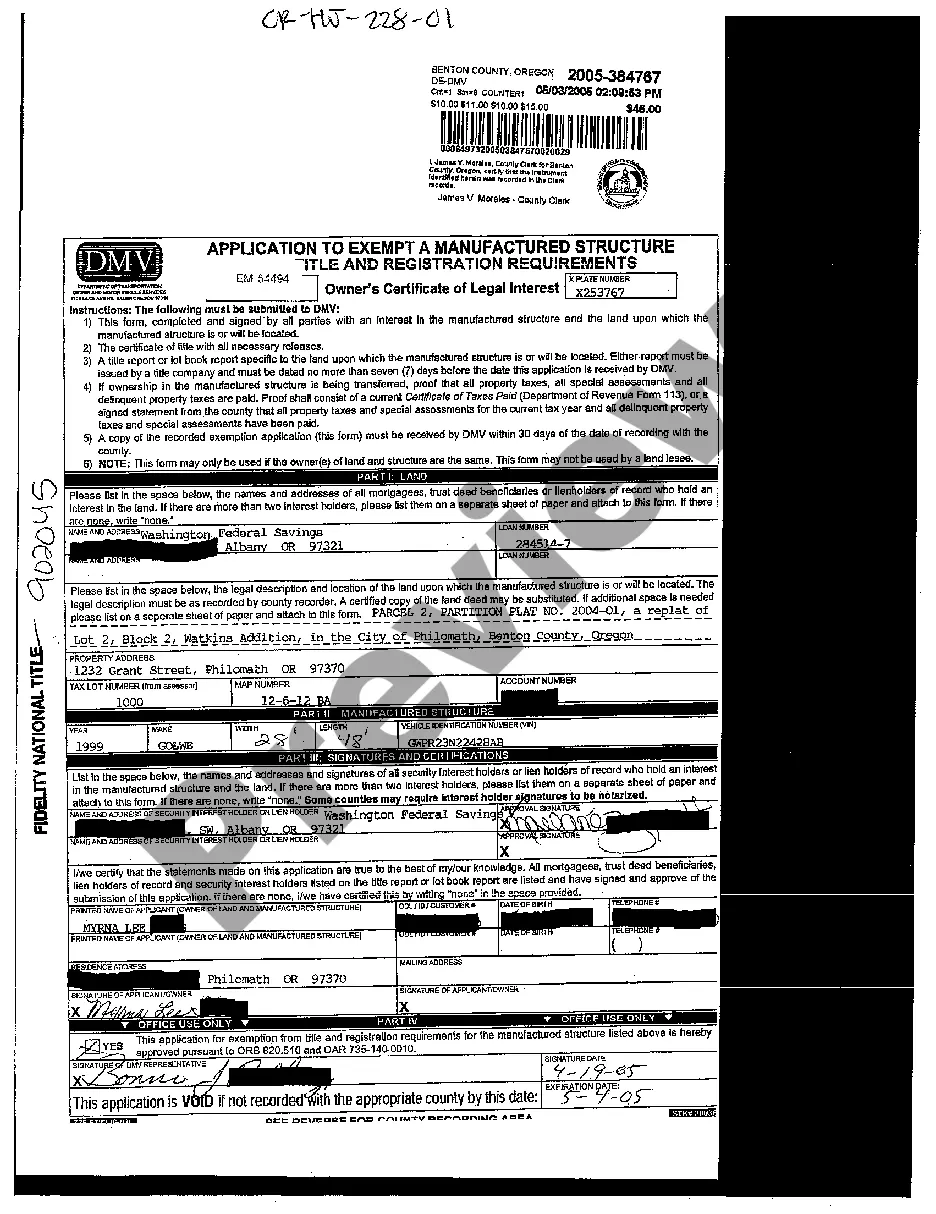

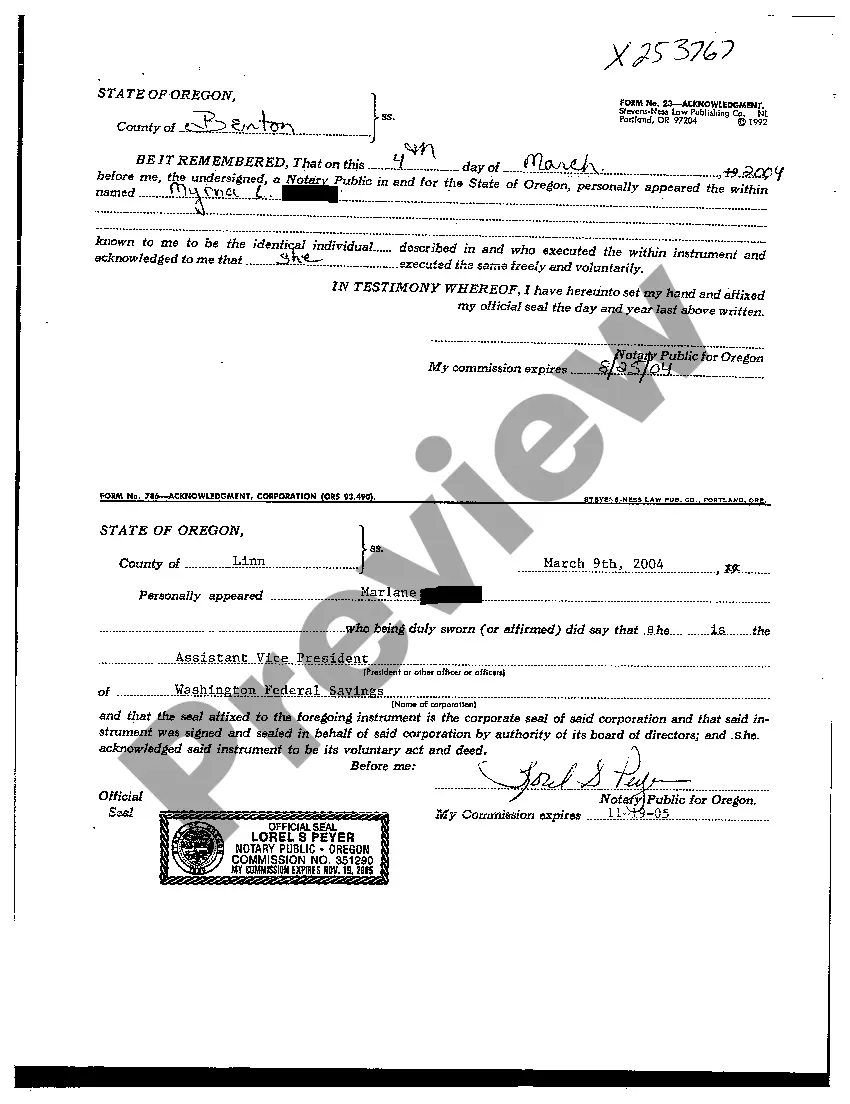

Bend Oregon Application to Exempt a Manufactured Structure: Overview and Types The Bend Oregon Application to Exempt a Manufactured Structure is a crucial process for owners of manufactured structures located within the city limits of Bend, Oregon. This application allows these structures to qualify for an exemption from property taxes, saving the owners a significant amount of money. In this detailed description, we will explore the procedure, requirements, and types of exemptions available under the Bend Oregon Application to Exempt a Manufactured Structure. The application process begins with the owner submitting a completed Bend Oregon Application to Exempt a Manufactured Structure form to the local tax assessor's office. Along with the application, the owner needs to provide various supporting documents, including a copy of the ownership deed, proof of residency, and any relevant building permits or licenses. The requirements for obtaining an exemption are defined by the Oregon Revised Statutes (ORS) and the City of Bend Code. One of the main criteria is that the manufactured structure must be permanently affixed to a foundation and meet certain construction standards. Additionally, the owner must demonstrate that the structure is used exclusively as a dwelling or is not used for commercial purposes. There are different types of exemptions available under the Bend Oregon Application to Exempt a Manufactured Structure, depending on the owner's circumstances: 1. Owner-occupied Exemption: This exemption allows owners who use the manufactured structure as their primary residence to qualify for a reduction in property taxes. To be eligible, the owner must provide proof of residency, such as utility bills or voter registration documents. 2. Senior or Disabled Exemption: This exemption is designed for senior citizens (age 62 or older) or individuals with disabilities. It offers additional tax relief for those who qualify, ensuring that these vulnerable groups are not burdened by excessive property taxes. 3. Combined Exemptions: In some cases, owners may qualify for multiple exemptions simultaneously. For instance, a senior citizen who uses the manufactured structure as their primary residence could be eligible for both the owner-occupied and senior exemption, resulting in substantial tax savings. It is vital for owners of manufactured structures in Bend, Oregon, to familiarize themselves with the specific requirements and guidelines of the Bend Oregon Application to Exempt a Manufactured Structure. Adhering to these regulations can ensure a smooth application process and allow owners to take advantage of potential tax savings while complying with local laws. In conclusion, the Bend Oregon Application to Exempt a Manufactured Structure provides owners with the opportunity to reduce or eliminate property taxes on their manufactured homes. By understanding the application process and meeting the criteria, owners can navigate the system effectively and potentially save a significant amount of money each year. Whether it's the owner-occupied, senior, disabled, or combined exemption, the City of Bend aims to support its residents in maintaining affordable housing options and a thriving community.

