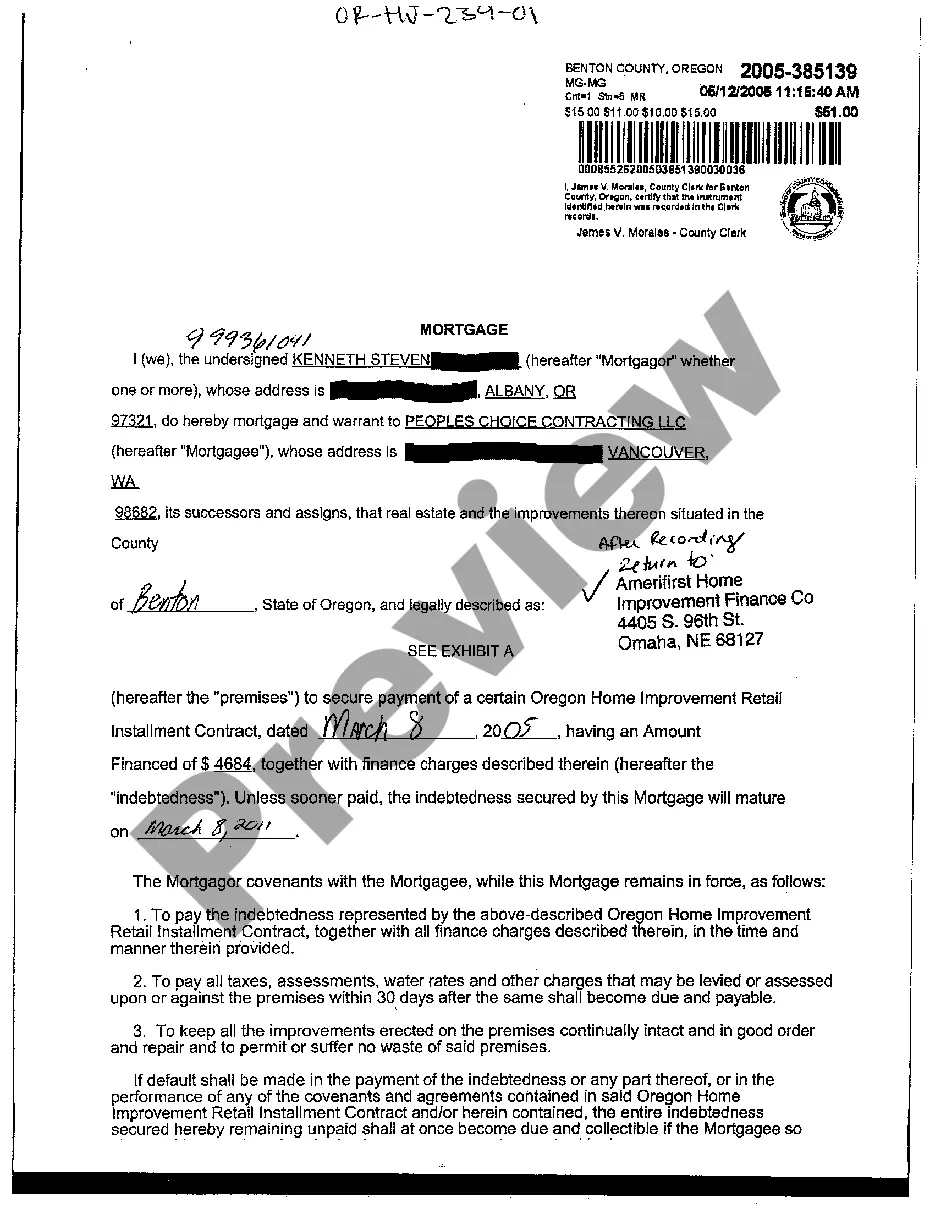

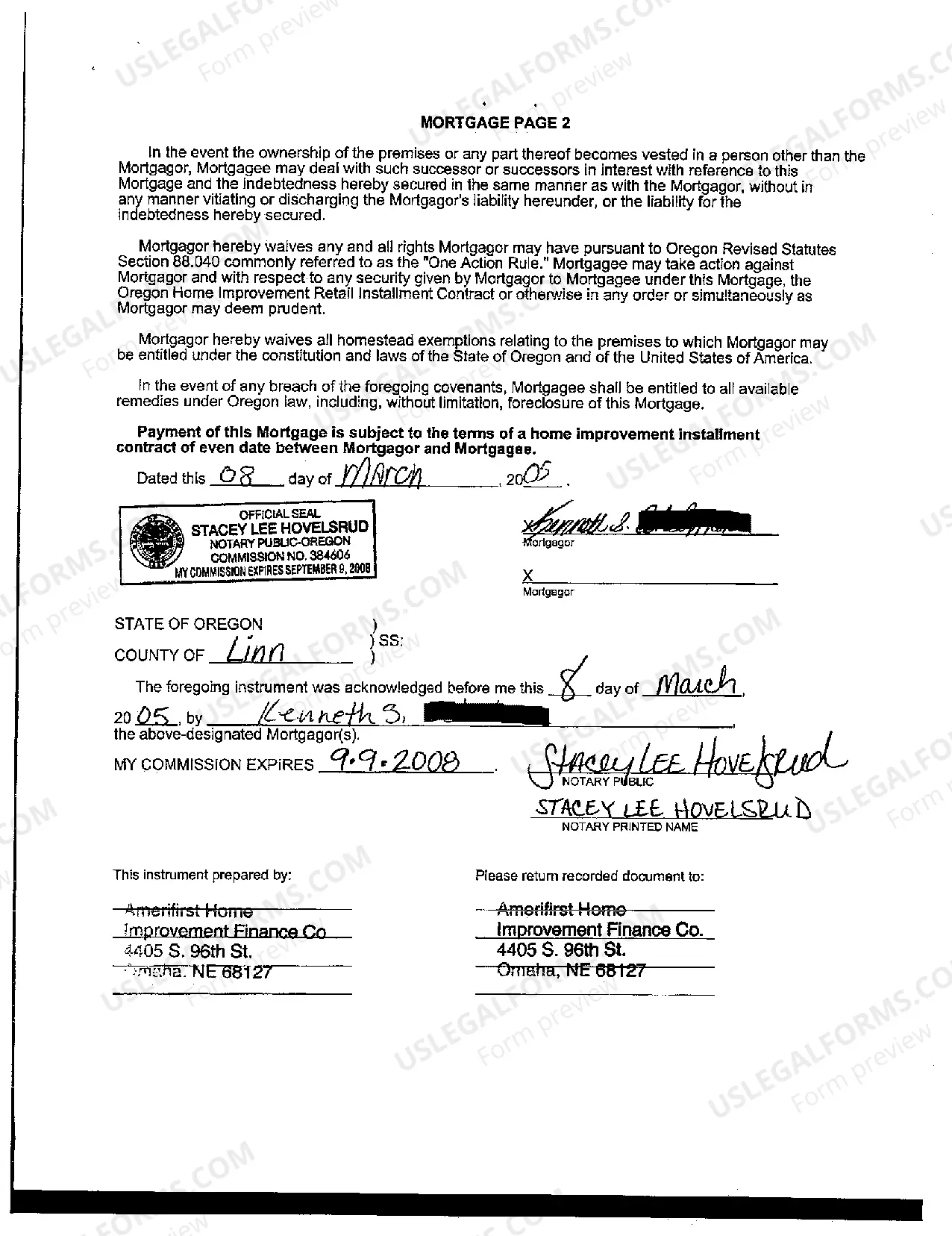

Bend Oregon Sample Mortgage for an Individual: A Comprehensive Explanation In Bend, Oregon, individuals looking to purchase a home often consider obtaining a mortgage to finance their investment. Bend is an attractive location with stunning natural surroundings and a thriving real estate market. To better understand the various options available, it is important to delve into the details of Bend Oregon Sample Mortgages for an individual. 1. Bend Oregon Fixed-Rate Mortgage: A fixed-rate mortgage is a popular choice among individuals in Bend. With this type of mortgage, the interest rate remains constant throughout the loan's lifespan. This allows borrowers to have a predictable monthly payment, providing stability and ease of budgeting for homeowners during their loan term. 2. Bend Oregon Adjustable Rate Mortgage (ARM): An Adjustable-Rate Mortgage is another option available to individuals in Bend. Unlike a fixed-rate loan, an ARM's interest rate adjusts periodically, usually after a specific initial fixed-rate period. This type of mortgage may be advantageous for individuals who plan to sell their home before the adjustment period or for those expecting their income to increase significantly in the future. 3. Bend Oregon Jumbo Mortgage: For individuals aiming to buy high-value homes in Bend, a Jumbo Mortgage is suitable. Jumbo loans exceed the conforming loan limits set by Fannie Mae and Freddie Mac, allowing borrowers to secure substantial amounts of financing. While interest rates on jumbo mortgages might be higher, this type of loan caters to individuals seeking larger, luxury properties. 