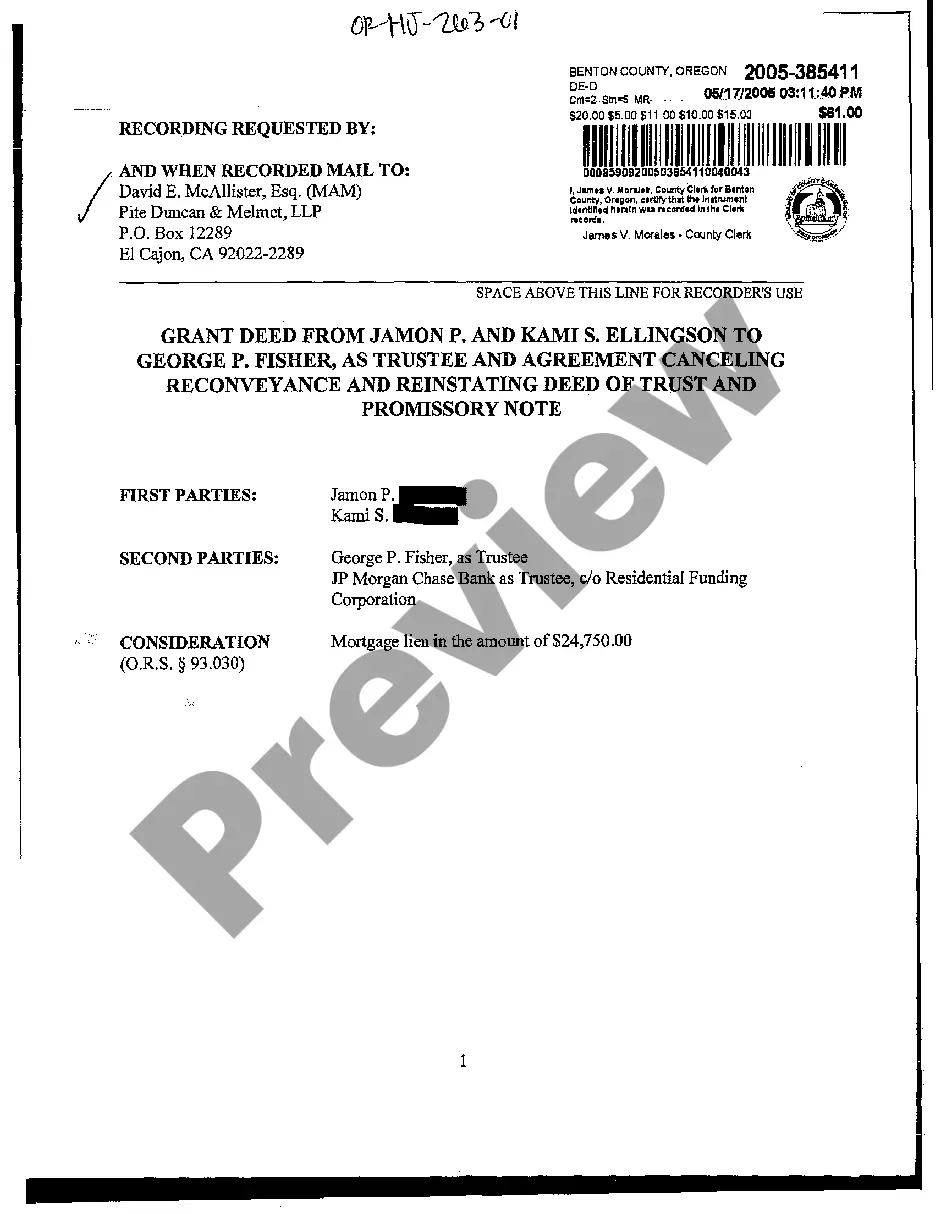

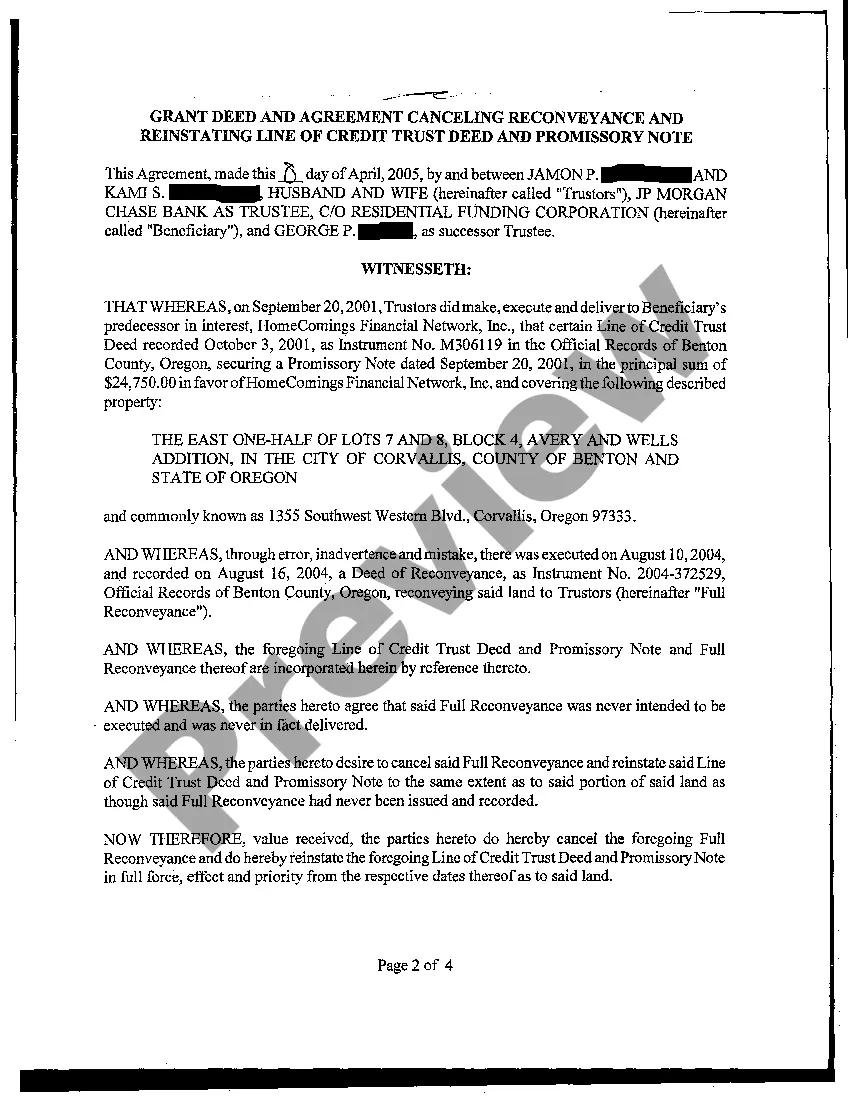

A Bend Oregon Grant Deed from Husband and Wife to Trustee is a legally binding document that transfers ownership of real estate property from a married couple (husband and wife) to a trustee. This type of deed is commonly used in estate planning, asset protection, and maintaining control over property within a trust. Keywords: — Bend Oregon: LocateDescarteses County, Bend is a city in central Oregon known for its outdoor recreational activities, beautiful landscapes, and thriving real estate market. — Grant Deed: A legal instrument that conveys real property rights from one party (granter) to another (grantee). It guarantees that the granter has full ownership and possesses the right to sell or transfer the property. — Husband and Wife: Refers to a legally married couple, who jointly own real estate property and wish to transfer it to a trustee while maintaining their interests and control over the assets. — Trustee: An individual or entity appointed to manage and administer a trust. They hold legal title of the property and are responsible for carrying out the instructions outlined in the trust agreement. — Estate Planning: The process of arranging one's assets and affairs during their lifetime to ensure an orderly transfer of property to beneficiaries upon their death, while minimizing taxes, probate, and legal complications. — Asset Protection: Strategies employed to safeguard assets from potential lawsuits, creditors, or other claims by transferring them into a trust, such as a revocable living trust or irrevocable trust. — Real Estate Property: Refers to land or any improvements on it, such as buildings, structures, rights, interests, or benefits associated with the land. Descarteses County: Located in central Oregon, Descartes County is where Bend is situated. It is known for its scenic landscapes, diverse outdoor activities, and growing population. Different types of Bend Oregon Grant Deed from Husband and Wife to Trustee may include: 1. Revocable Living Trust Deed: This type of deed allows the husband and wife to transfer ownership of their property to a trustee while retaining the ability to amend or revoke the trust during their lifetime. 2. Irrevocable Trust Deed: With this deed, the husband and wife permanently transfer ownership of their property to a trustee, making the trust and its terms unchangeable without the consent of the beneficiaries or a court order. 3. Testamentary Trust Deed: This deed takes effect upon the death of either the husband or wife. It enables the surviving spouse or a designated trustee to manage and distribute the property according to the trust's provisions, as outlined in the deceased's will or testament. In conclusion, a Bend Oregon Grant Deed from Husband and Wife to Trustee is a crucial legal document used to transfer real estate property to a trustee, providing flexibility, asset protection, and estate planning benefits for married couples.

