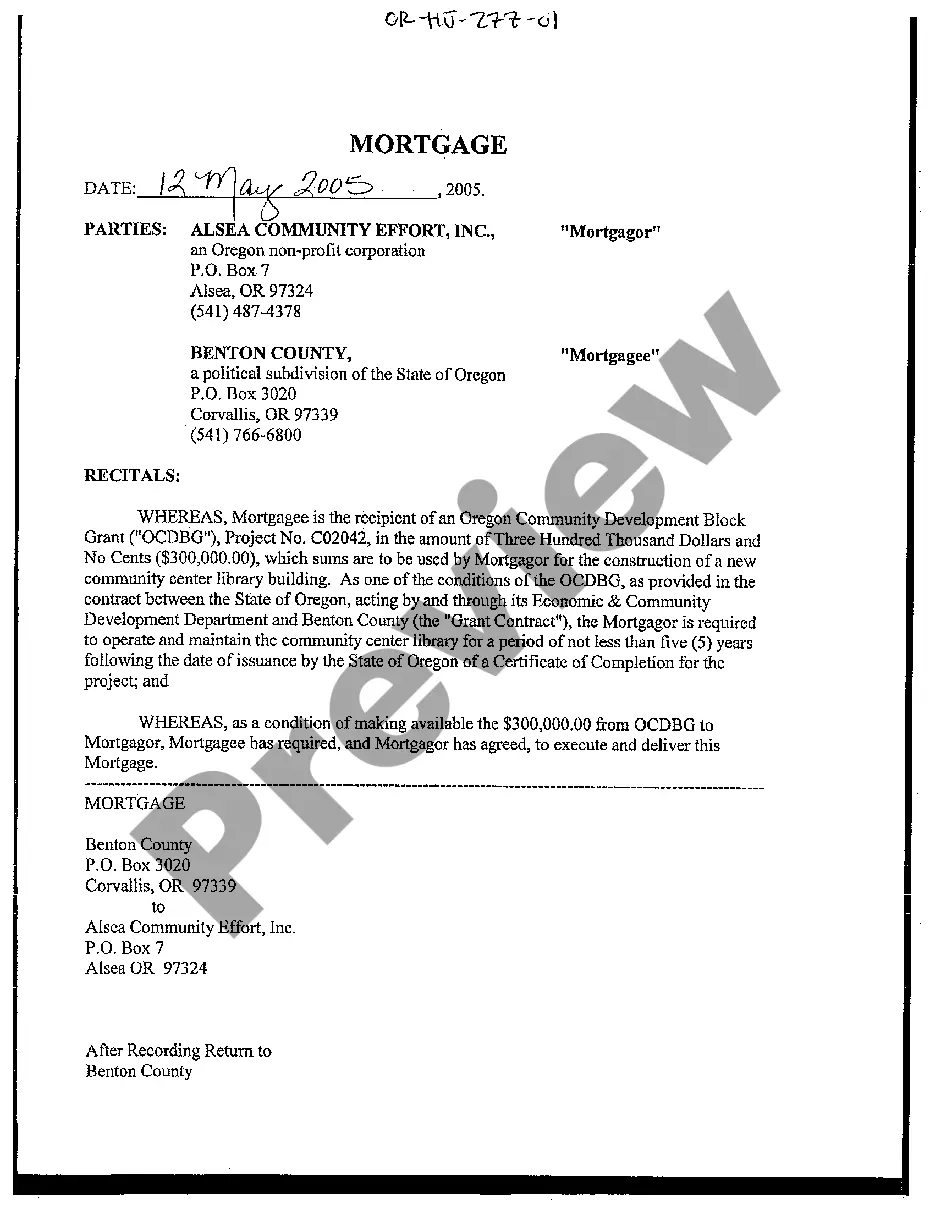

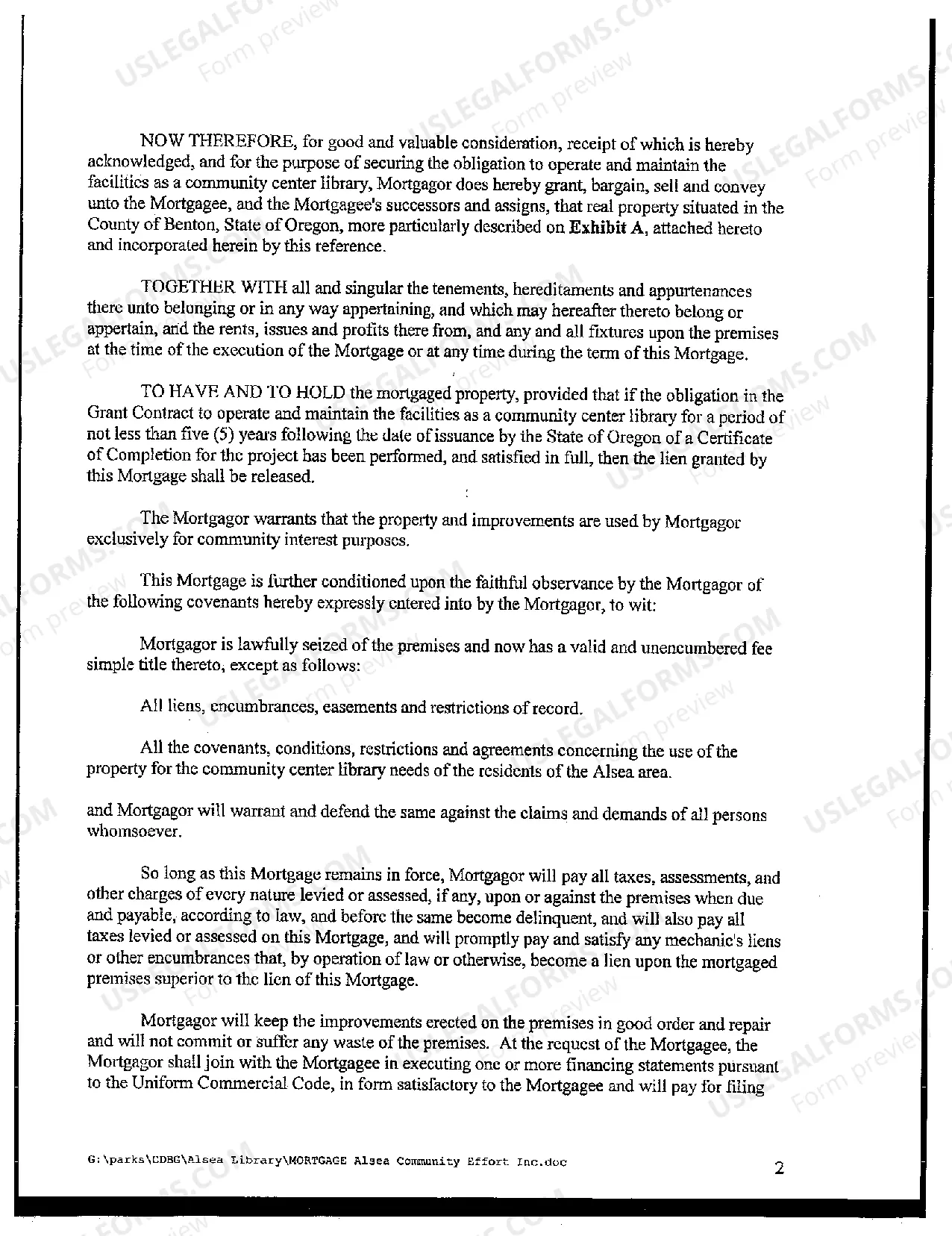

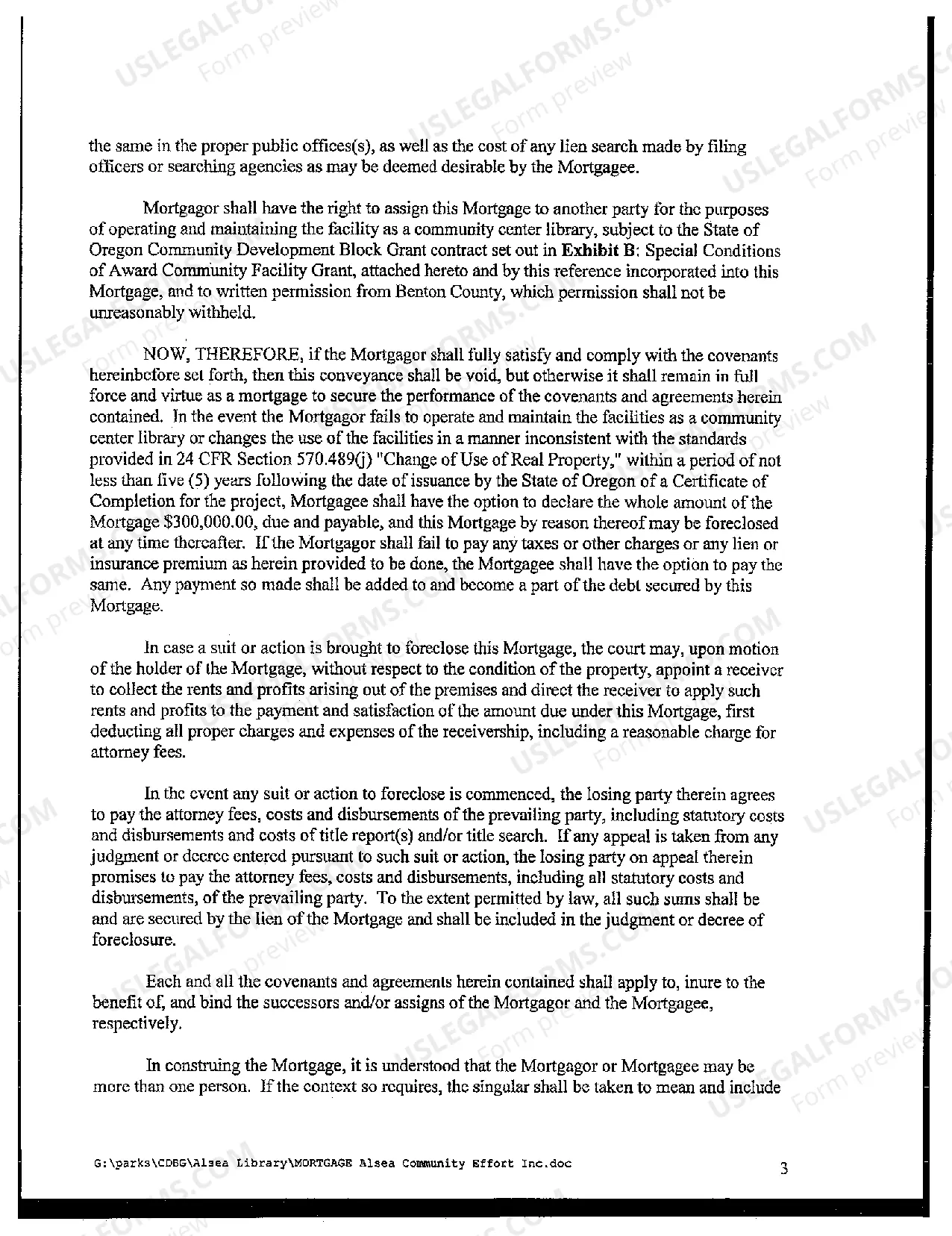

Portland Oregon Sample Mortgage for a Company: A Comprehensive Guide Portland, Oregon is a vibrant city known for its thriving business community and picturesque landscapes. Suppose you are a company planning to establish a presence in the city or looking to expand your operations. In that case, it is essential to familiarize yourself with the options available in terms of Portland Oregon sample mortgages for a company. This detailed description will outline the different types of mortgages suitable for businesses and provide key insights into the application process, requirements, and benefits. 1. Commercial Mortgage for Real Estate Investment: A commercial mortgage in Portland, Oregon, is designed specifically for companies engaging in real estate investment. Whether you aim to acquire, refinance, or develop commercial properties such as office buildings, retail spaces, or industrial facilities, this mortgage type is ideal. Commercial mortgages typically offer competitive interest rates and flexible repayment terms tailored to meet the needs of your company. 2. Small Business Administration (SBA) Loans: SBA loans are government-backed mortgage options aimed at supporting small businesses in Portland, Oregon. These loans offer attractive interest rates and longer repayment periods, making them a popular choice for startups and small enterprises. SBA loans can be used for various purposes, such as purchasing equipment, real estate, or funding working capital. The application process requires to be detailed financial documentation, business plans, and a solid credit history. 