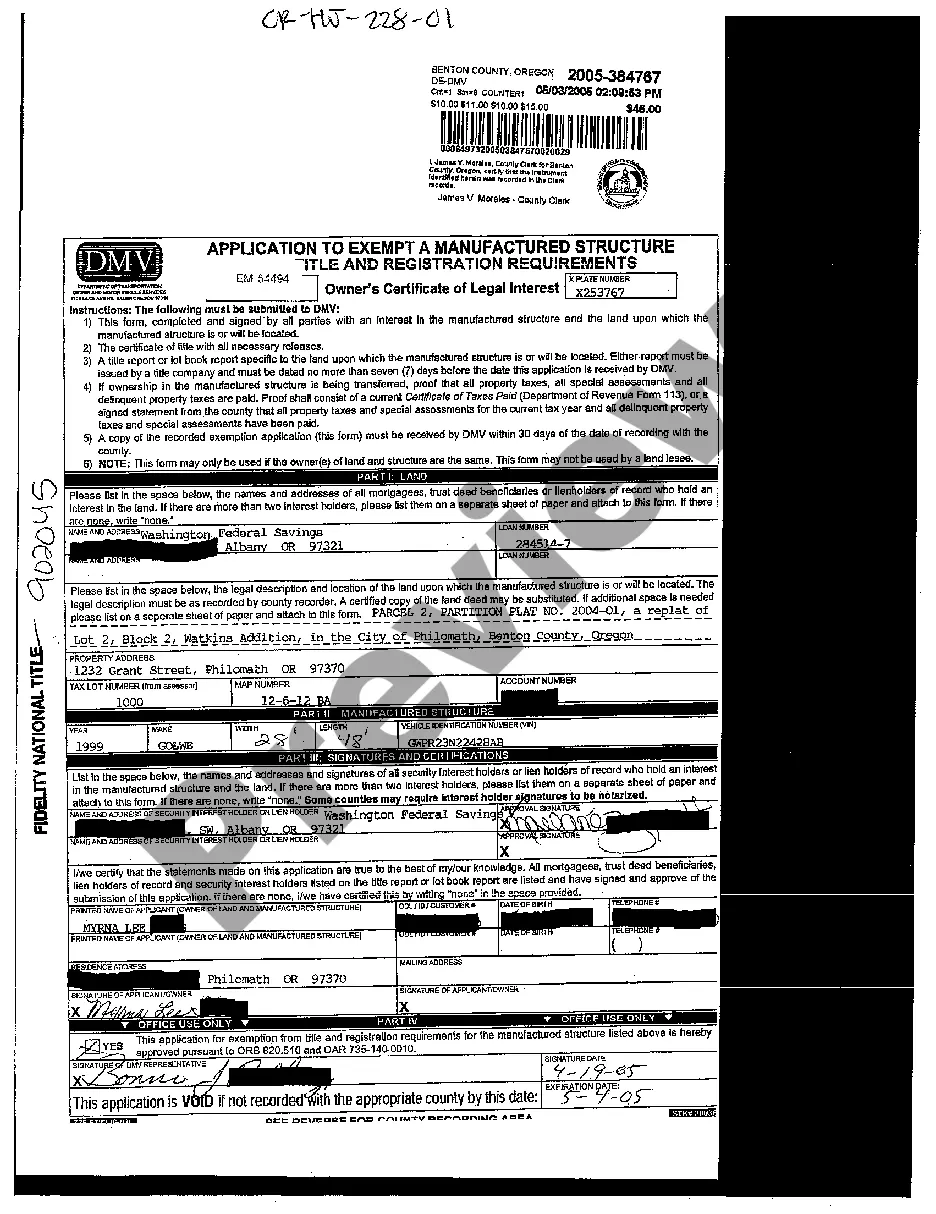

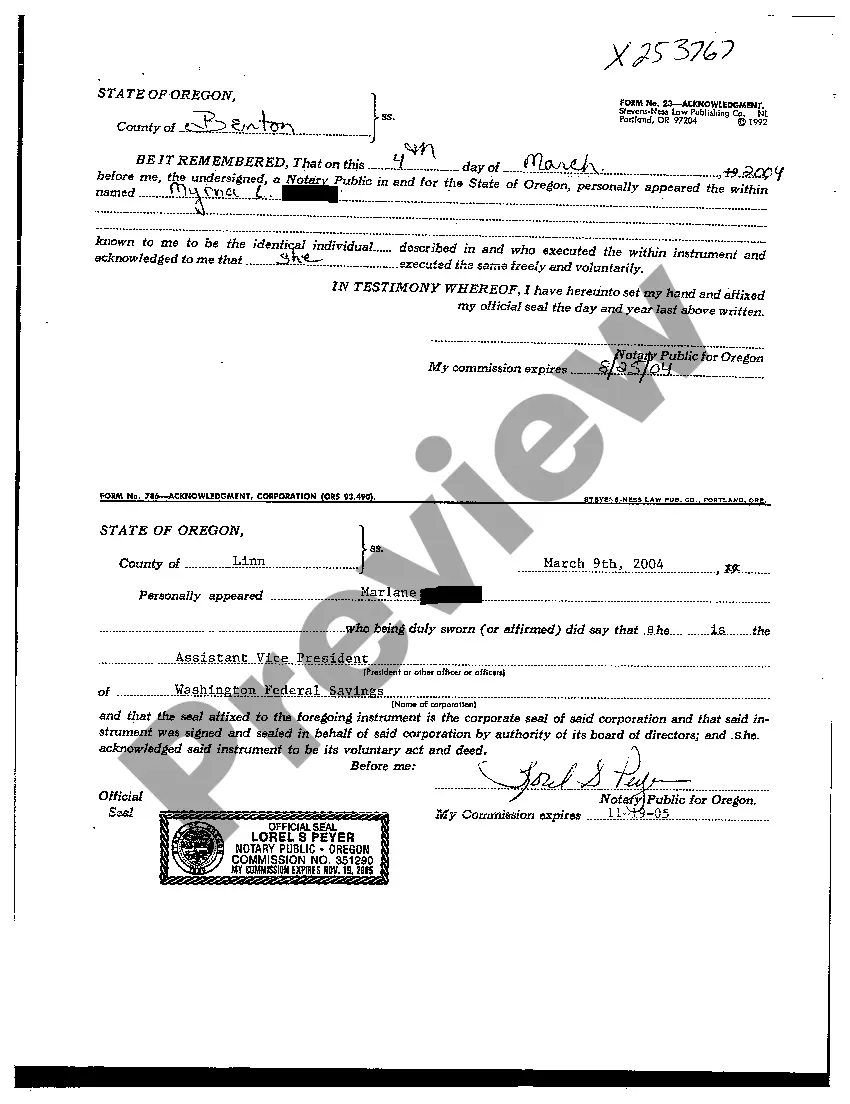

Detailed Description of Hillsboro Oregon Application to Exempt a Manufactured Structure: The Hillsboro, Oregon Application to Exempt a Manufactured Structure is an essential document that allows property owners to request an exemption for their manufactured structures from property taxes. This application is particularly relevant for individuals or businesses that own manufactured homes, mobile homes, or other types of prefabricated structures located within Hillsboro city limits. Applying for an exemption under the Hillsboro Oregon Application allows property owners to potentially reduce their property tax burden by providing proof that their manufactured structure meets certain criteria. The primary purpose of this application is to determine whether the structure qualifies as real property or personal property for tax purposes. The application outlines specific eligibility requirements and criteria that need to be met to qualify for the exemption. Some relevant keywords associated with the Hillsboro Oregon Application to Exempt a Manufactured Structure include: 1. Manufactured Home Exemption: This refers to the primary exemption category for homeowners who own a manufactured or mobile home. To qualify, the home must be used as the owner's primary residence and meet certain size and quality standards. 2. Special Purpose Exemption: This exemption category applies to manufactured structures that are not used as a primary residence. It includes structures used for educational, religious, charitable, or public purposes. 3. Investor Exemption: This category is for manufactured structures that are owned by investors and used for rental purposes. The exemption may only apply to a portion of the structure, typically the land or improvements. 4. Documentation: The Hillsboro Oregon Application requires property owners to provide necessary documentation to support their exemption claim. This may include proof of ownership, occupancy, land lease agreement, construction details, and other relevant paperwork. 5. Property Tax Exemption: Once the application is reviewed and approved, eligible property owners will receive an exemption from property taxes for the qualified manufactured structure, resulting in potential tax savings. Please note that the Hillsboro Oregon Application to Exempt a Manufactured Structure may have specific requirements and deadlines that applicants must adhere to. It is essential to carefully