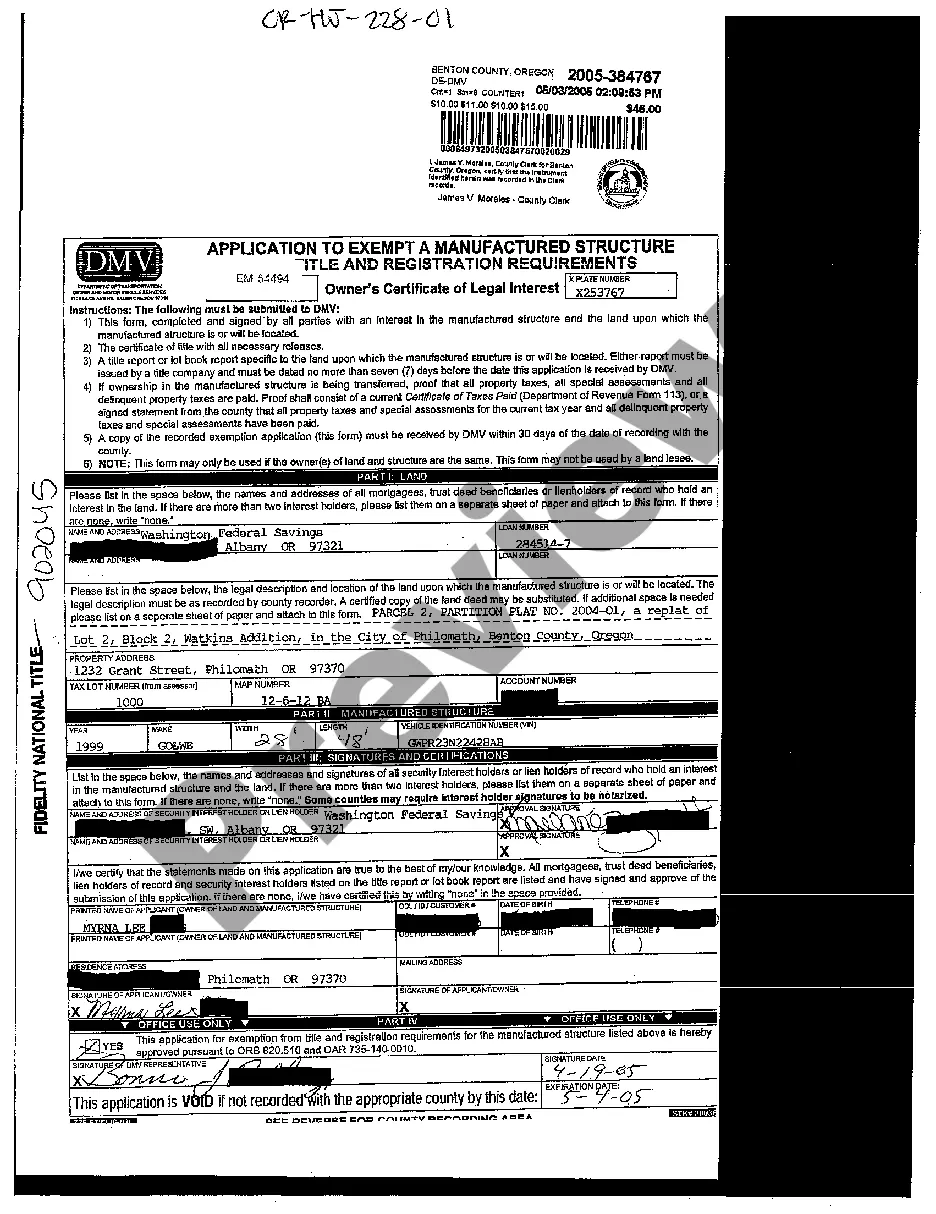

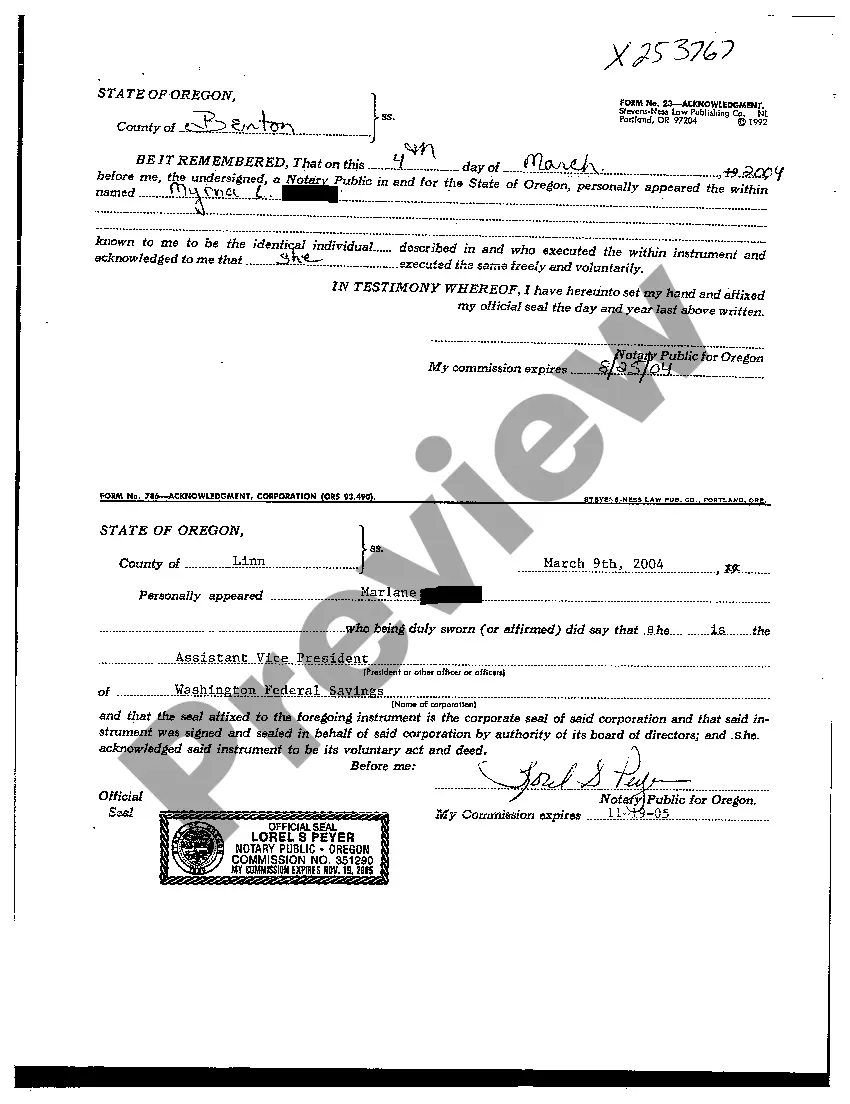

Title: A Comprehensive Guide to Gresham Oregon Application to Exempt a Manufactured Structure Introduction: Gresham, Oregon, offers an Application to Exempt a Manufactured Structure program, allowing eligible homeowners to receive an exemption from property taxes on their manufactured structures. This detailed description aims to provide a thorough understanding of the application process, requirements, and available exemptions. Below, we explore the different types of Gresham Oregon Applications to Exempt a Manufactured Structure and outline the key steps involved. 1. Gresham Oregon Application to Exempt a Manufactured Structure Types: a. Permanent Foundation Exemption: Homeowners can apply for an exemption if their manufactured structure is permanently affixed to a foundation that meets specific criteria outlined by the Gresham city code. b. Affidavit of Installation Exemption: This exemption applies to manufactured structures that are temporarily installed on residential lots for a limited period, such as during construction, renovation, or repair work. c. Transitory Location Exemption: Temporary exemptions can be sought if the manufactured structure is located on a site for a limited duration, typically up to 180 days, due to reasons like emergency housing or temporary usage purposes. 2. Eligibility Criteria: To qualify for any of the above exemptions, applicants must meet certain criteria, which may include: — The manufactured structure must meet the specific Gresham city code requirements. — The structure should be occupied as a primary residence for at least six months of the year. — The homeowner must hold legal ownership of the manufactured structure and the property it sits on. — Compliance with building codes, permits, and zoning regulations is necessary. — Applicants must submit the appropriate documentation, including proof of residency and ownership. 3. Application Process: a. Obtain and complete the Gresham Oregon Application to Exempt a Manufactured Structure form available at the Gresham City Hall or online through the official website. b. Provide all required supporting documentation, including proof of ownership, residency, and any applicable building permits. c. Submit the completed application package to the Gresham City Hall, following the specified submission guidelines. d. Wait for the approval or denial notification from the City of Gresham. The processing time may vary depending on the complexity of the application. 