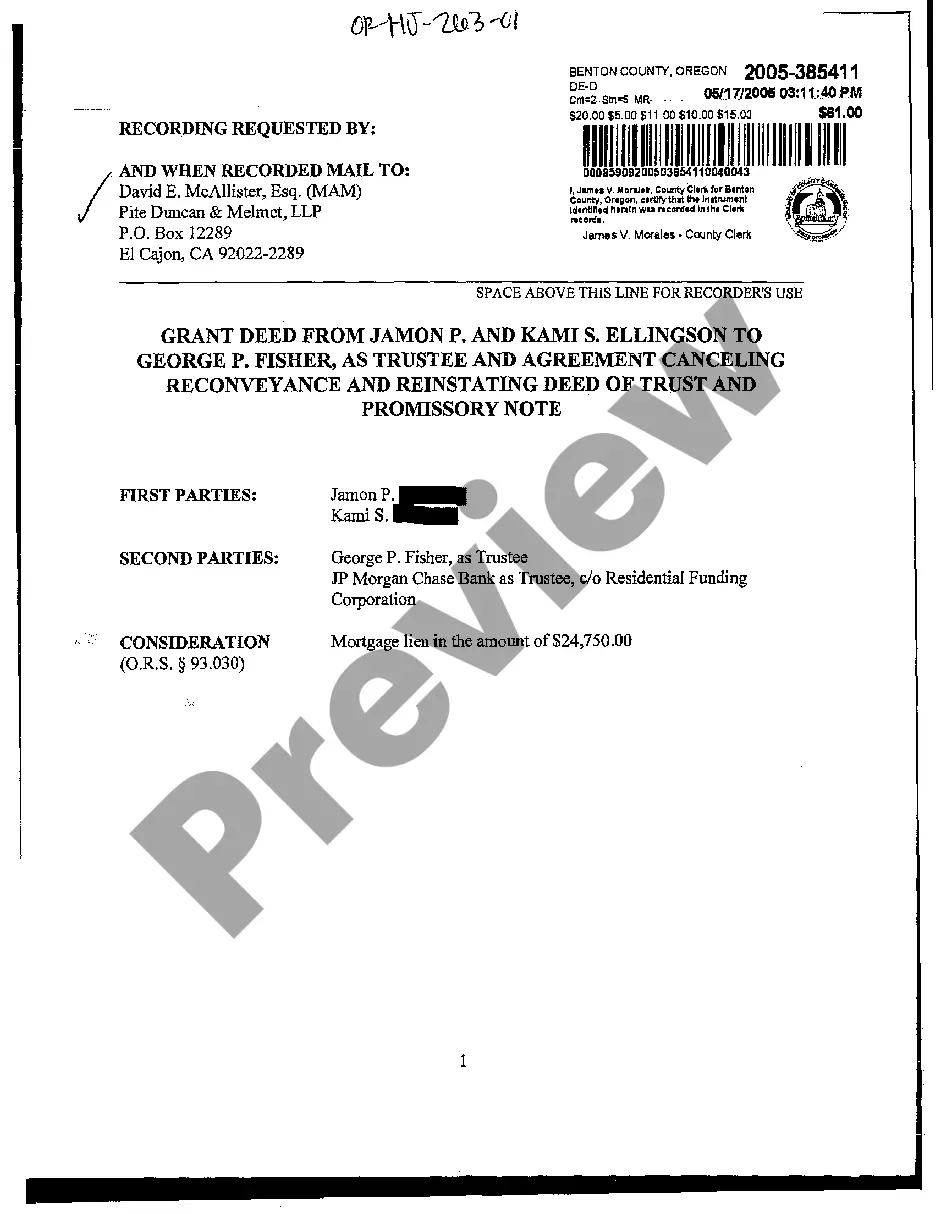

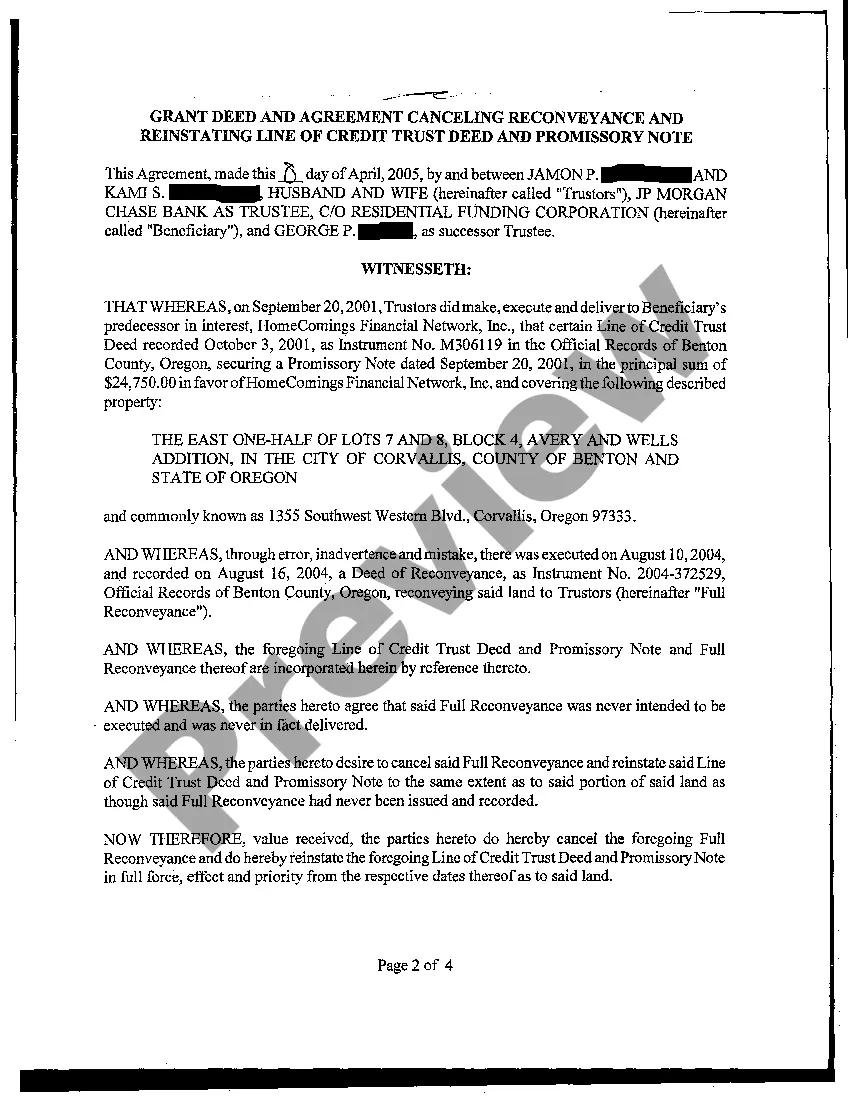

A Eugene Oregon Grant Deed from Husband and Wife to Trustee is a legal document used to convey ownership of real property from a married couple (husband and wife) to a trustee. This type of deed is commonly utilized in estate planning and asset protection strategies. In Eugene, Oregon, there are several variations of the Grant Deed from Husband and Wife to Trustee, each serving a specific purpose. These may include: 1. Revocable Trust Grant Deed: This type of grant deed is often executed when a couple establishes a revocable living trust for estate planning purposes. By transferring ownership of the property to the trustee of the trust, the couple ensures that their assets are properly managed and distributed according to their wishes upon their passing. 2. Irrevocable Trust Grant Deed: In certain cases, a married couple may opt for an irrevocable trust to safeguard their assets from potential creditors or to minimize estate taxes. The transfer of property through an irrevocable trust grant deed allows the assets to be protected and managed by the trustee, ensuring they are distributed as intended. 3. Special Needs Trust Grant Deed: Individuals or couples with a disabled or special needs family member often establish a special needs trust to protect the beneficiary's eligibility for government assistance programs. The transfer of property via a special needs trust grant deed allows the trustee to manage the property's ownership and financial arrangements while preserving the beneficiary's eligibility for necessary benefits. 4. Asset Protection Trust Grant Deed: Asset protection trusts are designed to shield assets from potential legal judgments or claims. A grant deed transferring property from a husband and wife to a trustee of an asset protection trust helps safeguard the property against potential creditors, frivolous lawsuits, or claims arising from business activities. When drafting a Eugene Oregon Grant Deed from Husband and Wife to Trustee, it is crucial to consult with an experienced attorney familiar with Oregon real estate laws and estate planning. The attorney can guide you in selecting the appropriate type of grant deed based on your specific needs and objectives. Important keywords: Eugene Oregon, Grant Deed, Husband and Wife, Trustee, Revocable Trust Grant Deed, Irrevocable Trust Grant Deed, Special Needs Trust Grant Deed, Asset Protection Trust Grant Deed, estate planning, asset protection, real property, married couple, revocable living trust, irrevocable trust, special needs trust, legal document, property transfer, estate taxes, government assistance programs, disabled family member, asset protection trust.

Eugene Oregon Grant Deed from Husband and Wife to Trustee

Description

How to fill out Eugene Oregon Grant Deed From Husband And Wife To Trustee?

Utilize the US Legal Forms and gain instant access to any document you need.