Bend Oregon Grant Deed from Husband and Wife to Trustee

Description

How to fill out Bend Oregon Grant Deed From Husband And Wife To Trustee?

If you are searching for a relevant form, it’s impossible to choose a more convenient place than the US Legal Forms site – one of the most extensive libraries on the internet. Here you can get a large number of document samples for organization and personal purposes by types and regions, or key phrases. With our advanced search option, finding the most up-to-date Bend Oregon Grant Deed from Husband and Wife to Trustee is as easy as 1-2-3. Moreover, the relevance of each record is confirmed by a team of professional attorneys that regularly review the templates on our website and revise them in accordance with the most recent state and county requirements.

If you already know about our system and have an account, all you should do to get the Bend Oregon Grant Deed from Husband and Wife to Trustee is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just refer to the instructions listed below:

- Make sure you have discovered the form you need. Check its description and use the Preview option (if available) to check its content. If it doesn’t meet your requirements, use the Search field at the top of the screen to find the proper document.

- Confirm your choice. Choose the Buy now option. After that, choose the preferred pricing plan and provide credentials to sign up for an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Receive the template. Choose the format and download it on your device.

- Make modifications. Fill out, edit, print, and sign the acquired Bend Oregon Grant Deed from Husband and Wife to Trustee.

Each and every template you add to your profile does not have an expiration date and is yours permanently. It is possible to access them using the My Forms menu, so if you want to get an extra copy for modifying or printing, feel free to come back and export it once more whenever you want.

Take advantage of the US Legal Forms extensive library to gain access to the Bend Oregon Grant Deed from Husband and Wife to Trustee you were seeking and a large number of other professional and state-specific samples in a single place!

Form popularity

FAQ

On a name change You'll need to download and complete Form ID1, which proves your identity when applying for a name change on the title register. Send ID1 with evidence of your change of name (for example, the deed poll document, your marriage certificate or your decree absolute) and AP1 to the Land Registry.

The only way to forcibly change the ownership status is through a legal action and the resultant court order. However, if an owner chooses to be removed from the deed, it is simply a matter of preparing a new deed transferring that owner's interest in the property.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

Effective January 1, 2012, Oregon law provides for a new form of deed known as a transfer on death (TOD) deed. These deeds allow an owner of real property to designate a beneficiary who will obtain title to that real property when the owner dies, without having to go through probate (subject to some exceptions).

An Oregon transfer-on-death deed?also called TOD deed or beneficiary deed?is a type of deed that allows an owner of Oregon real estate to designate a beneficiary to receive the property upon the owner's death.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.

An Oregon deed must be signed by the current owner transferring real estate?the grantor?or a lawful agent or attorney signing for the grantor. Notarization. The current owner's signature must be acknowledged before a notary or other authorized officer.

An Oregon quitclaim deed form is a written instrument that conveys a property owner's current interest in Oregon real estate. When executing an Oregon quitclaim deed, the current owner?called the grantor?transfers ownership to a new owner?the grantee?with no warranty of title.

You will need to have the quitclaim deed notarized with the signatures of you and your spouse. Once this is done, the quitclaim deed replaces your former deed and the property officially is in both of your names. You must record the deed at your county office.