4. Exemption Benefits and Limitations: a. Property Tax Exemption: If approved, homeowners can be exempted from property taxes on their qualified manufactured structures, providing significant financial relief. b. Duration and Renewal: Exemption durations may vary depending on the type of exemption, ranging from one year to multiple years. Renewal applications must be submitted before the expiration of the current exemption. Conclusion: Gresham's Application to Exempt a Manufactured Structure program offers homeowners valuable property tax exemptions. By familiarizing themselves with the different types of exemptions and following the application process, eligible homeowners can benefit from significant tax savings. Remember to review the specific criteria, gather the required documentation, and promptly submit your application to take advantage of this valuable opportunity.

Gresham Oregon Application to Exempt a Manufactured Structure

Description

How to fill out Gresham Oregon Application To Exempt A Manufactured Structure?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Gresham Oregon Application to Exempt a Manufactured Structure? US Legal Forms is your go-to option.

No matter if you require a basic agreement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed in accordance with the requirements of specific state and area.

To download the document, you need to log in account, locate the needed form, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Gresham Oregon Application to Exempt a Manufactured Structure conforms to the laws of your state and local area.

- Go through the form’s description (if available) to find out who and what the document is good for.

- Start the search over if the form isn’t suitable for your legal situation.

Now you can create your account. Then select the subscription plan and proceed to payment. As soon as the payment is done, download the Gresham Oregon Application to Exempt a Manufactured Structure in any available format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal papers online for good.