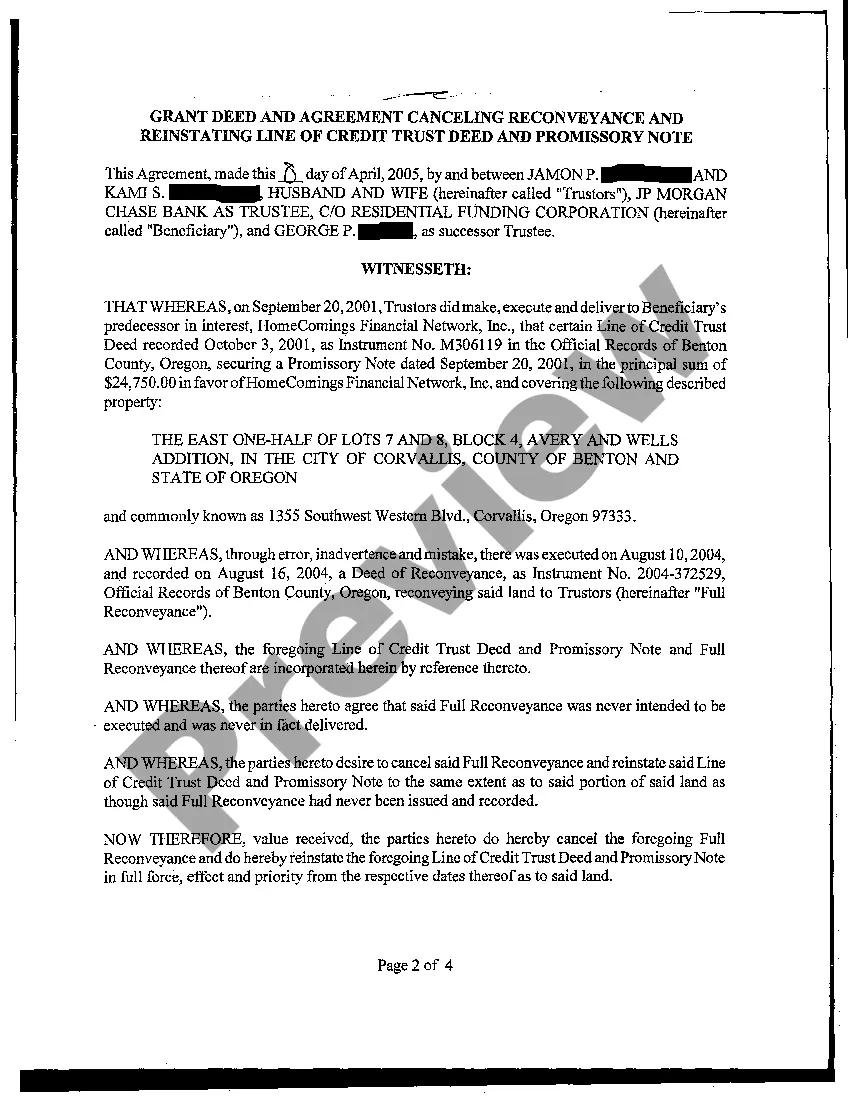

A Gresham Oregon Grant Deed from Husband and Wife to Trustee is a legal document used to transfer real property ownership from a married couple to a trustee. This type of deed allows the couple to vest the property in a trustee who has the authority to manage and distribute the assets for the benefit of the beneficiaries specified in the trust agreement. The Gresham Oregon Grant Deed from Husband and Wife to Trustee ensures that the property is protected and managed according to the wishes and instructions of the couple. By transferring ownership to a trustee, the couple relinquishes their direct ownership rights while retaining control over the property's use and distribution. There are two main types of Gresham Oregon Grant Deeds from Husband and Wife to Trustee: 1. Irrevocable Trust Grant Deed: This type of grant deed transfers the property to an irrevocable trust, meaning that the couple cannot change or revoke the trust provisions without the consent of the trustee and beneficiaries. It ensures that the property is protected from potential creditors and can be distributed to the beneficiaries as outlined in the trust agreement. 2. Revocable Trust Grant Deed: Unlike the irrevocable trust grant deed, the revocable trust grant deed allows the couple to make changes or revoke the trust provisions, including transferring the property back to themselves if they wish. This type of grant deed offers more flexibility and control over the property, but it does not provide the same level of creditor protection as an irrevocable trust. The Gresham Oregon Grant Deed from Husband and Wife to Trustee serves as a crucial component of estate planning, allowing married couples to ensure the proper management and distribution of their property while maintaining control during their lifetime. It offers numerous benefits, such as avoiding probate, reducing estate taxes, and providing for the smooth transfer of assets to the designated beneficiaries. Overall, the Gresham Oregon Grant Deed from Husband and Wife to Trustee plays a pivotal role in establishing a secure and efficient estate plan, providing peace of mind for the couple and ensuring the desired outcome for their real property holdings.