3. Construction Loan for Property Development: If your business plans involve new construction or major renovations in Portland, Oregon, a construction loan is a suitable option. This mortgage type provides financing to cover the costs associated with land acquisition, construction materials, labor, and permits. Construction loans typically have short-term durations and require periodic progress inspections to ensure adherence to construction timelines. 4. Multifamily Property Mortgage: For businesses interested in investing in multifamily properties such as apartment complexes or condominiums, a multifamily property mortgage is available in Portland, Oregon. These mortgages provide funds to business owners interested in purchasing, refinancing, or constructing residential properties with three or more units. Depending on the specific property and qualifications, it is possible to secure competitive interest rates and longer repayment terms. 5. Equipment Financing: Companies in various industries often require capital to acquire or upgrade equipment necessary for their operations. Equipment financing in Portland, Oregon, offers customized mortgage options that enable businesses to purchase or lease machinery, vehicles, technology systems, or other types of equipment. These loans can be secured by the purchased equipment and often have lower interest rates than unsecured loans. Applying for a Portland Oregon sample mortgage for a company generally involves a thorough evaluation of the business's financial health, creditworthiness, and the specific mortgage requirements outlined by lending institutions. It is advisable to consult with a knowledgeable mortgage broker or specialist to guide you through the application process and help you find the most suitable mortgage option for your company's needs. In conclusion, Portland, Oregon offers a range of mortgage options to support businesses at different stages of growth and investment. From commercial mortgages for real estate investments to SBA loans, construction loans, multifamily property mortgages, and equipment financing — each option caters to specific business requirements. Careful consideration and expert guidance will ensure that your company secures the best Portland Oregon Sample Mortgage suited to your goals and financial situation.

Portland Oregon Sample Mortgage for a Company

Description

How to fill out Portland Oregon Sample Mortgage For A Company?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Portland Oregon Sample Mortgage for a Company gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Portland Oregon Sample Mortgage for a Company takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make sure you’ve picked the correct one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Portland Oregon Sample Mortgage for a Company. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!