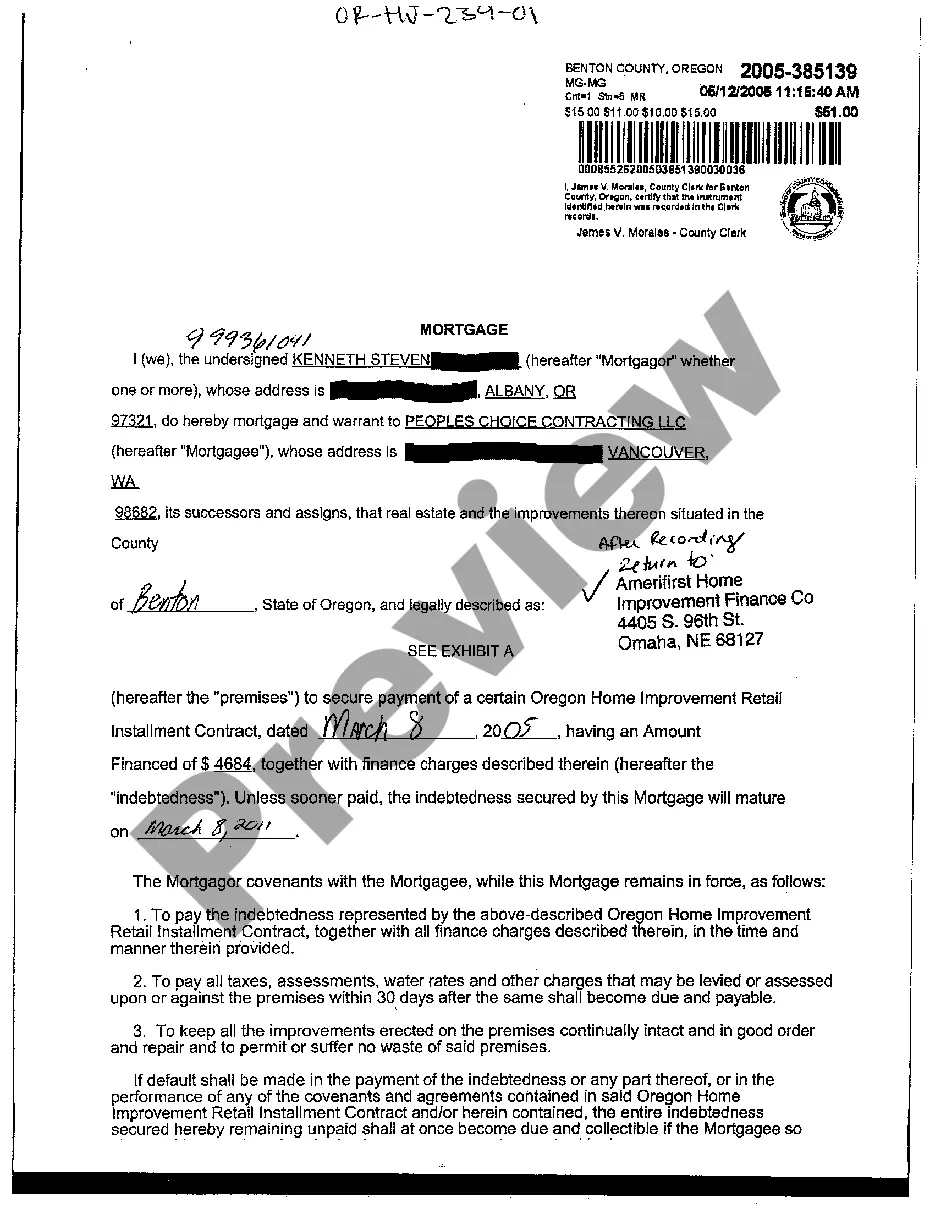

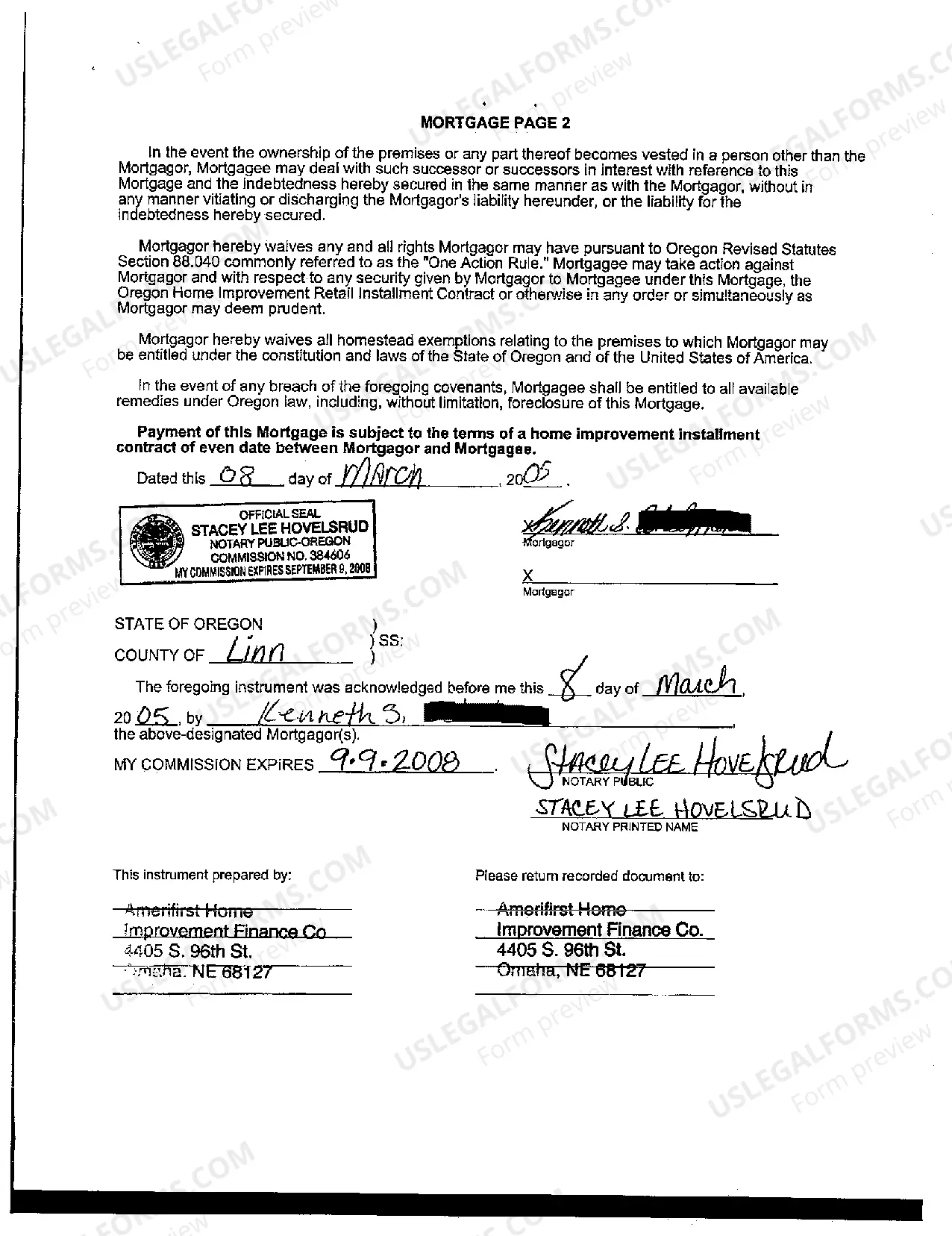

Gresham Oregon Sample Mortgage for an Individual: A Gresham Oregon sample mortgage for an individual is a type of loan provided by a lender to help an individual purchase a property in the city of Gresham, located in the state of Oregon, USA. This mortgage allows individuals to finance their home purchase by borrowing a portion of the property's value and repaying it over a set period, typically 15 or 30 years, with interest. Gresham, a vibrant suburban community located east of Portland, offers a variety of housing options suitable for different lifestyles and budgets. Whether you are a first-time homebuyer, looking to upgrade your current residence, or considering investing in real estate, obtaining a Gresham Oregon sample mortgage for an individual can be a great way to achieve your housing goals. Different types of Gresham Oregon sample mortgages for individuals may include: 1. Fixed-Rate Mortgage: With this type of mortgage, the interest rate remains consistent throughout the loan term. It provides stability and predictability in monthly payments, making budgeting easier. 2. Adjustable-Rate Mortgage (ARM): An ARM offers an initial fixed rate for a specific period, usually 5, 7, or 10 years. After the initial period, the interest rate adjusts periodically based on market conditions. This type of mortgage is suitable for individuals planning to sell or refinance before the rate adjustment period begins. 3. Jumbo Mortgage: If you are considering purchasing a higher-priced property in Gresham, you may require a jumbo mortgage. This type of loan exceeds the conventional loan limits set by government-sponsored enterprises like Fannie Mae and Freddie Mac. 4. FHA Loan: Backed by the Federal Housing Administration, an FHA loan is a mortgage option for individuals with lower credit scores or limited down payment funds. It offers more lenient qualification requirements and lower down payment options. 5. VA Loan: Available exclusively to active and retired military service members and their eligible spouses, a VA loan provides favorable terms such as no down payment requirement and competitive interest rates. When applying for a Gresham Oregon sample mortgage for an individual, it is important to gather necessary documentation such as income statements, bank statements, employment history, credit information, and property details. Lenders consider these factors to determine the loan amount, interest rate, and repayment terms. In conclusion, Gresham Oregon sample mortgages for individuals are tailored to help residents of Gresham achieve their dreams of homeownership. With various mortgage types available, individuals can choose the option that best fits their financial situation, allowing them to enjoy the benefits of living in this wonderful city.

Gresham Oregon Sample Mortgage for an Individual

Description

How to fill out Gresham Oregon Sample Mortgage For An Individual?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Gresham Oregon Sample Mortgage for an Individual becomes as quick and easy as ABC.

For everyone already familiar with our service and has used it before, getting the Gresham Oregon Sample Mortgage for an Individual takes just a few clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. This process will take just a few more steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the subscription.

- Download the Gresham Oregon Sample Mortgage for an Individual. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!