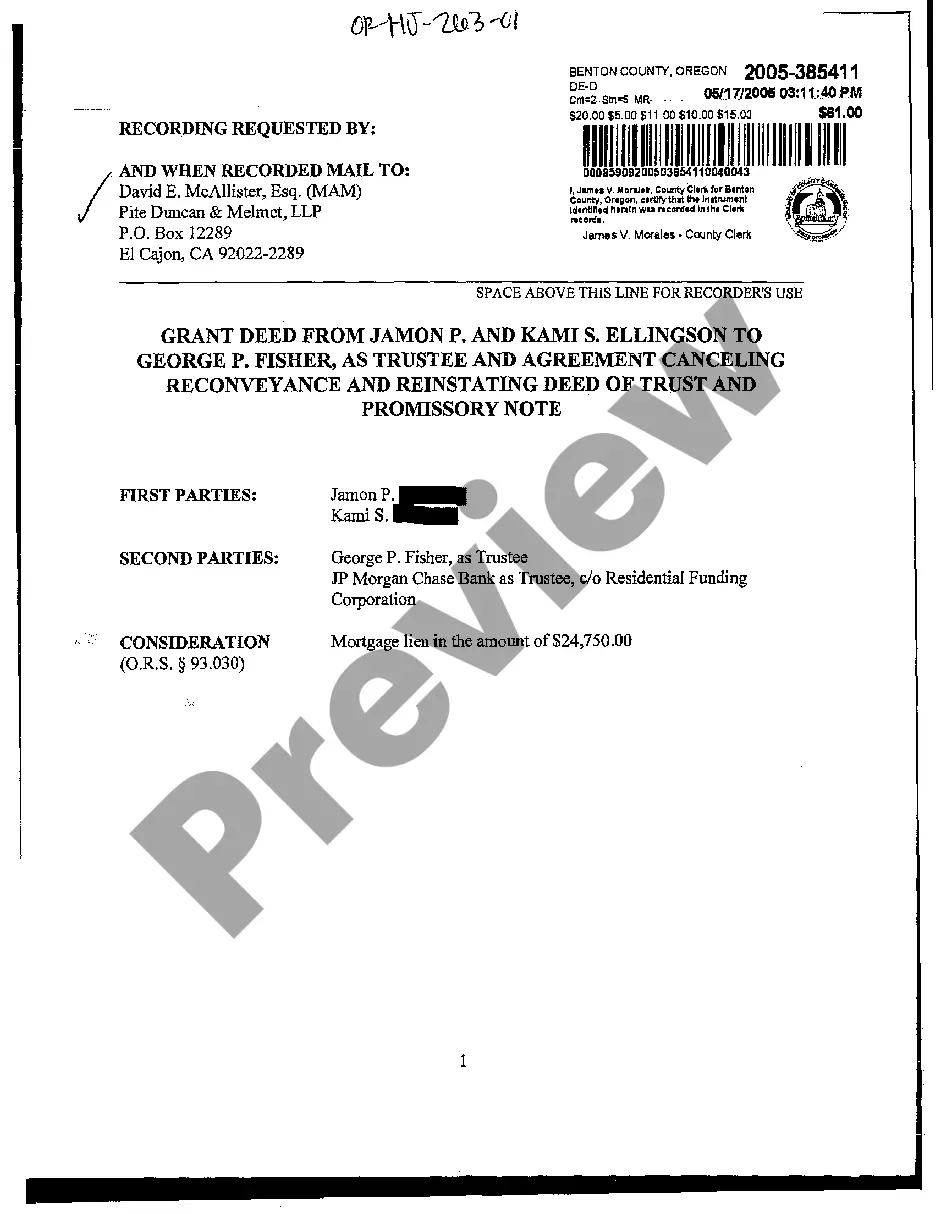

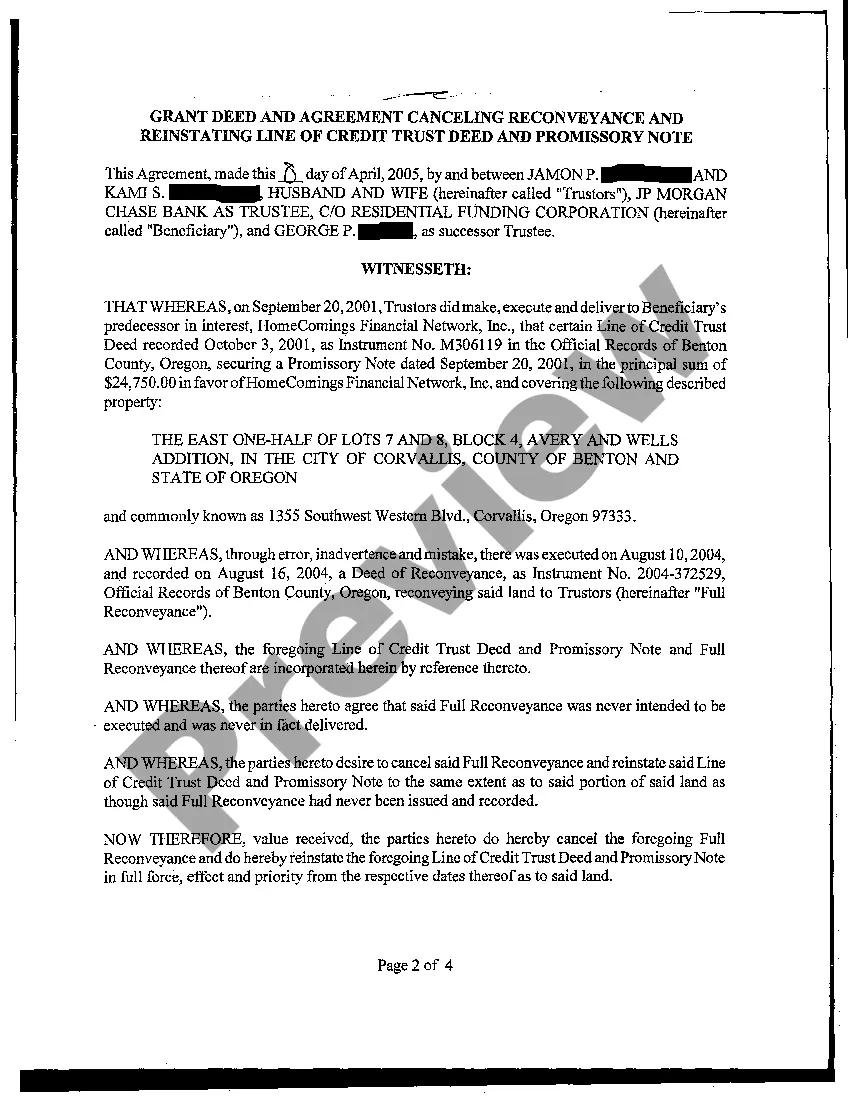

A Portland Oregon Grant Deed from Husband and Wife to Trustee is a legal document used to transfer ownership of a property from a married couple to a trustee. This type of deed is commonly utilized in various estate planning or asset protection strategies. With the inclusion of certain relevant keywords, here is a detailed description of the Portland Oregon Grant Deed from Husband and Wife to Trustee: 1. Definition: A Portland Oregon Grant Deed from Husband and Wife to Trustee refers to a legally binding instrument executed by the husband and wife (granters) to transfer real property to a trustee (grantee). This deed is often employed for estate planning, enabling the couple to title their property under a trust governed by the trustee. 2. Purpose: The primary purpose of this grant deed is to transfer the ownership of a property situated in Portland, Oregon, from a married couple to a trustee they nominate. This instrument allows the couple to remove their direct ownership over the property while retaining control and benefiting from it through the trust arrangement. 3. Types of Grant Deed: Under Portland, Oregon law, there are several types of Grant Deeds from Husband and Wife to Trustee. These may vary based on the specific circumstances and requirements of the granters. Some commonly used types include: a. Irrevocable Trust Grant Deed: This type of grant deed establishes an irrevocable trust, meaning the granters cannot alter or dissolve the trust without the trustee's consent, ensuring the property is protected and governed by the trust indefinitely. b. Revocable Trust Grant Deed: Unlike the irrevocable trust version, this grant deed establishes a revocable trust, allowing the granters to make amendments or revoke the trust in its entirety if necessary. This flexibility provides them with more control over the property and the trust's terms. c. Living Trust Grant Deed: This grant deed is specifically designed for couples who establish a living trust, commonly known as a revocable living trust, to hold their assets during their lifetime. Upon their passing, the property seamlessly transfers to the trustee, avoiding probate and minimizing complications. 4. Process: The process of executing a Portland Oregon Grant Deed from Husband and Wife to Trustee involves several steps. Initially, the granters must prepare the appropriate legal documents, including the grant deed itself and any associated trust documentation. These documents should adhere to the requirements set forth by the state of Oregon and be duly signed and notarized by both spouses. 