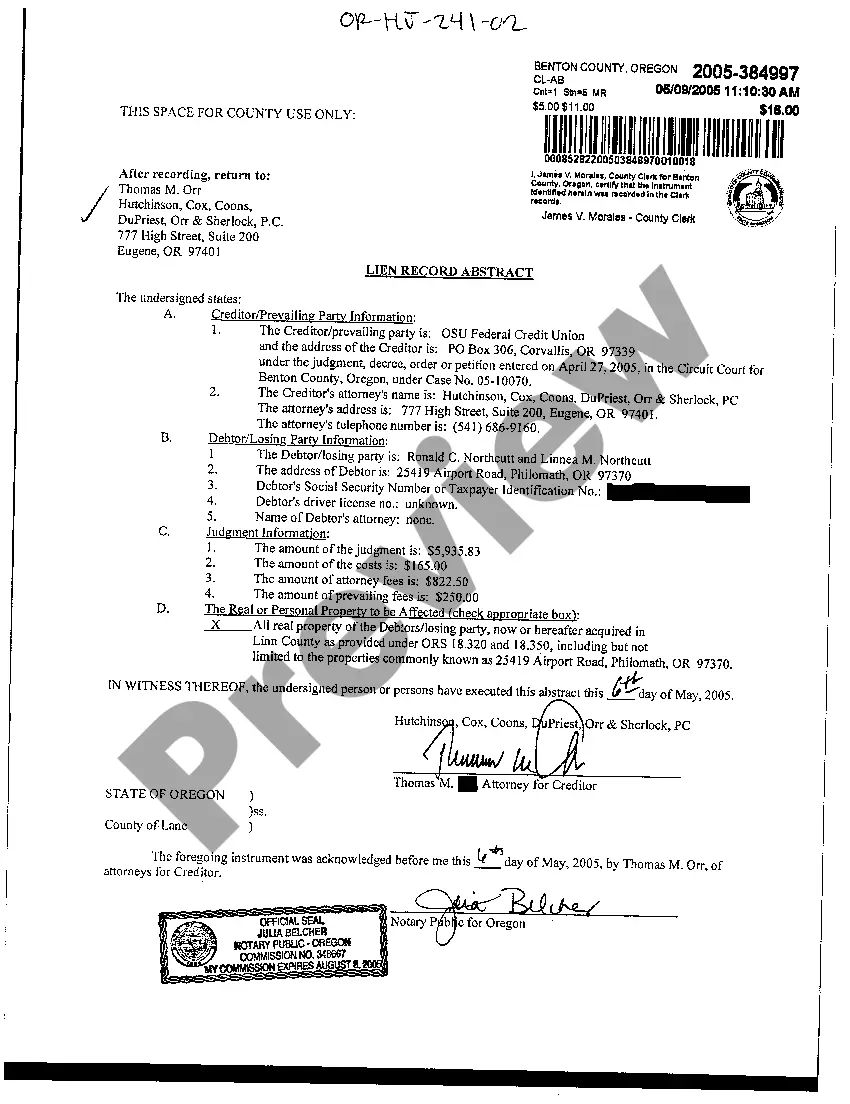

Keywords: Eugene Oregon, Lien Record Abstract, types Description: An Eugene Oregon Lien Record Abstract is an official document that provides detailed information about any existing liens placed on a property within the jurisdiction of Eugene, Oregon. This comprehensive abstract serves as a record of all outstanding liens, encumbrances, and mortgages associated with a particular property. The Eugene Oregon Lien Record Abstract comprises various types of liens, depending on the nature of the debt or claim against the property: 1. Property Tax Liens: This type of lien is placed when property owners fail to pay their property taxes. The abstract will include information regarding the unpaid tax amounts, penalties, and the period for which the taxes remain delinquent. 2. Mechanics Liens: Filed by contractors or suppliers who have not been paid for work done or materials provided to improve a property. The abstract will provide details about the contractor, the claimed amount, and the date the lien was filed. 3. Judgment Liens: These are filed by creditors who have obtained a legal judgment against a property owner owing debts. The lien abstract will include information about the creditor, the amount owed, and the court judgment reference. 4. Homeowner Association (HOA) Liens: Homeowners associations may place liens on properties within their jurisdiction when owners fail to pay their association dues or violate certain rules and regulations. The abstract will contain details about the HOA, the amount owed, and the duration of the non-payment. 5. State Tax Liens: Filed by state agencies against property owners who owe unpaid state income taxes or other state taxes. The abstract will outline the tax amount owed, penalties incurred, and reference the state agency responsible for the lien. 6. Federal Tax Liens: These liens are enforced by the Internal Revenue Service (IRS) when property owners fail to pay their federal taxes. The abstract will include information about the outstanding tax amount, applicable penalties, and the IRS office responsible for the lien. The Eugene Oregon Lien Record Abstract is an essential tool for potential property buyers, lenders, real estate agents, and anyone interested in a property's ownership history and financial status. It helps determine the existence of any outstanding liabilities that may affect the property's market value or future transactions.