Bend Oregon Application to Exempt a Manufactured Structure

State:

Oregon

City:

Bend

Control #:

OR-HJ-228-01

Format:

PDF

Instant download

This form is available by subscription

Description

Application to Exempt a Manufactured Structure

Bend Oregon Application to Exempt a Manufactured Structure: Overview and Types The Bend Oregon Application to Exempt a Manufactured Structure is a crucial process for owners of manufactured structures located within the city limits of Bend, Oregon. This application allows these structures to qualify for an exemption from property taxes, saving the owners a significant amount of money. In this detailed description, we will explore the procedure, requirements, and types of exemptions available under the Bend Oregon Application to Exempt a Manufactured Structure. The application process begins with the owner submitting a completed Bend Oregon Application to Exempt a Manufactured Structure form to the local tax assessor's office. Along with the application, the owner needs to provide various supporting documents, including a copy of the ownership deed, proof of residency, and any relevant building permits or licenses. The requirements for obtaining an exemption are defined by the Oregon Revised Statutes (ORS) and the City of Bend Code. One of the main criteria is that the manufactured structure must be permanently affixed to a foundation and meet certain construction standards. Additionally, the owner must demonstrate that the structure is used exclusively as a dwelling or is not used for commercial purposes. There are different types of exemptions available under the Bend Oregon Application to Exempt a Manufactured Structure, depending on the owner's circumstances: 1. Owner-occupied Exemption: This exemption allows owners who use the manufactured structure as their primary residence to qualify for a reduction in property taxes. To be eligible, the owner must provide proof of residency, such as utility bills or voter registration documents. 2. Senior or Disabled Exemption: This exemption is designed for senior citizens (age 62 or older) or individuals with disabilities. It offers additional tax relief for those who qualify, ensuring that these vulnerable groups are not burdened by excessive property taxes. 3. Combined Exemptions: In some cases, owners may qualify for multiple exemptions simultaneously. For instance, a senior citizen who uses the manufactured structure as their primary residence could be eligible for both the owner-occupied and senior exemption, resulting in substantial tax savings. It is vital for owners of manufactured structures in Bend, Oregon, to familiarize themselves with the specific requirements and guidelines of the Bend Oregon Application to Exempt a Manufactured Structure. Adhering to these regulations can ensure a smooth application process and allow owners to take advantage of potential tax savings while complying with local laws. In conclusion, the Bend Oregon Application to Exempt a Manufactured Structure provides owners with the opportunity to reduce or eliminate property taxes on their manufactured homes. By understanding the application process and meeting the criteria, owners can navigate the system effectively and potentially save a significant amount of money each year. Whether it's the owner-occupied, senior, disabled, or combined exemption, the City of Bend aims to support its residents in maintaining affordable housing options and a thriving community.

Free preview

How to fill out Bend Oregon Application To Exempt A Manufactured Structure?

If you’ve already used our service before, log in to your account and download the Bend Oregon Application to Exempt a Manufactured Structure on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Bend Oregon Application to Exempt a Manufactured Structure. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!