4. Bend Oregon FHA Loan: An FHA loan is ideal for individuals who may have limited funds for a down payment or have a lower credit score. The Federal Housing Administration (FHA) insures these mortgages, and they often offer more flexible qualifications compared to conventional loans. Bend Oregon FHA loans are a great option for first-time homebuyers or those with less-established credit histories. 5. Bend Oregon VA Loan: VA loans are specifically designed for eligible veterans, active-duty military personnel, and their families. These loans are guaranteed by the Department of Veterans Affairs (VA) and offer competitive interest rates and relaxed qualifying requirements. Bend Oregon VA loans are an excellent mortgage option for eligible individuals in the military community. When navigating the Bend Oregon mortgage market, it is essential to consider your financial goals, current circumstances, credit history, and requirements. Consulting with a reputable mortgage lender or broker in Bend can help individuals identify the most suitable mortgage options for their unique needs. Note: It is crucial to understand that the aforementioned Bend Oregon sample mortgages are intended to provide a general overview. Actual terms, interest rates, and eligibility criteria may vary depending on market conditions, individual qualifications, and lender-specific policies. Seek professional advice for accurate and personalized information based on your specific situation.

Bend Oregon Sample Mortgage for an Individual

Description

How to fill out Bend Oregon Sample Mortgage For An Individual?

