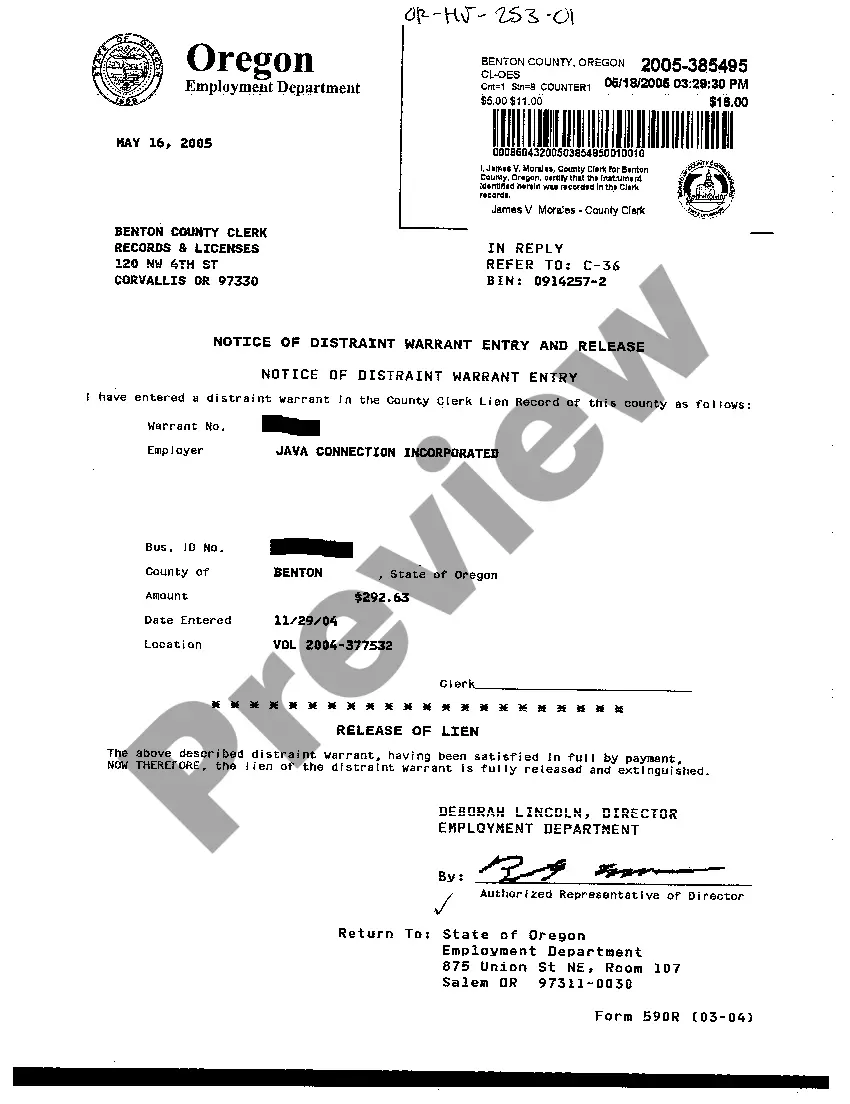

Title: Understanding the Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation Introduction: The Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation is a legal document that serves as a means of enforcing the collection of unpaid taxes or debts by a government agency. This detailed description aims to provide a comprehensive overview of this notice, outlining its purpose, process, and potential variations. Keywords: Gresham Oregon, Notice of Distraint Warrant, Entry and Release, Corporation, unpaid taxes, debts, government agency, legal document. 1. Purpose of the Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation: The purpose of this notice is to inform a corporation of the government's intent to enforce the collection of an outstanding debt or taxes owed to them. It serves as a legal warning to the corporation that the government agency has obtained a detainment warrant, granting them the authority to seize certain assets in lieu of payment. 2. Process of the Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation: Once the government agency establishes that a corporation has unpaid taxes or debts, they may proceed with obtaining a detainment warrant. This warrant enables them to enter the premises of the corporation and seize specific assets as a means of resolving the outstanding debt. The notice of detainment warrant entry and release specifies the date and time of the entry, allowing the corporation's representatives to be present during the process. 3. Variations of the Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation: a) Notice of Distraint Warrant Entry: This variation of the notice informs the corporation of the government agency's authorization to enter their premises in order to seize assets. It outlines the specific details of the entry, such as the date, time, and purpose. b) Notice of Distraint Warrant Release: In cases where the corporation settles the outstanding debt or appeals successfully against the detainment warrant, this notice is issued by the government agency. It confirms the release of the detainment warrant, stating that the corporation is no longer subject to any asset seizure. Conclusion: The Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation is a crucial legal document used by government agencies to enforce the collection of unpaid taxes or debts from corporations. By providing a detailed description of its purpose and process, this overview allows corporations to better understand their obligations and rights in such situations.

Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation

Description

How to fill out Gresham Oregon Notice Of Distraint Warrant Entry And Release For A Corporation?

We always strive to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we apply for legal solutions that, as a rule, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account in a matter of minutes.

- Make sure to check if the Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- Once you’ve made sure that the Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation is proper for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!

Form popularity

FAQ

An Oregon distraint warrant is a legal tool that allows the state to seize property to satisfy tax debts. This warrant is typically issued after a taxpayer fails to respond to tax obligations. If your corporation receives a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation, it indicates the state is serious about collecting the owed taxes. Engaging with legal experts can help you address any disputes effectively.

Yes, the IRS can issue distraint warrants to collect unpaid tax debts. These warrants allow the IRS to seize assets if the tax obligations remain unresolved. If you are dealing with a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation, it's crucial to understand how IRS actions may impact your business. Seeking advice from a tax attorney can clarify your situation.

The Oregon Department of Revenue can garnish a significant portion of your earnings for outstanding tax debts. They generally take up to 25% of your disposable income, but specific figures may vary based on individual circumstances. This includes cases involving a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation, where garnishment can occur. To protect your rights, consulting with a legal professional is advisable.

When the Oregon Department of Revenue reviews your refund request, it typically takes several weeks. During this time, they verify your information to ensure accuracy and compliance. If your refund is linked to a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation, understanding this process will help you anticipate any potential delays. It's essential to monitor the status and follow up if necessary.

In Oregon, if someone pays your overdue property taxes, they can potentially claim property rights over it. This process, known as a 'tax lien,' may lead to a sale of your property to recover expenses. Therefore, if you find yourself facing such a situation, it is wise to consult a legal expert. They can offer guidance on how to navigate issues related to a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation.

Oregon determines residency based on several factors, including where you maintain your primary home and where you spend the majority of your time during the year. Additional elements, such as family ties and the location of your business, also play a role. Understanding these criteria is crucial, particularly if your corporation receives a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation, as it affects your tax responsibilities.

In Oregon, property taxes do not automatically cease at a specific age; however, seniors may qualify for property tax deferral or exemption programs. These programs can provide financial relief to those over a certain age, especially if they are facing fixed incomes. Knowing the benefits available to you, including options related to your business and a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation, can enhance your financial situation.

If you withdraw funds early from your Oregon IRA, you may incur a penalty of 10% on the amount taken out. In addition, you will owe income tax on the early distribution, which can add to your financial burden. It is important to understand the full implications, especially if you are considering this option in connection with your business and a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation.

The 6 month rule in Oregon impacts the collection period for certain types of liabilities, particularly concerning taxes and fees. Essentially, it denotes that after a period of six months without action on a case, certain legal avenues for collection may be limited. Awareness of these rules, including the implications of a Gresham Oregon Notice of Distraint Warrant Entry and Release for a Corporation, can help you avoid unnecessary complications.

A distraint warrant in Oregon is a legal order that allows a creditor to seize a debtor’s property to satisfy a debt. This warrant can be issued following a Notice of Distraint Warrant Entry and Release for a Corporation when payment is not made. Understanding how this process works can help you navigate your obligations and rights effectively, ensuring you remain informed and prepared.