Eugene Oregon Lien Record Abstract

Description

How to fill out Eugene Oregon Lien Record Abstract?

If you have previously availed yourself of our service, Log In to your account and store the Eugene Oregon Lien Record Abstract on your device by clicking the Download button. Ensure your subscription is active. If it’s not, renew it as per your payment schedule.

If this is your initial interaction with our service, adhere to these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to reuse it. Utilize the US Legal Forms service to swiftly find and save any template for your personal or business requirements!

- Confirm that you’ve located an appropriate document. Browse through the description and utilize the Preview feature, if available, to verify that it satisfies your needs. If it’s not suitable, use the Search tab above to find the correct one.

- Purchase the document. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process your payment. Enter your credit card information or opt for PayPal to finalize the transaction.

- Acquire your Eugene Oregon Lien Record Abstract. Choose the file format for your document and download it to your device.

- Complete your form. Print it or leverage professional online editors to fill it in and sign it digitally.

Form popularity

FAQ

In Oregon, judgments generally have a lifespan of ten years, after which they can expire if not renewed. This means that if a creditor does not take action to renew the judgment, it will no longer be enforceable. Keeping an eye on your Eugene Oregon lien record abstract can provide clarity on any existing judgments. For further assistance understanding this process, consider using US Legal Forms to stay informed and manage your information better.

To find liens on property in Oregon, you can start by searching public records at your county clerk's office. Online tools and databases may also provide access to Eugene Oregon lien record abstract information. Websites like US Legal Forms offer resources that help you navigate these records effectively. By utilizing these platforms, you can simplify your search and find accurate lien information with ease.

In Oregon, a lien can stay on your property for a duration of 10 years. After this period, the lien may expire unless renewed by the creditor. Understanding how long a lien affects your property is vital for managing your financial obligations. For more details on managing liens, explore the resources available in the Eugene Oregon Lien Record Abstract.

In Oregon, judgments typically remain for a certain period, usually up to 10 years, but they can be renewed. This means that you must be aware of how long a judgment impacts your financial record. It's crucial to understand the process involved in clearing judgments. For more detailed information, consult the Eugene Oregon Lien Record Abstract.

No, a lien cannot be placed on your property without valid reasons. Creditors must follow legal procedures and demonstrate a legitimate basis for filing a lien. If you suspect an improper lien, it’s important to act quickly to protect your property rights. For guidance, you can refer to the Eugene Oregon Lien Record Abstract.

Yes, jointly owned property can be seized under certain circumstances. If one owner has outstanding debts, creditors may seek to claim their share of the property. This can lead to complicated situations, so it is essential to be informed about your rights. The Eugene Oregon Lien Record Abstract can provide useful information to navigate these issues.

Yes, a judgment lien can be applied to both real and personal property. This means that the creditor may claim a portion of these assets to satisfy the debt. It is important to understand the implications of this for your financial situation. For further insights, look into the Eugene Oregon Lien Record Abstract.

Yes, a lien can be placed on a joint account. When a lien is filed, it may affect both account holders equally. This means that your financial assets are at risk, especially if the lien is related to debts of one account holder. For comprehensive details on liens in your area, consider checking the Eugene Oregon Lien Record Abstract.

In Oregon, a lien functions as a legal claim that a creditor may place on your property to secure payment for a debt. This means if you do not fulfill your payment obligations, the lien allows creditors to recover their debt when you sell or refinance your property. For further details on different types of liens and how they might impact you, the Eugene Oregon Lien Record Abstract can provide helpful insights.

A judgment lien in Oregon typically lasts for ten years from the date it is recorded, but it can be renewed for another ten-year period. This means if a creditor has a valid judgment against you, they can secure their claim on your property for an extended duration. If you want to find out more about judgment liens, including how they relate to the Eugene Oregon Lien Record Abstract, consider checking resources from USLegalForms.