Make use of the US Legal Forms and get instant access to any form sample you require. Our useful website with a large number of templates makes it easy to find and get virtually any document sample you will need. You are able to download, fill, and certify the Bend Oregon Sample Mortgage for an Individual in just a few minutes instead of browsing the web for many hours trying to find a proper template.

Using our library is a great strategy to raise the safety of your document filing. Our professional attorneys on a regular basis check all the documents to make sure that the templates are relevant for a particular region and compliant with new laws and regulations.

How do you obtain the Bend Oregon Sample Mortgage for an Individual? If you have a subscription, just log in to the account. The Download option will appear on all the samples you look at. Moreover, you can get all the earlier saved files in the My Forms menu.

If you don’t have a profile yet, stick to the instruction listed below:

- Find the form you need. Ensure that it is the template you were looking for: check its headline and description, and utilize the Preview function if it is available. Otherwise, use the Search field to look for the needed one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and process your order with a credit card or PayPal.

- Export the document. Select the format to obtain the Bend Oregon Sample Mortgage for an Individual and change and fill, or sign it for your needs.

US Legal Forms is one of the most significant and reliable template libraries on the internet. We are always happy to help you in any legal procedure, even if it is just downloading the Bend Oregon Sample Mortgage for an Individual.

Feel free to take full advantage of our service and make your document experience as efficient as possible!