review the application instructions and contact the Hillsboro City Assessor's Office or relevant authorities for accurate and up-to-date information. In conclusion, the Hillsboro Oregon Application to Exempt a Manufactured Structure provides property owners with an opportunity to seek tax exemptions for their manufactured structures. By understanding the different types of exemptions available and meeting the eligibility criteria, property owners can potentially reduce their property tax obligations.

Hillsboro Oregon Application to Exempt a Manufactured Structure

Description

How to fill out Hillsboro Oregon Application To Exempt A Manufactured Structure?

If you are looking for a valid form template, it’s impossible to choose a more convenient place than the US Legal Forms site – one of the most comprehensive online libraries. Here you can get a huge number of document samples for organization and personal purposes by types and regions, or key phrases. With our high-quality search feature, discovering the most up-to-date Hillsboro Oregon Application to Exempt a Manufactured Structure is as easy as 1-2-3. Moreover, the relevance of every document is verified by a group of expert lawyers that on a regular basis check the templates on our website and revise them based on the latest state and county demands.

If you already know about our platform and have an account, all you need to get the Hillsboro Oregon Application to Exempt a Manufactured Structure is to log in to your account and click the Download button.

If you make use of US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have discovered the sample you want. Check its description and make use of the Preview feature to check its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the appropriate document.

- Confirm your choice. Choose the Buy now button. After that, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and save it on your device.

- Make changes. Fill out, modify, print, and sign the acquired Hillsboro Oregon Application to Exempt a Manufactured Structure.

Each template you save in your account has no expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to receive an additional version for enhancing or printing, you can come back and export it again whenever you want.

Make use of the US Legal Forms extensive collection to get access to the Hillsboro Oregon Application to Exempt a Manufactured Structure you were seeking and a huge number of other professional and state-specific samples on one website!