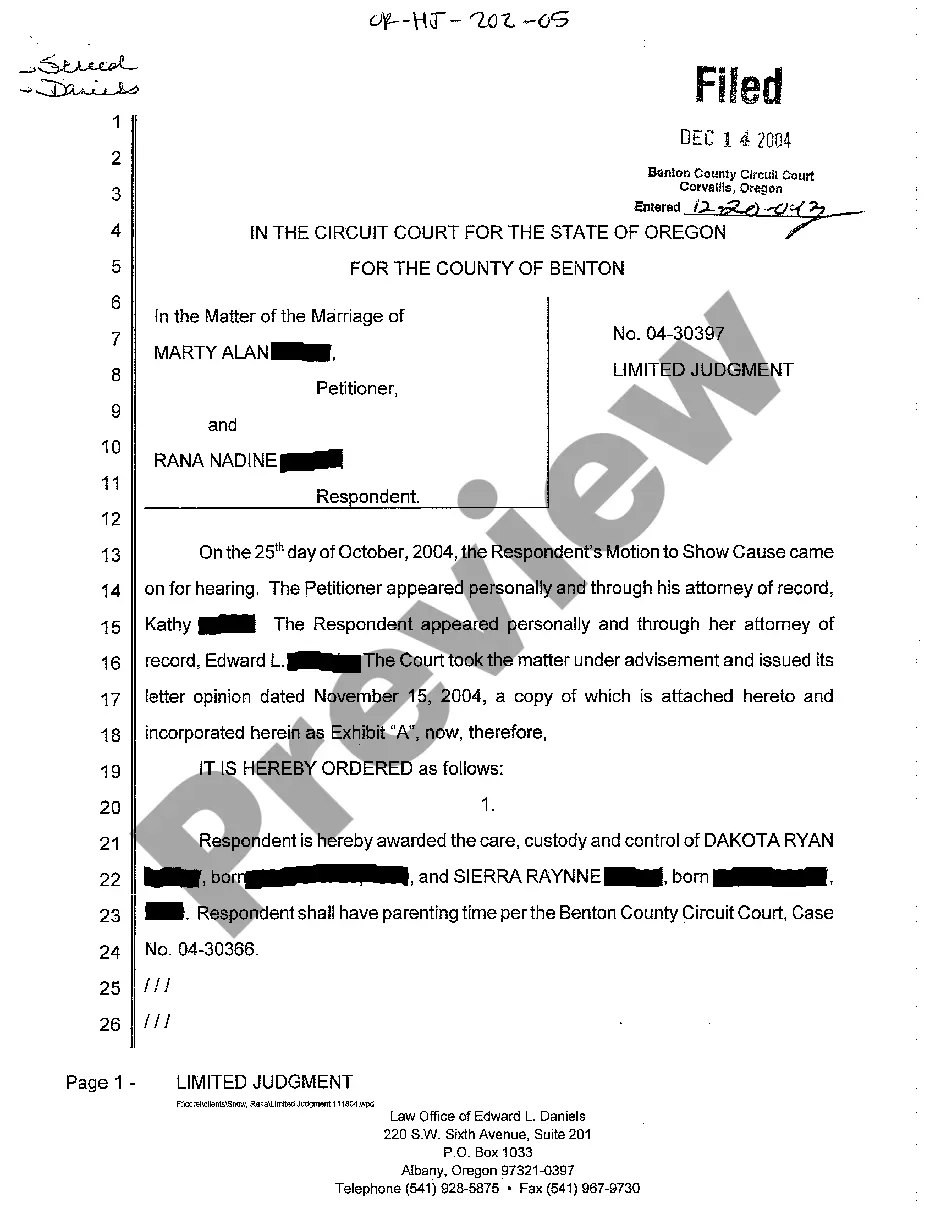

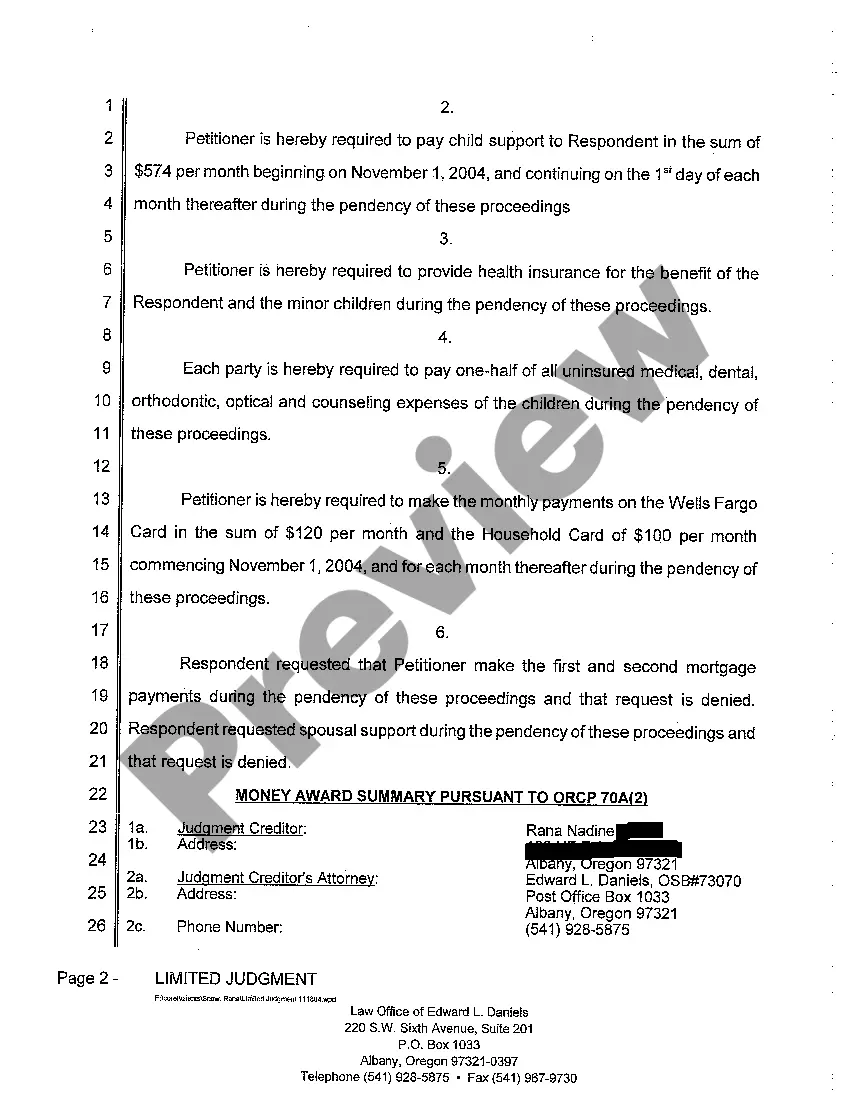

Eugene, Oregon Limited Judgment is a legal term referring to a specific type of judgment that imposes restrictions on the creditor's ability to collect the debt from the debtor. This limited form of judgment is applicable in certain situations, providing protections to debtors in Eugene, Oregon. In Eugene, Oregon, there are primarily two types of limited judgments which are commonly encountered: 1. Limited Judgment for Protected Income: An individual or family may qualify for certain forms of income protection under Oregon law. If a debtor's income falls within this protected category, the court may issue a limited judgment that prevents creditors from taking a considerable portion of the debtor's income. By safeguarding a portion of the debtor's earnings, this type of limited judgment ensures that individuals can maintain a basic standard of living while still addressing their debts. 2. Asset Exemptions Limited Judgment: In certain cases, the court may issue a limited judgment that exempts specific assets from creditor collection. Under Oregon law, various assets such as homesteads, personal property, and retirement accounts are protected to some extent. This type of limited judgment ensures that debtors can retain vital assets necessary for their daily lives while attempting to repay their debts. These limited judgments differ from regular judgments, as they restrict the amount of the debtor's income or assets that the creditor can pursue for repayment. They aim to strike a balance between debtors' responsibilities and their essential needs, prioritizing the well-being of individuals and families during financial hardships. In conclusion, Eugene, Oregon Limited Judgment refers to specific legal judgments that place limitations on the creditor's ability to collect debts owed by individuals or families residing in Eugene. The two primary types of limited judgments encountered in this region are the Limited Judgment for Protected Income and the Asset Exemptions Limited Judgment. These judgments serve to shield a portion of a debtor's income or specific assets from creditor collection, ensuring basic standards of living are preserved during the debt repayment process.

Eugene Oregon Limited Judgment

Description

How to fill out Eugene Oregon Limited Judgment?

No matter the societal or occupational rank, completing legal paperwork is a regrettable requirement in the current professional landscape.

Often, it’s nearly unfeasible for an individual without any legal training to generate such documents from the beginning, primarily due to the intricate language and legal subtleties they involve.

This is where US Legal Forms proves useful.

Verify that the template you’ve located is appropriate for your region, as the regulations of one state or county may not apply to another.

Review the document and read a brief overview (if available) of the situations the paper can be utilized for.

- Our service provides a vast collection of over 85,000 ready-to-use state-specific documents applicable to nearly any legal situation.

