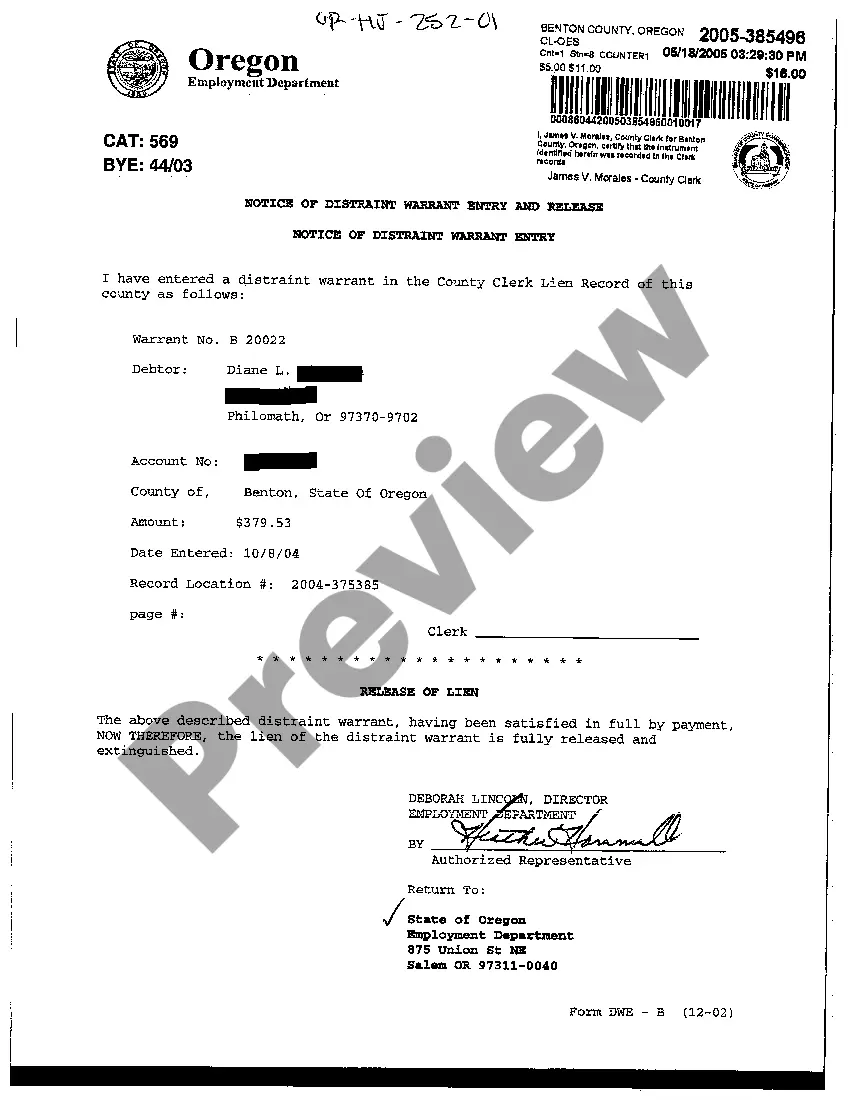

The Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual is a legal document issued by the local authorities in Gresham, Oregon, to notify an individual about the enforcement of a distraint warrant. This document is commonly used in cases where an individual owes a debt to a creditor or has unpaid taxes, and legal action is being taken to collect the outstanding amount. The notice provides a detailed account of the individual's obligations, including the specific debt amount, the name and contact information of the creditor or tax authority, and the legal basis for the distraint warrant. It also outlines the consequences of non-compliance, such as potential seizure of assets or garnishment of wages. There are various types of Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual, depending on the nature of the debt or tax liability. Some common types include: 1. Notice of Distraint Warrant for Unpaid Taxes: This type of notice is issued by the Oregon Department of Revenue, municipality, or other tax authorities to inform an individual about the enforcement of a distraint warrant due to unpaid taxes. It details the tax amount owed, the tax period involved, and provides instructions on how to rectify the situation. 2. Notice of Distraint Warrant for Debts: This notice is typically sent by a creditor or debt collection agency when an individual fails to repay a debt, such as a personal loan, credit card debt, or medical bills. It notifies the individual about the issuance of a distraint warrant and outlines the steps they need to take to satisfy the debt. 3. Notice of Distraint Warrant for Child Support Arrears: In cases where an individual is delinquent on child support payments, the Oregon Department of Justice may issue this type of notice. It informs the individual about the issuance of a distraint warrant and emphasizes the importance of fulfilling their child support obligations. In conclusion, the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual is a legal document used to notify individuals about the enforcement of a distraint warrant, typically for unpaid taxes, debts, or child support arrears. It outlines the specific liabilities, provides contact information for relevant authorities or creditors, and informs the individual about the potential consequences of non-compliance.

Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual

Description

How to fill out Gresham Oregon Notice Of Distraint Warrant Entry And Release For An Individual?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual becomes as quick and easy as ABC.

For everyone already acquainted with our service and has used it before, obtaining the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. The process will take just a couple of more steps to make for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!

Form popularity

FAQ

You can contact the Oregon Department of Revenue through their website, where you will find contact information for various inquiries. They provide assistance regarding property taxes, including details on the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual. It is wise to reach out directly for specific questions and guidance. Having the right information can help you make informed decisions.

Oregon operates primarily as a tax lien state, meaning that unpaid property taxes create a lien against the property. Thus, when you acquire a tax lien, you gain certain rights to collect on the unpaid taxes, which could lead to a Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual if needed. Understanding this classification is vital for anyone looking to invest in tax delinquent properties. It helps clarify the legal processes involved.

In Oregon, property taxes can go unpaid for up to three years before drastic measures, like the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual, come into play. During this period, interest and penalties accumulate, further increasing the total amount owed. It is advisable to address any unpaid property taxes promptly to avoid the complications that may arise. Taking action sooner rather than later can help prevent the need for legal interventions.

In Oregon, you can file taxes for previous years as long as you owe tax for those years. Generally, the IRS allows you to file returns for up to three years back to claim a refund. Additionally, if you receive a Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual, it's crucial to act swiftly and file any outstanding returns. Our platform, uslegalforms, provides resources to aid in filing past taxes effectively.

Oregon typically allows for a three-year period to assess unpaid taxes from the date you filed your tax return. However, if you fail to file or there is evidence of fraud, the statute of limitations can extend up to five years. Familiarizing yourself with these limitations can help you prepare for any potential Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual that may arise. Utilizing platforms like uslegalforms can assist you in navigating these complexities.

In general, the IRS can audit your tax returns for up to three years. However, if you omitted more than 25% of your income, this period extends to six years. It's essential to know that in cases of tax fraud, the IRS can pursue taxes indefinitely. If you find yourself facing a Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual, understanding your rights is crucial.

In Oregon, the state can collect back taxes for a period of 10 years from the date of assessment. This collection time frame is crucial for individuals who may have received a Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual. Understanding these timelines helps you plan your financial obligations and avoid penalties. If you find yourself facing issues with back taxes, consider using the US Legal Forms platform to manage your legal documents efficiently.

A distraint warrant in Oregon is a court order that allows tax authorities to take possession of individual property or assets in order to satisfy outstanding tax debts. This legal tool is used when informal collection efforts have proven ineffective. Knowing about the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual can empower you to seek the necessary resources to mitigate potential disruptions caused by such warrants.

Yes, the IRS can issue distraint warrants as part of its collection process for unpaid federal taxes. This warrant authorizes the IRS to seize assets to recover owed taxes. If you’re dealing with tax liabilities, understanding the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual can help you navigate similar issues at the state level.

An Oregon distraint warrant is a legal order enabling the government to seize property to collect unpaid taxes. This warrant typically indicates that all other collection efforts have failed. If you're facing this issue, it's crucial to familiarize yourself with the Gresham Oregon Notice of Distraint Warrant Entry and Release for an Individual to ensure you take the necessary steps to address your tax situation.