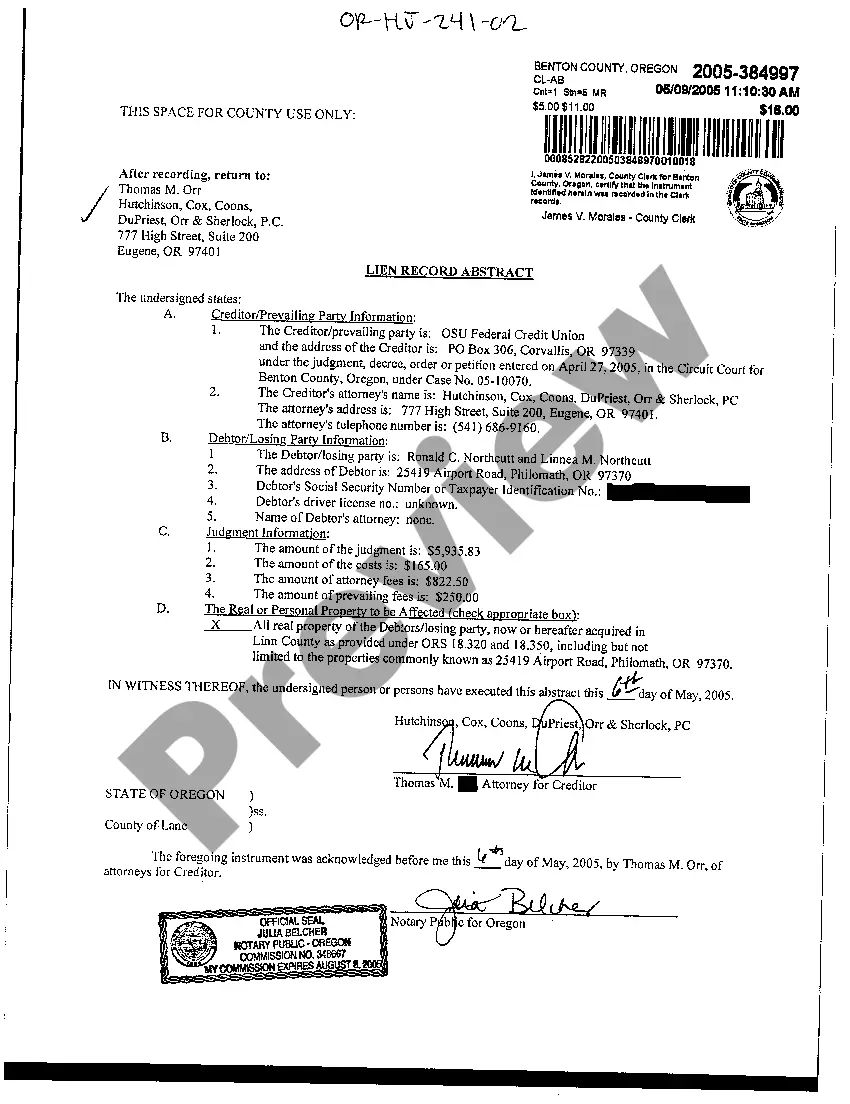

Bend Oregon Lien Record Abstract is a document that provides a detailed summary of any recorded liens against a property located in Bend, Oregon. Liens are legal claims placed on a property by creditors to ensure the repayment of debts or obligations. This abstract is crucial for potential buyers, lenders, and real estate professionals as it discloses any existing liens that may affect the property's ownership or marketability. The Bend Oregon Lien Record Abstract contains relevant information such as the property owner's name, the lien holder's name, the date the lien was filed, the lien amount, and specific details about the nature of the lien. This information helps individuals and businesses assess the financial obligations associated with the property and evaluate its risk level before making any investment or business decisions. Types of Bend Oregon Lien Record Abstracts: 1. Federal Tax Liens: These refer to unpaid federal taxes owed by the property owner to the Internal Revenue Service (IRS). These liens are typically enforceable throughout the United States and can significantly impact the sale or refinancing of a property. 2. State Tax Liens: These liens are similar to federal tax liens but relate to unpaid state taxes, such as income, sales, or property taxes. The State of Oregon may place liens on a property if the owner has outstanding tax debts. 3. Mechanic's Liens: These liens arise when contractors, subcontractors, or suppliers do not receive payment for work or materials provided in the construction or renovation of a property. If these parties are not compensated, they can file a mechanic's lien, which attaches to the property and must be resolved before the title can be transferred. 4. Judgment Liens: When a person or entity wins a lawsuit against a property owner and is awarded a monetary judgment, they can file a judgment lien that encumbers the property. This lien ensures that the debt is repaid from the proceeds of the property's sale. Obtaining a Bend Oregon Lien Record Abstract is crucial when purchasing or investing in real estate in Bend, Oregon. It allows potential buyers and lenders to make informed decisions, assess the property's financial liabilities, and protect themselves from unforeseen risks associated with existing liens. Real estate professionals can also use this information to guide buyers and sellers through the transaction process, ensuring a smooth and secure transfer of ownership.

Bend Oregon Lien Record Abstract

Description

How to fill out Bend Oregon Lien Record Abstract?

Finding verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Bend Oregon Lien Record Abstract becomes as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, getting the Bend Oregon Lien Record Abstract takes just a few clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a few more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to get the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Bend Oregon Lien Record Abstract. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!