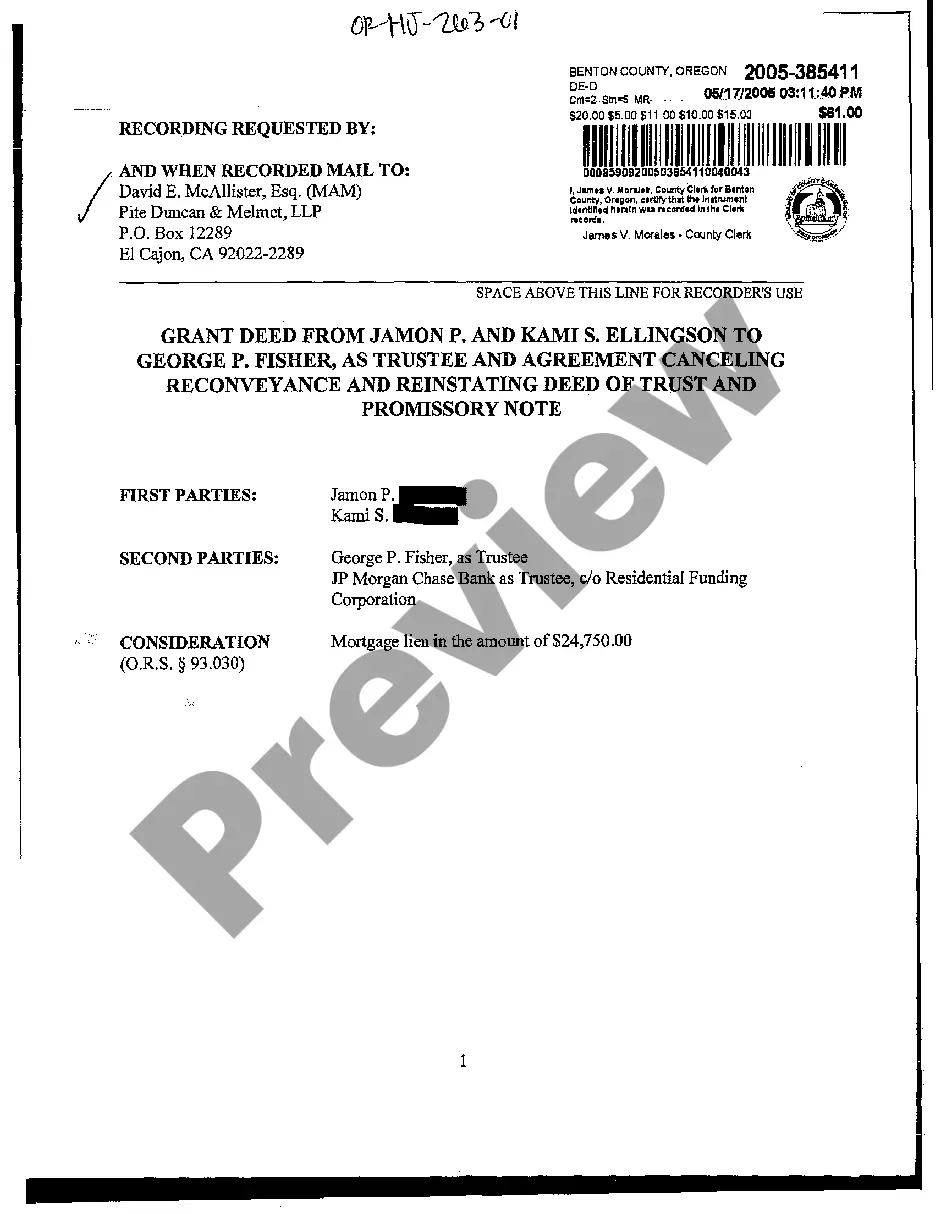

Gresham Oregon Grant Deed from Husband and Wife to Trustee

State:

Oregon

City:

Gresham

Control #:

OR-HJ-263-01

Format:

PDF

Instant download

This form is available by subscription

Description

Grant Deed from Husband and Wife to Trustee

A Gresham Oregon Grant Deed from Husband and Wife to Trustee is a legal document used to transfer real property ownership from a married couple to a trustee. This type of deed allows the couple to vest the property in a trustee who has the authority to manage and distribute the assets for the benefit of the beneficiaries specified in the trust agreement. The Gresham Oregon Grant Deed from Husband and Wife to Trustee ensures that the property is protected and managed according to the wishes and instructions of the couple. By transferring ownership to a trustee, the couple relinquishes their direct ownership rights while retaining control over the property's use and distribution. There are two main types of Gresham Oregon Grant Deeds from Husband and Wife to Trustee: 1. Irrevocable Trust Grant Deed: This type of grant deed transfers the property to an irrevocable trust, meaning that the couple cannot change or revoke the trust provisions without the consent of the trustee and beneficiaries. It ensures that the property is protected from potential creditors and can be distributed to the beneficiaries as outlined in the trust agreement. 2. Revocable Trust Grant Deed: Unlike the irrevocable trust grant deed, the revocable trust grant deed allows the couple to make changes or revoke the trust provisions, including transferring the property back to themselves if they wish. This type of grant deed offers more flexibility and control over the property, but it does not provide the same level of creditor protection as an irrevocable trust. The Gresham Oregon Grant Deed from Husband and Wife to Trustee serves as a crucial component of estate planning, allowing married couples to ensure the proper management and distribution of their property while maintaining control during their lifetime. It offers numerous benefits, such as avoiding probate, reducing estate taxes, and providing for the smooth transfer of assets to the designated beneficiaries. Overall, the Gresham Oregon Grant Deed from Husband and Wife to Trustee plays a pivotal role in establishing a secure and efficient estate plan, providing peace of mind for the couple and ensuring the desired outcome for their real property holdings.

Free preview

How to fill out Gresham Oregon Grant Deed From Husband And Wife To Trustee?

If you’ve already used our service before, log in to your account and download the Gresham Oregon Grant Deed from Husband and Wife to Trustee on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Make sure you’ve found a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Gresham Oregon Grant Deed from Husband and Wife to Trustee. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!