- US Legal Forms also acts as an excellent resource for associates or legal advisors looking to save time by using our DIY forms.

- If you're seeking the Eugene Oregon Limited Judgment or any other document suitable for your state or county, with US Legal Forms, everything is easily accessible.

- Here’s how to obtain the Eugene Oregon Limited Judgment swiftly via our reliable service.

- If you’re currently a subscriber, go ahead and Log In to your account to access the desired form.

- However, if you're new to our platform, be sure to follow these steps before acquiring the Eugene Oregon Limited Judgment.

Form popularity

FAQ

In Oregon, the statute of limitations on enforcing a limited judgment, such as a Eugene Oregon Limited Judgment, is generally ten years. This means that a creditor has ten years from the date the judgment is entered to pursue collection actions. However, a judgment can often be renewed for another ten years, extending the time you can enforce it. It's essential to act within this timeframe to protect your rights.

In Oregon, the statute of default on a judgment typically allows creditors to collect their debts. This statute defines the time frame during which enforcement actions can be taken against the debtor. With matters related to a Eugene Oregon Limited Judgment, staying informed about the statute helps you understand your rights and responsibilities. It's wise to seek advice to navigate these aspects effectively.

A limited judgment in Oregon refers to a type of court determination that restricts the scope of a judgment, often relating to specific debts or obligations. This form of judgment can have distinct implications for your financial situation. Understanding the specifics of a Eugene Oregon Limited Judgment can empower you to navigate your legal obligations effectively. Consulting legal resources can offer clarity in these situations.

In Oregon, a judgment can typically be renewed indefinitely within the statutory period. This means you can request to renew a Eugene Oregon Limited Judgment every ten years, as long as you file the appropriate paperwork before it expires. Staying informed about renewal timelines helps maintain your rights and obligations related to the judgment.

Filing a motion or an answer in Oregon involves submitting the necessary paperwork to the court clerk. You'll need to provide detailed information about your case and any relevant supporting documents. If you’re navigating a Eugene Oregon Limited Judgment, consider using platforms like USLegalForms to access templates that simplify the filing process. They can make it easier to ensure your submission is accurate and timely.

To vacate a judgment in Oregon, you must file a motion with the court that issued the judgment. You'll need to provide valid reasons for your request, such as a lack of proper notification of the original judgment. Engaging legal assistance can streamline this process, especially if you’re addressing a Eugene Oregon Limited Judgment. Proper guidance ensures you meet all necessary requirements.

In Oregon, judgments generally do not automatically disappear. Most judgments remain on your record for up to ten years, unless a court vacates them. If you are dealing with a Eugene Oregon Limited Judgment, it’s crucial to understand your options for removal or renewal. Be proactive to manage your credit and legal standing.

In Oregon, a debt generally becomes uncollectible after the statute of limitations expires, which is typically 6 years for most debts. Once this period passes, the creditor can no longer sue for the debt, making it harder to collect. If you're facing this situation with a Eugene Oregon Limited Judgment, staying informed about these timelines can save you time and effort in your debt collection strategy.

To collect a judgment in Oregon, you can take several actions, such as garnishing wages, placing liens on property, or seizing assets. It is essential to follow the proper legal channels to ensure that your collection efforts are valid and upheld in court. For assistance with the process, consider using US Legal Forms, which provides templates and resources to help you navigate collecting a Eugene Oregon Limited Judgment.

In Oregon, a judgment does not automatically fall off after 7 years. Instead, judgments can last up to 10 years, after which you must take specific legal steps to renew or enforce them. Knowing this can be important for anyone managing a Eugene Oregon Limited Judgment, as it affects your ability to collect debts over time.

Interesting Questions

More info

GENES L. S. and EMERSON S. Lane County has issued judgment, entered on January 12, 2014, granting summary judgment in favor of Plaintiff René S. Lane, as against Defendant City of Eugene. The judgment enjoins the City of Eugene from enforcing the Oregon Minimum Viable Wage Ordinance, Ordinance No. 551.140 (Ordinance No. 553.020), and all provisions of the Ordinance, including regulations governing the enforcement of the Minimum Wage for a Worker Permit. As to the minimum wages established in the Minimum Wage Ordinance, the judgment requires the City of Eugene to post a 1 minimum wage on all public business premises and private businesses on the first day of each week beginning June 1, 2013. City of Eugene is ordered to pay Plaintiff René S. Lane 10,543.75, plus costs and reasonable attorney's fees. Plaintiff is permitted to recover his/her attorneys' fees from the Defendant City of Eugene. CITY OF EUGENE, an Oregon municipal corporation, Respondent on Review, v. GENES L. S.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.