Our user-friendly platform with a wide array of templates facilitates the easy discovery and acquisition of nearly any document sample you require.

You can export, fill out, and authenticate the Eugene Oregon Grant Deed from Husband and Wife to Trustee in just minutes instead of spending hours online searching for the ideal template.

Using our catalog is a fantastic method to enhance the security of your form submissions. Our skilled lawyers consistently evaluate all the documents to ensure they are suitable for a specific state and conform to new laws and regulations.

US Legal Forms stands as one of the largest and most trustworthy template repositories online.

Our team is always eager to support you in any legal endeavor, even if it’s simply downloading the Eugene Oregon Grant Deed from Husband and Wife to Trustee. Feel free to fully utilize our service and simplify your document experience!

- How can you acquire the Eugene Oregon Grant Deed from Husband and Wife to Trustee.

- If you already possess a subscription, simply Log In to your account. The Download button will be activated on all the documents you view. Additionally, you can access all previously saved files in the My documents section.

- If you haven’t created an account yet, follow the steps below.

- Locate the template you want. Ensure that it is the document you were looking for: verify its title and description, and take advantage of the Preview feature when it is accessible. Otherwise, utilize the Search box to find the correct one.

- Initiate the downloading process. Click Buy Now and choose the subscription plan you prefer. Then, create an account and complete your order using a credit card or PayPal.

- Download the document. Select the format to receive the Eugene Oregon Grant Deed from Husband and Wife to Trustee and edit and finalize, or sign it according to your requirements.

Form popularity

FAQ

To transfer property title to a family member in Oregon, you can use a Eugene Oregon Grant Deed from Husband and Wife to Trustee to facilitate the process. Start by drafting the deed with accurate information about the property and parties involved. After signing, file the deed with the county recorder's office to officially document the transfer. Engaging a service like uslegalforms can simplify this process, ensuring all requirements are met.

The best way to transfer a property title between family members often involves using a Eugene Oregon Grant Deed from Husband and Wife to Trustee. This type of deed provides a straightforward method for the transfer and helps clarify the rights of the new owners. To ensure a smooth process, it is advisable to consult with a legal or real estate professional for guidance tailored to your situation.

To transfer a property title to a family member in Oregon, you typically need to prepare a Eugene Oregon Grant Deed from Husband and Wife to Trustee. This document needs to be correctly filled out and signed by the current owners. Once completed, you should file it with the county recorder's office for it to take effect. This process ensures the property officially moves into your family member's name.

A grant deed in Oregon is a legal document that transfers property ownership. It guarantees that the property has not been sold to anyone else and that there are no undisclosed liens. This type of deed typically includes important details about the property and the parties involved. When created by a husband and wife, it may be utilized as an Eugene Oregon Grant Deed from Husband and Wife to Trustee.

To add your spouse to a house title in Oregon, prepare a new grant deed that includes both names. This deed must be signed in front of a notary. After that, submit the deed to your local county clerk for recording. This process commonly involves executing an Eugene Oregon Grant Deed from Husband and Wife to Trustee.

Yes, you can add a spouse to a deed without refinancing your mortgage. This can be done by filing a new grant deed that names both parties as owners. It is crucial to check your lender’s policies, however, to ensure they don't impose any restrictions. This often involves an Eugene Oregon Grant Deed from Husband and Wife to Trustee.

To add your spouse to your deed in Oregon, you must complete a new grant deed that includes both names. You also need to ensure the deed is signed and notarized. Once completed, file this document with the county clerk's office. This process often involves creating an Eugene Oregon Grant Deed from Husband and Wife to Trustee.

Adding someone to a deed can complicate ownership. For instance, if the person you add faces financial issues, creditors may target your property. Additionally, both parties must agree on any decisions regarding the property, which can sometimes lead to disputes. It's essential to understand these implications before executing an Eugene Oregon Grant Deed from Husband and Wife to Trustee.

Whether to gift a house or place it in a trust depends on your individual circumstances and goals. Gifting a house can have immediate tax implications, while placing it in a trust, such as a Eugene Oregon Grant Deed from Husband and Wife to Trustee, can help you avoid probate and give you more control over the asset. Trusts offer benefits like protection from creditors and managing how assets are distributed after your passing. Consider discussing your options with a professional or exploring US Legal Forms for more detailed guidance.

While you can transfer a deed without a lawyer, it's often wise to consult one, especially for complex situations. The process usually involves filing a document, such as a Eugene Oregon Grant Deed from Husband and Wife to Trustee, which must comply with local laws. A lawyer can help you navigate any potential issues, ensuring a smooth transfer. US Legal Forms also offers resources that can assist you in this process, should you choose a DIY approach.