5. Legal Considerations: It is crucial to consult with an experienced real estate or estate planning attorney when considering such a grant deed. Legal professionals can guide the granters through the process and ensure compliance with applicable laws to protect their interests. They can also provide advice on tax implications, asset protection, and any specific local regulations in Portland, Oregon that may impact the deed's execution. In conclusion, a Portland Oregon Grant Deed from Husband and Wife to Trustee is a legal instrument used to transfer property ownership from a married couple to a trustee under various trust arrangements. The different types of grant deeds available include irrevocable trust, revocable trust, and living trust grant deeds. Seeking professional legal guidance is crucial to ensure compliance with local laws and to maximize the benefits of this grant deed for estate planning purposes.

Portland Oregon Grant Deed from Husband and Wife to Trustee

Description

How to fill out Portland Oregon Grant Deed From Husband And Wife To Trustee?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for someone without any legal background to draft this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our service offers a huge collection with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal case. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time utilizing our DYI tpapers.

Whether you require the Portland Oregon Grant Deed from Husband and Wife to Trustee or any other document that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Portland Oregon Grant Deed from Husband and Wife to Trustee in minutes employing our reliable service. In case you are already an existing customer, you can go on and log in to your account to download the appropriate form.

However, if you are new to our library, make sure to follow these steps before obtaining the Portland Oregon Grant Deed from Husband and Wife to Trustee:

- Be sure the form you have chosen is suitable for your area because the rules of one state or area do not work for another state or area.

- Preview the form and go through a quick description (if available) of cases the document can be used for.

- In case the one you picked doesn’t suit your needs, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option you prefer the best.

- utilizing your login information or create one from scratch.

- Pick the payment method and proceed to download the Portland Oregon Grant Deed from Husband and Wife to Trustee as soon as the payment is through.

You’re good to go! Now you can go on and print out the form or complete it online. Should you have any issues locating your purchased documents, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.